Investment Banking is Paradise

Life is good.

Investment banking is literal paradise.

You just graduated summa cum laude and finished your summer fucking the 19 year old broad you met at Santa Monica. The sun sets at 9PM, and your loving life.

Your pretty relaxed because it's July and your soon to start a brand new investment banking analyst program. Everyone in your university told you it was basically paradise. You make mad $$, fuck bitches, and get to accelerate your career. What's not to like?

You receive your onboarding email as an 1st year analyst at a Bulge Bracket in July 2021. You freak out with excitement. Your first week on the desk starts and your not given too much work. You say "this is not so bad". You go through standard compliance work on Day 1 reading actually reading this boring shit, and during the 1st week, you've managed to not really add much value, but rearrange logos and fiddle with Excel. It's 2 weeks past now, and your first pay cheque hits, your paid 110K. You buy yourself some dogecoin, beer and imagine your night at Santa Monica.

Life is good.

Is your name Robert or is it Chad Mutherfucking Boss? It's Chad. Your living in paradise, your 21 and king of Cali

Your living in paradise, your 21 and king of Cali

Week 3 enters, and the MD has booked a meeting for a client in 1 week.

The MD tells the senior director there is a live pitch. The senior director tells the VP there is a live pitch. The VP tells the associate there is a live pitch. The associate pings you at 9PM on a Tuesday that there is a live pitch, and you get your first comp set to run.

The associate is looking over your work and he gives you comp set to finish for tomorrow morning. It's 10:69PM and you decide to leave 5 minutes after the associate.

Associate (Brad) comes to Chad (Analyst) in the morning asking for comp set.

You go on to tell your associate, "you thought he can finish it Wednesday during the day".

Brad laughs and says "never to do that again".

You laugh nervously

Brad says "I'm serious. Please I wanted the comps done for tomorrow morning".

Your so impressed at Brad, that he feels like the Dad you've never had.

Week 3 ends, and you've spend Wednesday - Thursday finishing at 2AM.

Week 3 weekend comes, and your off. Paradise again. "Banking ain't so bad"

Week 4 comes, and your now working on your second pitch. MD tells all his banker subordinates what has to be done. Your going to pitch a large industrial company in the tubing industry.

Associate tells you at 4:20PM to start researching "can you pull up a list of all companies in the tubing industry in North Carolina", he says I want it due for tomorrow morning

You tell yourself you got this. Your Chad after all. Life is good.

You run the analysis, get some dinner, check Tinder, and finish off at 3AM. You cab it home, and arrive home at 3:20AM. You tell yourself sleep is overrated anyways. Life is good.

You wake up the next morning and head right to Starbucks. You order a black coffee with almond milk, because soy and regular milk is for pussies.

Fast-forward to week 12, you've completed several pitches (that went nowhere), and want to work on live deals. You convince your staffer to give you a chance, and you land a live sell-side process. Your staffed with updating the company description in the CIM. WOW. Your so impressed with yourself. After 3 months of intense work, re-wording every paragraph in the CIM, and the senior analyst basically doing all the heavy lifting, the deal closes.

As a reward your team goes out drinking, you get completely wasted, and manage to hook up, because you are Chad after all. The girl tells you her last boyfriend was a "FANG bro". You laugh and tell her once you get your bonus you'll be "Gucci'd out"

Fast-forward to week 52, and the new analysts start and you are now responsible for showing them the ropes. Your so impressed with yourself at how good your life is.

In 1 year, you've managed to close 1 sell-side process and 1 buy-side.

You go out to clubbing with your Big 4 friends, and they tell you how much they money they make. You don't understand how your bonus is bigger than your Big 4's buddy total compensation.

You compare watches. Banker watch Rolex Daytona, your Big 4 friend watch has a Seiko. What the fuck is a Seiko? More like psycho. Also you tell your Big 4 buddy he needs some milk. You also tell him to drop the Big, to just "four" which rhymes with "poor"

Damn, it feels good to be a banker.

After hitting the club on Thursday, you go back to the office, it's 11PM and likely won't leave until 2AM.

Because you've mastered IF statements, alignments and blue font colours in Excel, your workload has tripled. It's OK. You decide to buy some vests because some guy called Litquidity said it was dope AF. It's not even cold in Cali tho'.  You decide to start PE recruiting, not really knowing why, but because every Chad before you went to PE, you blindly follow. You get up to speed on LBO modelling.

You decide to start PE recruiting, not really knowing why, but because every Chad before you went to PE, you blindly follow. You get up to speed on LBO modelling.

At this point in your career, your quite efficient, you can function on 4.69 hours of sleep. You contact several recruiters and they are so impressed with your background. You do about 8 rounds of interviews, and convince your senior bankers to cover for you and land 1 offer at MF PE. Buy-side it is.

You deliberate if you should do HF, but you don't really understand the market, and ask yourself what's the point of investing if you can just diamond hand $AMC, $GME and $CRYPTO and earn 1000% return per annum. Your also only familiar with pump and dumping... and not referring to stocks here if you catch my drift.

However the PE firm makes you stay the full 2 years which is a huge grind. But it's all worth it.

However the PE firm makes you stay the full 2 years which is a huge grind. But it's all worth it.

Fast-forward to week 104 (2 years), your now in private equity.

Your in the driver seat. All the investment banks are showing you CIMs to invest in. Wow!!!

The senior investment professionals comes in and asks you if "we should take the largest hotel operator private".

You answer "I don't know, hotels aren't a good investment with COVID-19"

The senior investment professional says: "Please run a LBO, at 6 turns of leverage, 3 turns of senior, 2 turns of mezzanine, and 1 turn of equity, let me know what IRR is by tomorrow morning"

You go back to your chair, and say wow! Your actually learning and given a lot more responsibility. Instead of running DCF models, your now running LBO models!

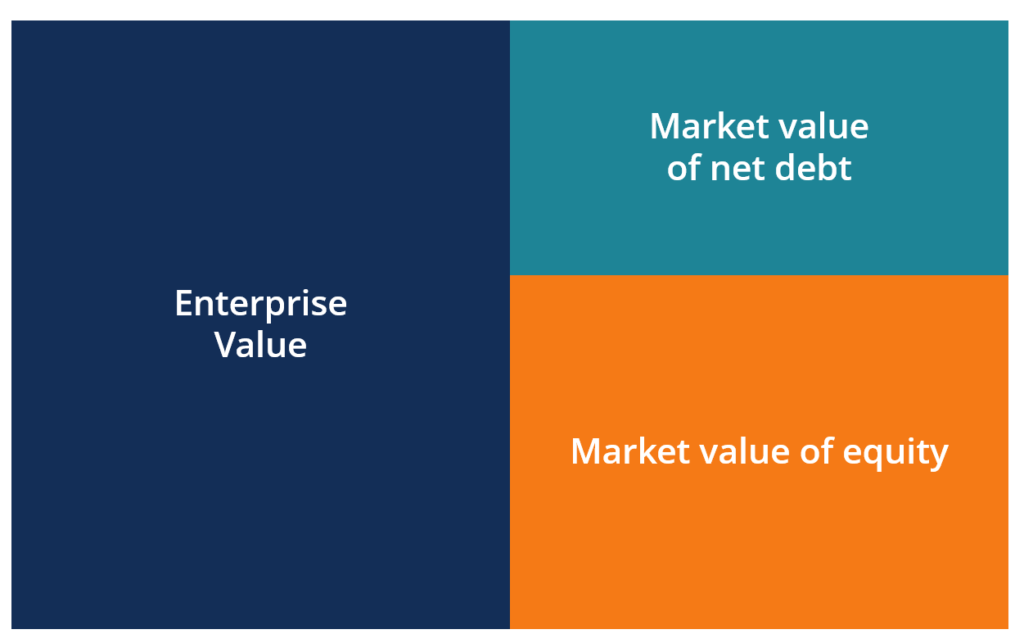

You also realize you no longer care about Enterprise Value as you did in investment banking, and it's about exit Equity Value.  You've now realized your the real shit.

You've now realized your the real shit.

You meet with your Big 4 friends and ask how tf are they still making under 100K ? Aren't they transaction services?

The only downside is the hours are pretty terrible.

However, you find yourself more stressed than investment banking. Your VP worked at Goldman. In fact all your VPs come from top investment banking backgrounds.

You execute several LBOs. One day you look at yourself in the mirror when you come home.

Confusion strikes. Isn't private equity the promised land? Why am I not happy? You reach into your pocket and take an Adderall.

You tell yourself "It's OK. Pay is great. Private equity is great. Your working on mega LBOs. You take another Adderall, because YOLO"

You look slightly older, but you tell yourself you age like fine wine anyways.

The partners at the fund are all from Wharton and Harvard, and you wonder if a MBA is what you should do.

So you do your GMAT, hit 740 and get in HBS.

You put your PE bonus in a rock NFT and buy calls on $AMC, and quadruple your initial capital. Your Harvard MBA is paid for with Ethereum and $AMC calls.

Fast-forward the end of 2 years in PE, and your now at Harvard Business School.

It's day 1 of Harvard. It's orientation day, and you notice a lot of diversity.

You recognize a couple guys you encountered at JP Morgan and Morgan Stanley.

Life's good. It's good vibes only. Everyone at HBS is surprisingly chill. No D-Bags.

You meet tech people, and although they seem very smart, you look down on them.

Tech Nerd: "Hi I'm Mark, nice to meet you Chad" Chad: "I'm ex- MF PE, ex- BB IB, nice to meet you, what do you do"

Chad: "I'm ex- MF PE, ex- BB IB, nice to meet you, what do you do" Tech Nerd: "'I'm an entrepreneur. I decided to go to HBS to broaden my network and get VC funding. I'm already at Series A funding for $69M. Hit me up on slack"

Tech Nerd: "'I'm an entrepreneur. I decided to go to HBS to broaden my network and get VC funding. I'm already at Series A funding for $69M. Hit me up on slack"

Chad: "Creating a business? HaHa Loser! I'm a banker. What's slack, sounds wack."

Chad: "Creating a business? HaHa Loser! I'm a banker. What's slack, sounds wack."

You attend your first class and you start learning strategy, leadership tools, and the case method.

You kind of ask yourself "What the fuck is the case method? What is Porter's 5 Forces"

The only thing you really understand at this point in your career is "LBO, M&A, Deal Closed"

Either way, the classes are chill, and the vibes are good vibes. HBS actually rocks and you enjoy the time off.

You join a bunch of ECs, especially the Blockchain & Crypto Club and meet a bunch of other Chad's who made money on NFTs. There is no investment banking or private equity club at Harvard, so you end up starting it and become CEO of the club. Your friends from BB IB joins you.

You party for 2 whole years, get shit faced, and somehow graduate with summa cum laude while doing half the work of your undergrad. Was that Harvard? No your Chad and everything comes easy.

You interview, and land an amazing investment banking associate job at a bulge bracket.

It was that or corporate development, but you decide to go for the money.

You spend your summer at Santa Monica, and you finish it by fucking the 23 year old broad you met at Santa Monica. The sun sets at 9PM, and your loving life. You are in literal paradise. Investment banking is paradise.

You are in literal paradise. Investment banking is paradise.

Your pretty relaxed because it's July and your soon to start a brand new investment banking associate program. You receive your onboarding email as an 1st year associate at a Bulge Bracket in July 2025. Your going to be working with several other MBAs you know.

You realize investment banking is paradise.

Life is good.

Is your name Robert or is it Chad? It's Chad.

Investment banking is literal paradise.

Life is good.

Ah yes the IB -> PE -> HBS -> Post-MBA IB Associate path

Everyone's dream!

You don't want to leave BB IB for PE and then get an MBA only to go back to BB IB again?? Weirdo.

I actually think it’s best to go IB -> PE -> HF -> MBA -> IB VP/D -> IB MD -> undergrad again -> IB AN just to start it all over again

Think it may be sarcastic....

I literally lol'd at this

read it all and regret

who tf is wasting time writing shit like that?

Motherfucking Chad

My guess is an ESL crackhead got access to this dude's account.

briefly skimmed it and my main question is how can one consistently use "your" instead of "you're" throughout such large amounts of text? Clearly OP not in PE and that's why there's barely anything there.

anyone remember that fan fic someone wrote about being an analyst and having a phone call with some uppity MBA Assoc on a call? it was great, everyone loved it and requests for more chapters were made but dont know if the person got round to it...

link?

Sorry wish I could but I don't remember. It was great though really hope someone remembers and posts it!

.

Man was going to post this but clearly someone else noticed too. Cringeworthy and couldn't finish reading after like five of these.

Thank you. Came to the comments strictly to make sure someone pointed this out. I stopped after the 3rd occurrence. Seniors would've been ticked.

OP somehow understands the rules for "you've" but not "you're".

https://www.wallstreetoasis.com/forums/memoirs-of-a-first-year-associate

This?

*you're

This is art. This should be an NFT.

Amazing. This is what the seniors in high school on here jack off to a week before leaving for college as an undeclared finance major.

Only at non-target state schools with an undergrad business program

Screw you

I have never cringed so much at your vs. you're.

More importantly, as others have said, who tf would go IB->MF PE->HBS->IB? I think that literally has never happened.

Maybe not in that exact order but doing PE and then ending up back in IB is very common

No, it is not. I go to one of the most common b-schools for IB recruiting (Wharton/CBS/Booth/Stern) and we had I think 2 or 3 people in my class who were in PE pre-MBA do IB recruiting concurrently with PE recruiting. Every one of them ended up in PE for internship. Across all schools, I've ever heard of one person who did PE->MBA->IB.

OP definitely has “Incoming Intern Candidate” as their title on LinkedIn

or Incoming IBD reject

Thank you for this.... Very Cool!

Everyone upvoting this should be ashamed. Cringeworthy

Prob a bunch of college kids. Ngl I used to think working on Wall Street was exactly like that.

You are is "you're". Your means your.

Hello, Ross :)

wow that enterprise value diagram color scheme brings back memories. I learned about IB from cfi jeez

Their FMVA any good?

Fear The Bulge is this you? haha

Damn that is a lot of pls fixes in that OP

he obviously did the your you're thing on purpose you absolute morons

This is WSO not Wattpad

Anyone take these and run it through GPT-3, yet for a second/third chapter?

Deleted

MD: Chad, you spelled Uranus wrong. Pls fix.

Temporibus rem quisquam fuga sequi consectetur dignissimos reiciendis. Amet excepturi ullam eius est quas non officia. Sit vitae eaque iusto necessitatibus cupiditate. Sint voluptatem odio ipsam natus quos cum voluptate. Sapiente voluptas est quia dolorum. Illum voluptatem odio voluptates quos deleniti ducimus rerum. Expedita illum neque voluptatem.

Dolorem et at quae dignissimos. Ducimus qui ut dolorem sit autem rerum at placeat. Numquam vero voluptate eos ratione. Laboriosam repellendus qui non ut voluptatem. Aut et in numquam accusantium saepe autem nostrum. Nemo repellendus nesciunt asperiores esse.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Maiores ut iste omnis impedit aut consectetur et nobis. Sint incidunt libero doloribus dolores est rerum error. Qui ipsa iure voluptate consectetur. Est et distinctio eaque harum eos dolores labore.

Incidunt suscipit quis deserunt incidunt tempore sapiente omnis perferendis. Reprehenderit unde et excepturi ut incidunt velit excepturi. Cupiditate excepturi aspernatur eaque esse. Error corrupti est velit omnis unde.

Velit et ab praesentium facere impedit et consectetur. Ipsa accusantium quos sint voluptatem ut minus. Aut qui cupiditate inventore nulla magnam. Facere quod sed id ipsa rem. Consectetur ullam sequi exercitationem impedit et minima. Sapiente facere maiores autem. In ut fugit expedita sequi. Ducimus exercitationem consequuntur earum quidem.

Quo iste est dolor enim. Et enim sit sunt est repellendus est.

Sed cupiditate sapiente quas autem. Numquam soluta non eos similique a recusandae. Ad minus et voluptatum nemo eveniet voluptas soluta. Aperiam ipsa praesentium qui laboriosam rerum.

Eos ut dolorem ut. Quisquam ullam ad unde enim. Quia omnis sint quia modi perspiciatis eligendi reprehenderit.

Ad numquam sunt aperiam blanditiis labore. Eum quia possimus facere unde ipsum enim.