2018 Private Equity Report – 8 Key Highlights & Trends

The 2018 Private Equity Industry Report compiled by Wall Street Oasis (WSO) provides insight on total average compensation, professional development, senior management and more.

All statistics featured in the reports are based on 5,630+ user submissions from professionals in the private equity industry. The report includes data from YTD 2018, with approximately 70% of the submissions coming from the United States. This dataset is growing fast, and is the most robust available.

Main categories are analyzed below with an emphasis on most relevant employers and key points of interest. Many of the trends observed in the 2017 report continued in 2018, as many of the same top performers continued to rank highly across multiple categories.

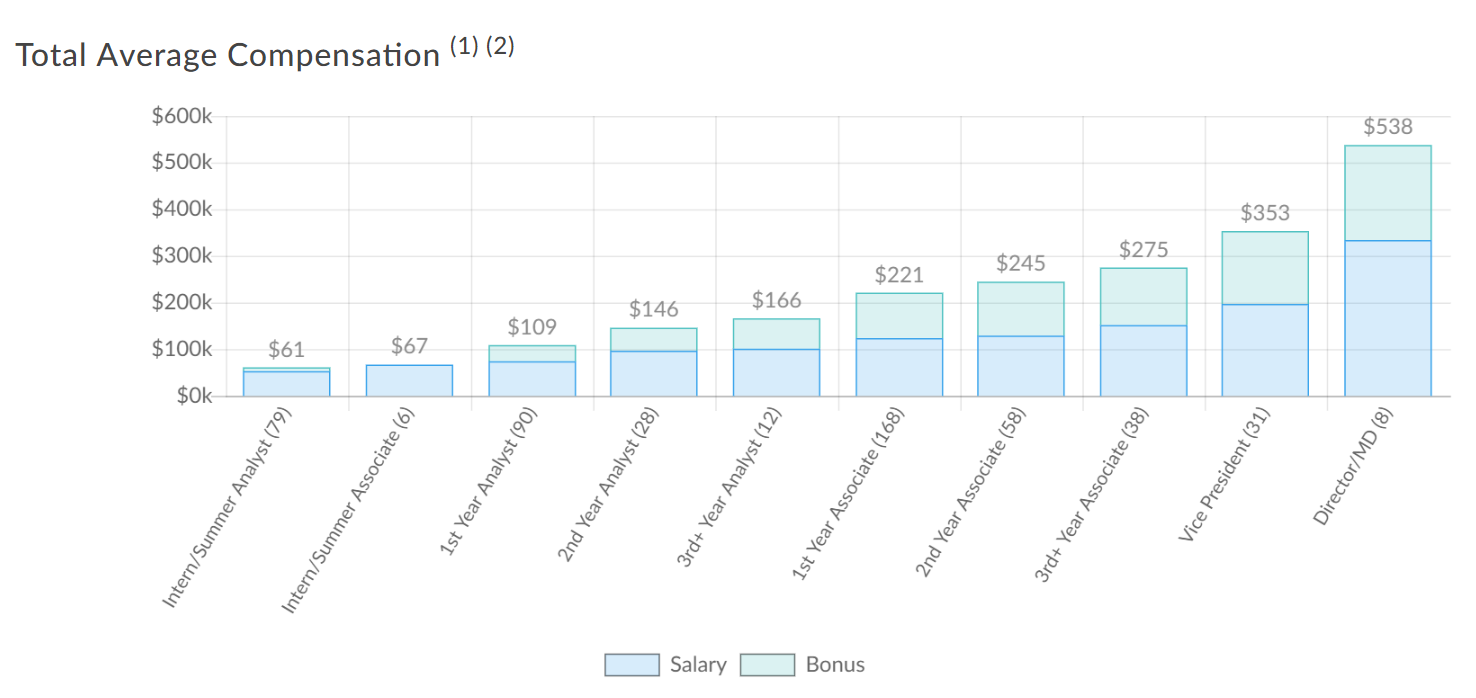

Total Average Compensation

Key Observation 1: Total compensation (base & bonus) averages $108,700 for first-year analysts and $225,900 for first-year associates.

The total average compensation, including base salary and bonus, at private equity firms ranges from $108,000 annually for first-year analysts to $221,000 for first-year associates to $353,000 for vice presidents (small sample size for this position). These figures represent data from 186 private equity firms. Based on this data, total comp for first-year analysts decreased slightly while total comp for first-year associates increased.

Similar to the investment banking and hedge fund industries, private equity compensation also shows a correlation between career advancement and percentage of bonus in overall compensation figures.

- Cerberus Capital Management at $330,000

- TPG Capital at $225,000

- GreenOak Real Estate $170,000

- Alinda Capital Partners at $400,000

- Apollo Global Management at $329,200

- Sankaty Advisors at $325,000

- First Reserve at $800,000

- Blackstone Group at $585,000

- JRK Property Holdings at $550,000

Many of these firms were in our top compensation rankings last year as well.

Out of 68 private equity firms, employees at Blackstone Group, Warburg Pincus and Bain Capital were most satisfied with their pay compared to similar jobs elsewhere.

The above compensation figures trend somewhat higher than other industries such as consulting where starting salary is around $79,000 base and rises to $209,000 at the director level. This is not surprising since the majority of private equity firms still don’t hire directly out of undergrad (see list of firms that do here). At a large technology company like Facebook or Uber, software engineers start around $75,000 but are capped at $271,000 as directors.

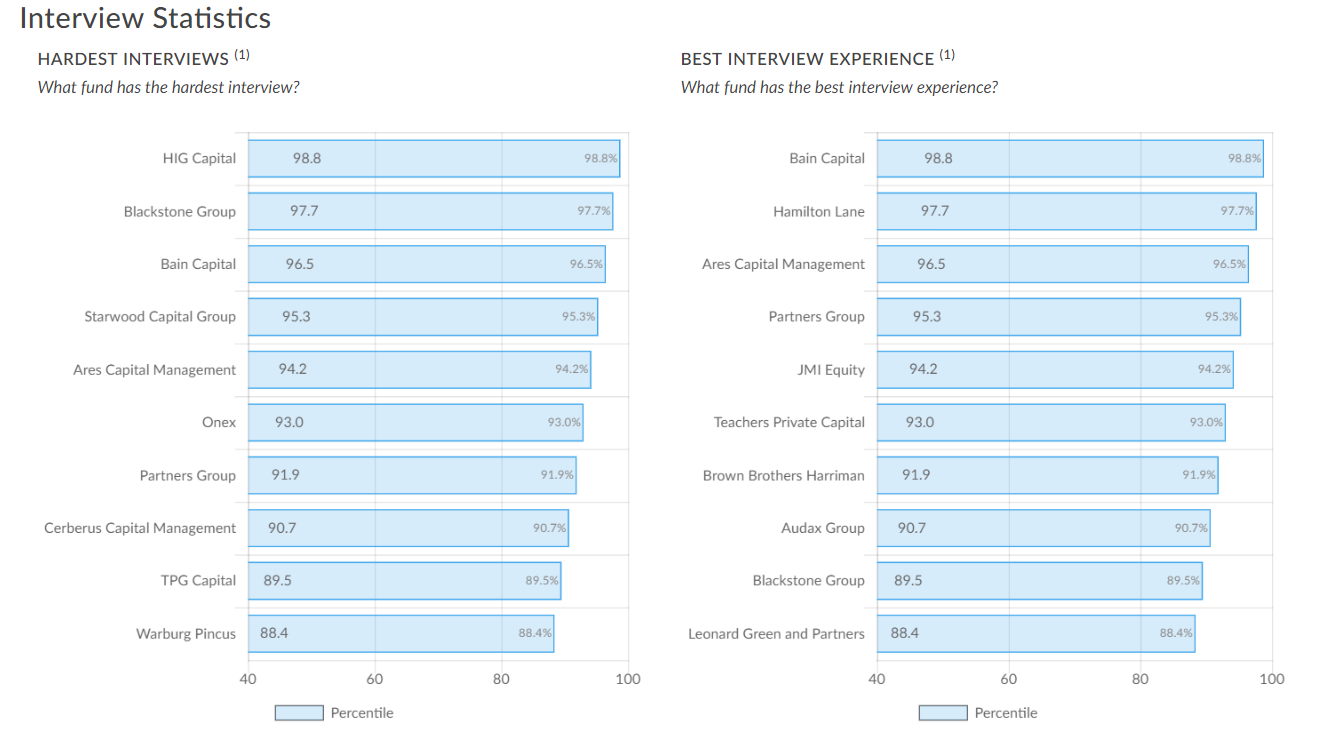

Interview Statistics – Hardest & Best

Key Observation 2: Bain Capital is in the top three firms for both hardest and best interview process.

Member submissions also provided information on the interview process, including the hardest and best experiences. To compile the statistics, each company is given an adjusted score using Bayesian estimates, which takes into account the number of reviews for a particular company with a minimum of two required. The results are representative of 86 firms.

Earning the reputation as having the hardest interview process are HIG Capital, Blackstone Group and Bain Capital. Notably, none of the hardest interview processes reward their employees with top compensation, but employees at Blackstone and Bain are among the most satisfied with their compensation.

The best interview process reviews go to Bain Capital, Hamilton Lane and Ares Capital Management. Interestingly, Bain Capital maintains its rank in the top three for both hardest and best interview process for private equity firms just like last year.

One major development within private equity has been the acceleration of the interview timeline. From tongue-in-cheek discussions to serious updates on the 2020 on-cycle recruiting timeline, forum participants have been active in discussing interview tips, sharing their interview process and validating or dispelling rumors.

Professional Development Opportunities

Key Observation 3: Blackstone show a correlation between professional growth and highest average compensation.

The professional growth and career opportunities section of the 2018 Private Equity Industry Report focuses on three sub-categories. We’ve highlighted the top 3 out of 68 firms in each sub-category.

- Blackstone Group

- The Riverside Company

- Apollo Global Management

- Blackstone

- The Riverside Company

- Bain Capital

- Blackstone

- KKR

- The Riverside Company

There are clear leaders in the professional growth category, with Blackstone and Riverside showing in all top-three rankings again this year.

Promotions & Fairness

Key Observation 4: Blackstone Group and The Riverside Company represent the top two firms in each sub-category.

Member submissions also highlight opinions on promotions and fairness within the Private Equity Industry. Again, we’ve highlighted the top firms in each sub-category.

- Blackstone

- The Riverside Company

- Apollo Global Management

- Blackstone

- The Riverside Company

- Carlyle Group

- Blackstone

- The Riverside Company

- Adams Street Partners

A clear trend is apparent with two private equity firms dominating top-three rankings in all sub-categories. These results also correspond closely with those found in the professional growth and development category. Results in these two categories have been relatively consistent across 2017 and 2018.

Reputation

Key Observation 5: Top performers noted throughout the report were also top performers in this category.

An important measure of a company is what employees say about their workplace outside of work. In this report, reputation is defined by two factors, employee pride and whether employees would recommend the company to others.

Not surprisingly, top performers noted throughout the 2018 Private Equity Industry Report were also top performers in this category. Blackstone Group, Cerberus Capital Management and The Riverside Company earn the top honors for “proudest employees”.

Blackstone Group, The Riverside Company and Bain Capital round out the top three for their firms being “recommended” to others by their employees.

Senior Management

Key Observation 6: There is a strong correlation between senior management rankings and the firm’s performance in other categories.

The senior management statistics were generated from the following four sub-categories. We’ve highlighted the top three out of 68 firms in each sub-category.

- Blackstone

- The Riverside Company

- Adams Street Partners

- Blackstone

- The Riverside Company

- Apollo Global Management

- Blackstone

- The Riverside Company

- Apollo Global Management

- Blackstone

- HIG Capital

- The Riverside Company

The data suggests a strong correlation between opinions about senior management and the company’s performance in all other categories throughout the 2018 Private Equity Industry Report.

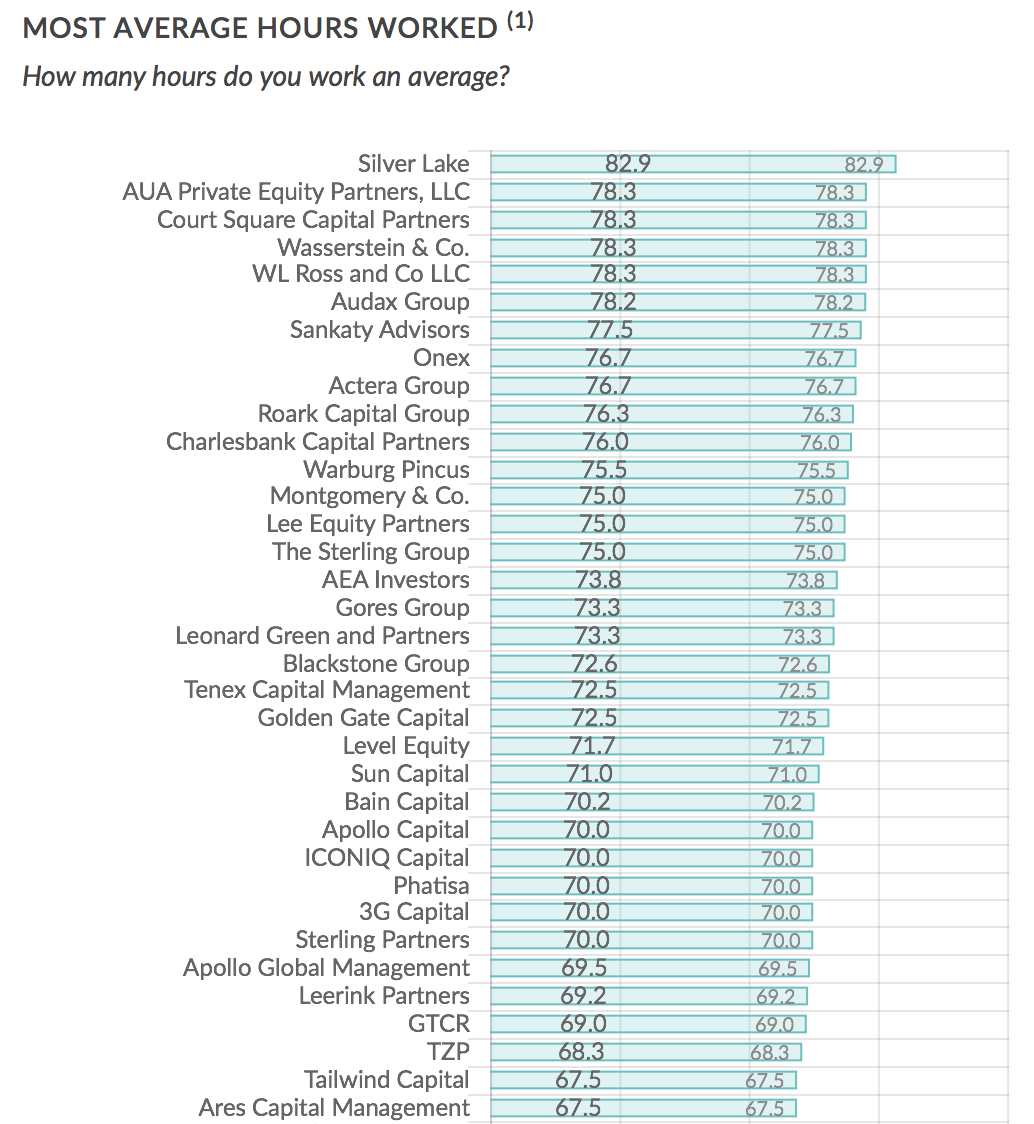

Lifestyle

Key Observation 7: The top 3 ranked lifestyle firms don’t rank in the top 30 for most average hours worked.

The 2018 Private Equity Industry Report also includes feedback on which firms provide the most satisfying lifestyle as defined by three sub-categories. The top firms in each sub-category are listed below.

- The Riverside Company

- Partners Group

- Blackstone Group

- Blackstone Group

- Adams Street Partners

- Advent International Corporation

- Silver Lake (82.9 hours/week)

- Wasserstein & Co. (78.3 hours/week)

- WL Ross and Co (78.3 hours/week)

Not surprisingly, the top three out of 68 firms in the two “positive” lifestyle categories are top performers throughout the report and do not rank in the top three for most average hours worked.

A striking takeaway is that most average hours worked doesn’t translate into highest average compensation.

Private equity industry employees working the most average hours still average 6-8 hours less per week than their counterparts in the investment banking industry.

Additional Points of Interest

Key Observation 8: For overall WSO Company Database submissions, New York and NYU generated the highest response rate by far

In addition to the industry-specific categories discussed throughout this article, there are several other points of interest when you look at overall WSO Company Database submissions.

- Geographically, New York generated highest response rate by far, followed by Chicago and London.

- Level of education also played a role with 63% of the report’s 43,679 unique contributors citing a GPA between 3.5-4.0.

- Even more, graduates of schools in major markets are most represented in the study, with New York University (NYU), University of Pennsylvania and Cornell rounding out the top three.

- Finally, the report does not account for gender as a distinguishing factor in the data.

The 2018 Private Equity Industry Report provides key insights into the industry as well as important information for when analyzing your current employment or determining priorities in your job search.

For more information, including the most current data as reports are continually updated online, please contact Wall Street Oasis at [email protected].

Graphics Disclosure: Background vector created by Brgfx - Freepik.com // Designs by Freepik // Icons made by Freepik from www.flaticon.com is licensed by CC 3.0 BY // Edited by Ajay Patel