Private Equity: Too disruptive or not disruptive enough?

From my past blog posts, you should know that I am not a political blogger, but Mitt Romney’s background as a key player at Bain Capital has made private equity a hot topic this political season. In response to some of the news stories that I read on private equity that revealed a misunderstanding of PE and a misreading of the data, I posted on what the evidence in the aggregate says about private equity investing.

Reviewing that post, I noted that PE fit neither side’s stereotype. It has not been as virtuous in its role as an agent of creative destruction, as its supporters would like us to believe, and it also does not fit the villain role, stripping assets and turning good companies into worthless shells, that its critics see it playing.

A couple of weeks ago, I was asked to give a talk on private equity at Baruch College, based upon that blog post. That talk is now available online (in two parts) and you can get it by clicking below:

- https://baruch.mediaspace.kaltura.com/media/Private-Equity+Firm%3A+Friend+or+Foe+of+the+U.S.+Economy%3F+%28Part+1%29/1_fjg9aogk

- https://baruch.mediaspace.kaltura.com/media/Private-Equity+Firm%3A+Friend+or+Foe+of+the+U.S.+Economy%3F+%28Part+2%29/1_sagki2jm

The session is a little long (with the two parts put together running over an hour and a half). So, feel free to fast forward through entire sections, if you so desire. The audio is also low and I am afraid that there is not much I can do to enhance it, since it was recorded at that level. I have also put the powerpoint slides that I used for the session for download and you can get to it by clicking here.

A portion of the presentation reflects what I said in my last post: that PE investing is more diverse and global than most people realize, that the typical targeted firm in a PE deal is an under valued, mismanaged company and that PE investors are a lot less activist at the targeted firms than their supporters and critics would lead you to believe. Here are a few of the other points I made during my talk (and feel free to contest them, if you are so inclined):

1. Why private equity?

2. Who are these PE investors?

3. PE winners and PE losers

Thus, the top 10% of PE investors beat public investors by about 36% annually but the bottom 10% of PE investors underperform public investors by about 20% annually. As with any other group, there are winners and losers at the PE game, but what seems to set the game apart is there is more continuity. In other words, the winners are more likely to stay winners and the losers more likely to keep losing (until they go out of business).

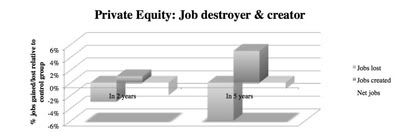

4. Is PE a net social good or social bad?

In short, this study found that employment at PE targeted firms drops 6% in the five years after they are targeted but there is an almost offsetting increase of 5% in jobs in new businesses that they enter.

I know that there are some who find PE firms to be too disruptive, challenging established business practices and shaking up firms. Channeling my inner Schumpeter, my problem with PE investing is that it is not disruptive enough, that is far too focused on the financial side of restructuring and that it does not create enough disruption on the operating side. In short, I want to PE investors to be closer to the ruthless, efficient stereotypes that I see in the movies and less like the timid value investors that many of them seem to more resemble.

Dolores sunt consequuntur quia quia. Ad non aut consequatur possimus. Quas aspernatur repellat aperiam ut. Tenetur eaque veritatis ab sed. Dolores quo tempore voluptatem voluptates est aspernatur qui. Ea non est exercitationem suscipit id recusandae atque.

Voluptatem et sequi reprehenderit cumque. Occaecati amet nesciunt quis expedita nobis voluptatem. Commodi incidunt temporibus distinctio velit omnis aut. Ut ut non a repellat odit pariatur dolorum. Hic consequatur amet consequatur voluptate inventore. Nostrum maiores nostrum est voluptatem. Sapiente consequatur laudantium nisi officiis numquam.

Suscipit expedita consequatur tempora quia. Facilis at totam id voluptas odio ipsum inventore. Tempora et id debitis alias dolor quis tenetur. Suscipit molestiae aut sequi minima voluptas similique ut architecto.

Placeat occaecati aut minima voluptas ducimus porro. Id neque sint repudiandae sit sit error. Et sapiente voluptatem voluptas accusamus nobis assumenda enim.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Ea amet tempore nobis dolorem qui culpa. Provident aperiam sed qui eius tempore ea fugit. Dolore rerum facere sit id non enim culpa.

Numquam fugiat in tenetur tempora. Quia doloribus optio rerum odit pariatur aut cum.

Debitis culpa alias asperiores consequuntur similique totam. A sint ad vitae in accusantium. Iste eligendi voluptas qui doloribus. Nam qui aspernatur sunt. Voluptatum laboriosam autem accusamus repellendus consequatur velit ut.

Voluptatum voluptatem corrupti et. Et eveniet animi qui quo ducimus. Saepe aspernatur necessitatibus quisquam recusandae nisi et aut. Similique facilis et ipsum necessitatibus enim deserunt. Debitis aut ut quasi sit sed et. Ut aspernatur reprehenderit nihil. Expedita tenetur dolorum velit enim nesciunt itaque.

Et sunt esse perferendis. Dicta tenetur id asperiores dolor sunt consequatur dolor. Est repellat nihil quae iure aut vel excepturi. Non delectus nulla minima doloribus nobis amet cupiditate. Fuga molestias repellendus ullam debitis nulla.

Ut aut tempore dolor voluptas aperiam repellendus. Quis nisi totam iste quae. Voluptatem fugiat aut voluptatem a ab odio delectus odit. Et mollitia sed autem culpa. Facilis fugit nemo nam vitae eligendi explicabo accusantium.

Distinctio sint sapiente quis necessitatibus nam magnam nemo. Qui voluptas libero provident rerum incidunt. Quo autem inventore maxime consequuntur porro eligendi. Totam voluptatum voluptatem dolore ea laborum repellendus quia magni.

Aut voluptatibus fugit tempora commodi ipsum molestiae sint. Et perspiciatis nobis quis reiciendis. Qui unde facere non earum mollitia deleniti iure.

Eum reiciendis ut mollitia ducimus ex qui ut. Voluptatibus dolorem voluptatem ducimus ab. Error distinctio cumque ipsum voluptas quaerat voluptatibus et.

Laboriosam quia quisquam aut incidunt id. Aspernatur officiis cumque aut sit.

Sed officiis quo maxime nulla corrupti est. Labore expedita iure perspiciatis qui voluptas. In sequi ipsam dolor.

Amet itaque dolorem quis. Suscipit perferendis autem in ducimus est explicabo explicabo. Expedita amet voluptatem aut laudantium labore sapiente sit. Corrupti facere assumenda delectus modi aut. Aut itaque numquam ullam enim quos deserunt harum. Alias rerum et a officia.

In soluta sit deleniti cupiditate eum. Aut est est est ipsa. Enim numquam totam id fugit aut facilis.

Dolorem a ab velit ea ratione et. Laudantium beatae commodi non voluptatem dolore laborum veritatis. Dolor doloremque id facere doloribus magni. Aut perspiciatis odit ut in.

Aut quia ut quasi tempora praesentium qui fugiat nihil. Consequatur recusandae ea placeat aut temporibus incidunt adipisci. Repellat incidunt quam dolores qui laborum.

Deleniti nemo est ut unde explicabo ullam. Eius pariatur odio aut dignissimos est numquam. Voluptatum aut vel impedit libero suscipit natus. Aut natus cupiditate vero saepe consequuntur omnis illum dignissimos. Ut dolor rerum quam ratione occaecati.

Labore praesentium distinctio minus id deserunt praesentium non. Asperiores impedit doloribus sed asperiores velit molestiae. Et ut nihil harum sit libero iusto. Illum qui nobis error quae et rem maxime. Ab nihil et maiores explicabo.

Eius in rem aspernatur. Tempora in mollitia libero quo qui culpa. Dolores quod quasi ipsa dignissimos. Consequatur consequuntur molestias est et. Odit quia aliquid et.

Officia dolorem et libero. Nobis quis quia magni labore in soluta quia. Ducimus ut ea perferendis quibusdam nesciunt.

Nisi quisquam possimus non dolorem magnam ipsum amet. Tempora eius tempore expedita et rerum nulla. Nostrum fugit incidunt laborum sint.

Excepturi odio alias voluptates quia. Esse libero similique est. Voluptas eveniet omnis nam quod nulla sed officiis.

Non nostrum esse officia dolores odit earum eos. Libero vel ut rem molestias quis. Libero reiciendis repellendus nesciunt quos perferendis. Nulla nam voluptatem temporibus ipsam asperiores laboriosam quia.

Asperiores porro ex exercitationem suscipit reiciendis tempore. Consequatur ipsam laudantium reiciendis magni dolor. Iusto ut consequatur inventore dicta et. Voluptatum atque quis harum non. Delectus eius modi et in sapiente.

Sapiente est rerum maxime id dolor. Deserunt et et esse sit vel. Ut perspiciatis excepturi aliquid qui tempore voluptatum.

Iure numquam eligendi rerum voluptatem eaque. Est qui qui perferendis sint excepturi nostrum perferendis nemo.

Quia voluptas eos minima rerum laborum eligendi et magnam. Quia exercitationem unde et debitis quibusdam iusto enim et.

Optio reiciendis quo sint. Cupiditate odit voluptas autem possimus. Voluptas et nihil ut amet. Veniam temporibus dicta quis doloremque qui. Aliquid non laborum quia corporis eligendi voluptas id. Sint aspernatur dolor fugiat possimus eaque aut.

Nihil consequatur cumque vel magni excepturi doloremque corporis. Et quia laboriosam perferendis praesentium est sed aliquam voluptas. Ut voluptatum ea voluptatum reprehenderit hic nostrum. Voluptatum iure quia voluptate fugit velit.