What's Going on with this Crazy Market?!

The massive rally of the stock market since March 2009 has been perplexing for many, but the state of confusion has reached new heights as the stock market has surged another +2.0% in May, surpassing the Dow 15,000 index milestone and hovering near all-time record highs. Over the last few weeks, the volume of questions and tone of disbelief emanating from my social circles has become deafening. Here are some of the questions and comments I’ve received lately:

“Wade, why in the heck is the market up so much?”; “This market makes absolutely no sense!”; “Why should I buy at the peak when I can buy at the bottom?”; “With all this bad news, when is the stock market going to go down?”; “You must be shorting (betting against) this market, right?”

If all the concerns about the Benghazi tragedy, IRS conservative targeting, and Federal Reserve bond “tapering” are warranted, then it begs the question, “How can the Dow Jones and other indexes be setting new all-time highs?” In short, here are a few reasons:

You hear a lot of noise on TV and read a lot of blathering in newspapers/blogs, but what you don’t hear much about is how corporate profits have about tripled since the year 2000 (see red line in chart above), and how the profit recovery from the recent recession has been the strongest in 55 years (Scott Grannis). The profit collapse during the Great Recession was closely chronicled in nail-biting detail, but a boring profit recovery story sells a lot less media advertising, and therefore gets swept under the rug.

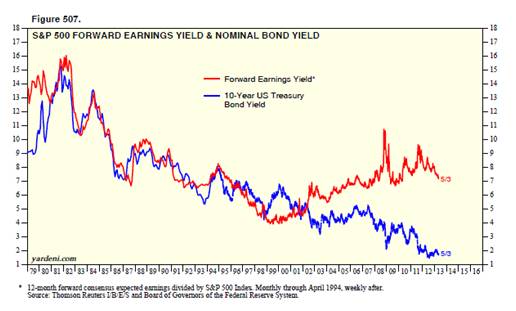

II.) Reasonable Prices (Comparing Apples & Oranges):

Source: Dr. Ed’s Blog

The Price-Earnings ratio (P/E) is a general barometer of stock price levels, and as you can see from the chart above (Ed Yardeni), current stock price levels are near the historical average of 13.7x – not at frothy levels experienced during the late-1990s and early 2000s.

Comparing Apples & Oranges:

At the most basic level of analysis, investors are like farmers who choose between apples (stocks) and oranges (bonds). On the investment farm, growers are generally going to pick the fruit that generates the largest harvest and provide the best return. Stocks (apples) have historically offered the best prices and yielded the best harvests over longer periods of time, but unfortunately stocks (apples) also have wild swings in annual production compared to the historically steady crop of bonds (oranges). The disastrous apple crop of 2008-2009 led a massive group of farmers to flood into buying a stable supply of oranges (bonds). Unfortunately the price of growing oranges (i.e., buying bonds) has grown to the highest levels in a generation, with crop yields (interest rates) also at a generational low. Even though I strongly believe apples (stocks) currently offer a better long-term profit potential, I continue to remind every farmer (investor) that their own personal situation is unique, and therefore they should not be overly concentrated in either apples (stocks) or oranges (bonds).

Source: Dr. Ed’s Blog

Regardless, you can see from the chart above (Dr. Ed’s Blog), the red line (stocks) is yielding substantially more than the blue line (bonds) – around 7% vs. 2%. The key for every investor is to discover an optimal balance of apples (stocks) and oranges (bonds) that meets personal objectives and constraints.

III.) Skepticism (Market Climbs a Wall of Worry):

Source: Calafia Beach Pundit

Although corporate profits are strong, and equity prices are reasonably priced, investors have been withdrawing hundreds of billions of dollars from equity funds (negative blue lines in chart above - Calafia Beach Pundit). While the panic of 2008-2009 has been extinguished from average investors’ psyches, the Recession in Europe, slowing growth in China, Washington gridlock, and the fresh memories of the U.S. financial crisis have created a palpable, nervous skepticism. Most recently, investors were bombarded with the mantra of “Selling in May, and Going Away” – so far that advice hasn’t worked so well. To buttress my point about this underlying skepticism, one need not look any further than a recent CNBC segment titled, “The Most Confusing Market Ever” (see video below):

It’s clear that investors remain skittish, but as legendary investor Sir John Templeton so aptly stated, ”Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.” The sentiment pendulum has been swinging in the right direction (see previous Investing Caffeine article), but when money flows sustainably into equities and optimism/euphoria rules the day, then I will become much more fearful.

Being a successful investor or a farmer is a tough job. I’ll stop growing apples when my overly optimistic customers beg for more apples, and yields on oranges also improve. In the meantime, investors need to remember that no matter how confusing the market is, don’t put all your oranges (bonds) or apples (stocks) in one basket (portfolio) because the financial markets do not need to get any crazier than they are already.

Wade W. Slome, CFA, CFP

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision.

Nice post. I've recently been reading the Intelligent Investor and in his book, Graham states that the smart investor should do the opposite of what the general public does. So for instance, when optimism is very high, and the public is willing to over-pay for stocks, the intelligent investor should sell. The concepts in Graham's books agree with what you've wrote.

If you've ever tried to understand an MD's overall strategy based on crunching pitchbooks, that would describe what it's like trying to understand the current market in strictly financial terms. You're trying to feel through the dark with incomplete information.

What the hell does that mean?

You most likely may never know what your MD is up to because you don't have full access but you do have full access to the public debate and you just have to pay attention: look at the larger environment that business operates within to understand the markets at this point. The markets are reacting to overarching political decisions and the standard rules apply but give atypical results given the asymmetrical power relationship between gov't and markets.

A lot of people think the market is 'fake' or is being 'manipulated' by the government. They're sort of right, but also dead wrong. The gov't isn't sneakily pulling strings of the economy. On the contrary: they're openly dumping massive amounts of liquidity into it while controlling for low interest rates. And they're doing it in broad daylight, telling you exactly how much as they go. In fact, we can see the shape of things to come, even if we don't know the exact dates and dollar amounts: they will slow liquidity infusions and raise rates. Anyone in this business should understand this, and seek to understand how it will affect their sector....this is not the first time in history we've seen this.

That money would flow into equities should not shock anyone who took econ 101, and I'm baffled how so many smart people on Wall Street don't see this. As rates rise and liquidity infusions slow down, some people are expecting equities to tank, but what they don't realize is that rates aren't going to go up very quickly and that there are MASSIVE cash reserves that have started entering the markets as confidence builds. So, from this framework of thinking, there's no reason for equities to fall aside from some price discovery (I'm betting many will go up as well during this process).

Why would the gov't do this? That's another conversation completely. Simply though: they value stability over rapid growth. The real winners look at the larger ideas driving things, and understand that the numbers just quantify them.....trying to divine the future from a set of metrics will prove frustrating simply because the standard reference points are deliberately altered by the government at the current time. What I suspect is the blinding so many people to what is plainly obvious is their conception of how they think government "should" run as opposed to how it's actually running things at this point.

I think it's likely that the next president will set a different tone and will likely be a republican, but for now, the agenda is set. The numbers just quantify that agenda, but you will not undersand that agenda only by looking at the numbers. You have to pay attention to the overall civilization. When you do, it will suddenly click and will seem incredibly obvious. Then you will understand and know where to put your money. Until then, you are stumbling in the same darkness the gold bull holdouts are.....very dangerous territory.

Stopped reading when I saw your first chart. This is such a misconception...

This is a great book and agree.

When your non-finance friends start pitching you stocks you should get ready to sell.

@ WSPB - LOL the public has been right for three years and even within my company the rank and file are getting pissed off at the bears. If the market goes down, then sell, but we've been hearing "sell sell sell" from the likes of Whitney and everyone (it seems) on mainstream news, and everyone has been waiting for a 50% drop in prices any day now. Meanwhile, those who have taken a prudent risk management approach, or simply bought index ETFs have done quite well....and if the markets start edging down they can sell off and take their profits.

To put things in perspective, we're hearing that the sky is falling, meanwhile the annualized returns from 1-1-09 to present are 12.96% 14.92% 20.32% for the DJIA S&P500 NASDAQ, respectively. At what point do the bears just admit they were wrong, or can the even do so? Hanging on to a thesis and revising the official day of reckoning every six months isn't strategy, it's voodoo.

Anyone can have a theory, but to be taken seriously and to make money, you actually have to call a surge/downturn at the correct time.

Respectfully, OP, this market isn't crazy at all. There's just some people looking at it wrong and then making a lot of noise and confusing the issue. I've been saying this for about three years now and I'm just going to stop myself because I've come to a point where I'd rather take stupid people's money than be right.

^ yeah so doesn't that mean the same thing? Basically when the talking heads have been saying sell this whole time you should be buying.

When you hear on TV consistently that S&P is going to 2,500... That's when you sell. Essentially we are in agreement.

As it stands now, people are still saying the world is going to end so no need to worry yet... Keep buying.

No one is getting rich with 1% CDs.

Agreed, S&P @ 2500 is far too optimistic, but that does not mean it's going to go below 1400 anytime soon without some black swan event. IF it starts to approach highs like that, then we'll know for sure that we're in an equity bubble and that QE wasn't drawn down fast enough. Thing is, if Joe nobody UFO on WSO can see this, I'm assuming the brightest minds at the FED are looking at this too?

Or maybe not? The gov't is the one that screwed the pooch in the first place. If they do it again, I'm just WAITING to cash in....and if they don't, hey great, my 401K beat 90% of hedge funds over the last couple of years.

Yeah we're pretty much speaking the same language here. One thing to note is the bears are becoming more and more quiet as of late.

Basically just waiting for everyone to become bullish then you run.

Also seeing a lot of bears talking about hyper inflation... If that is the case why in the world would you leave your money in a CD? Makes no sense, keep putting that cash to work.

Cool.....

so basically, the plan is to wait until S&P growth surpasses 20% annual growth and then buy ETF shorts. At this point though, I think it's too early. The other thing is that if prices go too high and then dip, my honest guess is that they'll bounce back quickly as the market continues to rise.

The other variable that's easy to lose sight of in conversation but is immediately apparent when looking at a 5+ year chart, is that stocks TANKED a few years back and are recovering. Start at 1300, hit 900, then rise to 1400 five years later......functionally, we're right back where we started as long as people don't assume that the equity appreciation rates we've seen the last couple of years are going to continue forever.

Likely, within 2/3 years we'll be back to 7% +/- per year and the politicians won't dick around with the system again.

^ absurd statement, we know the will :/

Love how everyone is talking about that "epic fall" and it's not happening, meanwhile one of my stocks posted earnings reports and jumped ~15% in a couple of days, should have bought more.

great post. easy read and informative

Everyone is talking September for the taper. We'll see if the fall occurs when the Fed starts tapering QE infinity. This should occur when we see a rise in GDP, they'll taper to avoid inflation. I would think the meteoric rise in the DOW has at least some of its value dependent on the Fed.

Agree. However, the magnitude of this effect varies substantially by industry based on the level clarity investors believe they have on the likely impact of reduced easing, creating valuation discounts and premiums that look absurd to fundamentally focused investors. Retail and defense are two good examples on opposite ends of the spectrum here from a historical valuation standpoint, although obviously company specific factors, especially medium term market share prospects, are as important as ever.

Not saying I agree or disagree with this analysis of the markets, although it is compelling. But I don't think this is what Graham is saying (I'm looking at the first quote in there). I think incidentally the intelligent investor does the opposite of what the general public does, but not BECAUSE it's the opposite of the general public. It's just that in bull markets, stuff is overpriced so one should stay away, whereas in bear markets stuff is undervalued.

The reason why I'm so unsure about investing right now is because what a strange situation this is...at least to me because I am not old enough to have experienced this before. I feel like a market where things could be overpriced but yet sentiment is low is possibly the worst combination to be involved with as a newb. It just feels so artificial right now...

dow or (whatever index) is at all time high....so market valuation must be overvalued.....how smart you are!

stop skirting around god-damn economic data points and start blaming yourself for not understanding "earnings".

Then, I guess you can go study earnings.

one wisdom from a guy whose name is benjamin graham that I think relevant and helpful to you.

"can you differentiate between "stock market" and "market of stocks or individual stocks"?

stop throwing words like "overvalue" or "undervalue" consciously or unconsciously without stating fair-valuation.

In my opinion, you lose your credibility unless it's matter of free of speech.

agreed with ufoinsider 100%

Excepturi doloremque ab laboriosam sint atque. Deserunt dolor incidunt magnam velit nobis dolorem. Quo quod maiores ad sint et. Dolorum veniam non at rerum aut aliquid qui ut. Illum ratione dolorem maxime non aperiam nihil.

Aut dolorem hic numquam voluptas voluptas. Magnam nesciunt inventore unde deleniti temporibus sunt.

Ut mollitia in et eos fugit aspernatur ea. Et aliquam perferendis ipsa magni aut incidunt. Occaecati dignissimos ipsa voluptatem sint. Ratione impedit commodi ut fugiat ipsam dolor. Iure nihil porro cupiditate dolores.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...