Are most HF opportunities actually not in L/S equities?

I read a Bloomberg article that showed Jain Global's "Expected Strategy Mix After All Capital Is Deployed". Fundamental Equities is 25% and S&T-adjacent strategies (Equity arbitrage/Rates/Credit/Commodities) account for 65%.

It seems like 90% of the discussion on this forum is about IB/PE -> L/S Equity. But the reality seems to be that l/s equities is a small portion of multi-strats' AUM. Obviously career choice comes down to personal strengths and interests, but given this, shouldn't the default path for most people to get into HFs be through sales & trading?

You read one article about one fund

No, generally speaking, you should not go to S&T if your end goal is to work at a HF.

This forum heavily steers towards young ppl in IB. Maybe not by design but by nature of who posts. To many of them it seems S&T is this homogenous field where everyone sits on the phone wearing 80s style suspenders and ties and shouts cash equity trades at each other.....

The HF world is so big that there are hundreds of strategies. There need to be. You can't have billions of AUM just being in l/s fundamental equities. Even forgetting about slippage the market is just too efficient to find any meaningful edge at that scale. The biggest funds in the world have to make millions of dollars an hour.

And I don't think IB is the only way to get into the HF world. If you want to be a fundamental equity analyst on the buy side it's probably a better background than being a cash equity salesperson at a bank. But if you want to be in rates or FX or anything synthetic/derivative, most people will have some background in sales and trading at a bank.

Figure out what your goal is, back solve the skills / background to get there.

There is just a sizeable portion of investment world that values the fundamental skills that an IB/PE person has that a S&T person just doesn't have.

As an analyst, it shouldn't be that hard to do some research on the size of the industry... such as where the AUM is (where it is growing and not), and then learning about the typical headcount profile per the strategies, and then learning a bit more here on this forum and linkedin what the typical paths look like.

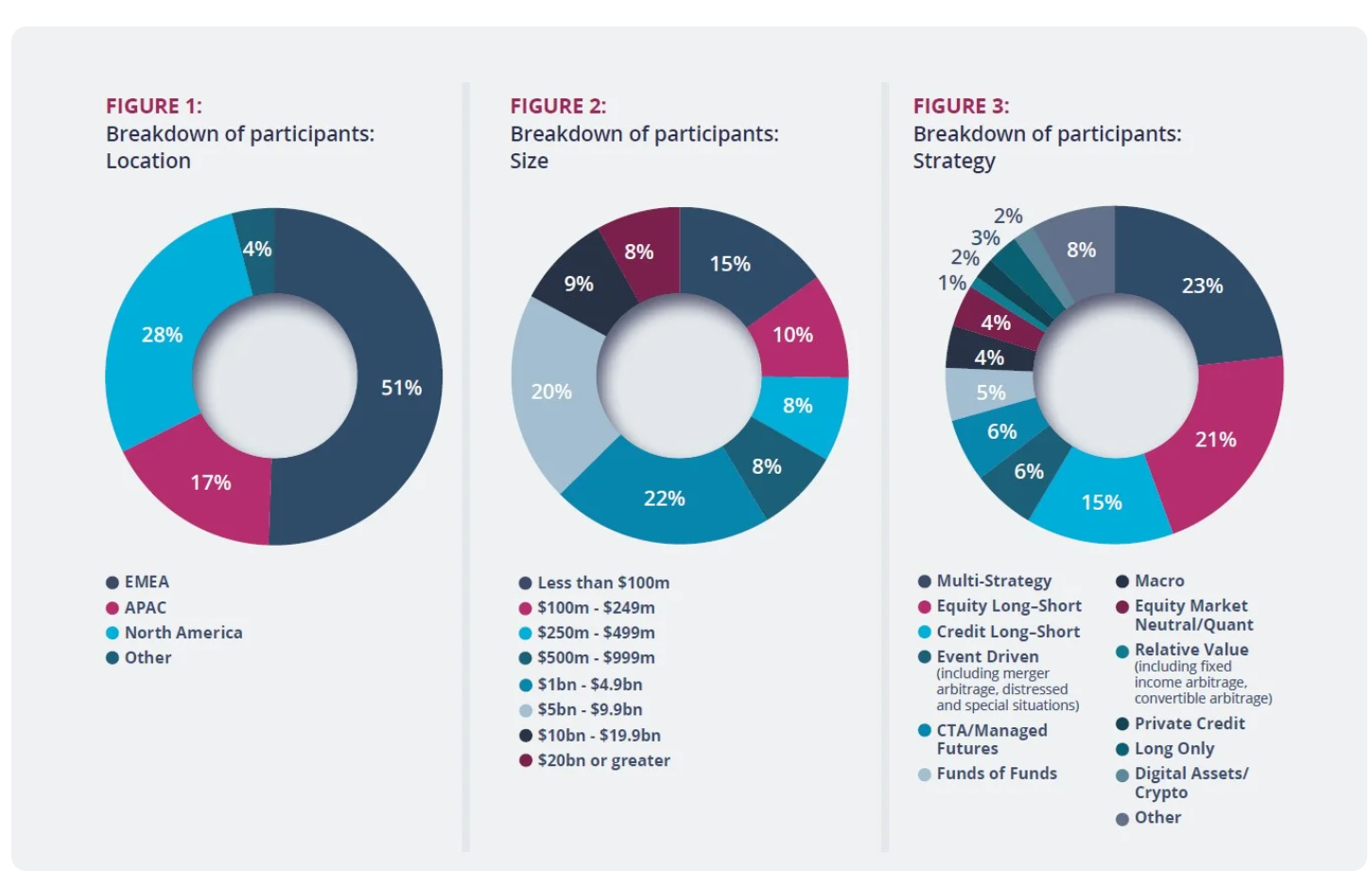

I just googled this so no idea how accurate - but from another report I saw once it looks relatively correct. Now think about things like how linearly some strategies might scale. A pod shop doing discretionary l/s covering individual equities, vs a quant shop for instance, or a global macro PM...

As other people said, its a big industry, and there are a lot of ways to extract $1... but at the end of the day, you either need to know corporate finance, economics, or statistics/math (usually a blend of all three). It makes sense why a forum originally designed for undegrads and that typically catered to IB folk focuses the most on some of the largest parts of the industry (anything that requires fundamentals).

Interned in both macro and l/s. Here is my 2cents:

Much easier to break into l/s, distressed, credit strategies. But much more competition. Macro is probably the toughest job to get in finance. RV is probably most represented at big MMs.

Fwiw, I think wages are more efficient in l/s because you have less of a moat. So few people are actually good at macro. Getting a shot is hard, and you could probably count the amount of star macro PMs on 2 hands. So you have more of a moat and get paid better.

1. So you're saying that few people are actually good at macro, but that there is more stability for average/underperformers?

2. Are the odds of becoming a "star PM" a lot higher in equity l/s than in macro? (Presumably due to more seats and being more conducive to running a framework process?)

1. macro = harder to get seat, even harder to be good, but highest level comp if a star

2. harder to be a star in l/s because there is much more competition, so harder to differentiate. Wouldn't select here on the probability of being a star--doing this you probably won't be one.

Expedita nemo voluptates cumque provident id nisi aspernatur aperiam. Quo hic voluptas vitae est qui aut id. At dolorem architecto voluptatem.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...