Go Long On "Brick"

Here in Argentina, people are always talking about buying “brick”. From the rooftop of my apartment, I can see many unoccupied apartments in the midst of a building boom.

The truth is that those are not really apartments, but private banks. Argentines, having been screwed over by the government more than once, and unable to save legally in dollars, buy “brick” (real estate) and put them away for a rainy day. I live in a sense, in a neighborhood surrounded by private banks, except there is no sign at the door. Some people rent to tourists, who pay triple the going local rate, but many just buy a place, lock the door, and start saving for the next brick. Without a mortgage market, it’s all done in cash (US dollars).

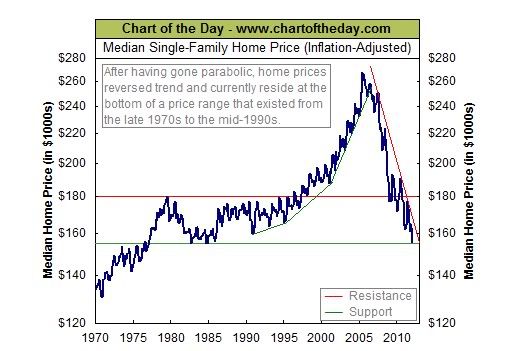

At any rate, it got me to thinking about similar opportunities in the US. Today’s Chart of the Day (see below) shows that US real estate prices are below 1979 prices. Adjusted median house prices are now 42% below the 2005 peak. Now if this was a stock, with a strong dividend payout, it would look like a good buy.

Look at Boulder, Colorado, for instance. A small town with a couple of huge universities, plus many corporate headquarters, and start up high tech companies, the demand for temporary housing is insatiable. Just like in the rest of the world, many local homeowners were forced to sell their homes, adding to the rental demand. Today because of this near perfect storm, you can probably get up to a 20% return if you buy brick in Boulder and rent it to tourists. If you rent to locals, you can probably get closer to 10%. Of course I am talking about a cash investment, like they do here in the other big Apple. If you still believe leverage is king, then you can get a bigger bang for your buck.

A recent article in the Wall Street Journal says Phoenix, Arizona’s real estate market is starting to rebound, after prices dropped 55%, leading the way for other cities. What’s causing the rebound? People booted out of their homes seeking rentals, high demand for rentals, investors buying brick to fulfill that demand. It’s that simple. And it is happening everywhere, including New York City.

When you buy brick, the only reason to sell is a liquidity crunch. It happened in Buenos Aires in late 2001, when home owners started dumping their real estate after the government froze their dollar accounts. But to me it presented a great investment opportunity, which has tripled in value since, not to mention the rental income.

We need another bubble, so I can retire at 35.

The current & last bubble is in the governement. It will probably burst withing 5-7 years. And when it do, you better be in your overseas farmland with your guns and gold.

I was just in Buenos Aires for a week ... funny you mention that phenomenon because multiple people there said the same thing.

trying to bet against USD/UST is going to be like trying to profit from a JPY/JGB collapse. it's been tried. more will perish than succeed. plenty of little hedgies tried to short real estate early in 2005 and were taught that that the markets can stay irrational longer than they can stay solvent.

A lil bit ironic. I just got off the phone with my lawyer with regards to setting up a c-corp and a few LLCs in order to invest. You basically stated my thoughts on real estate investment opportunities in the US, although I plan to go after some of the $800 billion of foreclosures that the banks are slowly unloading.

this is probably my favorite post in a while.. nice lil D

Rerum iusto eligendi aut eum. Optio suscipit tempora rerum ab sed quibusdam neque. Non voluptatum molestiae explicabo consequuntur et quaerat nesciunt aut. Et ut molestias deserunt aliquam ut voluptatem dicta. Sed quis accusantium aut incidunt ut laudantium. Sit et autem molestiae quis. Fugit ducimus et explicabo laudantium.

Qui in quia quos voluptas. Aspernatur vero tenetur neque possimus. Et soluta beatae fuga unde accusamus consequatur. Omnis quod voluptatibus cum et.

Neque explicabo illum provident dolorem consequatur. Mollitia adipisci non rerum et. Cupiditate fugiat fugit aut voluptatibus. Doloribus consequuntur fugit beatae excepturi quasi aut excepturi beatae. Cumque maxime ex quis omnis.

Molestiae commodi neque et reprehenderit vitae dolore. Quia quia repudiandae quod. Dolorem aliquam aut quam porro aut dolores illo voluptatem. Architecto saepe ea tenetur non. Assumenda ipsum dicta quas voluptatem. Perspiciatis est facilis quibusdam nihil alias itaque.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...