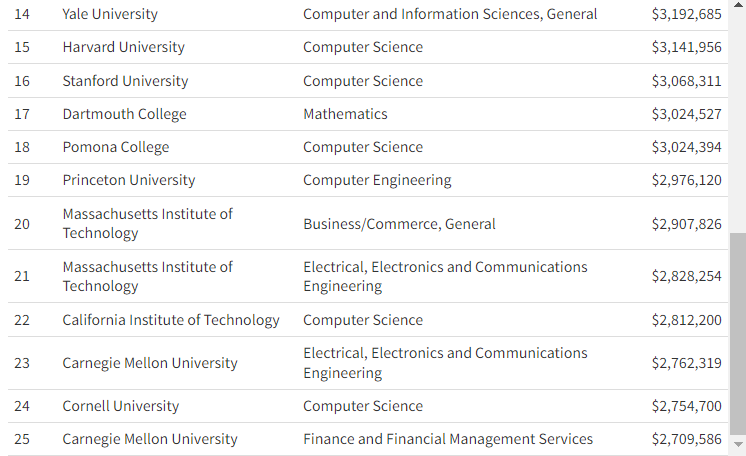

Return on Investment (ROI) Degrees Ranked - CS is the goated major?

Isn't the consensus among this forum that Finance/Econ at ivies have the highest ROI / lifetime value?

So how are all the top ROI degrees/schools basically all STEM majors, other than Wharton Finance at #2? Is it because most people don't make it to MD? Is CS at a top school the goated major/combo? Really intrigued by this.

bump

looking at aggregate results is usually not a great indicator of individual success/experience. From what I've seen, work ethic, connections, and just knowing how to play the game determine outcomes more than your school/major (which obviously still matters).

Finance doesn’t exist as a major in many of the top schools (outside of Wharton). So among majors such as economics or liberal arts majors, there is a very varied outcome when it comes to career interests and goals. It’s not like CS where almost everyone is going for FAANG as the baseline.

Most of the business school kids on this site are state school kids, and at the state schools a lot of people are perfectly content ending up as a FP&A manager at some regional city making $120k or so after working for 10 years. So that will bring any ROI averages down by a lot and you don’t see those majors/schools.

Translation: finance would look better if you could select for people who got that dawg in ‘em.

.

'Got that dawg in em' = ability to sit at a computer for 60-80 hours and format ppt decks or tinker with excel models

lmao hell of a cope

cornell has a business school, also where tf is stern, ross, etc?

Hotel Administration doesn’t pay anywhere close to traditional high finance roles although it does come with its own perks.

The other major is Econ which is no different than the examples I gave above

Ross is a state school which again revisit my point earlier.

I don’t know much about NYU to comment.

Nah im not talking about cornell's hotel school im talking about cornell dyson (cornells undergrad b school)

sure ross is a state school, but it's still a top undergrad b school lmao

Are you a Michigan grad? It’s a semi-target at best if that.

No, I went to an ivy

You fancy, huh?

cornell has a business school, also where tf is stern, ross, etc?

These "lifetime earnings" numbers were extrapolated from two things:

1. Earnings up to 2 years after graduation calculated from the College Scorecard

2. Census data which says how much someone earns, whether they went to college, and if so, what their major was, but not what college they went to

The way it is calculated is as follows.

First, they take the z score of the college scorecard data. So let's say a kid who goes to Wharton and studies finance has earnings 1.5 standard deviations above the mean of other finance majors. Then, they calculate the lifetime earnings through the census data with that z score. So they assume a Wharton kid is going to follow the standard earnings path of an finance major, but 1.5 standard deviations higher.

The article does make a decent attempt to predict lifetime earnings with the data they have access to, but I don't think you should rely on it.

I suspect this is an issue of fat tails. Properly accounting for the whales who are 2-3+ z-score makes a big difference in the figures. Thanks for explaining.

Well I guess now we know where their premise for Six Sigma that they worship comes from.

how did university of the pacific manage to become so GOATed?

What do Stanford cognitive science majors do after graduation?

Cognitive sciences is basically psychology. So if they continued on that path possibly a PhD in Psychology.

Repudiandae vel enim eos maxime accusamus ullam aut. Quos dolor repudiandae reprehenderit fuga consequuntur. Quos et et aliquam sequi.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...