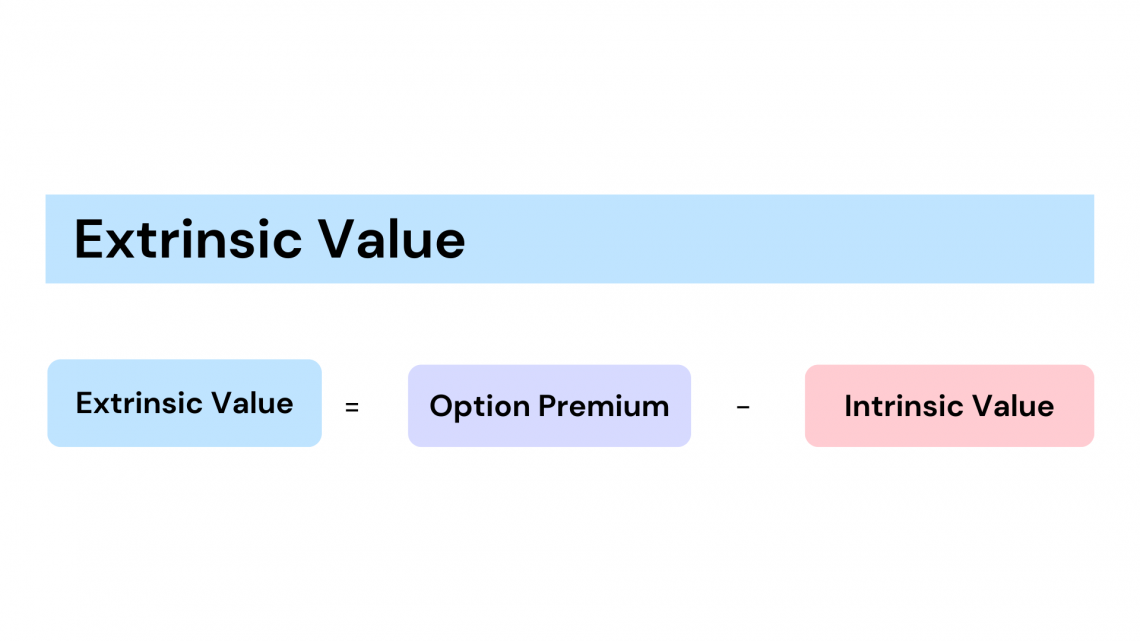

Extrinsic Value

The difference between the market price of an option and its intrinsic price

What Is Extrinsic Value?

Extrinsic value is the difference between the market price of an option and its intrinsic price. In other words, it is the option premium minus the intrinsic value. It can also be defined by the price that exceeds the intrinsic value. It can be either a positive or negative value.

It is a risk parameter that measures the changes in value when affected by external factors. We will discuss the external factors later in this section.

Out-of-the-money and at-the-money options consist of only extrinsic value. Out-of-the-money implies that the option has no intrinsic value. At-the-money occurs when the strike price is equal to the current market price of the underlying security.

On the other hand, in-the-money occurs when the strike price is favorable compared to the market price of the underlying security. The strike price is a set price at which a derivative contract can be bought or sold. Therefore, the strike price is also known as the exercise price.

Another way to think of this value is the portion of the price the option writer receives when buying a stock option. It can also be considered compensation for the risk the option writer takes when writing the contract.

Key Takeaways

- Extrinsic value is the option premium beyond intrinsic value, indicating risk or time value.

- Out-of-the-money and at-the-money options consist only of extrinsic value, while in-the-money options have intrinsic value.

- Extrinsic value is influenced by contract length (time premium), volatility, and market demand.

- Time decay, interest rates, dividends, and delta also impact extrinsic value.

Factors Affecting Extrinsic Value

It is determined by factors other than the price of the security. The three factors are:

1. Length of the contract

A contract becomes less valuable as it approaches the expiration date because there is less time for the security to benefit the holder. Thus, the holder pays more intrinsic value for options with longer expiration.

Since the length of the contract is an important factor, the extrinsic value is also known as the time premium.

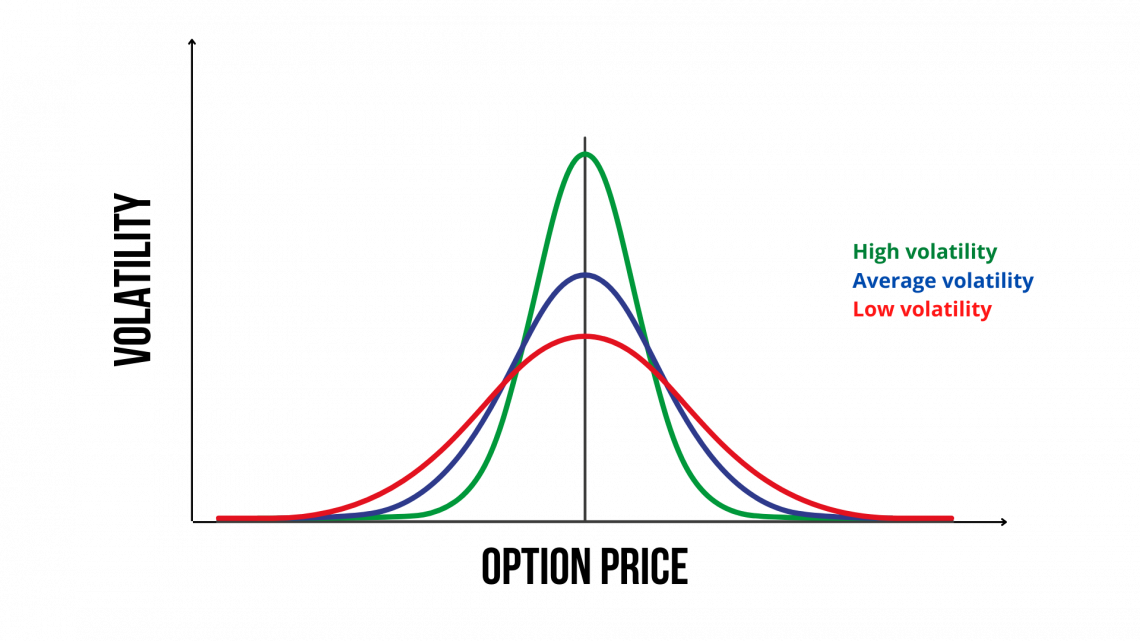

2. Volatility

Additionally, the time premium of an option is obtained when volatility is added to the time value. Hence, when volatility increases, an option's extrinsic value also increases. Vice-versa holds true as well.

It is used to estimate the likelihood of changes in price in a given security. To be more specific, this is called implied volatility. The market price of an option in the Black-Scholes model will be explained in more detail later.

However, it can only be calculated if the market price is known. Therefore, predicting implied volatility is very difficult to predict accurately.

Implied volatility increases when they are more buyers than sellers in the market. This drives up the market demand, which in turn increases the price of an option.

3. Market Demand

Moreover, Market demand is a crucial factor in determining the market price of an option. This means that the market demand impacts the premium a trader is willing to pay for an option.

There are also other small factors such as time decays, interest rates, dividends, and delta.

- Time decays usually impacts the option premium and benefits the option seller.

- Interest rates directly affect the option’s value. For example, a high risk-free interest rate would increase a call option’s extrinsic value. On the other hand, put options are negatively correlated with interest rates.

- Dividends decrease the value of call options but increase the value of put options.

- Delta is the sensitivity between the option’s price and its underlying security. A lower delta results in a higher extrinsic value.

Investors purchase options as a form of protection to cover the downside risk they might incur in a particular investment. This way, they can protect themselves against significant losses they fail to anticipate.

Assumptions of the Black Scholes Model

Under the model, there are a few assumptions analysts use to calculate the implied volatility:

- The volatility is known and constant

- The risk-free rate is known and constant

- The underlying asset has no cash flows

- No transaction costs or taxes

- No dividends are paid during the lifetime of the option

- Markets are randomized

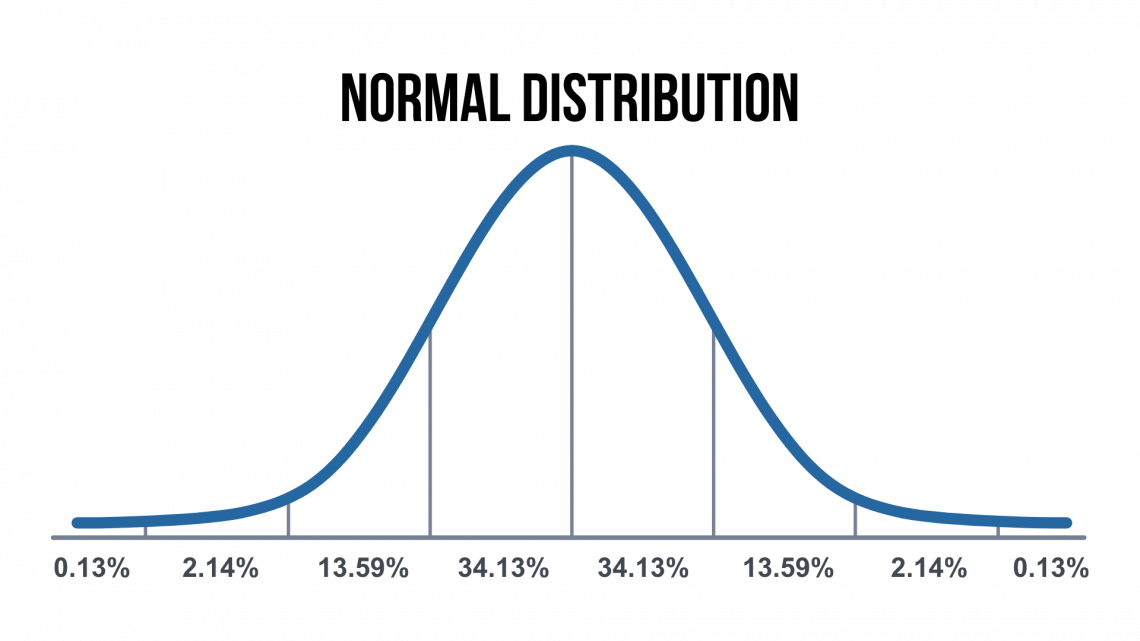

- Return of the underlying asset is normally distributed

The risk-free rate mentioned in assumption #2 is the theoretical rate of return, assuming the investment has zero risk. In practice, this does not exist since all investments carry a certain amount of risk.

It is useful because it gives the minimum return an investor would expect, as the potential return would be greater than the risk-free rate.

The interest rate of the three-month U.S. Treasury bill is often used as the risk-free rate because the government usually would not default on its obligations. Thus, the three-month U.S. Treasury bill is a useful proxy.

The normal distribution mentioned in assumption #7 is a statistical probability distribution for continuous random variables.

Under normal distribution, 68% of the values are within one standard deviation, 95% are within two standard deviations, and 99.7% are within three standard deviations.

The six assumptions simplify the formula used but are not always accurate in real-world scenarios.

Therefore, the model requires certain adjustments to incorporate variance. In addition, specific adjustments differ from analyst to analyst, so the extrinsic value calculated might differ slightly from the current market price.

The formula is calculated by multiplying the stock price by the standard normal probability distribution function.

However, the Black Scholes model is generally used to estimate the price for European options only. It does not consider that U.S. options can be exercised before expiration.

Additionally, dividends and risk-free rates may not be constant in real-world situations, violating the assumptions mentioned earlier.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?