Disintermediation

It involves eliminating intermediaries within an economic supply chain.

What Is Disintermediation?

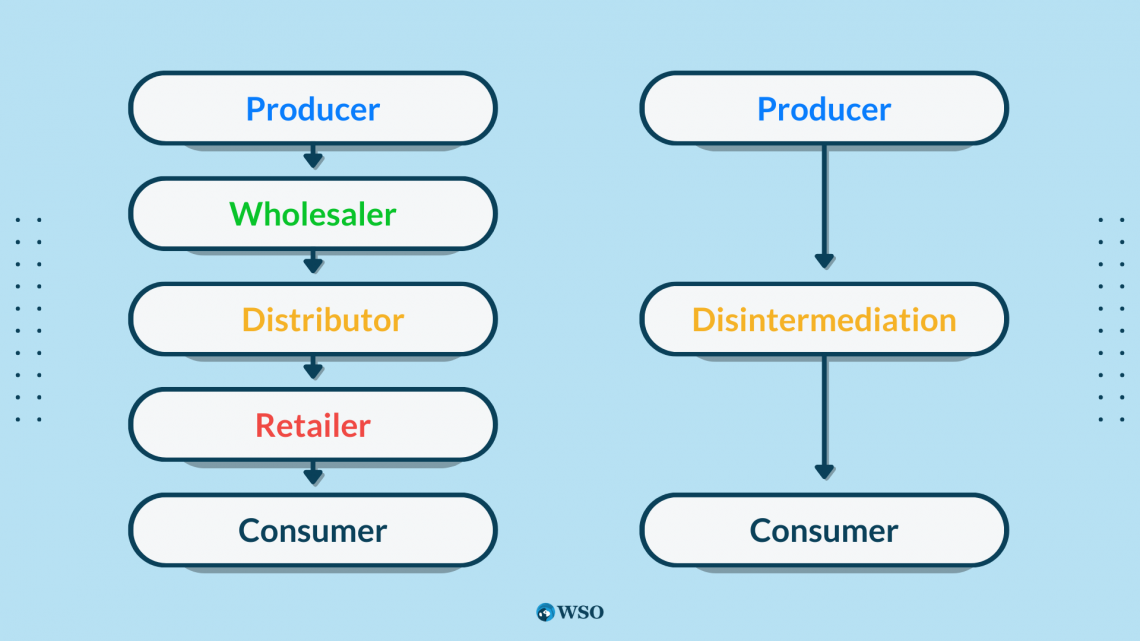

Disintermediation involves eliminating intermediaries within an economic supply chain, essentially bypassing the traditional "middlemen" during transactions or a series of transactions.

Rather than following conventional distribution channels that typically include intermediaries like distributors, wholesalers, brokers, or agents, businesses now have the option to engage directly with customers, often through online platforms such as the Internet.

This allows consumers to make direct purchases from wholesalers, skipping retailers or enables businesses to place orders directly with manufacturers without involving distributors. In the financial sector, it occurs when investors can acquire stocks without the intermediary role of brokers or financial institutions.

The primary objectives behind this process typically include cost reduction, expedited delivery, or a combination of both.

The term "disintermediation" originated in the 1960s to characterize a decline in funds held by conventional financial intermediaries and investment tools, replaced by a preference for direct investment in markets, presenting the opportunity for increased returns.

Over time, the term has been applied in diverse scenarios, encompassing the development of novel information channels and business frameworks that sidestep established intermediaries.

Key Takeaways

- Disintermediation includes removing specific aspects from the distribution chain, including retailers, wholesalers, brokers, insurance companies, or any other intermediaries.

- Usually, It is undertaken with the primary goal of cutting expenses or enhancing the speed of delivery.

- The term disintermediation originated in the financial sector, specifically when investors gained the ability to invest in various products directly. This led to a state of disintermediation within the investment market.

- In financial terms, it entails the exclusion of banks, brokers, or other third-party entities, allowing individuals to execute transactions or invest directly.

- The effectiveness of this process is not guaranteed, as it necessitates additional personnel and resources to take on the roles traditionally fulfilled by intermediaries.

How Disintermediation Works

In the field of real estate, property transactions commonly rely on intermediaries like agents, brokers, and legal representatives.

These middlemen connect purchasers and vendors, ensuring adherence to legal requirements and streamlining the process of transactions.

In a scenario where real estate transactions incorporate blockchain technology, individuals engaged in buying and selling can interact directly on the blockchain using smart contracts.

The smart contract triggers the fulfillment of the agreement when predefined conditions are satisfied, diminishing the need for conventional intermediaries such as agents and brokers.

The real estate transaction process is streamlined by this decentralized method, increasing its efficiency and possibly lowering expenses for all parties.

Disintermediation can happen when a buyer interested in purchasing goods can directly buy them from the producer. This direct approach can lead to lower prices for the buyer since it cuts out intermediaries like traditional retail stores.

In opting for this approach, the purchaser sidesteps additional expenses linked to the price increase that transpires as a commodity transitions from a distributor to a seller prior to reaching the consumer.

Origins of the Term Disintermediation

The process of disintermediation was initiated with the implementation of interest rate restrictions on savings accounts by the U.S. government in 1967.

The regulatory adjustment, perhaps unintentionally, has created opportunities for other financial institutions. These institutions can now appeal to savers by offering more favorable interest rates on alternative investment avenues, including certificates of deposit and money market accounts.

The banking sector's experience set the stage for a broader phenomenon that would later extend its influence to diverse industries.

Independent channels for consumers gained traction with the rise of technological progress, facilitating easier access to information on investment options and the autonomous execution of transactions.

The hotel and travel industries saw considerable transformations in the mid-2000s. Hotels started booking directly with customers on platforms like Expedia and Priceline, reducing the need for travel agents.

The dynamics of the newspaper sector evolved as more readers gravitated towards online news outlets. This shift led to a decreased reliance on conventional newsstands and publishers, marking a significant disintermediation in the industry.

The newspaper industry saw a transformation as more readers opted for online news sources. This change decreased the reliance on traditional newsstands and publishers, exemplifying a significant disintermediation process in the sector.

Online Disintermediation

The Following includes how the internet helps in disintermediation:

- Direct-to-Consumer Model: Online disintermediation often facilitates a direct connection between businesses and consumers. This enables businesses to establish direct connections with their desired audience, bypassing the need for conventional intermediaries like retailers or distributors. Such an approach encourages personal contact and customized offers.

- E-Commerce Platforms: The rise of e-commerce platforms exemplifies online disintermediation. Retailers can create online stores, allowing them to reach global customers without the need for physical outlets. Customers can also browse and buy products directly from that platform, making the shopping process easier.

- Travel approaches: The prevalence of online travel agencies (OTAs) and platforms like Airbnb has reduced intermediary roles. Now, travelers can book accommodations and services directly from property owners, bypassing conventional travel intermediaries.

Example of Disintermediation

The following includes some of the examples of disintermediation.

Dell

In the 1990s, Dell held a notable edge over rivals like Compaq and IBM, primarily due to their embrace of a direct sales approach.

Dell achieved incredible growth by implementing a direct-to-consumer sales strategy, bypassing middle management, and providing customized services. This increased the company’s revenue from $60 million in 1994 to $25 billion in 1999.

Tesla

Tesla employs a unique sales model by bypassing traditional dealerships and opting for their outlets to feature a limited number of vehicles for display and test drives.

Customers finalize their entire purchase process through online channels. This distinctive approach contributed to a 34% increase in Tesla's auto gross profit.

Additionally, it enables Tesla to exert greater control over the customer experience and foster an online community. Inspired by Tesla's achievements, both Audi and General Motors initiated experiments with direct sales in 2012 and 2013, following a similar path.

Flat fee MLS

At a fixed cost, property owners can independently list their homes on the MLS, removing the requirement for a full-service real estate agent.

Rather than entrusting the entire selling process to a conventional agent, sellers prefer a flat fee arrangement to showcase their property on the MLS. This database is commonly used by real estate professionals to exchange information about properties for sale.

This provides sellers with an opportunity to enhance the visibility of their listings, all the while preserving a higher degree of influence over the selling process.

Property sellers have the potential to lower expenses associated with commission costs, as they are not mandated to allocate a percentage of the sale price to a conventional real estate agent.

Nevertheless, vendors might find themselves responsible for managing different facets of the transaction on their own, such as promoting the product, engaging in negotiations, and handling documentation.

Apple

Apple utilizes a strategy of directly reaching consumers, promoting and vending its products via online platforms and brick-and-mortar retail outlets. This approach enables the company to circumvent conventional retail pathways, granting the chance to establish premium pricing for its products.

Benefits of Disintermediation

The following includes the benefits of disintermediation:

- Cost Control and Savings: Disintermediation helps in controlling price increases and predatory pricing, fostering a more competitive economy. Wholesale distribution and do-it-yourself services enable consumers to save money.

- Direct Manufacturer-Consumer Interaction: Selling directly to consumers allows manufacturers to bypass the expense of sales representatives. Direct interaction with consumers enables manufacturers to gather valuable information and build relationships with large-volume buyers, such as businesses.

- Cost Reduction and Efficient Processes: By eliminating middlemen connecting suppliers and customers, expenses, including those associated with marketing and advertising, can be significantly reduced. These cost savings can be transferred to consumers, leading to decreased prices.

- Enhanced Supplier Control: Cutting out intermediaries gives suppliers a stronger grip on selling their products or services directly to customers. By eliminating middlemen, suppliers can manage the customer experience more effectively and focus on delivering high-quality offerings.

- Consumer Benefits: Disintermediation can lead to lower prices for consumers. Customers could enjoy faster delivery and simpler access to information regarding products or services. The avoidance of conventional intermediaries creates opportunities for novel and creative methods for consumers to acquire products or services.

Risks in Disintermediation

Disintermediation, while offering advantages such as enhanced profit margins and reduced transit time for companies, comes with its recognized risks. These potential drawbacks encompass:

- Increased Costs: Removing retailers from the supply chain might result in higher expenses, as direct shipping to consumers could be more costly than distributing products to stores for customer pickup.

- Additional Management Responsibilities: The elimination of a supply chain component necessitates the introduction of another factor to avoid disruptions. For instance, if a computer company eliminates retailers without establishing an alternative channel for production, there is a risk of oversupply and decreased demand, leading to increased labor requirements.

- Diminished Brand Awareness: Poses a risk to brand awareness, particularly if the brand lacks competitiveness. Eliminating retail stores may reduce the brand's visibility, potentially jeopardizing its future success.

- Limited Market Potential: Consumers often visit large retailers for specific products. Consumers may opt for competing brands if a brand eliminates retail presence and fails to capture attention. Building a loyal community of followers can mitigate this risk.

- Ineffectiveness: Proves advantageous in specific contexts, yet its applicability varies. For certain enterprises, dispatching products to retail establishments emerges as a more judicious choice, offering a centralized platform for customer transactions.

Reintermediation

Reintermediation involves reintroducing an intermediary between producers and end users (consumers), especially in situations where disintermediation was previously observed.

Disintermediation has revolutionized the consumer landscape, enabling direct online purchases from producers and sidelining traditional supply chain middlemen.

Interestingly, instead of a straightforward, producer-to-consumer connection, the scene has evolved to include digital intermediaries like Amazon.com and eBay, injecting a fresh dynamic into the equation.

The shift towards reintermediation was prompted by various challenges associated with the direct-to-consumer model in e-commerce.

Issues such as the high cost of shipping numerous small orders, extensive customer service demands, and potential conflicts with disintermediated retailers and supply partners posed significant obstacles.

The absence of supply chain middlemen, who previously served as sales representatives for producers, meant that producers had to assume the responsibility of acquiring customers themselves.

Selling products online also incurred additional expenses, including website development, product information maintenance, and marketing costs. Moreover, limiting product availability to online channels required producers to compete for customer attention in an increasingly crowded digital space.

Disintermediation FAQs

It is influenced by advancements in technology, changing patterns in consumer behavior, and shifts in regulations. The internet and digital tools have notably enhanced direct interactions between producers and consumers.

In principle, when a link in the supply chain is removed, consumers may enjoy more competitive prices for a product. However, in reality, essential steps in the supply chain must still be carried out by individuals or entities.

Businesses and their clientele experience advantages from the streamlining of processes if the required tasks can be performed with greater efficiency and at a lower cost without the involvement of intermediaries.

Disintermediation has had notable impacts on various sectors. In retail, manufacturers now engage in direct sales to consumers, while the hospitality industry has seen a shift towards increased direct hotel bookings.

Online banking has become prevalent, reshaping the landscape of the banking sector, and in advertising, internet companies have assumed a more direct role in selling ads.

Authored and researched by Rani Thakur | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?