Call Warrant

Form of investment that permits the owner to purchase the stock of the company's securities at a specified price on or before a specific date.

What is a Call Warrant?

A call warrant is a form of investment that permits the owner to purchase the stock of the company's securities at a specified price on or before a specific date. Call warrants are frequently included in a company's new stock or Debt issuance.

The call warrant will expire useless if the holder doesn't use it. The worth of the contract will grow if the price of the underlying securities does as well. Consequently, the holder will only benefit if they believe the price will increase.

The purpose of these warrants is to offer investors an additional incentive to invest in the stock or bond offering. These are often traded independently on major stock exchanges and can be separated from the associated stock or bond certificate.

Often, a call warrant is just referred to as a warrant.

While both look similar, there are many variations between them. Similar to call options, call warrants give investors and speculators a chance to benefit handsomely if the company's stock price rises.

These are typically unavailable for growth stocks because some investors view them as excessively risky and speculative.

Key Takeaways

- The capital structures of some companies are not attractive to lenders. Hence, the cost of debt significantly rises due to a lack of access to capital markets. As a result, call warrant becomes a one-stop solution to raise money without any hindrances.

- Corporations generally lower their cost of financing by mixing call warrants issued with debt and equity.

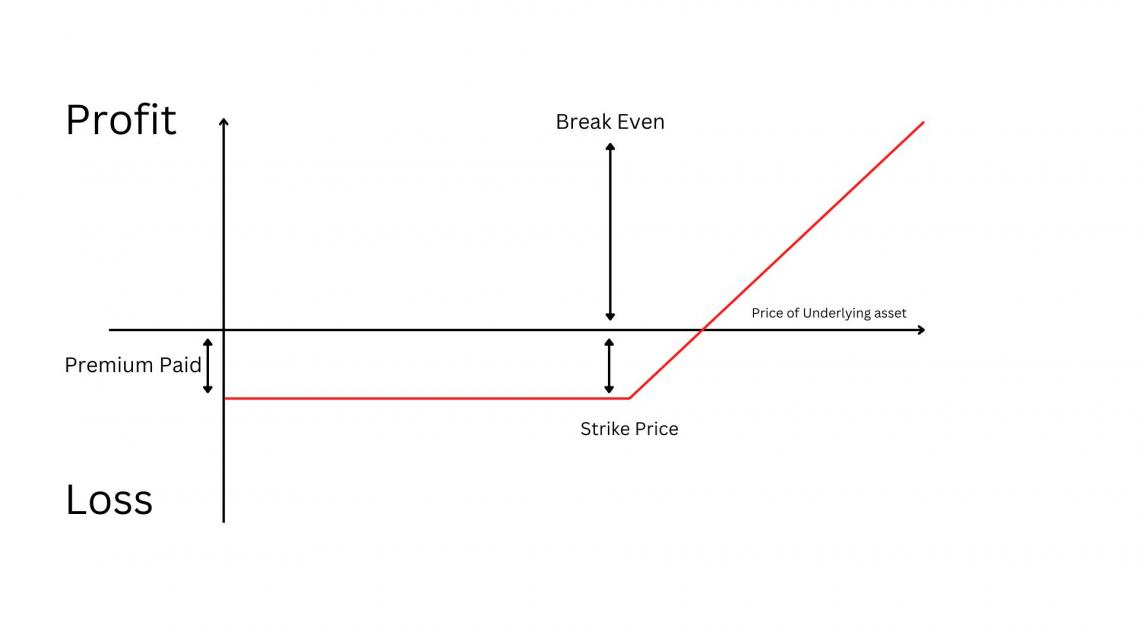

- The break-even price needs to be crossed if investors have profits in any situation, and if it touches the break-even price point, they are neither at a loss nor a profit.

- A decline in the share price will result in a decline in the price of the call warrant and a rise in the put warrant premium.

- This derivatives segment is particularly for large investors or HNIs (High net-worth individuals).

- This hazard from time decay is less concerned with warrants because they typically have longer till expiry than options, but it is still a big one.

How Call Warrants Work

A buyer of a call warrant is generally bullish on the price of the stock and, through the purchase transaction, gets an option to purchase the underlying security at a predetermined rate between the time of expiration or the date of expiration.

The break-even price needs to be crossed if investors have profits in any situation, and if it touches the break-even price point, they are neither at a loss nor a profit.

The exercise price, also known as the strike price, is the cost at which the warrant holder may purchase the underlying shares. This strike price is frequently established as "out-of-the-money" or at a specific margin over the base stock's current market price.

Warrant Prices Example

As stated above, the buyer of a call warrant is generally bullish on the stock; e.g., if Charlie buys ten shares of Apple Inc, he is expecting the stock price to go up.

Charlie now has the option to exercise his contract and execute the transaction through the purchase of shares between the buy date and expiration or on the expiration day of the options contract. It's generally the last Thursday of the month.

This factor plays a vital role in times of extreme market distress.

To allure investors and encourage them to invest in their business models, companies also offer warrants to raise capital from the financial markets.

They receive funds when selling the warrants and when stocks are purchased using the warrant.

Warrants are typically priced inexpensively compared to the underlying stock, making them more appealing to investors, especially if it's for an unproven company.

There are pricing models for warrants and options. Still, generally, the warrant price depends upon the underlying security price, and investors can exercise contracts and purchase company shares.

Factors Impacting Warrant Prices

The price of these warrants fluctuates like the price movement of the underlying stock. It can be due to a single factor or multiple factors. The following are considered key factors affecting the price of a warrant:

1. Underlying Asset's Price: Investors are intrinsically induced to take up a position with a call when the underlying asset moves up or down, which means an upside movement in the underlying asset makes a call warrant more valuable.

2. Volatility: The likelihood that the structured warrant will trade in-the-money increases with the underlying asset's price volatility.

Shares with low volatility generally have the same effect on the volatility of warrants and typically track share prices.

3. Interest rates: The interest rate also influences the premium calculation, but the effect is relatively small compared with the other factors above.

The holding costs of purchasing the asset value to hedge the warrants offered are impacted by interest rates, affecting a warrant's price.

As interest rates rise, the warrant's value increases while the put warrant's value drops.

4. Dividends: The market undervalues the payout of dividends when the underlying asset is a share that pays dividends, which causes the share price to decrease.

As we've previously stated, a decline in the share price will result in a drop in the price of the warrant and a rise in the put warrant premium.

The reverse will occur if dividend payments are reduced: a rise in the reduction of the put warrant's premium and an increase in the warrant's premium.

Researched and authored by “Arshnoor Kamboj” | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?