Paper LBO

The Paper LBO is an exercise commonly used in financial analyst-related interviews

What is Paper LBO?

The Paper LBO is an exercise commonly used in financial analyst-related interviews, where an analyst creates a leveraged buyout model to provide insight into their knowledge of the economics and mechanics of a leveraged buyout transaction.

It is referred to as the “Paper” LBO because this exercise is done on paper without the use of excel or a calculator.

A leveraged buyout is a financial transaction that occurs when one company uses a significant amount of debt financing to meet the acquisition costs needed to acquire either the majority stake or the entirety of another company.

The company performing the buyout may use the assets of the company being acquired and its assets as collateral to perform this buyout. The debt-to-equity ratio in these cases is normally extremely high, resulting in non-investment grade junk bonds.

The goal of the company performing an LBO is to maximize its return on investment (ROI) through:

- Operational Improvements

- Financial Restructuring

To perform the Paper LBO, you will need adequate knowledge of multiple financial concepts, such as:

- Enterprise Value

- Financial Forecasting & Modeling

- Free Cash Flow

- Internal Rate of Return

Key Takeaways

- A paper leveraged buyout is a common question asked by investment banking & private equity interviewers to vet potential candidates during the interview process.

- The paper LBO has you act like a financial analyst on a corporate transaction where a private equity firm is looking to acquire another firm.

- You must calculate the internal rate of return and the multiple of invested capital to provide a recommendation to the firm on whether this is a profitable transaction or not.

- The calculations needed for the paper LBO are complex and require a deep understanding of financial concepts, such as Free Cash Flow and the Rule of 72.

- There is no calculator or excel allowed when doing the paper LBO, so it is important to have strong mental math skills as you will be under a time crunch.

- After completing your financial transaction calculations, you will be asked to share your results and walk through them with your interviewer. Having a structured approach to performing the necessary steps for the paper LBO.

- A simple way to approach the paper LBO would be to list any important assumptions, calculate all the financials, and ultimately find the IRR, MOIC, or any other financial measures asked by the interviewer.

What is a Leveraged Buyout?

A leveraged buyout is a corporate finance transaction where a company uses money from loans and bonds to acquire another company. This results in little equity being put up to maximize their return on investment & internal rate of return.

They are most commonly done as a part of a mergers and acquisitions strategy, where they can acquire competing firms or use or enter a new market and diversity their portfolio.

There is normally a negative connotation that followers the term “leveraged buyout,” as they are viewed as a hostile method of corporate takeover. This negative reputation is why LBO transactions decreased for a while before resurging in the 2000s.

In reality, LBOs provide an easy exit for entrepreneurs at the end of their careers looking for a quick exit into retirement. Leveraged buyouts can:

- Transfer Ownership

- Make a public company private again

- Sell off a company's smaller sections and product lines

The company engaging the LBO tends to target companies that are

- New in the market and growing rapidly

- Low in debt compared to its assets

- Consistent Cash inflow into the company

- Proven Efficiency and Efficacy within Management

- In industries aligning with the sponsors' capital budgeting plans

- Easy to sell off at the end of the investment period

A deep understanding of the purpose and steps of a leveraged buyout at a corporate level will help you impress your interviewer when performing your paper LBO!

How is a Leveraged Buyout Performed?

To perform a leveraged buyout, you need a strong foundation in creating financial models and analyzing financial statements.

Most firms follow the same steps when performing a leveraged buyout.

1. Evaluate Target Company’s Future

The acquiring firm builds a couple of models to forecast the financial future of the target company. These normally predict the company’s performance for 5 to 10 years to determine a baseline for their return on investment.

2. Present-Day Financial Statement Analysis

The firm looking to engage in an LBO will analyze the 3 financial statements of the target firm to calculate the company's free cash flow. This will tell the purchasing firm how much cash is left over after paying daily expenses and capital expenditures.

3. Debt Repayment Plan

After understanding the potential return the target firm will net after the acquisition, the purchasing firm will create interest and debt schedules to calculate the principal and interest payments due each year to replace the loan.

4. Calculating Debt Leverage

Knowing the timeline on which the firm will repay the loan, an analyst working on the leveraged buyout deal will produce models on the credit metrics to understand the debt leverage the transaction can handle.

(As we’ve mentioned earlier, the firm engaging in the buyout of another firm would want to put up as little equity as possible to maximize its return.)

5. Return on Investment

This ultimately leaves the firm looking to calculate the free cash flow left over for the firm to pocket and normally predict the return for the company that will be acquired.

All this information can be used to perform sensitivity analysis on the transaction before following through.

How to Perform a Paper-Leveraged Buyout

The paper LBO is simplified practical test interviewers give for investment banking jobs. No calculator or Excel is allowed when performing your calculations, so you must rely heavily on your mental math skills.

The LBO test gives you a prompt with some basic information about an imaginary firm. The paper-leveraged buyout creates a hypothetical situation where you, as a financial analyst, must calculate the

- Internal Rate of Return (IRR)

- Multiple of Invested Capital (MOIC)

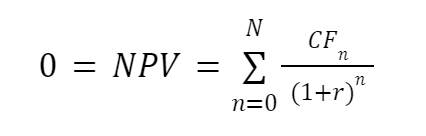

As a refresher, the formulas for IRR & MOIC, respectively, are:

Where,

- NPV = Net present value (Set to 0, as the IRR is the value that makes the NPV = 0)

- CF = Cash flow during year n

- N = Number of periods the investment is held

- n = integer value of the year the cash flow occurs

- r = rate of return

And,

MOIC = Total Cash Inflows/ Total Cash Outflows

Where,

- MOIC = Multiple of Invested Capital

- Total Cash Inflows = the total value expected to be realized at the end of the project’s life

- Total Cash Outflows = the total value invested into the project

Ideally, during your Interview, you would approach this question in the same manner in which you would approach a transaction deal discussion: With structure and poise. This is a commonly occurring ideological test private equity interviewers look for.

Steps to perform the Paper LBO

Different financial analysts will have their structure for forming a solution during the paper LBO test. Here is a sample 3-step structure that we will use to walk through our example:

1. Sort through the prompt & parameters and list out the operational assumptions

Here, we will determine how much the company is selling for and how much debt and equity are being used for the purchase.

2. Calculate the financials

We want to find the purchased company's net income and projected free cash flow.

3. Using the information we have calculated

Find the internal rate of return and the multiple of invested capital over the holding period. If these are given in the parameters, determine the returns and exit valuation.

You must meticulously approach and calculate every formula at every step, as errors will follow you across steps, potentially compounding until your final answer. Checking your math to catch any simple errors is a smart idea at every step.

You will also be asked to walk your interviewer through your thought process and the steps you took to reach your recommendation for the hypothetical firm. It is also a good idea to keep your steps simple so you can explain your reasoning accurately.

Example of a Paper Leveraged Buyout

Let’s now work through a paper-leveraged buyout prompt to see the formulas and calculations necessary to answer the question successfully.

You are a financial analyst working for the WSO Private Equity firm. The firm is interested in acquiring OSW, a financial technology company.

The OSW has an enterprise value of $50 million. The WSO private equity firm plans to put up 20% of the equity and finance the rest with a senior secured loan with an interest rate of 5%.

The OSW financial technology company has a projected EBITDA of $10 million for the next year, with an expected annual growth of 3% over the next 5 years.

Capital Expenditures are expected to be 10% of EBITDA, and the working capital is expected to be 15% of EBITDA.

The WSO private equity firm plans to exit the investment after 6 years with an EBITDA multiple of 6x.

What are the IRR and MOIC of the investment?

With this information, let’s use our structure from earlier to come up with a recommendation for the WSO firm:

Step 1: Determine purchase price and financing costs

Equity Investment = % of equity investment x total purchasing price

Equity Investment = 20% x $50 million = $10 million

Senior Secured Loan = Total purchase price - Equity Investment

Senior Secured Loan = $50 million - $10 million = $40 million

Interest Expense = Senior Secured Loan x Interest Rate

Interest Expense = $40 million x 5% = $2 million

Step 2: Calculate the necessary company financials. In our case, this is the company cash flows over the 6-year investment horizon.

The Cash Flow for Year 1:

Year 1 EBITDA = Revenue - COGS - Operating Expense

Year 1 EBITDA = $10 million

Year 1 Taxes = (EBITDA - Depreciation - Interest Expense - Tax Shield on interest Expense) x Tax Rate

Year 1 Taxes = ($10 million - 10% x $10 million - $0) x 35% = $2.45 million

Year 1 Free Cash Flow (FCF) = EBITDA - Taxes - Capital Expenditures - Change in Working

Year 1 Free Cash Flow (FCF) = $10 million - $2.45 million - $1 million - $1.5 million = $5.05 Million

The Cash Flows for Years 2 through 6:

Year 2 EBITDA = EBITDA Year 1 x (1 + Growth Rate)

Year 2 EBITDA = $10 million x 1.03 = $10.3 million

Year 2 CAPEX = 10% x EBITDA

Year 2 CAPEX = 10% x $10.3 million = $1.03 Million

Year 2 TAXES = (EBITDA - CAPEX - Depreciation) x Tax Rate

Year 2 TAXES = ($10.3 million - $1.03 million - 0) x 35% = $3.245 million

Year 2 FCF = EBITDA - Taxes - CAPEX - Working Capital

Year 2 FCF = $10.3 million - $3.245 million - $1.03 million - $1.575 million = $4.45 million

We can repeat this process of using the previous year's EBITDA, CAPEX, TAXES, & FCF to calculate these values for future years:

| Formula | Year 3 | Year 4 | Year 5 | Year 6 |

|---|---|---|---|---|

|

EBITDA |

$10.61 million |

$10.94 million |

$11.28 million |

$11.64 million |

|

CAPEX |

$1.061 million |

$1.094 million |

$1.128 million |

$1.164 million |

|

TAXES |

$3.319 million |

$3.446 million |

$3.553 Million |

$3.667 Million |

|

FCF |

$4.638 million |

$3.949 million |

$4.907 million |

$5.063 million |

Step 3: Calculate the Exit Valuation at the end of Year 6, along with the IRR and MOIC

Exit value = Exit multiple x EBITDA Year 6

Exit value = 6 x $11.64 million = $69.84 million

IRR: Use the cash flows from Years 1-6 and the exit value to solve for the IRR using the internal rate of return formula. (IRR: The Interest Rate that makes the NPV equal 0)

IRR = approximately 20.5 %

You can also use the “Rule of 72” to estimate the investment.

MOIC: Exit value / Total cash invested

MOIC = 2.24x

Final Recommendation: These are strong IRR and MOIC numbers for an investment project, but it ultimately depends on the WSO Private Equity firm’s investment portfolio and investment thesis.

Tips for Performing a Paper LBO in an Interview

Performing the Paper LBO may be stressful when doing it under a time crunch during an interview.

Here are some tips on how you can successfully do a paper-leveraged buyout during an interview:

- Read the prompt carefully to ensure you understand the parameters and assumptions of the transaction before you start any calculations.

- Structure your work to ensure every calculation & formula is organized.

- Show your work. This will make it easier to explain your thought process to your interviewer.

- Brush your mental math skills to save time when calculating.

- Be ready to explain your thought process to the interviewer.

- Stay calm and meticulous throughout the process.

- Be familiar with LBO vocabulary.

Private equity & investment banking positions are highly sought after, and candidates can be very stressed and nervous when participating in the interview.

Your interviewer is aware of the stress. They measure your composure under this stress to evaluate whether you are fit for the competitive nature of investment banking and private equity.

The best way to be calm under pressure is to practice and prepare for it. It is important to practice your financial analysis skills to feel more comfortable answering questions from your interviewer.

Check out our WSO mentor service to practice your interviewing skills with real career professionals who can give you feedback on your performance!

or Want to Sign up with your social account?