Junk Bonds

Issued by firms that have low overall credit ratings

What Is a Junk Bond?

A junk bond, also known as a high-yield bond or speculative bond, refers to a bond that has a credit rating below investment grade. Credit rating agencies rated Junk or non-investment grade corporate bonds below Baa3/BBB. These bonds are also called high-yield bonds because of their higher perceived credit risk.

Junk bonds have a higher default risk than the majority of corporate and governmental obligations. A bond is a debt or promise that, in exchange for being purchased, would pay investors interest payments as well as the return on their principal investment.

Junk bonds are bonds issued by struggling businesses that run a significant risk of defaulting, failing to make interest payments, or failing to return investors' principles.

They are issued by firms having low overall credit ratings as a firm. Credit rating agencies rated Junk or non-investment grade corporate bonds below Baa3/BBB. These bonds are also called high-yield bonds because of their higher perceived credit risk.

They are issued by firms having low overall credit ratings as a firm.

Reasons for non-investment grade ratings may include:

- High Leverage

- Unproven Operating History

- Low or negative cash flow

- Increased sensitivity to business cycles

- Low confidence in management

- Unclear competitive advantages

- Significant off-balance sheet liabilities

- Industry in Decline

Because high-yield bonds have higher default risk than investment-grade bonds, credit analysts must pay more attention to loss severity.

Junk Bonds advantages

We can enlist four significant advantages:

1. Higher Yield and Returns

"With high risk comes high returns." is a famous saying. The yield offered by a junk bond is much higher than most of the other debt options in the market that pay a fixed return.

The issuer issues these bonds at a discount price to their par value when the issuer cannot sell the security to the investors. Thus, providing the investor with an even higher return.

Thus, the bond purchaser benefits from high coupon payments and the discount at the time of the bond issue. On the other hand, the issuer has to pay higher coupon payments and consider the value at the time of issue while calculating its cost of capital or evaluating a project.

2. An Important Source of Finance

They are the central part of financing companies that have not been able to raise capital from other avenues. These bonds act like angels for these companies as they provide money for funding both their day-to-day activities and expansion plans.

These bonds are most suitable for startups with insufficient credit worthiness to raise money from financial corporations. They don't have enough assets to pledge as collateral to be able to raise money from them.

3. Indicator of Market Conditions

Its demand acts as a good indicator of market conditions. This is because investors buying these bonds constantly indicate they want to take more risk and earn higher returns; they are aggressive in their investment decisions.

The companies and issuers can take a cue from such a situation.

In such times, the companies can issue more risky products in the market through financial engineering. But, on the other hand, investors selling the bonds constantly will indicate that the investors are turning cautious and are more risk averse.

4. Adds To Diversification of Portfolio with Recurring Returns

Investors looking to diversify their portfolios can also buy junk bonds. It adds to the diversification of a portfolio as it provides regular returns in the form of coupon payments.

Risk-averse investors should also allocate a small percentage of their portfolio to such bonds to enjoy high returns without taking much risk while also benefiting from diversification.

Junk Bonds Disadvantages

The most common disadvantages are:

1. Callable

The biggest problem with high-yield bonds is the fact that these bonds are usually callable. This means that risky investors may not be able to take full advantage of their profits.

For example, if a company is in poor financial condition, it may start issuing high-yield bonds. Over time, they can improve their credit rating, increasing the value of bonds.

If a company calls a bond at such times to avoid paying the higher yield promised to the investor, it can result in a loss. To make matters worse, early bond issuance is widespread in high-yield bonds.

2. Lower Liquidity

High-yield bonds are bonds that are not investment grade. As a result, not many institutional investors hold these bonds.

Since institutional investors make up the majority of investors who buy and sell bonds daily, the absence of institutional investors will undoubtedly affect market liquidity. Low liquidity means that investors may not be able to sell their holdings immediately.

3. Multiple Risks

Common bonds are only exposed to interest rates and credit risk. However, there are even more risks involved with high-yield bonds.

For example, investors are at risk that a credit rating downgrade can reduce the value of their investment. They are also at risk of unexpected adverse events striking them compared to other investors.

4. Higher Volatility

High-yield bonds tend to have higher volatility than other bonds in the market. However, empirical data analysis has repeatedly shown what investors already know intuitively.

Trends in the empirical data indicate that high-yield bonds outperform average debt securities when the market is good.

However, when the overall market is terrible, high-yielding stocks that are the most volatile tend to be the worst. As a result, the number of defaults in high-yield securities tends to multiply during recessions.

5. Shorter Maturity

Another disadvantage of investing in high-yield bonds is that the maturities of these bonds are shorter. Shorter periods are considered detrimental because investors cannot lock in profits for more extended periods.

Worse still, the fact that many high-yield bonds are called before maturity makes maturity even shorter.

As a result, investors who choose high-yield bonds often face rollover risk. As a result, they must constantly find new investment options assuming their investment will be repaid—capital for them in a short period.

Real-life Cases of Issuance of Junk Bonds

Let's look at some of the real-life cases:

1. Ford (NYSE: F)

Ford has historically been rated investment grade but lost its investment grade rating in 2020 due to the coronavirus pandemic and the global recession. Nevertheless, the junk bonds are still trading at a premium, reflecting the company's status.

2. Tesla (NASDAQ: TSLA)

Tesla is a young and new company, and its junk-rated debt is a product of its financial performance. Focusing on growth means that Tesla has recently turned to positive free cash flow, despite Tesla's progress towards investment grade.

In other words, bonds are traded at a very high premium to par, despite their BB rating. This is because bonds can be converted into stocks.

Tesla's share rose 600% in the last 12 months until October 30th. As of January 1st, 2020, bonds have proven to be a valuable substitute for equities.

3. Netflix (NASDAQ: NFLX)

Netflix also falls into this category of growth-oriented companies.

Over the years, the company has generated junk bonds as part of its strategy to generate negative free cash flow to pay for new content for streaming services and fund its production of movies and TV shows.

Netflix bonds are also trading at a premium, rising slightly as the company approaches, generating positive free cash flow. With the company's credit rating improvements, Netflix may eventually reach investment-grade status.

Credit Ratings and Junk Bonds

Credit rating agencies assign ratings to categories of bonds with similar credit risks. Rating agencies rate the issuer (i.e., the company issuing the bonds) and the debt issues or the glue themselves.

Issuer credit ratings are called corporate family ratings (CFR), while issue-specific ratings are called corporate credit ratings (CCR). Issuer ratings are based on the overall creditworthiness

of the company.

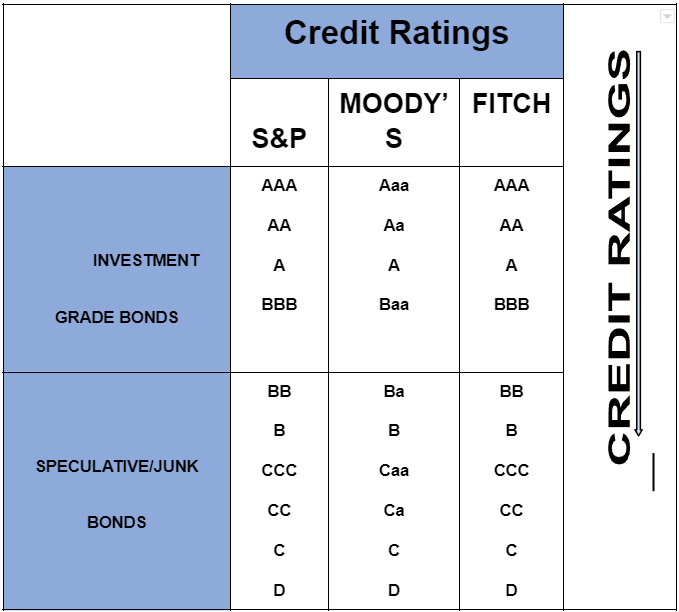

The issuers are rated on their senior unsecured debt. The figure below shows rating scales used by Standard & Poor's, Moody's, and Fitch, three major credit rating agencies.

Triple A (AAA or Aaa) is the highest rating. Bonds with Baa3/BBB- or higher ratings are considered investment grade. Bonds rated Ba1/BB+ or lower are considered non-investment grade and are often called junk bonds.

Bonds in default are rated D by Fitch and Standard & Poor's and are included in Moody's category C.

When a company defaults on one of its several outstanding bonds, provisions in bond indentures may also trigger a default on the remaining issues. Such provision is called a cross-default provision.

The ratings of a firm's bonds can differ from its corporate rating. The seniority and covenants of an individual bond issue are the primary determinants of differences between an issuer's rating and the ratings of its particular bond issues.

The assignment of individual issue ratings that are higher or lower than that of the issuer is referred to as notching.

Notching is less standard for highly-rated issuers than for lower-rated issuers.

For firms with high overall credit ratings, differences in expected recovery rates among a firm's bonds are less important, so their bonds are less important, so their bonds might not be notched at all.

For firms with high default probabilities, differences in expected recovery rates among a firm's bonds are more significant.

For this reason, nothing is more likely for issues with lower creditworthiness. For a firm with speculative credit, its subordinated debt might be notched two ratings below its issuer rating.

Junk Bonds Special Considerations

High-yield bonds' special considerations include liquidity, financial projections, debt, and corporate structures.

1. Liquidity

Liquidity or availability of cash is critical for high-yield issuers. High-yield issuers have limited access to additional borrowings, and available funds tend to be more expensive for high-yield issuers.

Bad company-specific news and difficult financial market conditions can quickly dry up the liquidity of debt markets. In addition, many high-yield issuers are privately owned and cannot access public equity markets for needed funds.

2. Financial Projections

Analysts use financial models to forecast future cash flows and earnings. They also try to consider the potential working capital and capital expenditure changes that will happen in the future, which helps them to identify possibilities of non-repayment of the principal.

3. Debt Structure

Companies having high risk often issue different types of debt, which have lots of levels of seniority of payment, thus having the additional non-repayment chance, which the company compensates by providing a higher return on the subordinate debt.

Secured bank debt, second lien debt, senior unsecured debt, subordinated debt, and preferred stock form a company's capital structure. Debt can also be convertible to shares, called convertible debt.

4. Corporate Structures

Many high-yield companies use a holding company structure. A parent company receives dividends from the earnings of its subsidiaries as its primary source of operating income.

Because of structural subordination, subsidiaries' dividends paid upstream to a parent company are subordinate to interest payments.

These dividends can be insufficient to pay the debt obligations of the parent, thus reducing the recovery rate for debt holders of the parent company.

Junk Bonds FAQs

Junk bonds are bonds issued by companies in financial distress and are at high risk of defaulting, failing to pay interest, or returning their principal to investors.

They are also high-yield because they require higher yields to offset the risk of default.

Junk issuers issue two specific types of zero-coupon bonds. One is a postpaid interest-paying banknote, and the other is a cash-paid bond. Because it is sold at a discounted price, it is often called zero and pays interest and principal.

Deferred interest rate bonds (DIBs) pay interest only after a certain period (usually five years).

Like other bonds, junk bonds are an investment in debt.

Companies and governments raise promissory notes by issuing promissory notes that describe the amount borrowed (principal), repayment date (due date), and interest rate borrowed (coupon).

Researched and Authored by Kunal Goel | Linkedin

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?