Economic Life

Refers to the time the asset remains useful to the owner

What is Economic Life?

Economic life, also called the depreciable life, useful life, or service life refers to the time the asset remains useful to the owner, assuming that there is preventive maintenance and normal usage of the asset.

In simple terms, it can also be said that for how much time the asset derives profit after it becomes obsolete or its cost of maintenance is more than the actual profit derived from operating it.

A taxi driver’s car’s economic life is only until the time when the driver can derive the profit against some cost of maintenance.

Some examples:

-

The economic life of a car could be up to 300,000 miles rather than ten years.

-

A house has an indefinite life rather than saying 50 years.

-

For a laptop, it could be until its components become outdated rather than an average life of about 2-3 years.

Key Takeaways

- Economic life, also known as depreciable life or useful life, signifies the duration an asset remains useful and profitable under normal usage and maintenance conditions.

- Accounting principles, specifically GAAP, play a crucial role in determining an asset's economic life, affecting depreciation calculations and financial statements.

- Accurate economic life estimation influences salvage value, affecting finances and loans.

- Intangible assets, subject to amortization, have indefinite economic lives based on historical experiences, renewals, or abandonment of associated efforts.

- Technological disruptions and regulatory changes can significantly shorten an asset's economic life, emphasizing the need for accurate estimation before investment decisions.

Understanding the Economic Life

The life of an asset is connected to various aspects.

The GAAP (Generally Accepted Accounting Principles) is a standardized set of rules and systems used by all firms with regard to their financial statements. This requires some sensible time involved in using the asset to calculate the life of an asset.

Businesses can shift their measurements based on the anticipated daily usage and other factors.

The increase in the asset's life leads to its wearing away, eventually decreasing its overall monetary value and life. For example, If a company bought a truck for 100,000 dollars with a useful life of over five years, it must be depreciated at about 20,000 dollars per year.

Calculating depreciation schedules may be required to quantify the asset's life. Some generally accepted guidelines prepared by the accounting bodies are used for estimating and adjusting the period.

Economic Life And The Salvage Value

The useful life of an asset is required to calculate its salvage value, and its value can be set too high or too low based on the accurate or inaccurate calculation of the life of an asset.

In turn, if the salvage value is set too high or low, it affects various other factors in a business, such as

-

The value of depreciation would be less or more.

-

The Net Income would be less or more.

-

Total retained earnings and the asset value would be overstated or understated in the company’s balance sheet.

-

The debt to asset ratio of a company could become lower, and the other components of a balance sheet could be affected.

-

The collateral value of a loan will be set low if the salvage value of an asset is too low. This affects securing future loans or financing the capital of a company.

Intangible Assets Economic Life

When the useful life of an asset is estimated, an entity’s historical experience might be used in how they consider extending the rights of an intangible asset. Also, the useful life of the asset can be extended based on extensions and renewals.

Intangible assets are subject to amortization over a stated period, just like how tangible assets like a car are depreciated over some time.

If the contractual terms of an intangible asset such as reacquired rights are continuing or not stated, then their service life can be indefinite (If a contract to renew reacquired right is based on automatic renewal, then it may not be considered as perceptual or continuing in nature).

Intangible assets used in Research and Development (R&D) after an initial recognition have an indefinite life until the completion or abandonment of the associated R&D efforts.

Defensive intangible assets that the corporation does not actively use but intends to hold to prevent others from obtaining the asset have a useful life until they contribute directly or indirectly to the Future Cash Flows (FCF) of the concerned business.

Economic Life Vs. The Physical Life

There is often confusion between the economic life and the physical life of an asset. These terms are often used interchangeably, but both the terms are different.

Useful life, as referred to above, is the life of an asset until the owner can derive profits from it. However, the physical life of an asset is how long that object will continue to exist.

The physical life of an asset can only be determined when the asset (tangible or intangible) becomes obsolete or dies, but on the contrary, the useful or economic life of an asset has to be estimated before it is bought.

Usually, the physical life of the asset should be equal to its depreciable life. Still, some inaccuracy related to the estimation may arise because an asset can become obsolete depending on the situation in life.

For example - An air conditioner worth $10,000 can be used for ten years which is its useful life and is depreciated at $1,000 a year, but the physical life of the air conditioner may become irreparable before its economic life ends and can also be prolonged more than its estimated useful life.

The table below depicts the difference between the economic life and the physical life:

| Aspect | Economic Life | Physical Life |

|---|---|---|

| Definition | Duration asset remains useful and profitable under normal conditions. | How long the asset continues to exist; determined when the asset becomes obsolete or irreparable. |

| Determination | Estimated before purchase, considering usage, maintenance, and obsolescence. | Determined when the asset becomes obsolete, dies, or is beyond repair. |

| Accounting | Used for calculating depreciation and financial statements. | Not directly used in accounting; relevant for assessing asset wear and tear. |

| Influence | Impacted by factors like technological changes and regulations. | Not influenced by external factors; depends on natural wear and tear. |

| Flexibility | Can change based on market disruptions and regulatory shifts. | Fixed and determined by the asset's inherent physical properties. |

Shortening Economic Life

Suppose that you are a taxi driver and bought a new car 1.5 years ago, and the estimated economic life of the asset is four years. The car you have has a mileage of 20 miles per gallon.

But, in the market, there is a new car which gets recharged by electricity and can be driven for 200 miles over a single charge.

Now that the cars which run on new-renewable fuel are a less feasible option in comparison to the newly launched electric cars. People have started buying electric cars instead.

It may be felt that your cab is not working as efficiently as it should be in comparison to the newly launched electric vehicles. Such that the technological disruption in the automobile industry just brought down the useful life of your asset from four years to just a year and a half.

Regulations describe how the assets are to be managed and used such that rules and regulations keep on changing pertaining to improving safety, efficiency, and various other measures.

Regulations describe how the assets are to be managed and used. These rules and regulations keep on changing pertaining to improving safety, efficiency, and various other measures.

Changes in rules and regulations related to the use of material or equipment might turn them obsolete quickly and, in turn, affect their predicted useful life.

Therefore, before making a decision to invest in an asset, various factors are kept in mind, and the use of the asset as viable or does not have to be ensured according to the rules and regulations mentioned in the law.

For example - Due to the amendments in the pollution laws, vehicles having diesel engines ceased to be produced, thus shortening and eliminating their economic life.

Technological disruption is a major factor that often brings the economic life of an asset down.

Determining an Asset’s Economic Life

Asset’s cost component always includes-

-

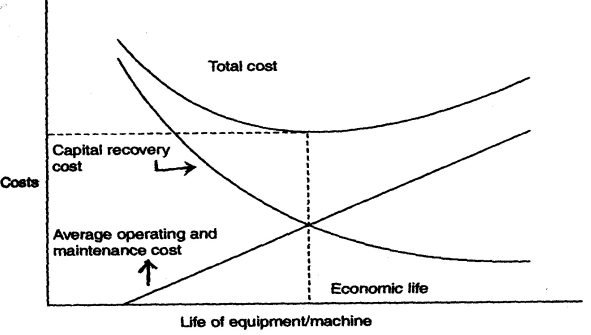

Capital Recovery Cost, which reduces over the period owing to depreciation. This cost is derived from the Purchase Cost of the asset.

-

Operating and Maintenance Cost of an asset. This type of cost increases over the period as the efficiency of the asset reduces, and thus the cost of operating and maintaining increases.

-

Total cost refers to the sum of Capital Recovery costs and Operating and Maintenance costs. It typically refers to the sum of all the Fixed costs and all the variables required to operate it. Further total costs help in defining average costs and marginal costs.

Total Cost = Capital Recovery Cost + Operating and Maintenance Cost.

It is clear that the total cost of the machine decreases and then starts increasing for the following period. So the useful life is determined when the total cost of the machine is minimum.

How is Economic Life Used?

This concept is useful for accountants, asset operators, and the decision-makers of a company.

For accounting purposes, economic life is the period in which depreciation is charged against an asset. Companies use it to allocate depreciation expenses charged for the use of the asset.

Asset operators manage the assets of the company where the salvage value of equipment, machinery, and various other equipment has to be estimated. The efficiency of the assets is necessary to reduce the operational cost of a company or its subsidiaries.

Managers at the highest of hierarchies in a company have to make decisions related to the investment or divestment of the assets of a company. For this purpose, the salvage value of the assets of a company like its subsidiaries or divisions.

Only after the salvage value of an asset is estimated can the company move forward with the decision of investment or divestment, as it affects not only the company accounts but also the shareholders or the external investors in a business.

Companies estimate the useful life of equipment before buying them, considering the normal usage level and maintenance of the asset over a while.

These businesses also need to appropriate the amount to be set aside to replace the asset bought after its physical life ends.

or Want to Sign up with your social account?