Naked Shorting

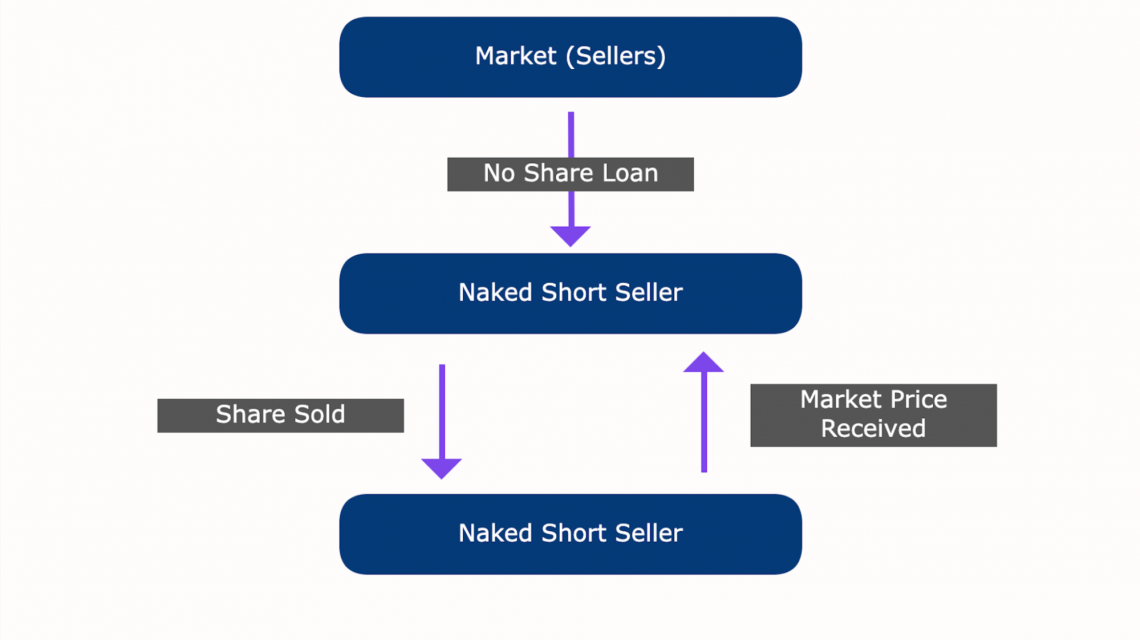

An instance where an investor takes a short position without first borrowing shares of the security they sell.

What Is Naked Shorting?

Naked shorting describes an instance where an investor takes a short position without first borrowing shares of the security they sell.

As high volumes of naked shorting have a strong impact on financial markets, requirements around shorting any security have been put in place by the U.S. Securities and Exchange Commission (SEC) to stop market manipulations.

Because creating a naked short position is illegal, it is an inaccessible strategy to most investors.

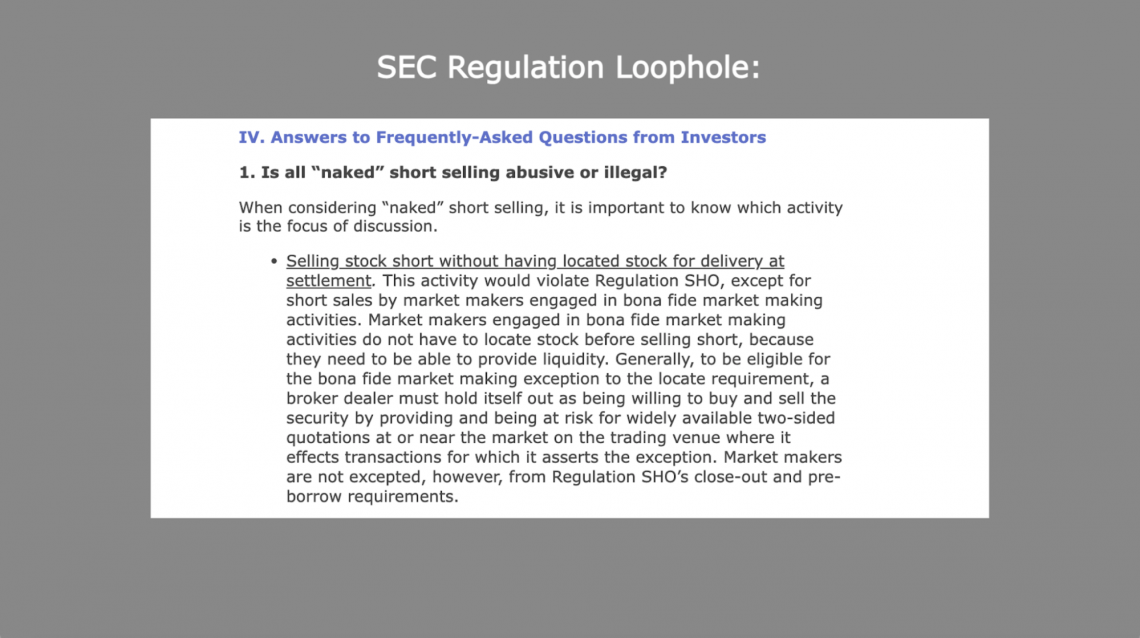

Although it is illegal, naked shorting still exists today. Loopholes in SEC rules and regulations allow hedge funds and brokers to use this strategy, often at the expense of retail traders.

To make it clear exactly how we will review the following:

- Short vs long positions, what is “going short?”

- Naked shorting compared to a short legal position.

- The market impact

- Existing regulations and history

Understanding Naked Shorting

Put simply. A naked short is an illegal short position created when shares are sold without first being borrowed. This share may not even exist. In the most extreme cases, more shares can be sold than are actually outstanding.

One might wonder how this is even possible. How can an individual sell a share if they have nothing to deliver?

Only some firms comply with delivery rules, those that are NASD affiliates. This means the lack of compliance from other investment firms allows this activity to continue unreported.

The truth is that naked shorting is carried out almost exclusively by market makers, such as brokers or large hedge funds.

Because it is an illegal practice, it can only be done using loopholes in trading rules and by taking advantage of differences between electronic and paper trading.

Market Impact

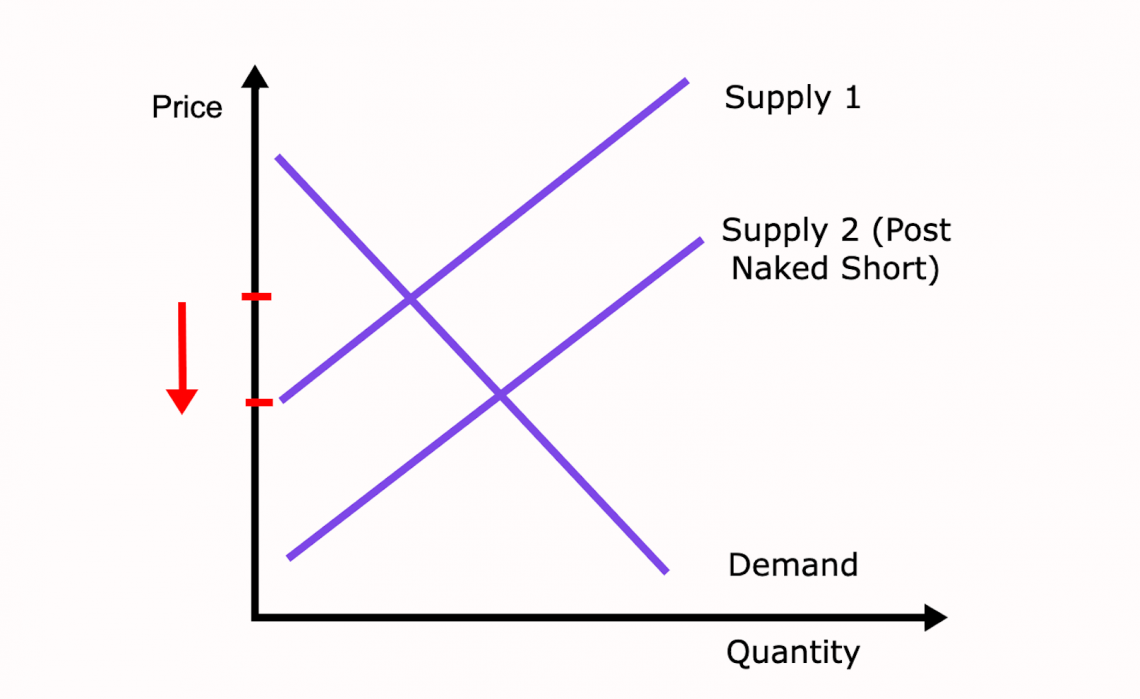

Creating naked short positions is, in many ways, a self-fulfilling prophecy. Creating and selling a counterfeit share expands the sell side of the market for that security overall. This consequently affects the current price of that security, which is determined by supply and demand day-to-day.

According to the laws of supply and demand, expanded supply without an increase in the demand for that security would be followed by a decrease in price.

If there was no restriction on naked short positions, counterfeit shares could flood the market, and the increased supply could grow infinitely. We can quickly see how creating a naked short is a self-fulfilling prophecy.

Investors looking to profit on downward price movement open a naked short position, expanding the supply-side quantity of the security. Prices would likely fall without investor expectations changing to cause a demand shift.

Now with the security at a lower price, the investor closes their short position, and the profits are the price difference.

The price change is negligent with small quantities of supply change from naked short positions. Issues arise when large quantities of naked short positions are created.

In addition to the first impact phase, when an increase in supply affects the price, the subsequent decline in share price will likely create more selling pressure.

Demand may also drop as the price declines because of the psychological impact of seeing the stock price lower.

For new investors, the price decline over time can be a disincentive to buy. For existing investors wanting to cut losses, an incentive to sell arises.

As demand further drops, the price declines even further. Short sellers who see this rapid price decline may become more confident in the probability of further bearish movement. More short positions are open. The process continues.

As we can see, the naked shorting of security can lead to an uncontrollable downward spiral of price movement. This effectively fulfills the wishes of short-sellers, who profit from decreasing prices.

The timeline can be summarized as follows:

- The investor opens a naked short position.

- Increased supply on the sell side lowers prices.

- Lower stock prices affect investor sentiment, and demand falls.

- Price falls further.

- The lower price makes naked short positions look more appealing.

- The cycle repeats.

Regulations On Naked Shorting

Because of the market impacts, regulations on naked short positions were put in place, inhibiting the ability of high net-worth individuals or companies to manipulate markets. Naked short selling was deemed illegal after the financial crisis in 2008.

What exactly happened in 2008? As the economic outlook became increasingly poor with the impending housing market crash, financial institutions holding large quantities of mortgage-backed securities were also likely to fail.

Although many of these companies would likely have gone bankrupt anyway, naked short-selling of financial institutions probably accelerated the demise of certain companies.

According to the SEC and Bloomberg, naked short positions on both Lehman Brothers and Bear Stearns affected the rate at which company stock plummeted to zero.

As discussed earlier, the self-fulfilling prophecy of short-sale activity is quite powerful, especially when investor sentiment is bearish.

The SEC enhanced its regulations on naked short sale activity to alleviate manipulation concerns overall from its previous restrictions established in 2004.

Initially, naked short sales were restricted for small-cap stocks with relatively low numbers of shares held publicly, as these would be more susceptible to price changes from selling abuse.

Blue chip companies were not seen as being at risk of short sale activity by the SEC until 2008. Short sales could have even been seen as a positive. The excess flotation of shares from naked shorts on these stocks helped with liquidity and market-making efficiency.

In July 2008, however, things changed. A temporary ban of short sales on Fannie Mae, Freddie Mac, and a handful of other large financial institutions was instated.

In September of 2008, as the gravity of the situation was becoming apparent, this ban was extended to over 700 other companies. This temporary ban was initially set to expire in October 2008.

In October of 2008, the SEC established another interim rule that required short sellers to first borrow the shares before selling to open. In July 2009, this rule became permanent and was applied to all stocks, large-cap and small.

Naked Short Examples

Assume stock for company XYZ is currently trading at $25. A few days later, after reporting bad earnings, a brokerage believes the stock will soon decline in value. The brokerage wants to open a short position to capitalize on the expected price change in the coming months.

Instead of borrowing shares, selling them on the open market, and hoping the price decreases, they use their market-making power to create a naked position. The fact that this lowers the stock appreciation risk is quite attractive.

The stock price drops rapidly by piling on an extreme excess of supply. Many investors have their stop losses triggered and end up closing their positions. Other investors simply sell out because they are worried about the price decline.

To close their position, the brokerage repurchases their shares. The extra liquidity from all counterfeit shares floated on the market and the panic selling from other investors makes this quite easy.

Let’s say they can repurchase all their shares at an average price of $15. If they went short 1 million shares, they would profit $10 million. $10 per share.

Not only was this trade extremely profitable, but the broker was able to push the market in a direction that made it so. By manipulating the market, they were able to capture lucrative returns.

Extreme short positions are still a reality today. Significant selling pressure in the form of short positions on Gamestop stock in 2021 led to retail investor backlash. Retail investors increased demand, rapidly driving up the price of the stock.

Because of the excess of short positions by financial institutions, the subsequent price jump left short position holders to cover their losses.

Although the SEC has since said there was no evidence of naked short positions on Gamestop stock, many retail investors would argue otherwise.

During extreme price increases, retail trading platforms halted investor trading and stopped retail investors from continuing to purchase shares.

As shares could still be sold, the orchestrated demand decrease without restriction to supply helped institutional investors close their positions. This stopped what looked like an impending short squeeze.

In addition to firms such as Melvin Capital, which lost billions of dollars from their original short positions, retail investors had the opportunity to see their profit stripped from them. The subsequent price decrease left many with losses as well.

What Is Going Short?

First of all, what is a short position? A short position is a position an investor can take when they believe the price of a stock is going to decline. Rather than buying to open a position, as is most common, the investor sells shares to open their position.

The investor must get the shares loaned to them to open a short position. These shares can then be sold at the market price for cash. The expectation is that this cash can later be used to buy back the shares at a lower market price. The cash left over will be the investor’s profit.

After the shares are repurchased, they are then returned to the lender. Any capital gains or losses are realized by the investor who had the shares originally loaned to them, based on changes in price after these shares were sold on the open market.

For example, an investor is loaned five shares of stock XYZ, and the market price is $100. These shares are then sold on the open market. This step is what is known as selling to open.

The investor now has $500 cash. This $500 is not effectively realized, as the investor is still liable for the five shares to the loaner of the securities.

If XYZ drops to $90, the investor can purchase these shares for $450. This is called buying too close. These shares are returned to the original owner, who lent the shares to the investor. The investor is no longer in debt for those shares.

The investor profit is the difference between the selling and purchase prices multiplied by the number of shares. In this case:

Profit = 5 x ($100 - $90) = $50

Generally:

Profit = number of shares x (sell price - buy price)

As is usually the case, profit is the difference between the selling and purchase prices. However, in the case of a short position, the investor sells first and then buys later.

Conclusion

There are a few main differences between short positions and naked short positions:

- Short positions are legal. Naked shorts are illegal.

- Short positions do not explicitly manipulate prices, and naked shorts create downward price pressure.

- Short positions are accessible to retail traders. Naked shorts rely on loopholes and are almost exclusively done by large institutions.

Investors interested in opening short positions should have a strong understanding of company fundamentals.

Typically, opening a short position is done when an investor has a bearish outlook on a stock’s performance. Investors can develop this outlook by using financial modelling to evaluate a company.

or Want to Sign up with your social account?