Private Equity: Too disruptive or not disruptive enough?

From my past blog posts, you should know that I am not a political blogger, but Mitt Romney’s background as a key player at Bain Capital has made private equity a hot topic this political season. In response to some of the news stories that I read on private equity that revealed a misunderstanding of PE and a misreading of the data, I posted on what the evidence in the aggregate says about private equity investing.

Reviewing that post, I noted that PE fit neither side’s stereotype. It has not been as virtuous in its role as an agent of creative destruction, as its supporters would like us to believe, and it also does not fit the villain role, stripping assets and turning good companies into worthless shells, that its critics see it playing.

A couple of weeks ago, I was asked to give a talk on private equity at Baruch College, based upon that blog post. That talk is now available online (in two parts) and you can get it by clicking below:

- https://baruch.mediaspace.kaltura.com/media/Private-Equity+Firm%3A+Friend+or+Foe+of+the+U.S.+Economy%3F+%28Part+1%29/1_fjg9aogk

- https://baruch.mediaspace.kaltura.com/media/Private-Equity+Firm%3A+Friend+or+Foe+of+the+U.S.+Economy%3F+%28Part+2%29/1_sagki2jm

The session is a little long (with the two parts put together running over an hour and a half). So, feel free to fast forward through entire sections, if you so desire. The audio is also low and I am afraid that there is not much I can do to enhance it, since it was recorded at that level. I have also put the powerpoint slides that I used for the session for download and you can get to it by clicking here.

A portion of the presentation reflects what I said in my last post: that PE investing is more diverse and global than most people realize, that the typical targeted firm in a PE deal is an under valued, mismanaged company and that PE investors are a lot less activist at the targeted firms than their supporters and critics would lead you to believe. Here are a few of the other points I made during my talk (and feel free to contest them, if you are so inclined):

1. Why private equity?

2. Who are these PE investors?

3. PE winners and PE losers

Thus, the top 10% of PE investors beat public investors by about 36% annually but the bottom 10% of PE investors underperform public investors by about 20% annually. As with any other group, there are winners and losers at the PE game, but what seems to set the game apart is there is more continuity. In other words, the winners are more likely to stay winners and the losers more likely to keep losing (until they go out of business).

4. Is PE a net social good or social bad?

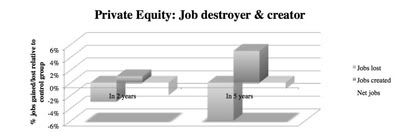

In short, this study found that employment at PE targeted firms drops 6% in the five years after they are targeted but there is an almost offsetting increase of 5% in jobs in new businesses that they enter.

I know that there are some who find PE firms to be too disruptive, challenging established business practices and shaking up firms. Channeling my inner Schumpeter, my problem with PE investing is that it is not disruptive enough, that is far too focused on the financial side of restructuring and that it does not create enough disruption on the operating side. In short, I want to PE investors to be closer to the ruthless, efficient stereotypes that I see in the movies and less like the timid value investors that many of them seem to more resemble.

Not sure if you covered this in the Audio - but what if you looked at Bain Cap alone, rather than the PE industry as a whole? What if you segmented the data set by growth equity deals and LBO deals?

Prof. Damodaran,

I think overall PE economic benefits far outweigh any jobs or assets losses, especially long-term. Private Equity Growth Capital Council (PEGCC) released yesterday a news analysis of returns provided by private equity investments compared to the S&P 500. "Based on the analysis of private equity benchmarks, private equity outperformed (net of fees) the S&P 500 for 1, 5 and 10-year time horizons by 1.8, 3.7 and 7.0 percentage points, respectively. Private equity underperformed the S&P 500 during the 3-year time horizon due to the index’s historic dip during the financial crisis, which inflated the S&P 500’s gains during this period."

I will be releasing next week a post on PE alpha (excess IRRs) for those that wish to read it.

Reading through a Datasite Roundtable discussion today, “There is definitely a disconnect between premier companies that perform well through the cycle and have been demonstrating years of stable growth, and, in some cases accelerated growth coming out of the trough, versus companies that have more of a story associated with them.” -S. Budoff. PE returns are not and could not be uniform. Of course, PE is a cyclical business but I don't see a positive correlation with the market, but rather a negative one.

I agree with Prof. Damodaran that PE could be more disruptive on the operational side, but you have to remember the U.S. is a highly regulated economy with stringent labor and regulatory review, so you can only do so much.

Bain & Co Global PE report

Awesome post - will be sharing

No problem with PE.

I just believe that all non-invested money should be taxed at income rates (no carry, etc). How this loophole exists is mind boggling to me.

As a petroleum engineer, I'm surprised to hear you say this. For example, the E&P industry is a constant state of need for capital infusion. The average oil & gas producer (in the US) has eight separate taxes they have to pay, excluding ad valorum and severance taxes. It's difficult enough for investors to commit capital to these projects at the current 15%. The economics could quickly put many new oil and gas wells out of the money for PE/HF/and other high net worth investors that would otherwise be economical.

There would be no change in E&P companies ability to get capital if the carried interest loophole was closed.

WOW, nicely done WSO loop in Professor Damodaran for a guest author! To incoming monkey's: Professor Damodran will teach you (by in large, sans how to get to work on time hungover) really the only relevant stuff during your training program.

Professor Damodaran, out of curiosity, what is your long term price target for FB? Has their stock price "bottomed out" yet? Also, I still (3 yrs latter) use a lot of the valuation methodologies that you taught my analyst class, and still, get yelled at by VP's and MD's for doing so! Although, during my time in PE (albeit short thus far) they seem more open to them as the right valuation number is more important than sensitivity tables hehe.

I don't think he actually reads WSO.

Trying to get him for the 2013 WSO Conference - yes, this is a syndication, so no guarantees that he is reading the comments.

Prof. Damodaran's article is about the industry as a whole. Does private equity creates jobs? This article is timely. Yesterday I read the following article about Bain Capital:

http://www.thedailybeast.com/newsweek/2012/10/14/david-stockman-mitt-ro…

The article is from a guy who spent more than 10 years working for Blackstone. It is very well written Basically, it says that most of Bain Capital 50% year return during Mitt Romney's stay came from 10 deals. Of those 10 deals, most of them went bankrupt after Bain cashed in.

The article left a bad feeling in my mouth about the whole PE industry. I know I may be judging the whole industry wrong as Bain Capital may not reflect the industry as a whole. And this article points to that. I don't work in PE, so I would like to know the opinions of those of you monkeys that work in a PE shop. And please, be honest, I know it is your job, but we can be objective here. Thanks.

Ut molestiae laborum assumenda at animi pariatur. Possimus temporibus aut vel dicta. Dolor quos voluptates ut cupiditate. Molestiae iste quisquam soluta aut. Et consectetur aliquid et assumenda consectetur dolorum. Et quo ad mollitia iusto sed id mollitia.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...