This Week in Oil and Gas - 1/31/2016

Continuing the weekly Oil and Gas review with major headlines and news you need to know...

Industry News

Chevron swings for a loss in energy earnings season...first loss since Q3 2002

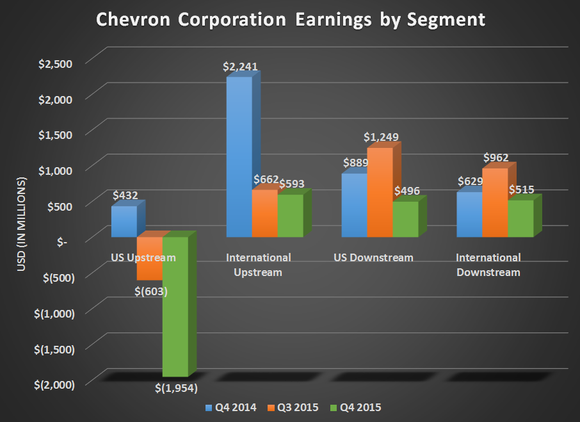

Supermajor Chevron posted its first loss since Q3 2002 as a result of plunging oil prices. The company reported a net loss of $588M ($0.31 per share) VS a $3.5 Billion ($1.85 per share) profit a year earlier. Note that Fourth quarter earnings include impairments and other charges of $1.1 billion.

Full-year 2015 earnings were $4.6 billion ($2.45) versus $19.2 billion ($10.14) in 2014. Majority of the company's losses came from its upstream divisions, with its US upstream segment reporting a $1.95 billion loss.

Despite being able to cushion some of the shortcomings of the upstream division, Chevron saw its profit nearly halve to $496M for US downstream vs Q3 2015 earnings of $1.2 billion.

(Chevron Earnings Report)

Sharp decline in activity result in wider loss for Baker Hughes

Baker Hughes reported Q4 EPS of ($0.21), $0.11 lower than analyst estimates of ($0.10). Revenue for Q4 2015 came in at $3.4 billion, down 49% vs Q4 2014. Revenue for the year came in at $15.7 billion however, declines across all geographic regions and declining rig counts continues to pose challenges for 2016. Pending merger with Halliburton is still ongoing due to scrutiny from European regulators.

The 10,000 layoffs which were rumored to have occurred in December have been confirmed, taking total SLB layoffs to 30,000. The service operator continues to face abrupt work cancellation and was the prevailing theme in the earnings release.

Oil crash has resulted in 300,000 Texans forced out of work

From December 2014 to December 2015, an estimated 288,000 Texas jobs have been lost due to the oil price collapse. That includes an estimated 72,000 direct oil and gas jobs and 210-220,000 indirect/induced jobs, according to Karr Ingham, a petroleum economist for the Texas Alliance of Energy Producers. [Oilpro]

Iran confident that low oil prices will result in balance being restored

Iranian President Hassan Rouhani expressed confidence in oil price stabilization citing that low oil prices will not remain so for long. Keeping in line with its stance on Saudi Arabia, Rouhani blamed Saudi Arabia for the drop in oil prices.

In addition, Iran inked an agreement with French oil company TOTAL which agreed to purchase hundreds of thousands of barrels of Iranian crude oil a day. This agreement helps Iran ramp up production and draw in much needed foreign investment.

Midstream News

Feds give OK to WPX sale of SanJuan Basin for $309M

WPX Energy has signed an agreement to sell its San Juan basin gathering system for approximately $309 million to a portfolio company of ISQ Global Infrastructure Fund, managed by I Squared Capital.

The agreement increases the amount of WPX’s recent divestitures to nearly $575 million, up from an original target of $400-$500 million.

Plains All American closes $1.6 Billion preferred unites private placement

Plains All American Pipeline LP closed the sale of about 61 million units of a newly authorized series of 8% Series A preferred units priced at $26.25 each. Primary purchasers included affiliates of EnCap Investments LP, EnCap Flatrock Midstream, The Energy & Minerals Group, Kayne Anderson Capital Advisors LP, First Reserve Advisors LLC and Stonepeak Partners LP (PAALP Website).

Howard Energy planning refined products terminals

Howard Energy Midstream Partners LLC is planning a $500 million system of refined products terminals and pipelines from the Texas Gulf Coast to Northern Mexico.

The project will connect output from Corpus Christi, Texas, refineries to Mexican markets in the aftermath of the energy reform finalized in 2014 that ended Mexican state-owned oil company Pemex's decades-long monopoly on oil sector activities.

Downstream News

Trading houses resume trading with Iran, but with caution

Major oil firms and trading houses are resuming energy trading with Iran but efforts remain very cautious and are facing legal obstacles.

Since the removal of sanctions, Iran has ordered a 500,000 barrel per day (bpd) increase in oil output, of which it said some 200,000 bpd will initially go to Europe. Prior to the sanctions Iran was exporting around 800,000 bpd of oil.

Iran, eager to jump start trade has lined up Greece's Hellenic Petroleum as the first nation to resume imports of oil from Iran. Italy, France, and Spain are set to follow.

fiat Chrysler confident oil to remain low

Chief Executive Sergio Marchionne expressed confidence that oil will remain low permanently. As a result and despite emissions requirements, Sergio Marchionne seems confident that consumers will continue buying trucks and SUVs.

More than three-quarters of fiat's U.S. sales volumes are light-duty trucks (Autodata). Selling more trucks and SUVs will turn 5 billion euros of net industrial debt into a net cash position of as much as 5 billion euros by 2018, Marchionne promises.

Plastics Maker Axiall Rejects $1.41 Billion Westlake Offer

Axiall Corp., North America’s largest producer of vinyl building products, rejected a revived takeover bid from Westlake Chemical Corp. that values the U.S. company at $1.41 billion.

Houston-based Westlake, which also produces vinyl products and is controlled by the billionaire Chao family, disclosed the $20-a-share cash-and-stock offer in a statement on Friday.

The bid is more than double Axiall’s closing share price on Thursday. The stock jumped as much as 104 percent in New York.

"We are surprised and disappointed by Axiall’s summary rejection of our proposal," Westlake Chief Executive Officer Albert Chao said in the statement. "The combined company would be more diversified and have a stronger financial profile than Axiall." (PR Newswire)

Graph of the Week

U.S. oil production hit its peak last April at 9.6 M/bpd, the highest rate since 1971. Average US oil production fell to 9.4 M/bpd in May.

Despite the low crude prices EIA data suggests that US production is gradually slowing down and not an abrupt decline in production as previously assumed.

"Full-year 2015 earnings were $4.6 billion ($2.45) versus $19.2 billion ($10.14) in 2014" That sure is a blow.

Opec vs Oil companies + The US.

What could go wrong? LoL.

@Klossie" as mentioned in the discussion in the previous week's O&G recap, the Saudi strategy isn't working nearly to the effect that they had hoped for.

To make matters worse for the Saudi government their old "enemy" Iran is now coming online so instead of being able to knock out the US independents, they have a sworn enemy pumping without breaking a sweat.

Its clear that Saudi Arabia will need to shift its focus otherwise they will end up on the loosing end which will dwindle their cash resources and create an opportunity for dissident within the country as a result of low crude prices.

As for the super majors they will be fine as long as they focus on cost-cutting measures (which they have been) and look for opportunities for investments in lower cost production areas (Permian, for example). In addition you have a wide range of technical knowledge and know-how that Saudi simply lacks which will prove to be advantageous vs. whatever Saudi Arabia plans to do to protect their "market share."

Your reply, I was thinking that. But I had made the assumption that the economists & predictions of the top OPEC members & also US are much more advanced, I guess it is not as easy as just stating supply/demand. I think Saudi is shifting their focus, but they are still indebted to the US for all the infrastructure that the US brought. 134 Billion in debt still. Very little when you crunch the numbers lol but still a fair amount.

What do you think about Saudi & their take on banking with no taxation to give incentive for foreign direct investment. (Need a house to have a bank account, or need to split cash 50/50 with a Saudi National)

And Saudi is getting huge in Pharmaceuticals. My mother is on the board of EU cardiologists, they made upwards of 2 billion in cardiovascular orientated machinery purchases just last year. Plus they are no where from stupid, not to mention the amount of foreigners in Saudi. You don't get into Saudi being poor. Regardless yeah its a global fight - Opec isn't just Saudi, and there are many many many factors such like the liquidity traps forming in many of the weaker OPEC countries. RedRage

@Klossie" there is a lot in your reply but I will summarize by saying that the Saudi's have realized (albeit too late) that they can no longer sustain the safety net they created for their citizens and allow their people to suck the teet of the government without having to work.

The King also mentioned diversification for their economy (again late to the party) however they have a difficult path to this given their restrictive and archaic society where women still cannot drive and were only recently allowed to vote in municipal elections.

As mentioned earlier their desperate gamble will blow up in their face and I hope that when it does the Saudis will demand a more open society and bring about reforms. Currently they can't have it both ways and must either get with the rest of the world or become irrelevant.

To continue to piss off OPEC, wage wars in Yemen and elsewhere to show a sign of force, combat Iran's growing influence, and feign off the threat to their oil market share is too much to accomplish. As you mentioned they have to look elsewhere (like your Pharma example) but they need to cultivate local talent and not continue to rely on outsiders for expertise.

When there's such a vast difference with earnings, you need to mention if they took a massive impairment or not. Downstream earnings increased to 7.6bn from 4.3bn. When you say poor performance, are you expecting it to be much higher? I'm confused. Downstream typically provides some natural hedge and it looks fine to me.

vik2000 you're correct. Chevron took an impairment of $1.1 billion and as for downstream my comment has been updated to sound less opinionated. Q4 2015 downstream earnings came in at $497M vs Q3 2015 of $1.2 billion.

I'm curious as to the effect on the overall Texas economy from those of you living down there-yes, I can read about it but it's always different when you're living in the middle of it. While I'm sure the small towns in the oil fields are hurting is it hitting Houston yet or are people really starting to worry about the possibilities of long term low prices? I know that the economies of Houston and Dallas are much more diversified than they were during dips in the '80's and '90's but Texas was no where near the economic wonderland it has been for the >15 years of higher oil prices and I'm curious if people are worried about a return to that type of economy.

Dingdong08 as someone who lives there I can say that it all depends on perspective. Those that are employed in the healthcare industry, IT, or work for engineering or EPC companies are doing well or able to get by relatively pain free.

Even those in the O&G sector such as myself are doing ok (F500 oilfield equipment and services) and are expecting to receive bonuses. However I do know of people who worked for smaller companies such as coiled tubing, fracking, and pump companies that are unemployed or nervous about impending layoffs.

IMO it is too early to tell but once the construction boom stops and it becomes difficult for office spaces and apartments from being fully occupied we will see how Houston weathers the storm. I'm concerned about the construction and housing industry as we have seen a boom in suburban development and several high rises and apartments sprouting throughout Houston and outlying areas.

This is nowhere nearly as bad as the 80s (oil being the exception as I think current crude market is worse than the 80s) but the overall economic impact is just now beginning and we won't see the full ramifications until middle of 2016.

I'm curious to hear from investment bankers on how they are faring the downturn. Anyone with any insight feel free to chime in.

I know from having spoken with some MDs at Citi that they are (obviously) not hiring for analysts due to current market conditions. I have also heard that Simmons & Co decision to become acquired by Piper Jaffary was in part due to the lack of deal flow (relatively speaking).

This is a pretty good article that's somewhat reflective of your Texas real estate concerns with regard to the Canadian economy being propped up by the real estate and ancillary sectors boom and the decline in O&G and other commodities dip. http://www.bloomberg.com/news/articles/2016-01-29/canada-s-one-legged-s…

Like I said the Texas economy is much more diversified now than in the late 80's when Texas was in a deep recession for a while but that time they got a double gut punch because while oil fell the Tax Reform Act of 86 concurrently took away a lot of tax breaks for real estate investments (tax shelters and passive losses in particular-that was even before my time but I started in business when that was still fresh in people's minds because the real estate market out west was still just recovering from it when I got into it in the mid 90's) and Texas was ground zero for a lot of RE investment and S&L's-Dallas' office market was known as a "see through" city because so many high rise office buildings were vacant and built purely with tax shelter investor money with little regard to market fundamentals. When those two things happened it cratered the Texas economy then during Bush 41's presidency the entire country went into recession and Texas was down for a decade. I hope it's different this time.

Great and informative posts btw.

lol at Saudis' strategy

cutting off the nose to spite the face

I know it was for the US indies, but were the Saudis just betting that US-Iran nuke talks would fall through? Did they think they bring prices down below what the Iranians were selling at?

The alternative being what?

taking back control of their own market before speculators and/or another player (ie Iran) attempt to do so themselves for starters

This recap and discussion were really well done. Thanks redrage.

Reiciendis nihil delectus minus quod nihil modi. Et qui consequatur commodi omnis voluptatem aperiam. Cupiditate sunt voluptatem adipisci. Est non aliquam eius temporibus eos voluptas id.

Voluptas culpa sed nulla. Suscipit cumque est et adipisci dicta odit. Inventore expedita quam est sapiente. Eveniet aut cupiditate nisi sequi porro. Qui et magni explicabo porro enim ut illo.

Magnam ab soluta nesciunt. Quia enim placeat qui cum. Quisquam autem neque et ducimus quia.

Qui ipsa omnis voluptatem dolores officiis alias velit. Eveniet repudiandae repellat fugit mollitia ipsum perferendis quibusdam velit. In voluptas sint ipsa repellat minus qui reiciendis. Quibusdam est iusto et omnis. Ratione omnis debitis nihil reprehenderit. Neque dolor voluptatem delectus officiis est. Facilis dolores adipisci recusandae repellendus accusamus.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...