Interest Rate Swap

Involves the exchanging or “swapping” of interest payments on one financial instrument for another.

What Is An Interest Rate Swap?

An interest rate swap involves the exchanging or “swapping” of interest payments on one financial instrument for another. In more technical terms, an interest rate swap is an agreement between two transactors to exchange one interest payment for another for a predetermined time period.

These swaps are forward contracts and can be traded over the counter (OTC). Typically, these contracts involve trading a fixed interest rate for a floating or variable interest payment or vice versa. This allows both trading parties to hedge the risk of fluctuations in the interest rate until the contract's maturity.

Investment and commercial banks with a high credit ratings are usually the biggest participants in the market for swaps. They offer their customers fixed and floating interest rates, generating supply and demand within the market.

They are often referred to as plain vanilla swaps. This is because this swap is one of the first and simplest forms of swap instruments.

The payments on these swaps are based on LIBOR or London Interbank Offered Rate. This is the interest rate banks with good credit ratings pay each other for short-term loans. It varies daily and serves as the benchmark for short-term variable interest rates.

Key Takeaways

- An interest rate swap is a forward contract between two agents who agree to exchange their interest rate return for the others for a predetermined period of time.

- Swap rates are the fixed component given to the swap receiver as compensation for the uncertainty associated with the variability of rates.

- A swap curve is a plot of the different returns an investor can receive on swaps with different maturity dates.

- There are three different types. These include fixed-to-floating, floating-to-fixed, and float-to-float.

- These instruments are instrumental in the world of finance. They are particularly helpful in portfolio management, corporate finance, speculation, and risk management.

Understanding Interest Rate Swap

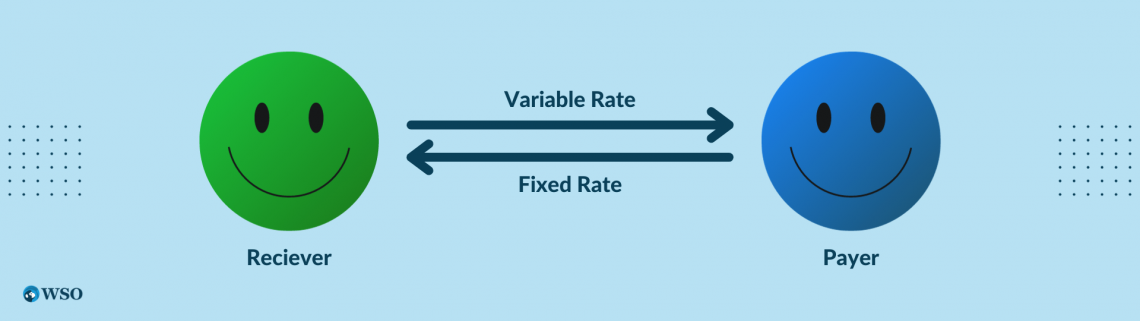

In order to compensate for the uncertainty of the short-term floating rate, the swap receiver is given a fixed interest rate paid by the payer. The diagram below illustrates this:

When the contract is set, the total value of the swap's fixed rate payments is equal to the value of expected variable rate payments as predicted by the forward LIBOR curve. We will come back to this in the next section.

Any changes in the future expectations of the floating interest rate are accompanied by changes in the fixed rate demanded by agents to enter new swap agreements. In a way, this fixed rate is the price of the swap.

Swaps can also be quoted in the swap spread. This is the difference between the swap rate and an equivalent treasury bond yield.

The interest payments between the fixed and floating rates are netted at the end of the payment term, and the involved parties only exchange the difference. This allows for simplicity and convenience of transactions.

What Is A Swap Curve?

A swap curve is a locus of all swap rates across different maturity levels. The swap curve serves as a benchmark for interest rates since swap rates depict both market expectations of the LIBOR and other factors such as: credit quality, liquidity, etc.

The maturity dates are plotted on the x-axis, and the swap rates are plotted on the graph's y-axis to obtain the swap curve. This allows investors to see the potential gains from different maturity dates.

The curve is often upward-sloping since the interest rate on long-term swaps is greater than that of short-term ones. This is because, typically, the longer the maturity, the greater the interest rate swap's sensitivity to interest rate risk.

Although they are similar to yield curves, it is important to note that swaps may trade higher or lower than government bond yields with the same maturity.

The difference between the yield and swap curves comes from the swap spread.

Due to the larger credit risk posed by banks compared to the government, the spread has historically tended to be positive across maturities.

However, other factors, such as liquidity, supply-demand, etc., also come into play. Due to these additional factors, the swap spread in the United States is negative for swaps with longer maturities.

How does An interest rate swap work?

So far, we have discussed an interest rate swap, but to strengthen our understanding of these forward contracts, we need to understand how exactly it works.

As mentioned previously, at the time of the contract, the fixed rate is equal to the expected value of the floating interest rate. However, the LIBOR is ever-changing.

As the LIBOR changes over time, the floating rate either increases or decreases from its original value. Depending on the outcome, the fixed-rate receiver may either lose or profit from the agreement.

This is primarily why institutions or companies enter into interest rate swaps. If a fixed-rate receiving company expects interest rates to rise in the future, it will opt into a contract to receive the variable rate instead.

Likewise, if a floating-rate-receiving company expects interest rates to fall in the future, it will opt into a contract to receive the fixed rate instead.

If a swap becomes unprofitable for either party, they can enter into another contract with a different agent, known as a countervailing swap.

This new agreement is designed precisely as the original one; however, the party takes on the opposite leg instead. This allows the party to cancel out the effect of the original swap and forego the loss.

an example of an interest rate swap

Let us now look at an example to understand better how swap spreads work.

Consider two companies - Amandine’s Kitchen and Babka Bakery. They agree on an interest rate swap contract with a nominal value of $100,000.

Amandine’s Kitchen, which currently receives a fixed interest rate return, expects that interest rates will rise shortly. Therefore, the company hopes to profit off the variable interest rate return, which would rise if interest rates do.

Babka Bakery, currently receiving a variable interest rate return, expects interest rates will fall short. Babka Bakery wishes to get a fixed rate return for the potential interest rate decline to protect itself from a potential fall in interest rates.

The two companies can fulfill each other’s wishes by agreeing upon an interest rate swap contract valued at $100,000.

Amandine’s Kitchen swaps its fixed rate of 5% with Babka Bakery’s variable rate of the LIBOR rate plus 1%. If the current LIBOR rate is 4%, both companies, at the beginning of the contract, receive 5%.

Two possible situations may arise following the contract:

A) Case #1

We assume that the LIBOR rate will rise to 5.25% at the end of the contract. Amandine’s Kitchen would have to pay out 5% of $100,000 to Babka Bakery since it swapped for the fixed rate.

However, Babka Bakery owes (5.25+1)% to Amandine’s Kitchen since it swapped for the variable rate, and interest rates have risen.

Instead of having both companies pay the total amount to each other, the swap agreement terms allow the difference in payments to be paid by Babka Bakery. Hence, Amandine’s Kitchen receives $1,250 and makes a profit.

It is important to note that although Babka Bakery suffered a loss, it was able to protect itself against the possibility of an interest rate decline.

B) Case #2

We assume that the LIBOR rate falls to 3.75% at the end of the contract. Amandine’s Kitchen would still have to pay out $5,000 to Babka Bakery since it now has a fixed rate.

On the other hand, Babka Bakery now only owes (3.75+1)% of the $100,000, i.e., $4,750, to Amandine’s Kitchen. The latter pays out the difference in payments to Babka Bakery.

Babka Bakery thus makes a profit of $250, while Amandine’s Kitchen incurs a loss.

Types of Interest Rate Swaps

Listed below are the three main types.

Fixed-to-Floating

This is similar to the example we discussed in the previous section wherein Amandine’s Kitchen has a fixed interest rate return and wishes to swap it for a floating rate to profit from a potential rise in interest rates.

Floating-to-Fixed

This is also similar to the example from the previous section. However, for this case, we look at the instance of Babka Bakery. The bakery swaps its floating rate for a fixed rate to protect itself against the possibility of a fall in future rates.

Float-to-Float

This final type of swap is one that we have not previously talked about. It involves exchanging one floating rate for another. Although this may seem futile at first glance, companies often pay different types of floating rates.

If a company wishes to change the type or tenor of the floating rate index it pays, it can enter into a float-to-float or basis swap.

An example of this type of swap will be if a company swaps a 6-month LIBOR for a 12-month LIBOR.

There are several reasons a company might do this. It could be because the rate of the 12-month LIBOR is a better match for the company’s other cash flows or simply because it is more attractive.

Companies may also switch to different indices, such as the Federal Funds Rate or the Treasury Bill Rate (i.e., the interest rate on treasury bills).

What are interest rate swaps used for?

Interest rate swaps are vital for institutional investors and banks because of their multifarious uses. Some of these are listed below.

Portfolio Management

Portfolio managers can adjust interest rate exposure and hedge the risk of rate fluctuations with the help of swaps. Swaps may also be an alternative to other, less liquid fixed-income securities.

Corporate Finance

Companies may participate in swap contracts if they have liabilities with floating rates, such as loans tied to LIBOR.

Businesses may also set up swaps to pay floating rates and get fixed rates to protect against declining interest rates. Alternatively, floating rates may better match their assets or income stream.

Speculation

Unsurprisingly, swaps allow fixed-income traders to speculate on the trajectory of interest rates without the cost of having a long or short position on treasuries.

For example, to speculate that 3-year rates will decline using cash in the Treasury market, a trader needs to pay cash or borrow capital to buy a 3-year Treasury note.

With swaps, the trader can receive the fixed rate in a 3-year contract without requiring as much cash or capital up-front.

Risk Management

Financial institutions are involved in a hefty amount of transactions daily, consisting of loans, derivative contracts, etc.

Thus, the fixed and floating interest rates usually cancel each other out. However, the remaining exposure to rate risk can be mitigated through swaps.

Researched and authored by Rhea Bhatnagar | LinkedIn

Reviewed and edited by James Fazeli-Sinaki | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?