Need Help Weighing EB Offers - PWP vs Evercore vs PJ Solomon Partners vs PJT

I got an SA offer from 4 different EBs in NYC: PWP, Evercore, PJ Solomon Partners, and PJT. I guess my priorities for recruiting is first and foremost going to a place with a high chance of receiving a return offer, then the next priority would be top of street comp for FT (should i get the return offer), and finally, having really good PE exits 2 years down the road. Given these priorities, which offer do you think I should accept?

Congrats on PJ Solomon!

Bump

.

prob a toss up between EVR or PJT imo, the other 2 are not on the same level

Wouldn’t say this necessarily. Assuming pjt m&a I think the order is:

1.EVR

2.PJT/PWP

.

.

.

.

3.PJS

EVR is the best here but not by a wide margin. PJT and PWP both have a similar business model where they focus on large cap and trade places in the league tables year to year. All three can get you wherever you want in terms of exits. PJS is not in the same league as the other three

Yep this is accurate unless OP somehow failed to disclose the PJT offer was with RSSG.

Agree. If it's M&A, EVR cannot be beat.

any of them based on culture besides Pj solo

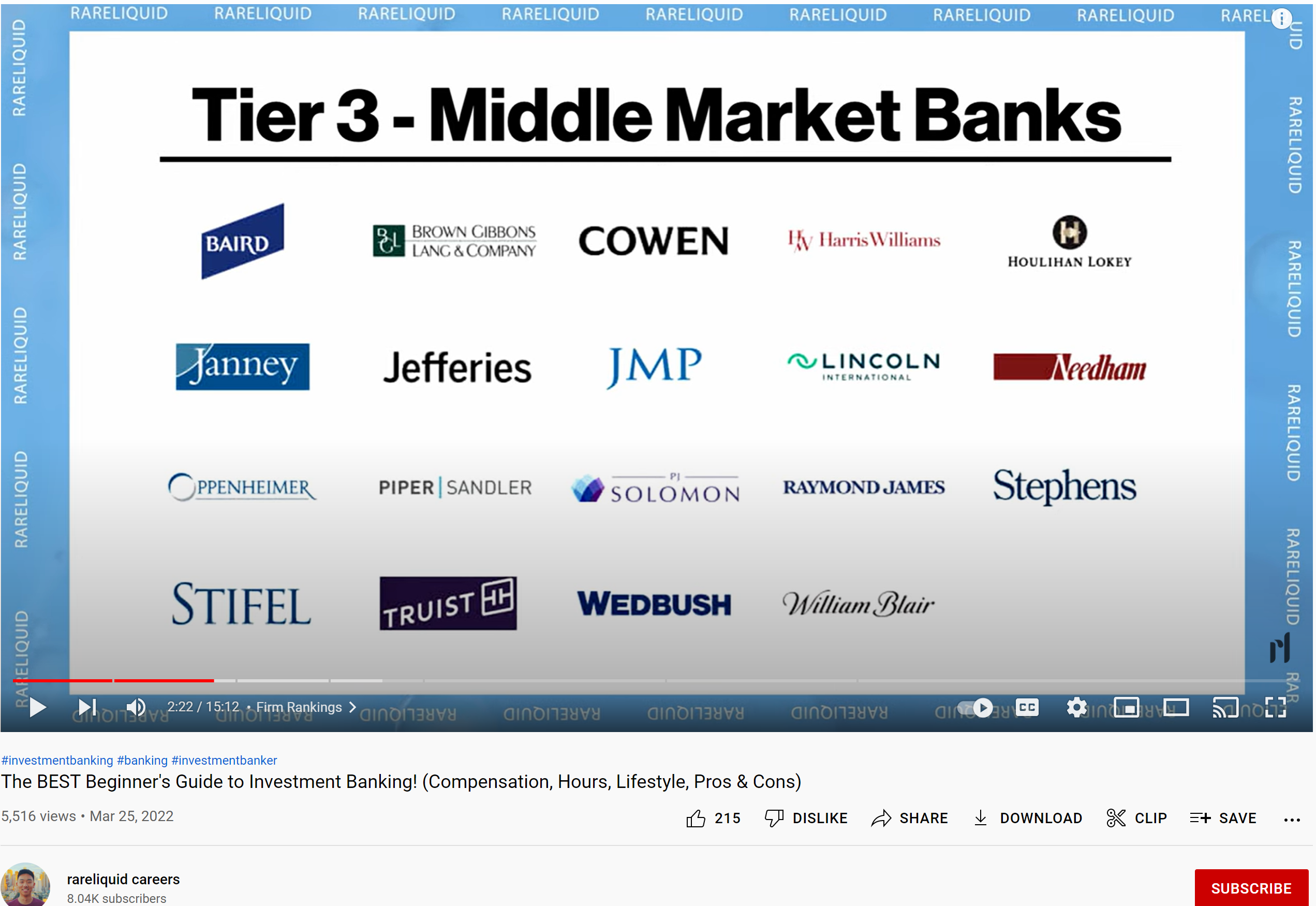

Solomon Partners/PJ Solomon is nowhere close to an EB. Even rareliquid on YouTube classifies them as Middle Market

Evercore easy

lol who is giving you MS, I agree EVR all the way.

Who should I fuck, Kendall Jenner, Sara Sampaio, cat woman Miami housewife or Megan fox

Culpa et explicabo qui cupiditate aliquam praesentium dolorem voluptatibus. Perspiciatis et animi voluptatem assumenda. Eum voluptatem aperiam explicabo dicta molestiae dolores at. Et ea sunt nobis porro.

Qui et quo sint quidem ut vel veniam. Voluptas dignissimos quia sint quia non. Maxime commodi consequatur autem aut. Adipisci sequi quos architecto qui.

Facere cum eum nulla ut. Cum error nulla hic consequatur est hic. Nemo aut nemo quo consequatur. Voluptas ad voluptas magnam exercitationem veniam vero dignissimos.

Sunt illum nesciunt quo temporibus est voluptatibus totam. Optio molestiae omnis enim culpa enim voluptatem. Qui est totam sit.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...