Reasons behind homebuilder optimism

Yesterday a report from the National Association of Home Builders showed that US homebuilders have turned rather optimistic again. Given the recent weakness in construction spending some have dismissed this survey data.

Recently we did however see some signs of improving homebuilder activity in the markets as lumber futures stabilized in mid-May after months of declines.

Source: barchart

Source: barchart

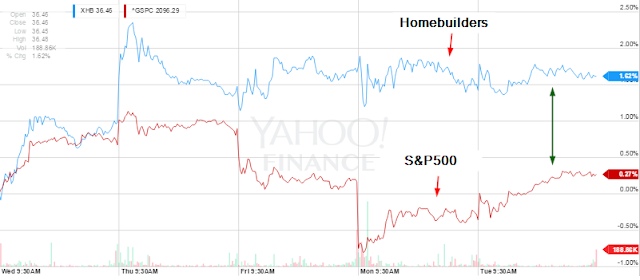

Moreover, homebuilder shares have outperformed the broader market over the last few days.

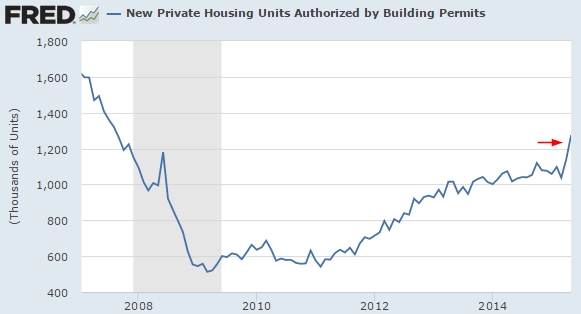

And today we learned the reason for the renewed builder optimism. They are going to have a busy year as new home construction permits spiked to levels not seen since 2007.

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

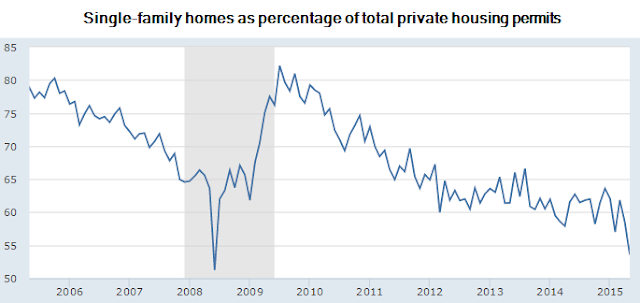

Does this mean US families are finally getting mortgages and buying new homes? Not exactly. While demand for new homes continues to gradually improve, it is concentrated in the "luxury" sector (larger and more expensive homes). In general single-family housing as a percentage of the overall homebuilding activity continues to decline.

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

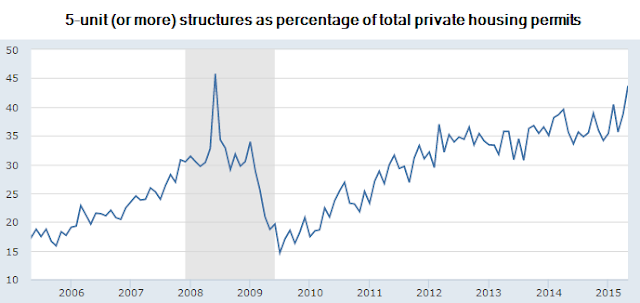

Instead, most of the demand is coming from multifamily housing as the need for rental units continues to increase. This is the sector that has been boosting builder optimism and where we are about to see increased construction activity.

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis