Floating Rate Note

A form of a financial instrument having a variable interest rate that changes in response to changes in the benchmark rate

What is a Floating Rate Note (FRN)?

An Floating Rate Note (FRN) is a form of a financial instrument having a variable interest rate that changes in response to changes in the benchmark rate. Variable-rate bonds have interest rates that vary based on a benchmark interest rate.

The LIBOR, the prime rate, and the rate on treasury bills are good examples of Benchmark Rates as opposed to fixed-rate bonds, which have an interest rate that remains constant during the bond's existence.

The organizations that issue these notes include corporations, governments, and financial institutions. In addition, they are frequently used to obtain funds for short-term initiatives such as infrastructure or development.

These are also used to refinance existing debt or manage interest rate risk.

The interest rate on these notes is typically set as a spread above the benchmark rate. For example, a company may issue an FRN with an interest rate equal to LIBOR plus 1%.

If LIBOR is currently at 2%, the interest rate on the note would be 3%. If LIBOR rises to 3%, the interest rate on the note would increase to 4%.

A floating rate note protects investors from inflation since its interest rate is erratic. The benchmark rate is anticipated to increase along with inflation, raising the note's interest rate. This can help maintain the purchasing power of the investment.

These notes also provide issuers with flexibility in managing their debt. For example, to avoid locking in a high-interest rate, an issuer may issue a floating note instead of a fixed-rate bond if interest rates are likely to climb.

Key Takeaways

- Floating Rate Notes (FRN) are financial instruments with variable interest rates that adjust in response to changes in benchmark rates. Unlike fixed-rate bonds, the interest on FRNs fluctuates over time.

- The interest rate on FRNs is tied to benchmark rates like LIBOR, the prime rate, or treasury bill rates. It is typically set as a spread above the benchmark rate, providing flexibility in adjusting to market conditions.

- FRNs are issued by various entities, including corporations, governments, and financial institutions. They are commonly used for short-term financing, infrastructure projects, debt management, and refinancing.

- FRNs can protect investors from inflation since their interest rates tend to rise with increases in benchmark rates. This helps maintain the purchasing power of the investment.

How to Calculate Interest on A FRN

The interest calculation on a variable rate note is more tedious than on a fixed-rate bond. In addition, because the interest rate on this note fluctuates over time, one must be aware of the current rate to compute the interest payments they will accrue.

Let us discuss how to calculate the interest on an FRN:

1. Determine the benchmark rate

Finding the benchmark rate to which the bond's interest rate is connected is the first step in computing the interest on a variable rate note.

This could be a rate like LIBOR, the prime rate, or another market interest rate. The benchmark rate is typically expressed as an annual percentage rate.

2. Determine the spread

The spread is the amount that the interest rate on the note is above or below the benchmark rate. For example, if the benchmark rate is 2% and the spread is 1%, the interest rate on the note would be 3%.

3. Determine the current interest rate

The interest payments on a variable rate note must be computed using the current rate because the interest rate changes over time. Therefore, the current interest rate is typically determined by adding the benchmark rate and the spread.

To simplify, the current interest rate would be 5% if the benchmark rate is 3% and the spread is 2%.

4. Calculate the interest payment

You may compute the interest payment once you've calculated the current interest rate on the FRN. One must get hold of the face value of the bond as well as the interest payment term to do so.

One must determine the interest payment for each quarter if the bond has a $10,000 face value and is subject to a quarterly interest payment schedule.

Add the portion of the year covered by the interest payment period to the bond's face value and the current interest rate to determine the interest payment.

The quarterly interest payment would thus be computed as follows if the bond's face value is $10,000, the current interest rate is 3%, and the frequency of interest payments is every quarter:

(3% * $10,000 * 3/12) = $75 in interest payments

So, the interest payment for each quarter would be $75.

5. Adjust for any accrued interest

If you are buying or selling an FRN during an interest payment period, you may need to adjust for any accrued interest. Accrued interest is the interest that has accumulated since the last interest payment date.

To calculate the accumulated interest, multiply the current interest rate by the bond's face value and the year's portion from the previous interest payment date.

Note

If you purchase a note, you must also pay the bond's purchase price plus any accumulated interest to the seller. If you are selling a note, you will receive the accrued interest from the buyer in addition to the sale price of the bond.

Calculating the interest on notes requires knowledge of the benchmark rate, the spread, the current interest rate, the face value of the bond, the interest payment period, and any accrued interest.

By following these steps, investors can calculate the interest payments they will receive on a floating-rate note and make informed investment decisions.

Floating Rate Note Limitations

Below are a few limitations of the rate:

- There are some hazards connected with investing in these notes. One of the main concerns is that the interest rate won't increase as anticipated or perhaps go down, giving investors lower profits.

- They can be harder to purchase and sell on the secondary market since they are sometimes less liquid than fixed-rate bonds.

- Investors should know the issuer's creditworthiness before investing in a floating-rate note. Investors may not obtain the projected profits if the issuer cannot make bond payments.

- These are debt securities with a variable interest rate that changes based on a benchmark rate. As a result, issuers frequently utilize them to obtain financing for short-term projects or to minimize interest rate risk.

- While they provide investors with inflation protection and issuers with flexibility in managing their debt, they also involve significant dangers, such as the possibility of reduced yields and decreased liquidity.

Callable Floating Rate Note vs. Non-Callable Floating Rate Note

A floating rate note is a type of debt instrument whose interest rate fluctuates over time based on a benchmark interest rate, such as the London Interbank Offered Rate.

Callable FRNs and non-callable FRNs are two variations of this instrument. Callable FRNs give the issuer the right to redeem the notes before maturity, while non-callable FRNs do not have this feature.

This article will examine the benefits and drawbacks of callable and non-callable FRNs.

1. Callable Floating Rate Notes

Callable FRNs are a bond or note that the issuer can redeem anytime before the maturity date. The issuer often takes advantage of this chance to renew the loan at a lower interest rate when interest rates decrease.

These usually have a higher yield than non-callable FRNs because of the added risk of early redemption.

| Pros | Cons |

|---|---|

| Callable FRNs typically offer a higher yield than non-callable FRNs due to the added risk of early redemption. | Callable notes expose investors to interest rate risk. If interest rates fall after the notes are issued, the issuer may choose to redeem them, leaving investors with a lower yield than expected. |

| Callable notes allow issuers to redeem the debt when it is advantageous for them to do so, such as when interest rates have fallen. This can help reduce their interest expense and free up capital for other investments or operations. | They typically have a cap on the maximum interest rate they can pay. This limits the potential for investors to benefit from rising interest rates. |

2. Non-Callable Floating Rate Notes

Non-callable FRNs are debt instruments the issuer cannot redeem before maturity. However, they offer investors a predictable income stream, as the interest rate is tied to a benchmark rate and is usually reset periodically.

| Pros | Cons |

|---|---|

| They provide investors with a predictable stream of income, as the interest rate is tied to a benchmark rate and reset periodically. | Non-callable FRNs typically offer a lower yield than their counterpart because they do not have the added risk of early redemption. |

| They also reduce interest rate risk for investors. Because the notes cannot be redeemed before maturity, investors are not exposed to early redemption risk. | These don't provide issuers the freedom to restructure the loan at a lower interest rate if the market changes. |

Callable and non-callable notes each have their own set of advantages and disadvantages. For example, callable FRNs offer higher yields and flexibility for issuers but expose investors to interest rate risk and limit their upside potential.

Non-callable FRNs offer a predictable income stream and lower interest rate risk but have lower yields and limit issuers' flexibility.

Investors and issuers should carefully consider their objectives and risk tolerance before investing or issuing either type of floating rate note.

Note

Callable notes may be appropriate for investors seeking higher yields and issuers seeking flexibility, while non-callable notes may be suitable for investors seeking a predictable income stream and issuers looking to reduce interest rate risk.

Discount Margin On a Floating Rate Note

A discount margin is a crucial element of bonds known as floating rate notes (FRNs). These bonds vary from traditional bonds in that their interest rate is changeable.

An FRN's interest rate is linked to a benchmark rate, such as the London Interbank Offered Rate (LIBOR), and fluctuates over time.

The discount margin is a fixed spread added to the benchmark rate, determining the interest rate paid to the bondholder. The interest rate changes when the benchmark rate changes, meaning the discount margin remains constant throughout the bond's life.

The discount margin is significant for investors as it impacts the yield of the FRN. Yield is the total return the bondholder will receive from holding the bond, and the discount margin plays a crucial role in calculating the yield.

A bigger discount margin equals a higher yield, and a smaller one equals a lower yield.

The discount margin technique is employed to compute the coupon payment's spread portion. The margin aids in matching the present value of future cash flows to the current market price using this technique.

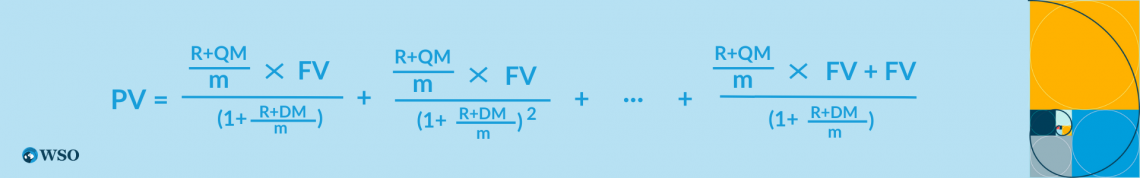

The time value of the money idea is utilized to determine this margin across N periods. The following formula is used:

Where:

- PV = Present value

- QM = Quoted margin

- M = Bond duration

- FV = Face value

- R = Rate of reference

- DM = Discount margin

When investors evaluate an FRN, they should consider several factors that impact the discount margin. Creditworthiness is a vital consideration when assessing an issuer's risk.

An issuer's credit rating reflects its financial strength and stability, with higher ratings representing lower risk. Therefore, a higher credit rating may lead to a lower discount margin and vice versa.

FRNs offer flexibility since the interest rate on the bond changes over time. This feature means that the bondholder can benefit from rising interest rates.

The discount margin is a crucial element of FRNs. The discount margin sets the bondholder's interest rate and remains constant during the bond's life. Therefore, investors should evaluate creditworthiness, term, and other factors when considering FRNs.

Floating Rate Note FAQs

Some advantages of using a floating rate note are that it provides less volatility and higher returns and is also considered a safer investment.

Because FRNs are bonds that invest in fixed-income securities and floating-rate funds, they are not liquid. Nevertheless, liquid funds invest their assets in securities with short tenures, such as bank deposits, commercial papers, short-term government bills, etc.

Financial organizations, governments, and businesses can issue floating rate notes or floaters with maturities ranging from two to five years.

Individual floating-rate bonds can be purchased through a broker, or you can invest in mutual funds that solely deal in floating-rate securities. When interest rates are low or have decreased rapidly in a short period and are likely to climb, it is the optimum moment to buy floating-rate bonds.

The required margin (or Discount) is the spread above or below the reference rate that causes the FRN to be valued at par on the day the rate is adjusted. Thus, if the issued floater is valued at par, pays a 3-month LIBOR, and adds 0.50%, the advertised margin is 50 basis points (0.50*100).

or Want to Sign up with your social account?