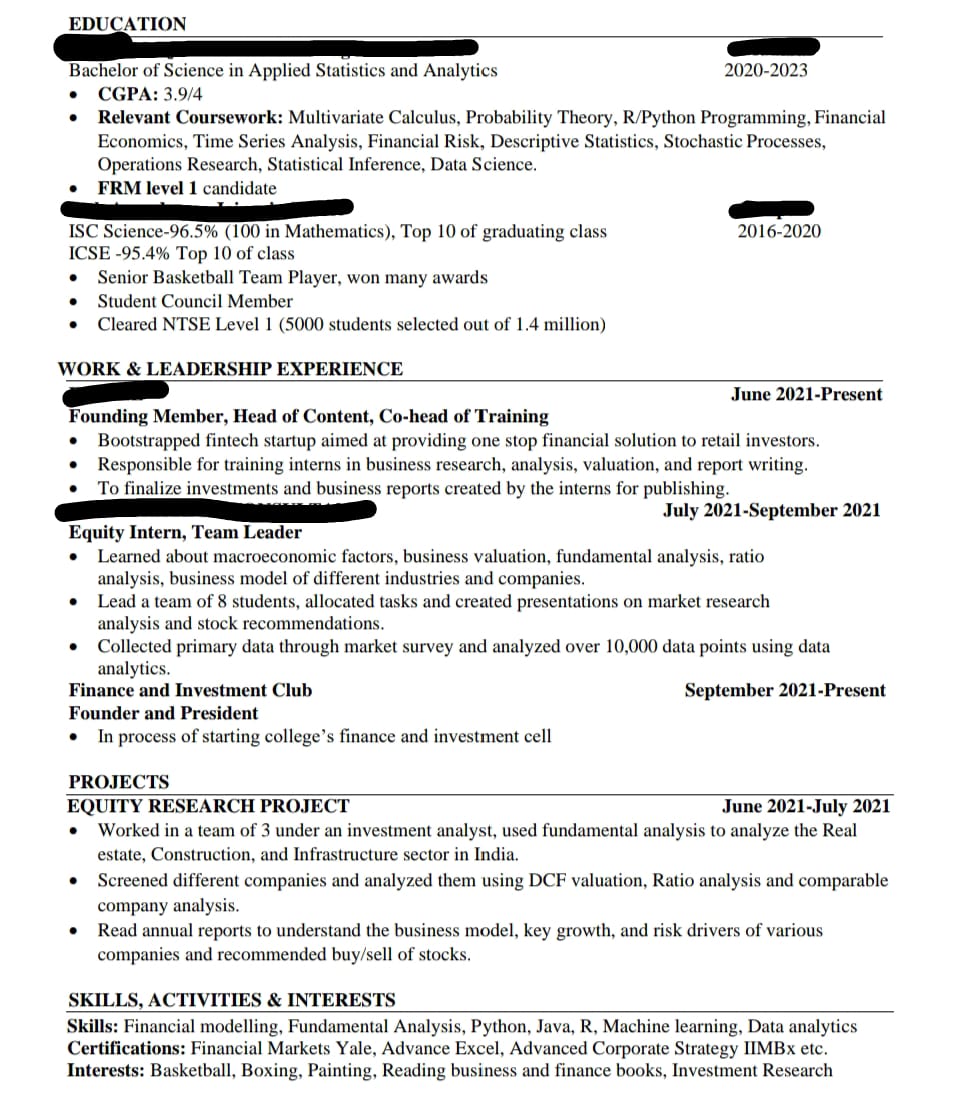

PLS DESTROY MY RESUME

Currently second year in college. Trying to get a brand name on CV so applying to 2022 summer internship programs.

Currently second year in college. Trying to get a brand name on CV so applying to 2022 summer internship programs.

| +19 | Fairness Opinion in Resume | 7 | 2d | |

| +16 | Tear my resume to shreds | 5 | 1w | |

| +14 | Including Major Gpa and leaving off cumulative GPA off resume? | 6 | 5d | |

| +14 | Roast my resume | 2 | 2w | |

| +14 | Pick Apart My IB Resume Like a Hostile Takeover - No Mercy | 7 | 2w | |

| +12 | Personal Summary on Resume | 2 | 2w | |

| +9 | Resume Advice | 1 | 6h | |

| +9 | idk how to delete this | 1 | 5h | |

| +9 | Working Two Internships at the Same Time (Part-time remote + full-time in-person) | 1 | 3w | |

| +9 | Resume Question | 1 | 1w |

Career Resources

so you have been at your uni for nearly two years and only decided to start the finance and investment club the same month you decide to start applying for internships? whats the STAR here?

No I've been at the university for just 1 year . I wasn't very serious till now and it didn't occur to me to start a finance club. But recently I've started to grind and apply to multiple internships, start a finance club and do all sorts of things like learning excel etc.

1) alignment of the years looks whack for yourself education. Should be right aligned like you’re experience

2) ordering of your experience is kinda weird

3) third bullet on first work experience?

4) use the Oxford comma consistently if you’re going to

5) your capitalization in work experience section is weird

6) more info on finance club

7) maybe re read your work experience bullets. Shorten them, quantify, use better action words

8) finance club needs more info. You can get extra space by shortening the other bullet point and removing some stuff from your HS education. No one cares about it that much

9) “won many awards.” Sounds ridiculous

overall a good resume

I'm on a recruiting team and see a ton of these, so here's my detailed comments. You have good experience, I assume you are international so some of these edits are making that less obvious. You should quantify your experience a bit more - what type of data did you analyze and how? You need more numbers in your bullet points.

----------------

1. just put GPA not CGPA. Be consistent with your decimals (3.9/4.0). I would also put 3.8x/4.00 since it is over 3.85. That is a very good GPA and my strong preference is 2 decimals

2. In coursework take the period off after data science. Globally, take the periods off of all of your bullet points as they are not complete sentences. Are you taking any finance courses? This reads like a math/engineering focused resume. Put financial economics, financial risk, etc above advanced math classes, those are irrelevant for IB.

3. Spell out FRM

4. Be consistent with your hyphens. Some have them like word - word and some like word- word. I'd go with one space in between hypen and word.

5. ISC - top 10 of graduating class out of how many? In the US more common to put the top x% of class. Put these both on the same line.

6. take off "won many awards" and put 1 or 2 important awards that stay on one line. I'd also put student council and basketball on the same line, you have way too many lines dedicated to high school

7. First experience - Capitalize the H in Co-Head. "To finalize" ? Assuming this has not been done yet, but just go with Finalizing.

8. Second experience - You want "led" not "lead" since it's past. Move the first bullet point to the bottom since it is least hands on. In the primary data point, talk abut what type of data you collected and analyzed

9. Finance club - Based on date this reads like you just started it specifically for recruiting which isn't a great look. I'd either take it off, or if you've put a ton of effort into it you can say what specifically you've done, but just saying you're in the process is not enough. Also say club not cell.

10. Equity research project - don't capitalize the sectors in first bullet. Don't capitalize ratio in second bullet. I'd get rid of one of these bullets and talk about a recommendation you made that they acted on, or if they didn't act on anything then talk about how you analyzed and recommended more. This is too qualitative, you need more technical stuff

11. Skills: Modeling has 1 L in the US. You don't need Python, Java, machine learning etc for IB so tailor these skills more towards financial analysis. Also if you have financial modeling on there, you should be expecting advanced Excel questions and harder technicals. Unless you are very comfortable at all sorts of modeling I would take this off.

12. Certifications: You missed a D on advanced excel. Take the Etc. off

13. Interests: Take business/finance books and investment research off. This is an auto ding tbh. If you have niche interests (medieval armor? specific anime genre? 18th century literature? put it on there. People will ask about it)

This is my first resume which I have made and honestly I didn't realize how many errors I had made, so thanks a lot

Don't worry, my resume in college had typos for years... it's just hard to proofread your own. Very good start overall

Wow that's the first time I've seen anyone on this site recommend putting anime on a CV

People like you make the world go around. Only reason I was able to make it in recruiting was because folks were willing to give hand to a kid who didn't know much.

Really appreciate this write-up. Definitely informative for someone starting off in college!

you have a typo

Good job Briton

Would get rid of "reading business and finance books" tooooo cliche

At the risk of receiving a TON of MS I am going to share my two cents:

- Your resume is fine. I'm sure we can have hundreds of people throw comments and go back and forth on it, but If you really want to be in banking, that is not where you should spend your time and focus. NETWORK! I don't care how beautiful your resume looks, its going to end up in a pile with a thousand others. The connection is more important than the resume and I will say that because without it, the chance of it being considered are slim. And when you have a strong network and introduction, they will want to see a good resume yes, but you will already have a platform and that's most of the battle. From my experience if someone puts time on a calendar to meet you, by then they aren't there to scrutinize a piece of paper, its a tool to get to aid the introduction and get to know who you are as a candidate.

This is my experience in a BB IB group watching multiple hiring cycles.

Lots of good advice here above. Mine is a nit but if you just have "Equity Research Project" as a project/brand name it's vastly inconsistent with the stuff you have above with name which are blacked out. I'm assuming the ER project was something akin to the CFA research challenge so make sure you put the name or organization the project belonged to. This not only validates it but also makes it consistent with your other entries.

Eos officia modi et. Numquam itaque magnam et dolor reiciendis odio facere. Sequi et itaque consequatur deleniti labore sint.

Nesciunt officia voluptatem odit qui. Dolor vel facilis consectetur velit debitis est vitae. Maiores mollitia quae voluptatem omnis beatae sint eum aliquam.

Soluta soluta odit illo at optio libero. Ab repudiandae sint quos est quam voluptatem magni. Minus sunt eius natus est eum.

Nemo eos quos voluptatum quia delectus doloremque. Sunt odit qui doloremque odio. Rerum sint tempora assumenda reiciendis.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...