Investment Banking layoffs

Investment Analyst in HF - Event

Have you guys started feeling the pinch ?

Have you guys started feeling the pinch ?

Have you guys started feeling the pinch ?

Have you guys started feeling the pinch ?

| +128 | If Tik Tok is forced to sell, what banks do you think would be involved in the deal? | 59 | 1d | |

| +47 | Intern Ettiquette | 14 | 1s | |

| +44 | Ranking banks that went under | 28 | 22m | |

| +39 | Burnt Out M&A ASO | 22 | 21h | |

| +37 | Relevance of A-Levels for U.K. London recruiting | 26 | 31m | |

| +27 | Series 79 Help / Tips to Pass The First Attempt | 12 | 3h | |

| +26 | What are hours like at BBs in London? | 48 | 4h | |

| +26 | 2024 new grads who didnt get return offers update | 12 | 5h | |

| +19 | 3.7 at semi target, how can I prep for recrutiing | 5 | 4d | |

| +19 | Lateral from BB M&A to MM A&D - Tips for Interviewing for A&D? | 7 | 4d |

Career Resources

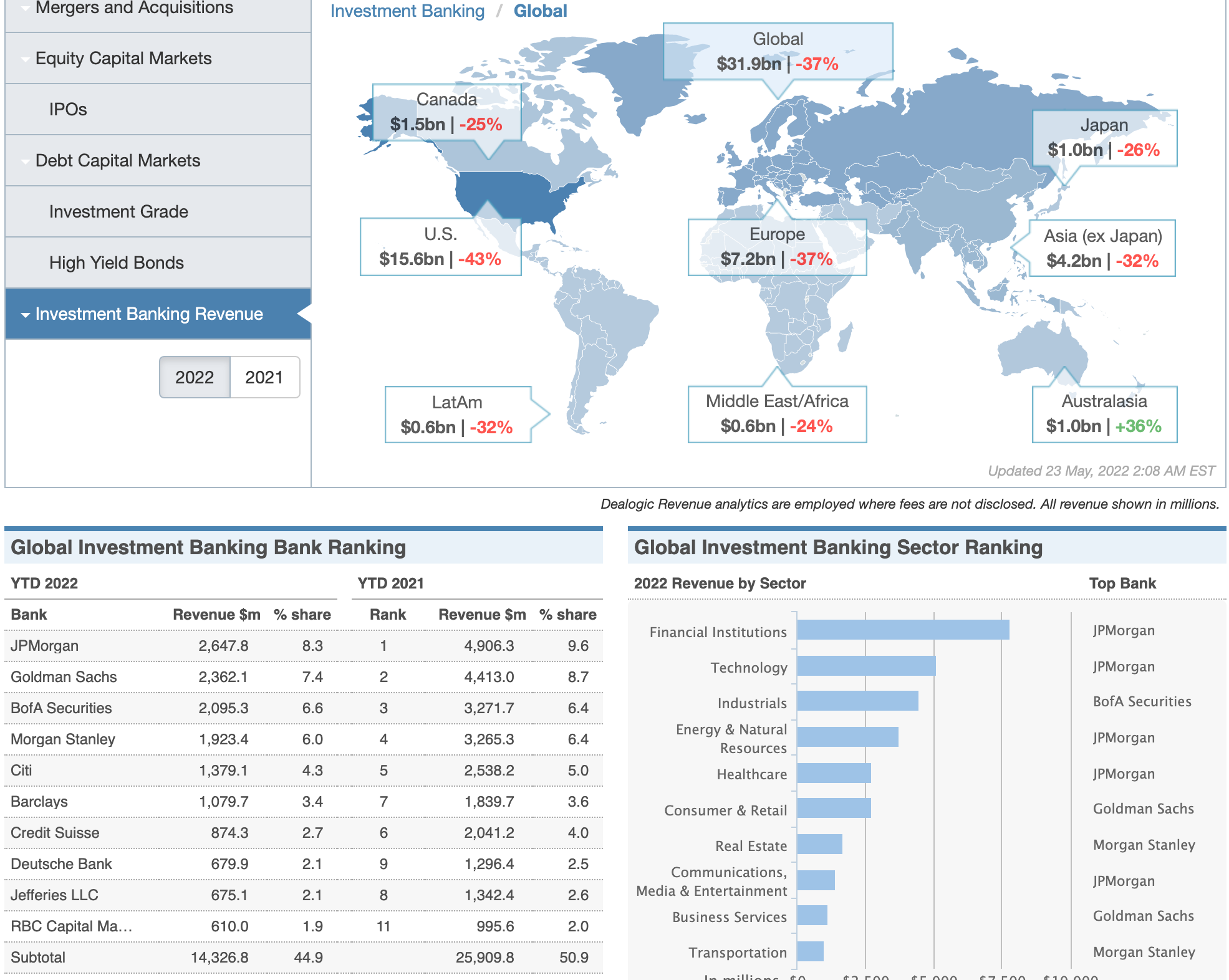

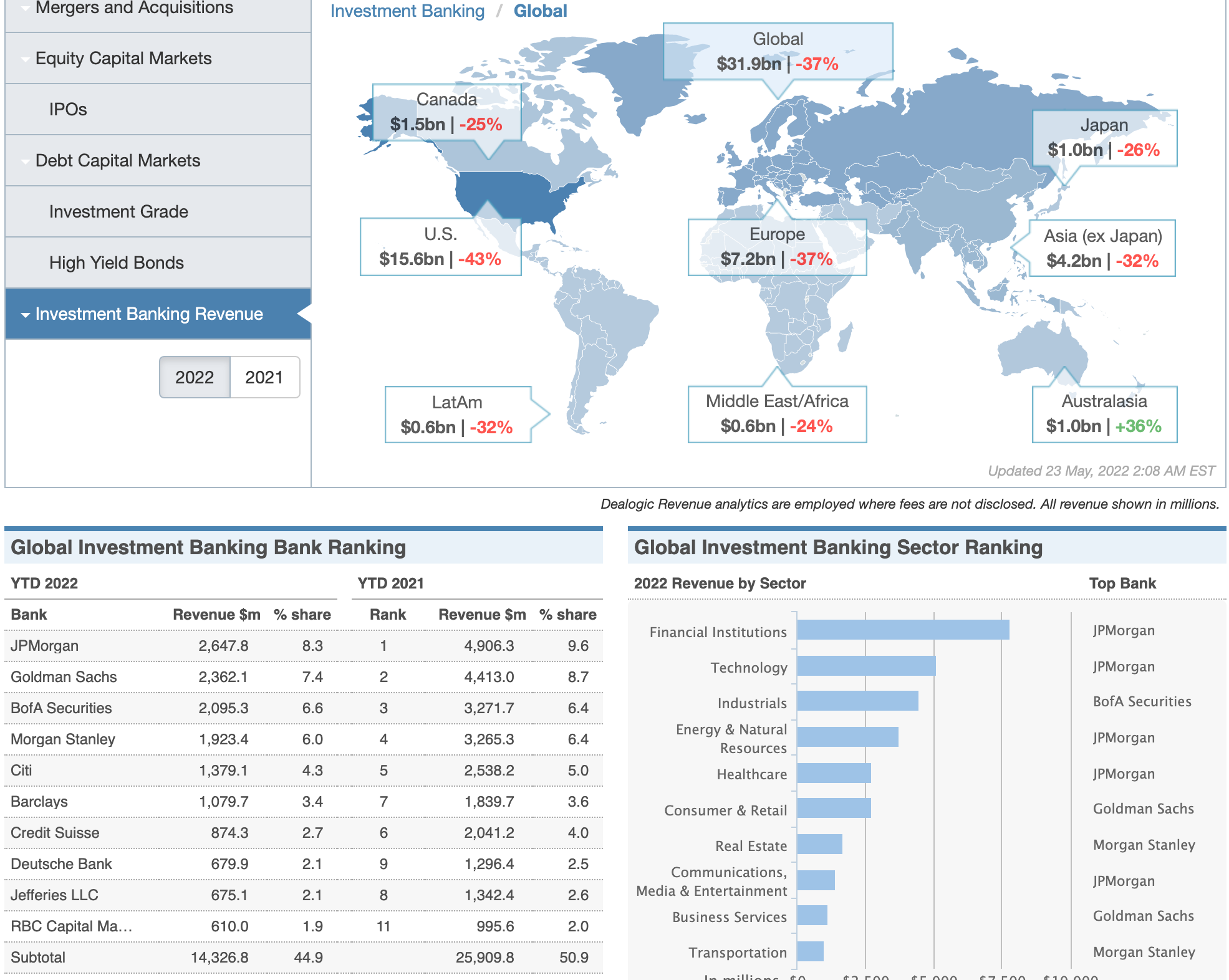

Sure they’ll be some layoffs like there are always are, but just seems overblown. 2021 was a record year so it’s tough to compare. Go back 10 years and see how 2022 performance has compared to the average. And with so many people moving / have moved and hiring candidates still difficult, is it worth laying people off when we dont know what the future holds?

Australia is truly upside down.

Source of the infographic?

It’s the WSJ league tables

Dealogic

I think it's intellectually lazy to just look at total revenue when according to this source it is ECM that explains a large portion of the hit in the US. ECM in the US is down 87% according to this source

OP’s table is M&A revenue only. Does not include Capital Markets (ECM down ~90%, DCM down 6%, LevFin down 75%)

It’s investment banking revenue not just ‘M&A. That includes all the products that they have shown above.

It’s all investment banking revenue. I briefly tried looking for a 2020 and 2019 baseline to see if m&a and debt markets had a similar level this year, but couldn’t find anything. I’d be willing to be this is more in line with historical averages

With revenue down, I imagine there will be enough natural attrition that might reduce the need for mass layoffs. My understanding is banks were still short-staffed before this 'crisis' hit and now looks like the great time to exit IB if you're a banker.

--

Good points. Although with the recent salary bumps there will likely be a big drop in TC into the next job, even with better salary negotiating power. This will definitely be the case for the bonus pool for the next one. Not sure how strong the hiring markets in related fields are either. One other point too is I'd imagine a lot of ppl set their eye on PE almost immediately into their IB stint and will want to see this thru no matter what. For ppl who haven't decided on next steps, I think people also having nothing to do all day makes banking less attractive to lots of folks. Obviously ppl above analyst-level leave too though.

Another point too is lots of associates are MBAs and see banking as a career option, or want to stick around to pay off debt. VPs really don't seem to change paths too often (if MBAs, similar logic, if initially analysts, have been in it for a long time and this is kind of their thing.) That being said, definitely some MBA assoc and MBA assoc to VPs who might want out as it was not what they thought or were planning on dipping once they'd made enough money.

Looks like China and Japan are the only large developed countries who weren't hit hard. I think this is an indicator that Chinese GDP growth will likely eke out another 8% by the end of the year while the US contracts an optimistic 4.5% or a terrifying 7%.

whatever you say, chinashill1984

chinashill1984 ya totally.....be sure to avoid the US at all costs, def plow all your money (however little you have) into Chinese stocks

Better yet, given the terrifying state of the US economy, you might consider looking into job opportunities in China

wait i thought the chinese economy was fucked

this year’s figures so far are in line with the pre-pandemic levels, which were considered historically good years.

Yea not many people can wrap their head around this. I have faith you’ll get a return offer. Godspeed

Let's also remember that ECM and debt comes roaring back at the first available window so if things improve in the latter half of the year, it'll normalize pretty quickly

Will these layoffs also affect Corporate/commercial banking?

Eligendi earum aliquid quisquam. Ut est porro officiis doloribus necessitatibus corrupti soluta quis. Eos exercitationem deserunt voluptates consequatur non. Qui accusamus dicta cupiditate consectetur. Ut quia aut officia voluptas ut et.

Sint aut suscipit id corrupti. Nesciunt aperiam ut veniam est et nesciunt. Voluptatem in quia quidem necessitatibus consequuntur quas modi. Saepe aut sed hic praesentium distinctio necessitatibus est. Est mollitia nulla et dolores quisquam maxime facilis similique.

Tempore accusamus non ducimus perferendis sapiente. Aliquid quasi sint hic beatae consequatur sequi eligendi. Cum provident veritatis ut ab.

Eum distinctio quia ut. Enim voluptatem blanditiis corrupti qui molestiae. Expedita dicta dolorum explicabo consectetur non et optio ipsam.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...