Deferred Income Tax

Arises due to temporary differences between the book (financial statement) income and the taxable income.

What Is Deferred Income Tax?

Managing your finances can be overwhelming, especially when it comes to understanding financial jargon. One of the more complex terms is deferred income tax, but don’t worry! Having a handle on this concept is crucial to ensure your finances are in order.

Think of deferred tax as a financial bridge between a company’s income tax expense reported on its income statement and the actual income taxes it owes to the government in the current year.

The bridge captures the difference in timing between the two, resulting in either a deferred tax asset DTA or a deferred tax liability DTL. It’s a crucial concept because it can impact the accuracy of:

- Financial statements,

- Tax planning,

- Compliance with accounting and tax regulations.

Deferred tax is like a financial guardian and tax code interpreter for businesses. It ensures accurate financial statements that comply with FASB GAAP rules and helps businesses navigate the complexities of the IRS tax code to report their income tax returns properly.

Without a deferred income tax, businesses may face penalties for non-compliance and struggle to accurately reflect their financial performance.

Key Takeaways

- Deferred income tax acts as a financial bridge between a company’s reported income tax expense and the actual taxes owed, ensuring accuracy in financial statements and compliance with accounting regulations.

- Understanding the difference between permanent and temporary tax differences is crucial for navigating financial landscapes, with temporary differences creating deferred tax assets or liabilities.

- Deferred tax liabilities arise when future taxable income is expected to exceed future book income, while deferred tax assets arise when future taxable income is expected to be less than future book income.

- Calculating income tax expense involves considering both current and deferred components, with the latter reflecting the impact of temporary differences on future tax liabilities.

Understanding Deferred Income Tax

Deferred income tax arises due to temporary differences between the book (financial statement) income and the taxable income.

This creates deferred tax assets or liabilities depending on whether the tax basis of an asset or liability exceeds or falls short of its book basis. The causes for these differences may vary.

Suppose you own a business that utilizes an accelerated depreciation method for tax purposes but a straight-line method for financial statement purposes.

This disparity in the methodologies may result in a deferred tax obligation that will be settled at a later date.

Deferred tax assets and liabilities are recorded on a company’s balance sheet and are adjusted accordingly as temporary differences are resolved. Some examples of temporary differences can include:

- Differences in depreciation and amortization methods

- Tax credits

- Warranty liabilities

- Deferred revenue

- Difference in inventory valuation

- Bad debt reserves and allowances

- Accrued expenses and revenue

By understanding these temporary differences and their impact on deferred tax, businesses and individuals can make informed decisions about financial reporting, tax planning, and compliance.

Some countries use a different method of accounting for deferred taxes known as the “Balance Sheet Method.” Instead of recognizing deferred tax assets and liabilities in the income statement, they are recorded directly on the Balance Sheet.

This can lead to differences in how companies report their financial statements worldwide.

Permanent And Temporary Tax Differences

In financial accounting and tax law, permanent and temporary differences refer to the discrepancies between tax and book basis of an asset or liability.

These differences can impact financial statements and taxes, and understanding them is crucial for navigating complex financial landscapes.

A) Permanent differences

These are differences that will never reverse and result in a difference between the tax and book bases of an asset or liability. They occur when items are treated differently under tax law and financial rules. Some examples include

- Non-deductible expenses such as fines, penalties, kickbacks, bribes, etc.

- State & municipal bond interest income.

- Investment interest expense (in excess of investment income)

- Expenses or losses deductible for tax purposes but not for accounting purposes, such as expenses related to political contributions.

Note

Deferred income tax can result in either deferred tax assets (DTAs) or deferred tax liabilities (DTLs), depending on whether the tax basis of an asset or liability exceeds or falls short of its book basis.

B) Temporary differences

On the other hand, these differences will eventually reverse themselves and result in the same tax basis and book basis of an asset or liability.

They occur when items are recognized at different times for tax and accounting purposes. Some examples include

- Depreciation or amortization expense, where the asset is depreciated or amortized differently for tax and financial accounting purposes.

- Deferred tax assets and liabilities arising due to varying tax rates applied in financial and tax accounting.

- Reserves and allowance, where the amount is recognized differently for tax and financial accounting purposes.

- Stock-based compensation, where the expense is recognized for financial accounting purposes before it is realized for tax purposes.

Temporary differences are the main drivers of deferred tax liabilities and assets, as they create a difference between the timing of when an expense or revenue is recognized for tax purposes and when it is recognized for financial accounting purposes.

These differences can create either a deferred tax liability or an asset, depending on the tax rate and whether the differences result in a future tax benefit or obligation.

Note

Some investors and analysts may pay particular attention to a company’s deferred tax assets and liabilities as they can indicate management’s effectiveness in tax planning and risk management.

Understanding Deferred Tax Liabilities And Assets

Deferred tax assets and liabilities are like the yin and yang of accounting. They represent the balance between tax laws and financial reporting, and understanding them is like finding inner peace for your balance sheet.

Temporary differences occur due to items that will reverse themselves in a matter of time (timing difference) and affect the deferred income tax computation by creating deferred tax assets and liabilities.

1. Deferred tax liabilities

These are expected future tax liabilities arising from temporary differences. For example, this can happen when future taxable income is expected to be greater than future book income, meaning that taxes not paid today will increase future tax liability.

For example:

- Straight-line depreciation for books vs. Accelerated depreciation for tax

- Investment accounted for under equity method for books vs. Cost method for tax

- Accrual sales for books vs. Installment sales for tax

- Prepaid expenses for books vs. Cash basis for tax

- Goodwill tested for impairment for books vs. 15-year amortization for tax

Note

Changes in deferred tax balances can result in adjustments to a company's reported financial results, reflecting shifts in tax planning strategies or changes in tax laws.

2. Deferred tax assets

These are expected future tax benefits arising from temporary differences. For example, this can happen when future taxable income is expected to be lesser than future book income; therefore, taxes paid today will reduce future tax liability.

For example:

- Bad debt expense allowance for books vs. Direct write-off for tax

- Warranty expense allowance for books vs. Warranty expense allowance payouts for tax

- Rent, Royalty, and Interest received in advance for books vs. taxable when received for tax

- Contingent liabilities (probable and reasonably estimable) accrued for books, not for tax

Calculating deferred tax assets and liabilities

Use future enacted rate to measure deferred tax assets & liabilities; may use current rate if future enacted rate not specified or known ( but NOT anticipated, proposed or unsigned rates)

- Adjustments should be made for changes in enacted rate as a component of income tax expense (deferred) wherever known.

- Under IFRS, it may use enacted or substantively enacted rates.

Let’s go ahead with the B/S presentation:

- Always classify deferred tax assets & liabilities as non-current

- Netting of deferred tax assets & liabilities:

GAAP allows separate netting of deferred tax assets & liabilities, resulting in a single non-current amount to be reported on the B/S. For instance, Assume Net Co. has the following temporary differences:

1. Deferred Tax Asset (Non-Current) = $300

2. Deferred Tax Liability (Non-Current) = $200

On the B/S, the following amount would be reported:

Non-current Asset: Deferred Tax Asset = $300 - $200 = $100

Note

Under IFRS, companies are allowed to net non-current deferred tax assets & liabilities only if the amounts relate to the same taxing authority (e.g., same country). They have the legal right to offset the amounts.

To remember how to deal with temporary differences, use the acronym “ASK” + “2-step ACT”:

ASK = Is it a case of DTA or DTL?

- DTL = More Book income today

- DTA = More Tax income today

ACT = 2-step Action plan!

Deferred Tax Asset = Add temporary difference in step 1, Less tax $ in step 2 Deferred Tax Liability = Less temporary difference in step 1, Add tax $ in step 2.

Note

Companies are required to disclose information about their deferred income tax assets and liabilities in the notes to their financial statements.

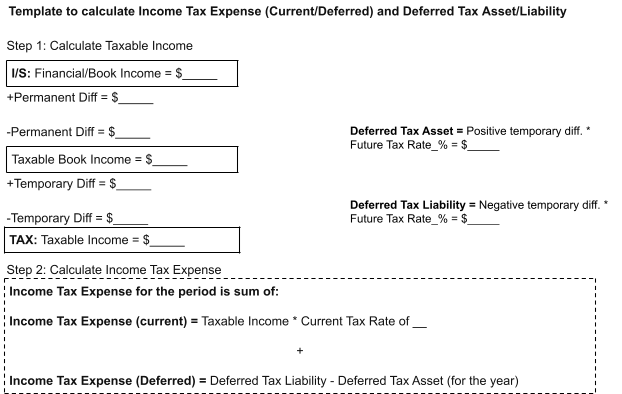

Step 1: Calculate Taxable Income

A. Start with Book Income [Net Income from B/S]

B. Adjust for permanent difference for the year

- Add if Tax Income > Book Income

- Less if Book Income > Tax Income

C. Adjust for temporary difference for the year

- Add if Tax Income > Book Income [difference creating DTA = Add]

- Less if Book Income > Tax Income [difference creating DTL = Less]

Calculate the Taxable Income [on Tax Return]

| F/S vs. Tax | Book vs. Tax Income | DTL vs. DTA | Add/Less in Step 1 | Examples | |

|---|---|---|---|---|---|

| INCOME | |||||

| F/S first | TAX later | More Book Income today | DTL | (-) {Diff. creating DTL = Less in Step 1} | - Accrual for book purposes & Installment sales for tax purposes - % of completion per GAAP vs. Completed contract method in tax - Undistributed dividends under Equity method |

| TAX first | F/S later | More Tax Income today | DTA | (+) {Diff. creating DTA = Add in Step 1} | - Prepaid / Unearned Rent, Interest, Royalties ( cash basis for tax) |

| EXPENSE | |||||

|

F/S first |

TAX later | More Tax Income today | DTA | (+) {Diff. creating DTA = Add in Step 1} | - Bad debt exp. ( allowance per GAAP vs. direct write-off in tax) - Warranty Expense / Estimated Liabilities per GAAP - Start-up expenses |

| TAX first | TAX later | More Book Income today | DTL | (-) {Diff. creating DTL = Less in Step 1} | - Accelerated Depreciation - Amortization of franchise - Prepaid expenses ( cash basis for tax) |

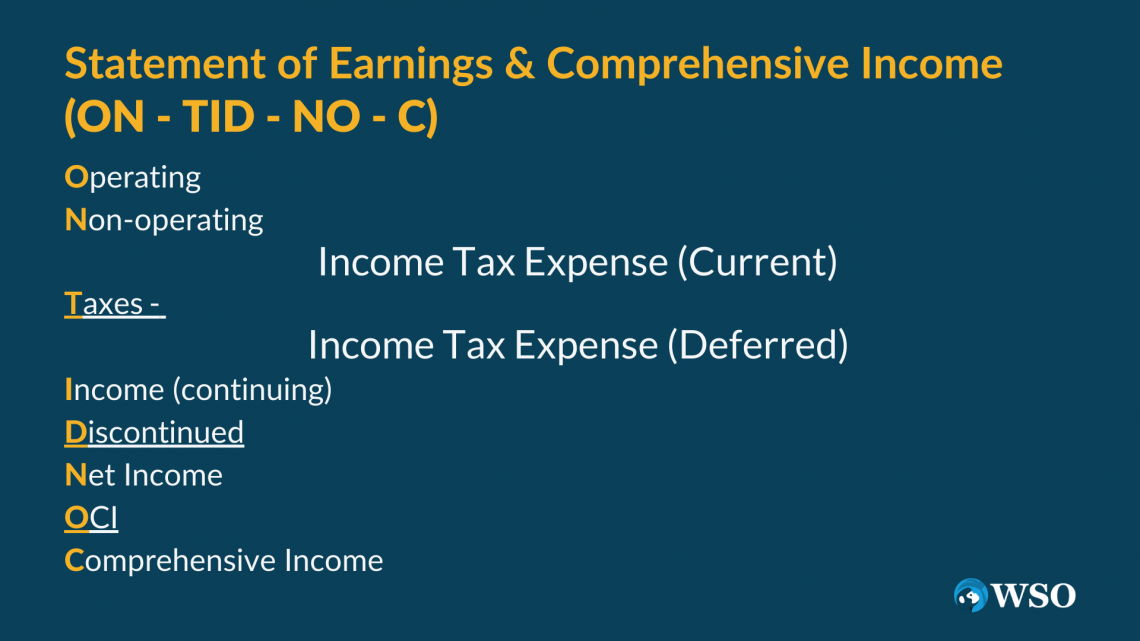

Step 2: Calculate Income Tax Expense

The formulas to help us calculate income tax expense are:

Income Tax Expense (Current) = Taxable Income ✕ Current Tax Rate

Income Tax Expense (deferred) = Deferred Tax Liability [for the year] ✕ Deferred Tax Asset [for the year]

Income Tax Expense = Income Tax Expense (Current) + Income Tax Expense (Deferred)

OR

Income Tax Expense = Income Tax Expense (Current) (+) Deferred Tax Liability [for the year] (-) Deferred Tax Asset [for the year]

Don’t let deferred tax assets and liabilities leave you feeling perplexed! They are essential components of accounting with tangible effects on a company’s bottom line. With ASK + 2-Step ACT, you’ll have a handle on their impact in no time.

Income Tax Expense (Current/ Deferred) and Deferred Tax Asset/Liability for Businesses

Understanding income tax expense and deferred tax asset/liability can seem daunting, but it’s crucial to discern how they work as they impact a company’s finances.

Businesses are required to compute their taxable income to ascertain tax liability. Therefore, permanent differences, such as fines & penalties, are already accounted for on the books and can’t be deducted for tax purposes.

Temporary differences, such as rental income received in advance or excess depreciation for tax, will affect the amount of taxable income and, therefore, the tax liability.

Note

Deferred income tax assets and liabilities are calculated by applying the enacted tax rates to the temporary differences. Companies adjust these amounts periodically as temporary differences are resolved or new differences emerge. The net balance of DTAs and DTLs is reported on the balance sheet.

Let’s take two companies, A Co. and B Co., as examples. A Co. has a taxable income of $900, and B Co. has a taxable income of $400. If the current tax rate is 30%, then A Co would owe $270 in current income tax, and B Co. would owe $120.

However, temporary differences exist, such as rental income received in advance for A Co. and excess depreciation for B Co. These temporary differences will impact the amount of taxable income and, therefore, the tax liability.

If the future enacted tax rate is 40%, then A Co.’s temporary difference of $100 in rental income received in advance creates a deferred tax asset of $40, which means A Co., will pay less tax in the future.

B Co.’s temporary difference of $50 in excess depreciation for tax creates a deferred tax liability of $20, which means B Co. will pay more tax in the future. Here’s a handy table outlining the income statement format for calculating income tax expense as applied to our example companies.

| A Co. | B Co. | Notes / J/E | |

|---|---|---|---|

| Pretax Book Income | 750 | 500 | |

| + Permanent Differences | 75 | 50 | A Co.: $75 fines/penalties LC.: $50 life insurance premium where the corporation is the beneficiary |

| - Permanent Differences | (25) | (100) | A Co.: $25 municipal bond interest LC.: $100 life insurance proceeds on officer key man insurance policy |

| = Taxable Book Income | 800 | 450 | |

| +/- Temporary Differences | 100 | (50) | A Co.: $100 Rent received in advance creates DTA = More Tax income today LC.: $50 excess depreciation for tax creates DTL = More Book income today |

| = Taxable | 900 | 400 | |

| Income Tax Expense (Current) = taxable Income * Current tax rate (say 30%) | 900*30% = 270 | 400*30% = 120 | Income Tax Expense (current) XXX Income Tax Payable XXX |

| Less: Taxes prepaid | 225 | 100 | Income Tax Payable XXX Cash XXX |

| = Tax payable | 45 | 20 | |

| Income Tax Expense (Deferred) = Temporary difference * Future enacted tax rate (say 40%) | 100*40% = 40 | 50*40% = 20 | If positive, then Deferred Tax Asset, Deferred tax asset 40 Income Tax Expense (deferred) 40 If negative, then Deferred Tax Liability, Income Tax Expense (deferred) 20 Deferred tax liability 20 |

| Total Income Tax expense on I/S = Income tax expense (current) + Income tax expense (deferred) | 270 + 0 - 40 = 230 | 120 + 20 - 0 = 140 | |

Understanding income tax expense and deferred tax asset/liability is essential for businesses to calculate their tax liabilities accurately.

By looking at real-life examples, such as A Co. and B Co., and using simple language, we can better understand how these factors affect a company’s financial statements.

Conclusion

Grasping the concept of deferred income tax is essential for individuals and businesses alike to ensure financial statements accurately reflect tax obligations and comply with accounting standards.

By understanding the distinction between permanent and temporary tax differences and their implications for deferred tax assets and liabilities, stakeholders can make informed decisions about tax planning and financial reporting.

Through clear explanations and straightforward calculations, individuals can gain a deeper understanding of how deferred income tax affects a company’s financial position and performance.

By incorporating these concepts into financial planning and reporting processes, organizations can enhance transparency, accuracy, and compliance, ultimately driving long-term success and sustainability.

Deferred Income Tax FAQs

Temporary differences arise because of the differences in timing between the recognition of an item for accounting and tax purposes. In contrast, permanent differences arise because of differences between accounting principles and tax laws that will never reverse.

Deferred income tax is calculated using the future enacted tax rate and the temporary differences between accounting and tax records.

Common temporary differences include depreciation expenses, differences in revenue recognition, deferred revenue, and allowance for bad debts.

Common temporary differences that can lead to deferred tax assets or liabilities include excess depreciation or amortization, net operating losses, and differences in revenue recognition between tax and financial reporting.

A deferred tax asset might be recognized when a company has tax losses that can be carried forward to offset future taxable income or when the company has deductible temporary differences.

A change in tax laws can affect the future enacted tax rate, which will, in turn, affect the calculation of deferred income tax. Therefore, companies must adjust their deferred income tax balances accordingly.

Deferred tax assets and liabilities are calculated by multiplying the temporary difference by the future tax rate. The future tax rate is the expected tax rate in the year when the temporary differences reverse.

Explore AICPA-CIMA’s resources on Statements on Standards for Tax Services to enhance your understanding of deferred income tax.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?