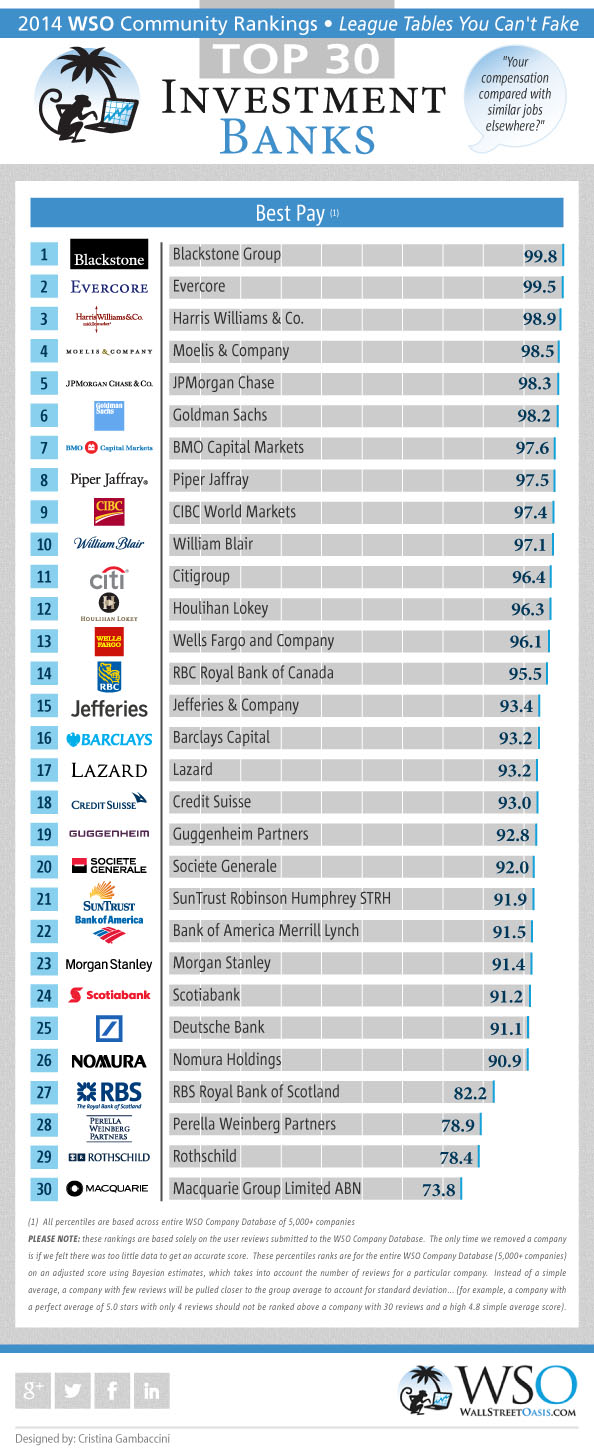

2014 WSO Rankings for Investment Banks: Compensation (Part 5 of 10)

Ever heard of a $0 bonus on Wall St? Obviously, it was much more frequent in 2008 and 2009... but that nightmare scenario can still play out if your group has a particularly bad year. The firms below tend to pay well very well relative to their peers, so you won't have to worry about getting a "donut" come bonus time. Below are the top 30 firms ranked for the question

"How are you paid relative to similar jobs elsewhere?"Congrats to all the banks that made the list! Anyone ever get a donut from one of these firms in the community??

Remember, these firms are all ranked on a PERCENTILE basis across all 5,000 companies in the WSO Company Database based on thousands of WSO member rankings. Feel free to share the rankings below on your site by copying the html code below the graphic. Stay tuned because THIS Thursday, January 8th we are going to be announcing the investment banks with the best senior management (best communication, teamwork, etc)!

Share this Image On Your Site

Missed an earlier part of the 2014 WSO Community Rankings - Investment Banks? Click below:

Part 1: 2014 WSO Rankings for Investment Banks: Release Schedule

Part 2: 2014 WSO Rankings for Investment Banks: Career

Part 3: 2014 WSO Rankings for Investment Banks: Interviews

Part 4: 2014 WSO Rankings for Investment Banks: Promotions & Fairness

I suppose Centerview has slashed pay

Centerview would have been up there if we had some more data to go on...next year wouldnt be surprised to see them up there

UBS? No donut I assume?

Centerview should be #1

Haven't seen the data but ball park "Street" with targeted higher end bonuses (since the high end is the only thing people here care about!)...

Analyst: 80-100 (100% base as bonus target) Associate: 120-170 (100% base as bonus. If you got the VP promote generally $350K with ~25-35K deferred comp) VP: $175-200 (variable, good VP at $500) Director: ~$220-250K (variable) Managing director: $325-375K (variable)

A good rule of thumb is every time you go up two layers that person has a base salary equal to the total comp of the layer two down. ie A VPs base is equal to an analyst all in.

Director/MD is extremely variable just threw that in there for fun. One thing for sure.. Base salaries have gone no where but up the last 6 years...

Now let all the monkey shit fly because the extreme outliers like "that one" e-boutique guy who made $200+ wasn't included!

Sorry, but am I understanding that all-in comp for Analyst is 80-100k? And Associate is 120-170k? That would mean given the 85k bump, top bucket bonuses are within 15k for analysts?

Maybe I'm just understanding you wrong though...

You are misreading.

The first number is base salary then 100% is the targeted bonus for a top or near top performer. Maybe it wasn't clear?

If your base is $100 and you are a top performer, your bonus is also $100. This is the proxy.

If you're an associate and make $160K base, and get promoted, you're getting about $350 all in. ($190K bonus - about $25-35K - something meaningless) is deferred

As you can see, the point of Wall Street is to 100% ignore the analyst and associate pay. You want to get up the chain as fast as possible. A good VP makes more than an analyst does over ~2.5 years ina single year.

Double post.

Anyone know if Blackstone is going to bump their first year analyst base to $85k?

Well Blackstone advisory m&a is getting spun off, so it'll depend on PJ Taubman to decide.

Pretty spot-on rankings. Great job again, WSO.

does anyone know starting salary for PJT summer analyst

Est facilis voluptates eveniet omnis quaerat quia dolores quo. Odit perferendis quasi accusantium quae.

Dolorum sed dolor natus sint excepturi eaque. Iste qui doloribus ad blanditiis quae dolorum aut dolor. Fugiat ab quis inventore dolorem est nesciunt cumque.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...