Eclectic Paradigm

A three-tiered review framework to determine if a Foreign Direct Investment (FDI) is advantageous.

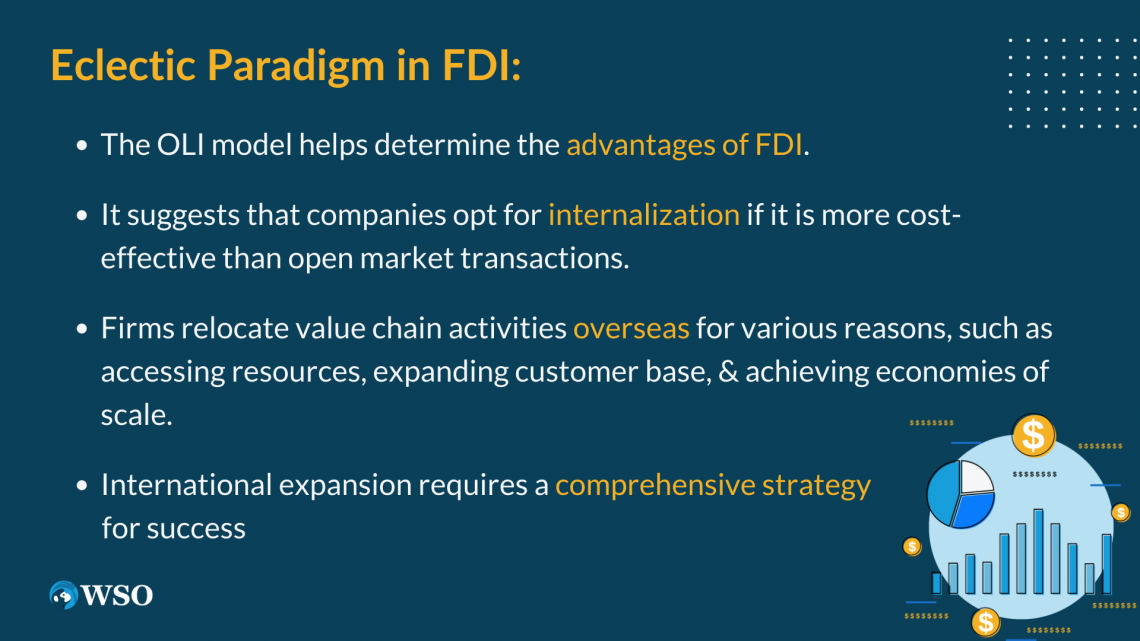

An eclectic paradigm, also known as the ownership, location, internalization (OLI) model or OLI framework, is a three-tiered review framework that companies can use to determine if a Foreign Direct Investment (FDI) is advantageous.

The eclectic paradigm predicts that institutions will avoid open market transactions if internal or in-house completion of identical work is less expensive. It is based on internalization theory and was first formulated in 1979 by researcher John H. Dunning.

By relocating certain value chain activities overseas, firms can expand their operations outside national borders. There are several reasons why businesses do so.

First, they may seek more desirable natural or strategic resources, including physical, financial, technological, and human capital. In other circumstances, the company's sole objective may be to gain new customers.

It may export more goods and services than it sells domestically. They may choose to operate in the nation that purchases their goods the most, avoiding shipping fees.

To achieve economies of scale and reduced costs, firms seek to improve efficiency.

Regardless of the benefits, these companies need a complete international expansion strategy.

Understanding an Eclectic Paradigm

A commercial and economic evaluation is important when determining the feasibility of foreign direct investment. There are numerous entry-mode tactics, each with its advantages and disadvantages.

Common investment strategies include exporting, licensing, franchising, building a strategic alliance, establishing a joint venture, acquiring, and beginning from scratch with a greenfield investment.

The latter three examples are foreign direct investments because they involve substantial stock investments.

Utilizing the OLI framework effectively excludes at least a portion of these options (this is also known as the eclectic paradigm).

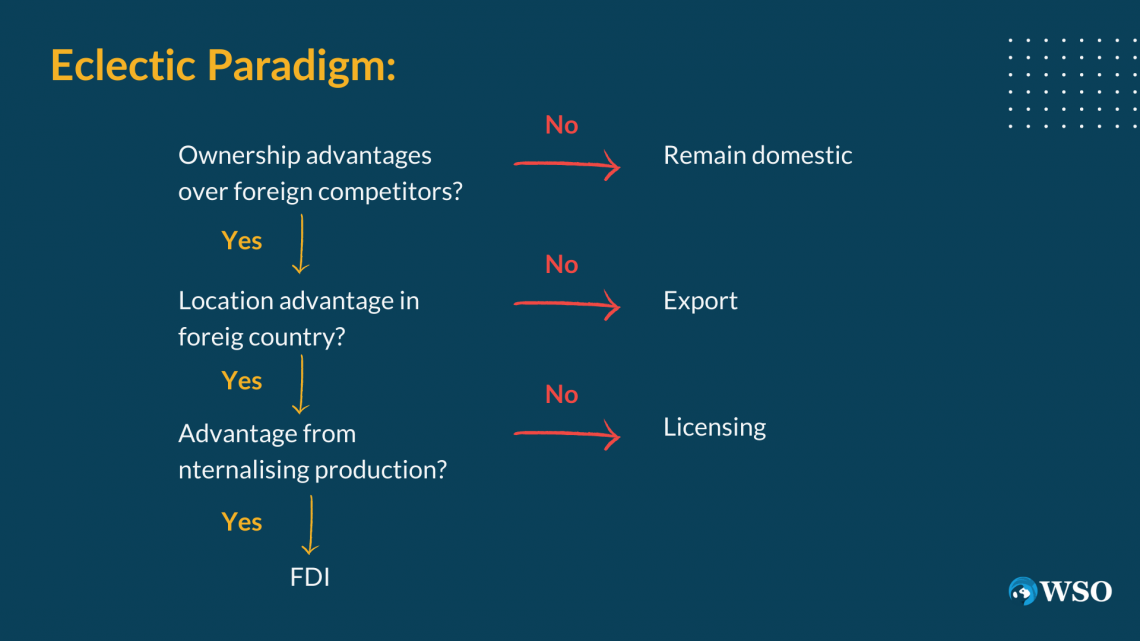

According to this paradigm, a company must possess three benefits to engage in FDI successfully. If these criteria aren't fully met, the company may decide to utilize an alternative entry-mode strategy.

The basic hypothesis of this paradigm is that the level and structure of a company's international value-adding activities will be contingent on meeting three parameters:

- Exclusive and enduring ownership of certain advantages relative to other companies (Ownership Advantages – "O")

- The extent to which the company believes it is advantageous to add to its O advantages as opposed to selling them to other overseas companies (Internalization Advantages – "I")

- The amount firms are interested in generating, gaining access to, or leveraging their "O" advantages in a foreign place (Location Advantages - "L").

Ownership Advantage

To overcome the disadvantage of foreignness, a firm must first possess an ownership advantage.

The liability of foreignness refers to the inherent disadvantage foreign businesses suffer in host countries due to their non-native status. These disadvantages range from simple linguistic difficulties to unfamiliarity with local client requirements.

A company's ownership advantages include its proprietary information and other ownership rights. This advantage results from the company's brand, copyright, trademark, or patent rights, as well as its internal use and expertise.

Consequently, ownership benefits are typically perceived as intangible. These benefits should be attractive, rare, difficult to imitate, and engrained in the organization.

In other words, the resource must be valuable enough to provide a competitive edge over an international rival.

The OLI paradigm does not restrict "O" benefits to firm-specific benefits. Instead, they pertain to competencies that a business can cultivate internally or acquire externally through business networks.

Dunning divided ownership benefits into asset-based (Oa) and transaction-based (Ot) benefits.

He indicated that the OLI Paradigm might be utilized in studies examining phenomena such as FDI effects, foreign disinvestment, and FDI-related dynamics, among others.

Therefore, businesses should evaluate if they possess a competitive advantage that they can export to compensate for their foreignness liability.

Examples include a powerful brand name with a stellar reputation, exclusive technology or skills, and significant economies of scale.

Location Advantages

The second essential advantage is the location advantage. Considering the risk of foreignness, host countries must offer compelling benefits to make internationalization profitable for FDI.

These advantages may be merely geographical or the result of inexpensive raw resources, low salaries, a skilled workforce, special taxes, the absence of tariffs, etc.

Dunning expanded on the L component upwards (regional integration) and downwards (clustering), demonstrating his interest in the subnational level.

Companies must determine if there is a comparative benefit to conducting certain services in a given nation. Frequently, these factors depend on the cost and availability of resources.

Moreover, the characteristics of the selected areas vary. Location advantage typically refers to natural or artificial resources.

These resources are typically immobile and require collaboration with a foreign investor in the target site to be utilized to their maximum potential.

"L" benefits are not limited to country-specific benefits. In addition, they include benefits associated with supra-national regions and geographic advantages inside a host country, particularly at the sub-national level, as found in regional clusters.

The Porter's Diamond model is an excellent instrument for identifying these location advantages. Companies should consider whether the target market offers any location advantages.

Internalization Advantage

To decide between licensing and FDI management, the eventual advantage of internalization should be considered. For example, is it preferable to do the value chain activity internally rather than contracting it out?

Certain activities may be outsourced to foreign businesses because they are better at doing it for less money, have greater local market expertise, or because management wishes to focus on other activities in the value chain, such as marketing or design.

Lastly, internalization advantages indicate when an organization should create a specific product internally instead of contracting with a third party.

Occasionally, it may be more economical for a company to run from a separate market location while retaining production in-house.

If a business chooses to outsource production, it may be necessary to negotiate relationships with local suppliers.

However, outsourcing is only economically viable if the contracting company can meet the organization's policies, standards, and quality criteria at a much lower price.

As an alternative, the foreign partner may provide knowledge of the local market or even better workers who may produce a superior product that the company lacks.

The best internationalization options for a corporation to employ include forming joint ventures with local partners, buying already-existing local businesses, or beginning from scratch with a greenfield investment.

Example of an Eclectic Paradigm (OLI Framework)

Businesses can use the OLI framework to assess, comprehend, and decide how much foreign direct investment (FDI) to make.

For instance, a business considering a foreign investment may utilize the OLI framework to identify the most important ownership, location, and internalization aspects that will influence its choice.

Maybe the business is looking for a place with a low labor cost. In this situation, the business would prefer to find a nation with a cheap cost of ownership.

Alternatively, the business may look for a nation with a skilled labor force. In this situation, the business should look for a nation with a high internalization cost.

The company may choose where to invest more wisely and strategically if it knows the criteria that matter most. Using the OLI methodology, researchers can also analyze FDI and forecast foreign investment trends.

The patterns of foreign direct investment can be better understood and forecasted by studying the ownership, location, and internationalization elements that affect a company's decision-making.

Then, based on these forecasts, organizations and governments can create policy recommendations.

1. Case study of Shanghai Vision Technology Co. Ltd.

According to Research Methodology, independent research and analysis firm Shanghai Vision Technology Company utilized this paradigm while deciding to export its 3D printers and other unique technologies.

While they carefully considered the disadvantages of higher tariffs and transportation expenses, their internationalization approach ultimately enabled them to thrive in new markets.

2. Assessing the Eclectic Paradigm

The OLI paradigm claims that the specific configuration of the OLI parameters facing a given firm and the firm's response to that configuration is highly contextual.

In particular, it will reflect the economic and political characteristics of the investment firms and the country or region in which they seek to invest.

The industry and nature of the value-added activity in which the firms are engaged; the characteristics of the individual investing firms, including their objectives and strategies for pursuing these objectives; and the reason for the FDI.

Combining our knowledge of the OLI parameters, the economic features, geographical features, etc. of the home and host countries, and the investing or potentially investing enterprises, we may generate a wide range of reasonably detailed and operationally testable ideas.

Thus, it may be hypothesized that some industries, such as the oil and pharmaceutical industries, are more likely to generate FDI than others, such as the iron and steel or aircraft industries.

This is because the characteristics of the former generate more unique O advantages, whether for their locational needs favoring production outside their home countries or because the net benefits of internalizing cross-border intermediate products are greater.

Dunning's Four Motives for FDI

Incorporating insights from strategic management and basing his findings on the distinction between Oa and Ot, Dunning identified four reasons for FDI:

1. Market-Seeking: To capitalize on the opportunities given by larger markets.

(i) Gain access to new markets/opportunities

→ Local production in other nations enhances customer service and lowers the price of shipping.

(ii) Follow key customers

→ Businesses may follow important clients abroad to prevent other suppliers from providing their services. Additionally, the company is better positioned to meet customer needs by starting local businesses.

(iii) Compete with critical rivals in their markets

→ To damage a competitor by making it use resources to protect its market, it is advantageous to compete against present or potential rivals in their home market.

2. Efficiency-Seeking: To take advantage of variances in the cost and availability of traditional factor endowments, economies of scale and scope in various nations are utilized.

(i) Economies of scale and scope

(i) Economies of scale and scope

→ The company can boost its economies of scale by going global. This is all made possible by falling fixed costs, workforce specialization, bulk discounts, and access to other financial economies.

→ Economies of scope are the cost reductions that result from utilizing a relatively fixed base of managerial personnel, infrastructure, and other business resources across a broad suite of products and services.

(ii) Locate production near customers

(iii) Take advantage of government incentives

(iv) Avoid trade barriers

3. Strategic Asset-Seeking Investment: Instead of leveraging existing assets, acquire and supplement a new technical basis.

(i) Knowledge

→Through FDI, a company can create a local presence and better understand its target markets. FDI typically gives the foreign company better access to market information, clients, distribution networks, and management of local businesses.

(ii) Technological & managerial know-how

→ The company might gain from having a presence in a significant industrial hub. By doing this, the business will be surrounded by organizations that share its goals and will be encouraged to innovate and advance.

4. Resource-Seeking Investment: To gain access to specific types of resources that are unavailable or more costly in the native country.

(i) Raw materials needed in extractive and agricultural industries

→Businesses in the agricultural and extractive sectors are forced to go to the locations of the raw materials.

(ii) Unskilled/semi-skilled labor

→ Companies may decide to use FDI to shift production to low-wage nations to reduce costs and boost profit margins.

These factors pertain to selecting the optimal location for every FDI project.

Extension of the OLI Model

The OLI paradigm's analytical framework links various theories of international business) derived from concepts from various disciplines.

It can be applied at various levels of analysis to understand the types of foreign production, the contexts in which they exist, and why multinational enterprises (MNEs) choose them.

Business groups don't typically have the "firm-specific advantages" (FSAs) that the OLI framework mentions, but their ownership advantages come from the locational advantages of their home country.

FSAs have significant brand recognition, IP rights, and other intangible asset benefits. Because ownership and locational advantages interact and reinforce one another rather than acting alone, the FSAs of business groups are characterized by the locational advantages of their home countries.

The FSAs of corporate groups will give "reduced marginal gains" in their internationalization process as pro-market reforms are enacted in emerging economies, strengthening their integration with the global economy.

These FSAs, however different from the classic multinational FSAs of industrialized countries and will offer the same benefits as those covered by the Ownership-Location-Internalization (OLI) paradigm.

As a result, certain additions have been made to the OLI Paradigm, resulting in the OLMA model (meaning Ownership, Location, Mode of entry, and Adjustment).

Others have interpreted the paradigm in e-business and given the OLI configuration a network-based advantages component.

Some have added a political perspective to the OLI paradigm to explain FDI in fragile and emerging frontier markets.

or Want to Sign up with your social account?