Forecasting Cash Flow

Process of predicting a company's future cash inflows and outflows to assess its financial health

What Is Forecasting Cash Flow?

Forecasting Cash Flow is the process of predicting a company's future cash inflows and outflows to assess its financial health. However, companies can use that previous data to predict their future financial performance.

The fundamental financial statements are:

To anticipate the company's future financial health, small firms may want to forecast their income statement, balance sheet, and cash flow statement.

Cash flow prediction involves estimating the money entering and leaving a company within a specific time frame. Accurate cash flow prediction enables businesses to estimate future financial balances, prevent cash shortages, and maximize the return on any cash surpluses.

The financial staff, along with input from various organizational stakeholders and data sources, is responsible for forecasting cash flow in larger firms.

Key Takeaways

- Forecasting Cash Flow involves predicting a company's future cash inflows and outflows using financial statements like the Income Statement, Balance Sheet, and Cash Flow Statement.

- The choice of cash flow forecasting technique depends on business goals, management preferences, and available information. Techniques like discounted cash flow analysis or trend analysis can be employed based on specific business objectives.

- The steps for the Cash Flow Forecasting Model includes

- Establish forecasting goals

- Determine prediction period

- Select a forecasting technique

- Gather information for your forecast

How to calculate Forecasting Cash Flow?

The most accurate technique to predict your company's cash flow will depend on your business goals, management team or investor demands, and available information. Techniques such as discounted cash flow analysis or trend analysis can be used.

The most accurate technique to predict your company's cash flow will depend on specific business goals. For instance, if a company aims to monitor debt obligations weekly, a strategy focusing on real-time tracking may be suitable.

Here are the steps we advise taking to create a cash forecasting model. Identify and gather relevant data, including historical cash flows, current financial obligations, and future anticipated revenue and expenses.

The steps include:

1. Establish Your Forecasting Goals

The first step in taking meaningful business insights from cash flow estimates is to identify the specific business purpose. This involves assessing your company's goals and financial priorities.

For example, firms frequently employ cash predictions to achieve various goals. It's crucial to identify the primary goal that aligns with your business needs, such as:

-

Planning for short-term liquidity: involves daily cash flow management to ensure your company can pay short-term obligations.

-

Interest and debt reduction: ensure the company has adequate Cash to cover any loans or debt payments.

-

Agreement and important date recognition: project your cash levels for important reporting dates like the end of the year, the quarter, or the month.

-

Liquidity risk management: involves gaining visibility into potential future liquidity problems so you may handle them sooner.

-

Growth planning: Ensure the company has enough operating Cash to pay for actions supporting future revenue growth.

Depending on your organization's characteristics, select the target that aligns with your financial priorities. For instance, organizations with debt may benefit from projecting cash flows to plan for upcoming payments.

However, organizations with sufficient cash reserves may prioritize other goals in their cash projection, such as interest and debt reduction, agreement and important date recognition, liquidity risk management, or growth planning.

2. Determine the Prediction Period

The next thing to consider is how far into the future your forecast will extend once you've selected the business objective you aim to support.

Again, the availability of information and prediction duration are typically trade-offs. Finding the right balance between having sufficient information for accuracy and the appropriate prediction duration aligned with your business goals is important.

Note

Forecasts are more likely to be less precise or accurate further into the future due to increased uncertainties and variables. Therefore, picking the appropriate reporting period can significantly affect the precision and dependability of your forecast.

Here are the forecasting intervals we advise using and the business goals they work best for:

- Short-term forecasting: Short-term forecasts typically cover the next two to four weeks and include a breakdown of daily cash payments and receipts. As one might anticipate, short-term predictions are frequently best suited for short-term liquidity planning, when it's crucial to have day-to-day specificity to make sure a company can pay its debts.

- Medium-term predictions: Useful for managing liquidity risk, reducing debt, and keeping critical dates visible, typically looking two to six months into the future. The rolling 13-week cash flow prediction involves continuously updating the forecast for the next 13 weeks.

- Long-term projections: Annual budgeting processes frequently begin with longer-term forecasts, which typically look 6 to 12 months out. They're also crucial for determining the money needed for long-term projects, capital initiatives, and growth strategies.

3. Select a forecasting technique

The two main categories of forecasting techniques are direct and indirect. The primary distinction between them is using specific cash transaction data by direct forecasting instead of anticipated balance sheets and income statements by indirect forecasting.

Considering the duration, goals, and the type of data you have at your disposal, the cash flow forecasting window you selected in the previous step will determine which forecasting technique is best.

Below is a list of the applications for which each technique is most valuable:

A. Direct Method

It is less common than the indirect method. The direct method for estimating cash flow might be much more straightforward. It's less common because conventional reports from a company's accounting software can't be made utilizing it.

It's less common because conventional reports from a company's accounting software can't be generated using it. However, with the direct method, you rely on specific transaction data rather than reports from your accounting system.

Note

The drawback of using the direct method is that some bankers, accountants, and investors might prefer to see a cash flow estimate using the indirect method, even though the direct approach is accurate.

The direct approach to predicting cash flow is based on a straightforward general formula:

Cash Flow = Cash Received - Cash Spent

B. Indirect Method

The indirect technique is more widely used to create cash flow statements, as it involves obtaining net income and adjusting for factors that impact profits but not cash.

You obtain your net income and then add back factors that impact profits but not cash to produce the indirect cash flow statement. Additionally, you eliminate items like sales that have been scheduled but not yet paid for.

4. Gather the Information for Your Cash Flow Forecast

The accuracy of meeting business objectives through forecasts depends on various factors, and the choice between direct and indirect forecasting should align with the specific needs and goals of the company.

Ultimately, the sources for obtaining accurate cash flow data for your forecast depend on the financial processes and systems your company employs.

You can typically find accurate cash flow information needed to create your projection in your bank accounts, accounts payable, accounts receivable, or your accounting software, but the process may vary based on your company's specific financial practices.

What you should get from those systems is as follows:

-

The forecasted period's initial cash balance is typically obtained from the most accurate and up-to-date financial snapshot, such as the company's current financial statement.

-

Cash inflows for the anticipated period are typically based on confirmed orders, historical sales data, or other reliable indicators of expected sales receipts during the forecasting period.

-

Financial outflows throughout the forecasted time frame, such as earnings, rent, investments, bank fees, and debt repayments, should be tracked and categorized based on their relevance to your firm's financial priorities.

-

Financial inflow categories, including Intercompany funding, dividend income, revenues from divestitures, and inflows from third parties, should be considered and incorporated into your cash flow forecast based on their significance to your company's financial operations.

Advantages of Forecasting Cash Flow

Forecasting your cash flow will help your business vision and strategy to be on a solid base for those reasons

1. Enabling more predictable business growth

When a company expands through investment, it typically does so at the expense of cash flow. Since cash flow projections make it easier for firms to plan their cash surpluses efficiently, they also make implementing a growth strategy more predictable.

2. Prepare for any potential cash shortages

By using forecasting, you may identify cash gaps before they affect your company, giving you enough time to make up for the shortfall in your cash flow. You can also take action before it occurs by foreseeing and anticipating potential cash shortages.

To prevent the cash deficit from harming your company, it could be necessary to reduce operational expenses or put off replacing your equipment until you're out of the woods.

One of the key benefits of accurate forecasting is the ability to predict and address a potential cash shortage before it adversely impacts your company.

3. Monitor your spending money

By tracking your company's expenses without doing it manually by using cash flow forecasting. For instance, you can determine your guaranteed total outgoings if a specific sum, such as payment for utility bills, is scheduled to depart your business each month.

Since everything is tracked, you can quickly identify and address any areas where your company might be overpaying, ensuring more effective financial management.

Note

If forecasting hadn't been used, potential mistakes, such as overpayments, might not have been identified through manual checks, highlighting the importance of accurate forecasting for financial oversight.

Forecasting Cash Flow Challenges

Cash Flow Forecast Example

Here's a simple example of a monthly cash flow forecast for XYZ Company:

| Particulars | Month 1 | Month 2 | Month 3 | Total |

|---|---|---|---|---|

| Cash Inflows | ||||

| Sales Revenue | $50,000 | $55,000 | $60,000 | $165,000 |

| Other Income | $2,000 | $1,500 | $1,000 | $4,500 |

| Total Cash Inflows | $52,000 | $56,500 | $61,000 | $169,500 |

| Cash Outflows | ||||

| Rent | $5,000 | $5,000 | $5,000 | $15,000 |

| Utilities | $1,500 | $1,600 | $1,700 | $4,800 |

| Employee Salaries | $30,000 | $32,000 | $34,000 | $96,000 |

| Supplies and Materials | $8,000 | $9,000 | $7,000 | $24,000 |

| Marketing Expenses | $3,000 | $2,500 | $2,000 | $7,500 |

| Loan Repayment | $2,000 | $2,000 | $2,000 | $6,000 |

| Total Cash Outflows | $49,500 | $52,100 | $51,700 | $153,300 |

| Net Cash Flow | $2,500 | $4,400 | $9,300 | $16,200 |

| Opening Balance | $10,000 | $12,500 | $16,900 | |

| Closing Balance | $12,500 | $16,900 | $26,200 |

This cash flow forecast helps a business anticipate periods of surplus or shortfall and enables better financial planning.

Cash Forecasting Tools

You can overcome common forecasting difficulties with efficient cash flow forecasting tools. They support you in managing and monitoring your company's current and prospective cash flows.

This enables one to decide on investments and strategies for their company more wisely by providing real-time insights into cash inflows and outflows, allowing for informed decision-making.

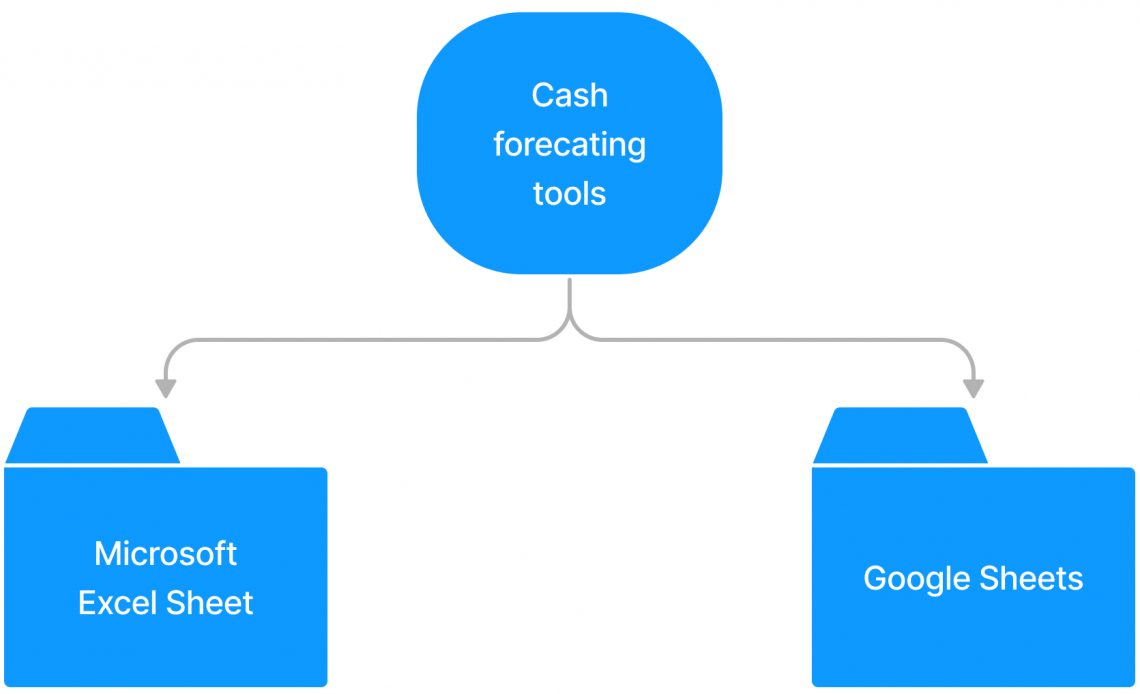

1. Simple tools for small and medium-sized businesses

According to market data, 63% of American businesses used spreadsheets for planning and reporting in 2018 alone. In addition, spreadsheets are still regarded as the most fundamental go-to tool for cash flow forecasting, even though this number was dropping.

For small and medium-sized businesses, the two primary (free) providers of cash forecasting tools are:

- Microsoft Excel Sheet

- Google Sheets

Your spreadsheets can be as complex as you like. However, most smaller businesses have historically performed their cash flow forecasts on spreadsheets.

They have less complex setups and fewer data sources. As a result, getting the information you require is simpler.

Spreadsheets have the benefit of being very efficient and affordable. However, they become unmanageable and start consuming a lot of your team's resources as your firm gets bigger, and you start using many banks and other source systems like ERPs.

2. Moderate tools for small and medium-sized businesses

Several intermediate cash forecasting tools offer more advanced features and benefits for smaller and medium-sized businesses compared to basic tools.

They frequently serve as a supplement to spreadsheets; however, Occasionally, these intermediate tools might entirely replace spreadsheets, especially when more advanced features and capabilities are required.

Below are some of the essential tools for it:

A. Microsoft POWER BI

It is a technology that can gather data from many sources and let you view it through dashboards. It's a valuable tool, but users may need some time to familiarize themselves with its features, and training might be necessary for optimal utilization.

Power BI integration with your systems, data import, and report creation might require manual processes, potentially posing challenges in terms of efficiency and automation.

Note

The systems that Power BI can link to are few. In addition, there are limitations, particularly in the bank and ERP interfaces, which are important for larger organizations, where Power BI might have some shortcomings.

B. CAUSAL

Probabilities are that Causal can assist you with gathering such data in one location if you have an accounting system, a CRM, and some data storage system. Their data visualization tool lets you better grasp the combined data from your connected places.

Causal, similar to Power BI, lacks the capability to directly link to financial organizations like banks, limiting its ability to provide real-time financial data from these sources.

C. SHEETGO

Sheetgo is a valuable tool when merging data from various spreadsheets. However, the more financial data spreadsheets you have, the more difficult it is to combine them and create precise cash flow estimates.

Sheetgo does not eliminate the need for manual data extraction from source systems. Instead, it was more designed as an Excel or Google Sheets integration tool.

D. Nomentia

Nomentia Liquidity is a fantastic choice if you're searching for a cash flow forecasting solution that can link to various source systems, banks, and ERPs.

You may see your previous, present, and future cash positions thanks to Nomentia Liquidity. Each client's data is automatically gathered by Nomentia from various source systems and presented in a specific way.

or Want to Sign up with your social account?