Private Equity Deals Process Course - Just Released

Dearest primates, we just released our newest course covering the private equity deals process. Included in this course are 190 lessons across 8 modules, with 10+ hours of video lessons.

This is the course I wish I had when I was transitioning from IB to PE for many reasons:

- There's no crying in PE...in other words, you are often left to "figure it out" on your own, especially if you come from IB

- It demystifies the entire deal process so you can walk in day 1 to your buyside job understanding a PE deal (from NDA through Funds Flow)

- The course shows you how to build an incredibly detailed (and flexible!) underwriting model so you no longer have to be intimidated in front of the Investment Committee

- It uses REAL redacted deal documents crowdsourced from the 900k+ WSO community (actually realistic) and doesn't just rely on a "dummy" or overly clean case (unique to our offering)

- Developed and taught by the best of the best PE team (KKR + L Catterton for both megafund + LMM fund perspectives + Goldman banking for modeling prowess)

ps - Also I should mention that if you sign up for our PE Master Bootcamp (July 27-29) you will receive lifetime access to this course + our LBO Modeling course for free.

Included in this course:

- Private Equity Review (12 video lessons)

- Initial Business Appraisal (11 video lessons)

- First Round Bids (31 video lessons)

- Conducting Diligence (17 video lessons)

- Valuation and Financing (25 video lessons)

- The Final IC Memo and LOI (18 video lessons)

- The Close Process (11 video lessons)

- Portfolio Company Monitoring (6 videos)

WSO Private Equity Deals Process Course - Video Preview

Receipt of Process Letter and CIM:

Common QoE Addbacks:

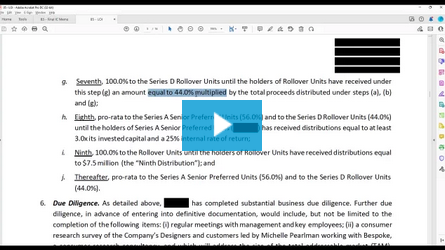

LOI Example - Distribution Waterfall: