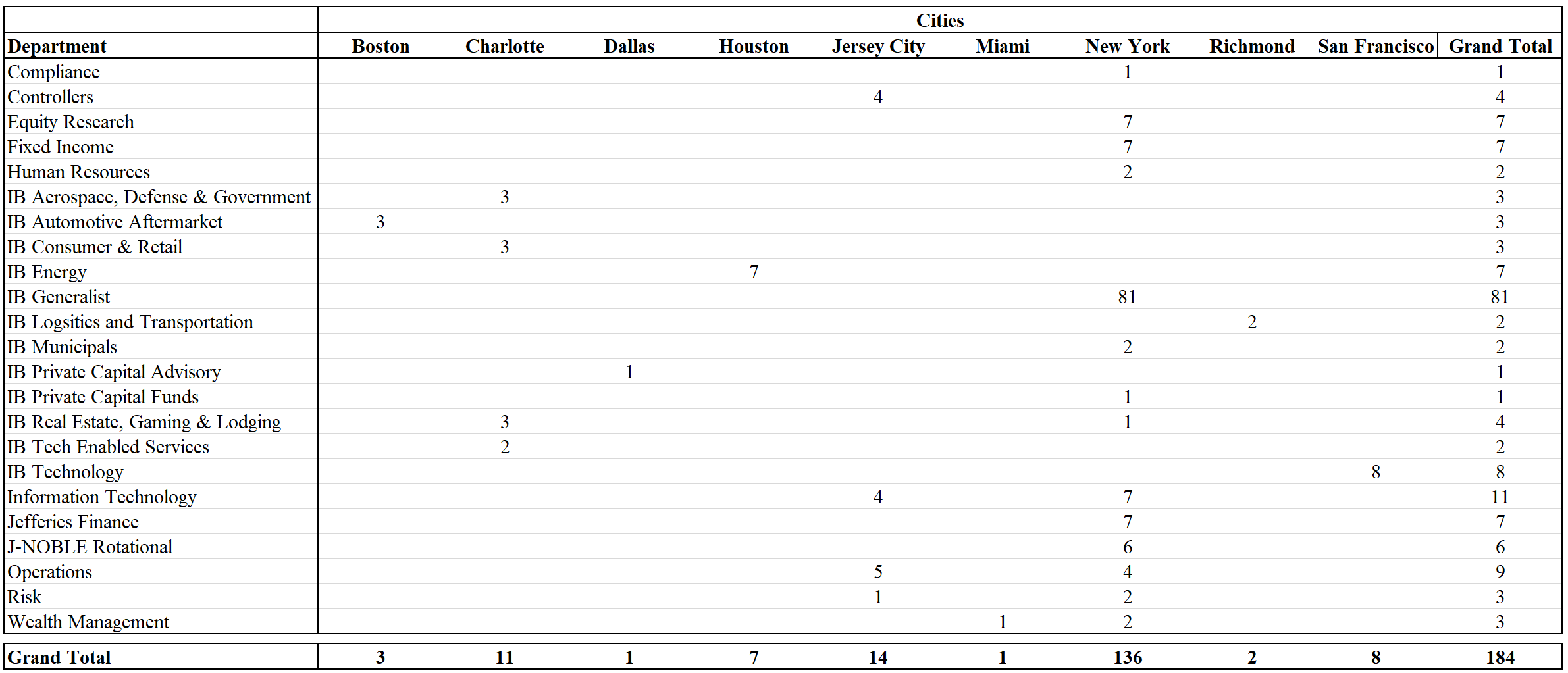

Jefferies Class Size

Incoming intern at Jefferies and wanted to just provide the class size, group, and locations as a data point for WSO. Reward with an SB if you enjoyed it. Looks like there is a total of about 117 IB summer analyst + summer associates. 85 of those are in NY (63 summer analysts, 22 summer associates) with SF and Houston taking a lion's share of the rest of them. Gotta admit didn't expect Jefferies to have such a big class size. Anecdotally have heard that SA 2022 is going to be even larger than this.

Looks like there is a total of about 117 IB summer analyst + summer associates. 85 of those are in NY (63 summer analysts, 22 summer associates) with SF and Houston taking a lion's share of the rest of them. Gotta admit didn't expect Jefferies to have such a big class size. Anecdotally have heard that SA 2022 is going to be even larger than this.

Interested in hearing your thoughts.

What’s conversion rate to FT offers? Any info on J-NOBLE numbers?

Well, this is for the upcoming summer so obviously don't have numbers but would expect to be in-line or above historical numbers. Historically it's been ~95% and if you get an offer from Jefferies you have a full-time offer with your name written on it so as long as you don't screw up you'll get an offer. J-Noble, if I recall correctly, is for sophomore summer so I would expect a near 100% conversion rate for that for the next summer given how low the bar usually is.

Great, thanks. Looking forward to next summer and joining JEF.

last summer interns in markets got shafted, super low rate like sub 40% I heard.

bump to avoid bug

Hahaha glad to see you adopted and improved the pivot table.

what do you mean lol

https://www.wallstreetoasis.com/forums/bulge-bracket-sa-class-sizes#com…

Very hard to believe they took 80+ IB SAs in NYC. Thought it was more like 40-50 max across M&A/ Coverage/LevFin/Restructuring in NYC. Especially after what they did this summer, doesn’t seem accurate.

Also incoming SA at JEFF, this includes Summer Associates as well, so it's about 50 SA, 30 SummerAssociates

That makes much more sense. This was incredibly misleading. Jefferies recruits differently than a BB, smaller range of core schools (seems to mainly just be Penn, Georgetown, UVA, Michigan, BC) for NYC and a bunch from noncore. Smaller process

This is not accurate they take maybe 10 summer associates maximum (NY Gen)

Yeah, it's actually 63 summer analysts and 22 summer associates. If by "what they did this summer", you are referring to the perceived ~50% return offers, that's actually incorrect. The SA-FT rate for SA 20 was about 95%. They came back and gave an offer to almost everyone within a month but couldn't do this before because of an internal hiring freeze.

What are you smoking? I joined JEF FT in 2016 as an analyst. My FT class had 55 analysts in nyc. Not surprised at all by these numbers...

its the 8th largest bank in the world by revenue and people in this thread are surprised that there are huge analyst classes. go figure LOL

I think it is the 8th largest by revenue in IB but yeah I agree with you completely. I think people just don't realize how fast Jefferies has grown over the past 5 years (even 2 years). They have added a new group in IB (PCA), their usual groups have continued to do extremely well, ECM has boomed from the increase in SPACs and this is being reflected in the league tables, and lev fin is killing it too and they are also building out their RX rather quickly. It's almost like the bank is on steroids or something. I would wager that Jefferies has been the fastest growing bank over the past 5 years (both in terms of headcount as well as financial performance). There's no denying JEF's performance.

The problem is that the reputation takes time to catch up to the actual performance. People still think of Jefferies like what the bank was like in 2013. Give it time and I think Jefferies' reputation will catch on in the next couple of years.

Spot on post. Jefferies outperforms UBS and DB for the past two years, is growing way faster and has better momentum and yet ppl still talk like the latter aren’t even in the same category. JEF is knocking on the door of Barclays and CS too... I think 2021 league tables will surprise a lot of folks

Jefferies is a good shop, but I have never met an employee who was happy to work there. Ask someone what they think of senior management and grab your popcorn

Thanks for the insights

Any idea how many interns are there for ECM?

At the internship level the NY intern class is generalist across all groups (except those listed separately here). So, don’t have a specific number sorry.

No worries. I'm just curious then, If I want to recruit for ECM, do I have to apply for the generalist role only? Can't seem to find an ECM application on their website.

Hey can anyone provide insight on what their target schools are or how the JEF class is divided by schools (if you have that info), thanks

OP here. give me 30 mins I’ll let you know (have the data just don’t have my laptop near me).

appreciate that man

Thanks for doing this! Do you have any data available on Associates by chance?

Here you go:

Thanks for uploading!

I wish someone would do this for the other banks. I kinda screwed myself by applying to regional offices thinking it would be easier than NY.

I am also part of this class at Jefferies at a regional office and just fyi everyone in my class is from a school that office recruits at. I am about 80% sure there aren't any non-targets in the SA 22 batch either. I have first-hand seen people (specially those from the usual targets) have the misconception that it'll be easier to apply to a regional office. If anything I think it is more difficult. That's because the spots are much fewer (so you have fewer apps but also fewer spots). Given the OCR relationships that the bank has with universities, they'll try to get at least 1 from the uni and that really fills up all the spots.

Yeah, it's very misleading but you only learn. I thought NYC would be swamped with applications and it would be easier to get into a regional office; however, really not the case.

Any information on LDN?

Don’t have any on London/other offices unfortunately, sorry.

Quo asperiores quia pariatur ipsam. Non magnam eos aspernatur sunt. Facere voluptas dolores omnis. Eveniet omnis dolores rerum ratione illum et. Magni sint est minima rerum debitis perspiciatis.

Qui qui dolor explicabo voluptas. Et aliquam neque sed quia.

Et aliquid eum aut. Nesciunt nihil nobis aspernatur ratione. Maxime et et dolorem dicta vitae velit. Impedit excepturi laborum ut eligendi distinctio voluptatem vitae dolore. Delectus quas natus mollitia quod nostrum. Ad unde est asperiores et.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Dignissimos quia dolor nobis inventore harum rerum omnis. Excepturi officia minima temporibus sint sunt. Sit culpa quia dicta numquam tenetur suscipit perferendis.

Ex sed sed omnis aut omnis. Eaque numquam natus temporibus optio. Iusto saepe earum aspernatur in libero inventore. Est et voluptatem magnam commodi vitae.