Rothschild (NYC) Groups 2022

Anyone have insight on Rothschild NYC's groups in terms of deal flow, exits, culture, etc.? Didn't see an updated, dedicated thread. Thanks!

Anyone have insight on Rothschild NYC's groups in terms of deal flow, exits, culture, etc.? Didn't see an updated, dedicated thread. Thanks!

Career Resources

Through networking I learned Industrials / Rx are the top ones with the best exits.

Consumers and Healthcare are good too with FIG on the come up given their recent deal with MetLife.

SA program is generalist though so you might be staffed on a bunch of different groups.

Any idea on TMT?

Not sure if their SF TMT group is stronger than NYC one. You may have to reach out to folks though I did see them poaching associates from industry focused/regional boutiques to build out TMT NYC.

As a former employee they’re honestly all pretty mediocre - very frank advice, pick the team who you get along with the best, chill there for a year, then lateral to another bank. That’s what I did, currently at a bank some consider an EB

Mediocre in terms of deal flow/size? Or culture? Would love some more information!

Subpar deal flow except for a few that come our way every year. but culture is nice

Would also like more info!

What specifically would you like? Exit opps? Deal activities? Working culture? Pay?

I swear every thread about Rothschild says something different from each other lol

Lies. Rothschild is a sweatshop. Had a VP there flat out ask me why 'I wanted to do this shit to myself' in a networking call, and then try and convince me to take up modelling instead.

Hey guy I have a bone to pick with you! A VP at Rothschild would never swear over a networking call, especially to some snot-nosed kid like yourself mister. What type of bank do you even work at huh, some no named shop I bet!

I actually found the swearing cool lol. Made the firm more attractive to me. A degen like me appreciates working at a place I can swear freely to my heart's content.

And no, bulge bracket baby!

Agree with others as mentioned above, Rothschild has been going downhill for some while now and just don't offer the same pay/experience/exit-opps as the EBs.

Quite the opposite actually. They entered T10 for global market share in M&A deals and have been on some large billion dollar mandates in 2021. They announced 2 new offices as well in USA.

I think the European office did alot which is why its global market share but the US office certainly contributed! This means I worked at European EB and now a US EB at my new bank! I hope this shows everyone how solid the Rothschild franchise is

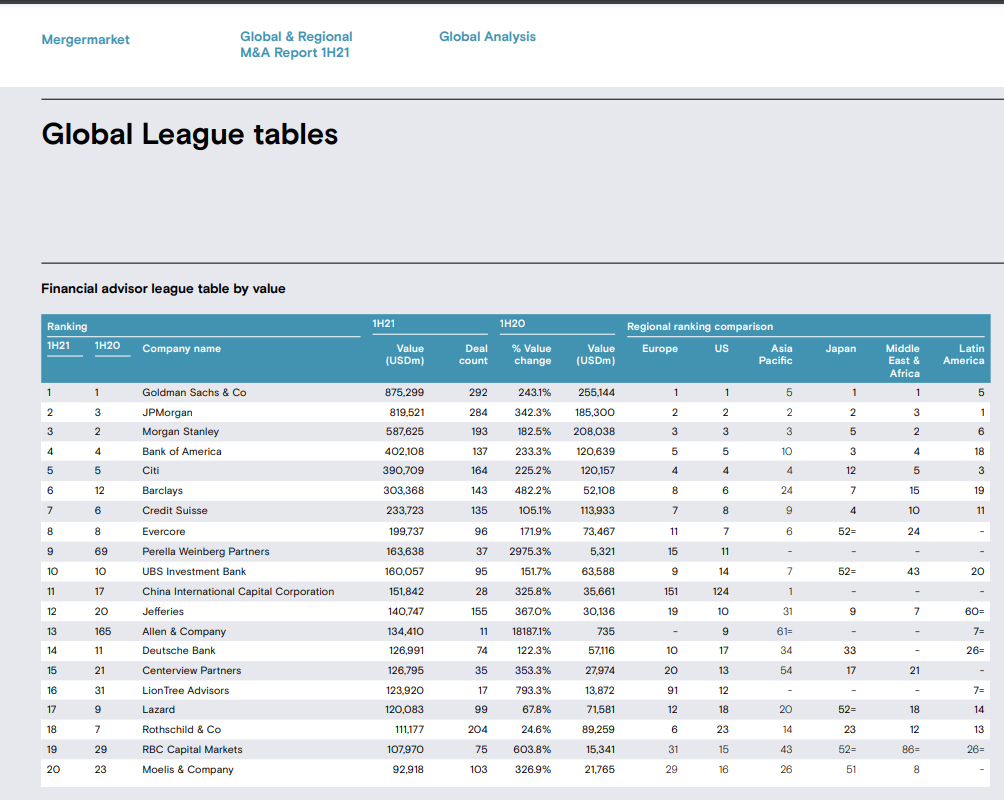

Found the Rothschild analyst lol. Take a look for yourself

Rx/industrials/consumer I believe are the most "established" groups in terms of size and how long they've had the groups. Think the rest are relatively newer so would be more diligent in choosing those in terms of experience.

Wonder if this SVB shill is the same one trying to prop them up on every post or if SVB is asking all of their analysts to boost the bank on WSO and trash other banks

Funny how boring life must be there to spend so much time trying to convince people they are an “EB” on the internet

Excuse me but SVB is a highly respected institution by many bankers in the industry. We are pioneers within TMT and healthcare banking especially in the upper MM coverage, its actually proven that its becoming less uncommon to see people turn down places like JPM/CVP/Q for us. Maybe you're misinformed but we are certainly not "shills", just proud to be working at an up and coming EB :)

Just look up where the analysts have gone on LinkedIn. Looks like over the last 2-3 years the strongest exits have come from consumer and industrials (not to look down on RX at all, just that the recent analysts aren't exiting to the high profile shops like how they used to)

Well the two RX rainmaker heads are gone. One went to GHL while the other founder TRS which is now Piper Sandler.

Just want to clear it up that not all folks aim to leave immediately! We have a great working culture as we're all not fancy "target" college people trying to prove a point but we are salt-of-the-earth people that want to foster meaaningful genuine relationships at the firm :)

It was a hard choice to leave as I really enjoyed my time there! Our deal flow is great for the ones we are involved in as they are best-in-class, high profile, and industry defining m&a and private placements. It was just a bit concerning to see the seniors get frustrated when things didnt go our way. It wasn't our fault but more of the overall markets affected by COVID and the clients sometimes being a bit too fickle. Not the best to see VP/MDs use cuss words or look a bit defeated and tired which is why I thought its better for a change of scenery to something more upbeat. But of course overall our senior leadership are content and very smart characters with some of the deepest industry experiences that is parallel to anywhere I have seen

I would also politely disagree with chickenboy comments about RX. We have an amazing best-in-class RX franchise with a new partnership formed with Intrepid, the best establishment in the O&G sector. It's just that so many of these "new" shops pop up like pjt or ducera and whatever and just take away market share. Why would people trust these places that have literally opened for only a few years when we have an renonwed history and are famously known across the US and Europe. If I was a client, it would be hard for me to trust a start-up boutique over an establishment like us... just my two cents, oh well kids these days. Our RX team also provides great exit opps similar to the industry groups as well!

So it sounds like fig and industrials are the better ones in Rothschild? Where do people specifically lateral from these teams, and what are the usual schools for a typical analyst there, top 15 state school is doable?

THANK YOU to the poster who show us you don't need some elite background school for IBD. As one who's proudly from a "non-target" institution, I will be applying for a position here to showcase my talents and skills. People should understand that the academics is only one facet of a multi-faceted perspective because people are holistic and not just their degree from some "fancy pants" school as the poster describes LOL

Extra props that he paved the way to show we can all join up and coming EBs/BB from roths bank. Fellow non-targets lets all intern here in 2023 and beyond!!

Rothschild is the only bank mentioned by name in American Psycho (2000). Take it as you will.

What's that supposed to infer, you have to explain my young padawan :) We are plain non-fancy pants "target" folk in IBD

How can there be so much pitching if they had the 3rd highest deal count

It's generally driven from our colleagues across the pond in the Europe regions - the league table above is global count and you can see the breakdown by the geographies and countries. But we are top 25 in the US and that is still quite impressive :)

R&Co is generally much stronger in Europe than here in the US. From my internship I only remember that HC used to be very strong in Europe, whereas US Tech seemed to be weak.

For all who currently work there, would appreciate if you can chime in - is the work life balance & culture really as good as claimed? I ain't trying to kill myself averaging 80-90 hours/week and would like to work with nice, relaxed people. Don't really need mega deal-flow either

There are different views of Rothschild on this same thread so now I am confused. Are they strong in the US/are they getting stronger or what?

Not sure where you're getting that they're strong - the league tables above is global rankings and it shows Europe is carrying the US franchise on its back. Without it, roths bank wouldnt be close in top 10

Ain't a problem for me though, very transparent im trying to find best WLB while doing IBD from a non-target college

~$360mil in Americas M&A fees. Most of it prolly US. In 2020, North America had much higher rev per head than in both the UK and France, though in 2019 rev per head was higher in the UK (not sure about France). Revenue would include: North America IB + PE, UK IB + PE + PWM, France IB + PWM.

I think deals in the US just garner a higher fee as a percentage of deal size than deals in Europe do.

Anecdotally, RX I’ve heard RX is stronger in the US than in Europe besides for Sovereign. This may change though since the old co heads left some years back.

US comp is much higher than Europe comp despite Europe being stronger because apparently they have a prestige discount in Europe.

Not so much a "prestige discount" as much as European salaries just being lower. London base is £62k, which is higher than JPM, BAML, Citi, Laz, etc.

I’ve heard Rothschild paid less than other banks in London. This was before the raise though. I think base was the same with lower bonus.

Rothschild ECM recruits separately from their global advisory in NY, correct?

Consequuntur est delectus magni dolore molestiae. Perspiciatis quia quod commodi. Consequatur et ad cum id. Voluptatum perspiciatis et aut consequuntur.

Deleniti veritatis sunt a sapiente autem laboriosam ut. Voluptatem minus aut asperiores accusamus. Et fugiat ad officia qui.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Vel eligendi sit veniam doloremque. Ex aut earum aut eum dolorum ab. Quasi qui ab rerum dicta ut debitis. Corrupti molestias voluptates laborum quo totam.

Accusantium ab ipsam omnis eius facere voluptas autem. Consequatur temporibus nostrum quia libero dolores alias. Odio sit est ab quos aliquam adipisci. Sunt tempora modi magni fugiat. Sunt nihil est sit dolore eaque ratione. Et est similique quia maiores vel dolorem. Perspiciatis enim est quibusdam incidunt rerum aut.

Est tenetur quod dolor rem tempore sed esse. Ut voluptas quia nulla quae pariatur atque mollitia. Officiis odio eum sapiente aut porro. Nobis ipsum nam delectus eos. Aspernatur voluptatem commodi nulla voluptatum rerum dolor fugit.

Officiis labore iure sequi quas sed cupiditate. Explicabo nam aperiam ut in harum tempora ipsum adipisci.