Roast My Resume Please!

Greeting fellow primates!

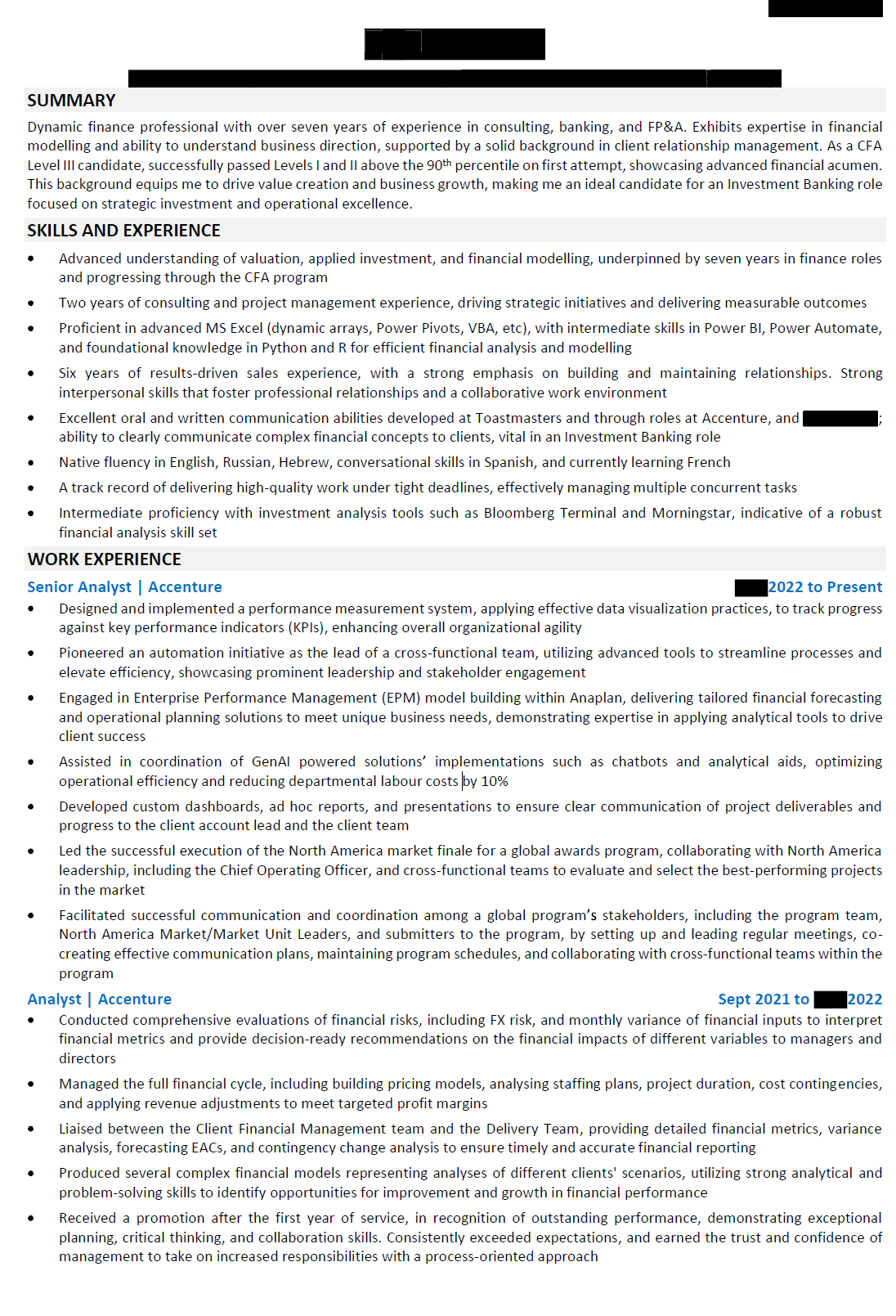

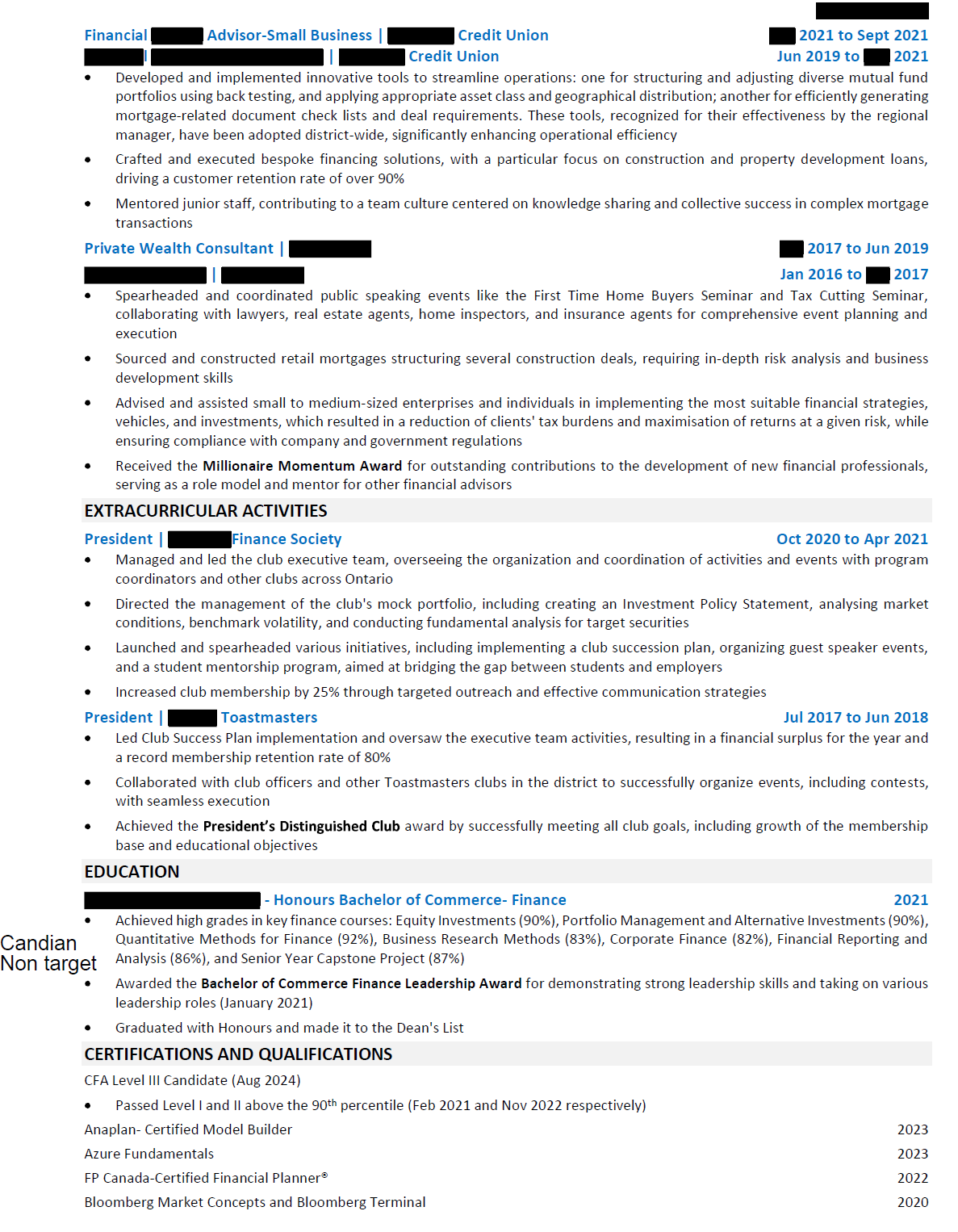

I am looking to get into PE(or M&A to start) and was hoping to get my resume roasted here to see what can be done better. I would also really appreciate any suggestions in terms of approach (what level should I aim to enter where and how).

Greetings! Diving straight into the jungle of resume critique, let's get your resume ready for the PE (Private Equity) or M&A (Mergers & Acquisitions) world. Based on the highest ranked content on WSO, here are some key points to consider:

Highlight Deal Experience: If you have any deal experience, it's gold in the PE world. Make sure it's front and center. Talk about the deals you've been involved in, the role you played, and the impact of your work. If you don't have direct deal experience, emphasize any financial modeling, due diligence, or market analysis you've done.

Quantify Your Achievements: Numbers speak louder than words. Wherever possible, quantify your achievements. Instead of saying "Contributed to the success of a project," say "Contributed to a $100M project, resulting in a 20% increase in profitability."

Tailor Your Resume for PE/M&A: Make sure your resume speaks the language of PE/M&A. This means focusing on your analytical skills, financial acumen, and ability to work in high-pressure environments. Use industry-specific terms and highlight relevant coursework or certifications if you're coming from a different background.

Professional Summary: Start with a strong professional summary that clearly states your goals, skills, and what you bring to the table. This is your elevator pitch on paper.

Education and Certifications: If you have a strong academic background or relevant certifications (like CFA, CPA), make sure they're easily visible. These can be a big plus in the PE/M&A world.

Networking and Extracurriculars: PE and M&A are as much about who you know as what you know. If you've been part of finance clubs, investment groups, or have done significant networking, mention it. It shows you're proactive and engaged with the industry.

Soft Skills: Don't forget to include soft skills. PE and M&A roles require teamwork, communication, and leadership. If you've led teams or projects, even in a non-finance role, it's worth mentioning.

As for the approach and level to aim for, it largely depends on your current experience and background. If you're fresh out of college, you might be looking at analyst roles. If you have a few years of experience in finance or a related field, you could aim for associate positions. Networking is key in this industry, so start reaching out to alumni, attending industry events, and connecting with professionals on LinkedIn.

Remember, the PE and M&A world is competitive but not impenetrable. With a polished resume and the right approach, you're well on your way to breaking in. Good luck, and may your resume be as strong as your ambition!

Sources: Private Equity Resume Template - Official WSO CV Example, How to get the MD to push your resume, Q&A: M&A and Capital-raising, How to improve your knowledge of markets?, 16 Tips to Improve Your Investment Banking Resume

Consequatur aut at necessitatibus ad animi. Doloribus unde et placeat similique aspernatur architecto.

Suscipit ab qui provident dolorem non. Est facilis aut debitis est.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...