Levered DCF - existing cash treatment

Hi All,

(I was mistaken about my issue so deleted the original content. Credit to the great answers I have received. I now have found what the real issue is.)

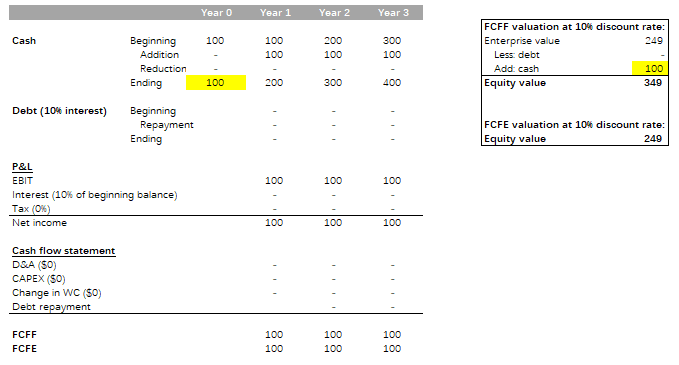

I am preparing a DCF model for a company that has cash in hand. I aim to solve for equity value, so I did the following:

-

Calculate FCFF and get enterprise value, and add cash and subtract debt to get equity value;

-

Calculate FCFE (cash flow from operations - CAPEX - net borrowings) and get equity value.

However, the two numbers of equity value are quite different, and I think it is probably because of my treatment of existing cash. The following case may illustrate my points:

In relation to the highlighted content, the only difference is the $100 cash that I add back to enterprise value. So my question is, what should we do in terms of the treatment of existing cash?

Agree with this. To pile on, CFO - Capex - net borrowings is just an approximation of cash flow. It is a quick-and-dirty method, similar to how EBITDA is a quick-and-dirty method to approximate cash flow. Calculating FCFE is a more precise method. Since you're building a levered DCF to precisely estimate FCFE, you should just trust the FCFE and ignore other approximations of cash flow.

Thanks both for the help. I edited my original post to show two mini cases of calculation to illustrate my confusion where the equity value in the two cases are quite different using FCFE but the same using FCFF to equity. Could you please kindly help? Thanks again.

technically:

Don’t see why equity value should be significantly lower when using cfo - capex - net borrowings due to debt repayment.

High level in both cases you will be taking out the same debt balance to arrive at equity value

intuitively:

Imagine you have your own business, which you financed with debt. You ask your banker friend to value it. He comes back and says, your equity is worth X based on unlevered DCF but Y based on levered DCF.

What will be your first thought?

Thanks for the intuition. I edited my original post to show two small cases of calculate to illustrate my confusion. Still don't quite understand where the difference is from. Could you kindly help? Thanks again.

Considering I understood correctly, case 1 is your attempt at arriving at the equity value through unlevered DCF and case 2 through levered DCF. If so, here is something that will help you:

COVID hit and you see people wanting to outsource.

You have $500k in savings. You put together a couple of servers, hire a couple of programmers and start offering a new cloud-based LMS to SMEs (eg moodle / blackboard). You aim to generate more than 15% return on your equity.

What’s your WACC in year 1?

At the end of year 1 you quickly realise there is a lot of demand. You take out a loan in order to scale quickly (hire more people for R&D and add servers). Since your company existed only a year, banks seem this as a risky investment so they demand 5% return on their capital.

Do you think your WACC will change in year 2?

You are hugely successful in year 2. You generate enough cash to pay out the loan. You pay out the loan at the end of year 2.

Do you think you WACC will be different in year 3?

If you refi the debt indefinitely (ie maintain capital structure), would value be the same? Think the issue here might just be timing

Thanks. And yes, if I refinance the debt, there will be no material difference. I suspect that I might have done something stupid in relation to the valuation part. I edited my original post and created two cases to illustrate the difference in valuation. Could you kindly help?

Hi, no expert but feel free to PM.

The issue with the first case is that you don't consider terminal value. You value the company's cash flows for 3 years, so either it gets bought at that point or ceases to exist - either way the debt cannot remain on the balance sheet. Therefore, you would have to pay down debt in the final year. Your FCFE to equity would be 90,90,-10 which if you discount will give you the same answer as in the unlevered case.

Thanks. You are right and I was mistaken. I think the issue is not debt, but rather the existing cash that I add to enterprise value to derive equity value. Could you please kindly take a look at my updated post? Appreciate your help.

Doloribus dignissimos et commodi dignissimos temporibus. Repudiandae consequuntur doloribus molestias accusamus sunt. Et dolor voluptatibus suscipit dolores maxime tenetur incidunt.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...