Sources and Uses of Funds Statement

A financial statement showing the inflows and outflows of a company's financial positions

What Is A Sources And Uses Of Funds Statement?

A sources and uses of funds statement, otherwise known as a flow of funds statement, gives an updated look into a project, the allocated funds for that project, and how they are being spent. They can be for investing, financing, or even operating activities.

All of these can be found on any company's financial statements, understatement of cash flows, and are imperative to the success of a business. There are different sources to pay attention to when it comes to a statement of funds, and they are:

- Notice of changes in the financial position

- Cash flow statement

- Statement of funds.

These sources and uses of funds can be accessed at any time but are released annually. They help accountants, and other industry professionals see how much money is allocated at certain times or for specific projects.

It is essential to understand the different ways funds can flow and the statements documented to track the progress of each.

Key Takeaways

-

The Sources and Uses of Funds Statement provides a comprehensive view of fund allocation and spending. It's essential for understanding investment, financing, and operational activities.

-

Mastering fund flow isn't just about accounting; it's crucial for business strategy and loan credibility. It reflects financial health and attracts potential investors.

-

The statement draws data from financial position changes, cash flow, and fund allocation. This gives professionals valuable insights into fund utilization.

-

Funds stem from operations, share issuance, loans, asset sales, non-trading receipts, and reduced working capital. Balancing these sources is crucial for cash flow optimization.

-

Effective cash flow management ensures positive cash flow, liquidity, and stability, all vital for business success.

The Flow of Funds

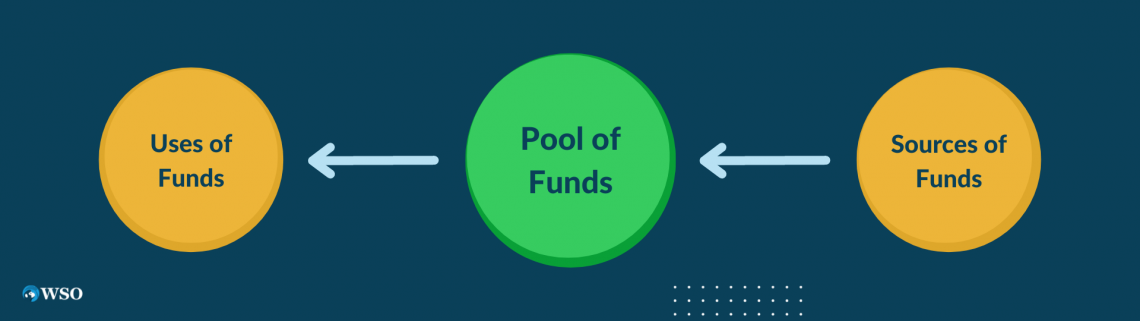

How a company presents its fund flow statements can indicate the business and whether they are reliable for loans or even a future pool of funds.

Lending someone money requires a mutual trust that the money will get returned. If a company has a good flow of funds, it can be easier to delve out cash because it is tied up somewhere else.

There are many sources of funds, some of which are better than others. However, the funds flow between business and customers is essential for the success and longevity of a business in a particular field.

Here is a flow chart of how funds can flow within a business.

The different sources of funds can ultimately tell you a lot about the position of the money.

Along with the part of the money, the Top 6 Sources of Funds, non-related to the different sources of statements of funds, are:

- Funds from operations or trading profits

- Issue of Share Capital

- Raising of loans and debentures

- Sale of fixed assets of long-term investments

- Non-trading receipts

- Decrease in working capital

We will dive into each one in its specific light and how they ultimately affect the flow of funds to and from different businesses.

Funds from Operations or Trading Profits

The profit one receives from operations within the business and trading at profits are some of the best ways to source funds. However, sales alone are the primary source of cash flow for businesses.

This is done simultaneously while increasing current assets such as cash or other outstanding bills. Along with support, the funds flow from businesses for their cost of goods sold, and expenses are just as necessary.

As a result, the total effect of business operations relative to their cash flow will be a source of funds if the same inflow from sales is more than the outflow for expenses and cost of goods sold.

These are basic ideas, as you want to bring in more money than you are spending, hence the topic of profit.

It is imperative to remember that funds from operations do not account for a firm's profit and loss account because many operating and fund items are non-profitable. The reason is that they may have been debited or credited to profit and loss.

There are many examples of such items on the debit side of a profit and loss account.

- Amortization of fictitious and intangible assets, such as goodwill,

- Preliminary expenses and discount on issue of shares and debentures written off;

- Appropriation of Retained Earnings, such as Transfers to Reserves, etc.,

- Depreciation and depletion; Loss on sale of fixed assets; Payment of dividend, etc.

The non-fund items are those which may be expenses linked to operational activities. They do not affect the funds of the business. For example, funds do not move out of the company for depreciation charged to a profit and loss account.

Items deemed as non-operating may result in the outflow of funds but are not related to the trading operations of the business.

An example of items deemed as non-operating is the payment of dividends when you get paid for holding the stock.

Issuance of Share Capital

If a business increases capital shares at any time during the year, it inevitably means that money has been raised. These shares of capital can either be preference or just equity.

Issuing shares is a source of funds because it means an in-flow of funds. So even if it is not fully paid, receiving calls from partly paid shares still represents a source of funds.

These funds are still documented on the funds' flow statement. It is also important to remember that the sum proceeds from whatever net profit you are making from the shares of capital you were issued still amounts and counts as a source of funds.

If shares are issued at a premium price, even the collected premium still counts as a source of funds.

The same goes for when these shares are issued at a discount; these shares will not be the actual numerical value of shares, but rather the deducting discount will amount to and is considered a source of an inflow of funds.

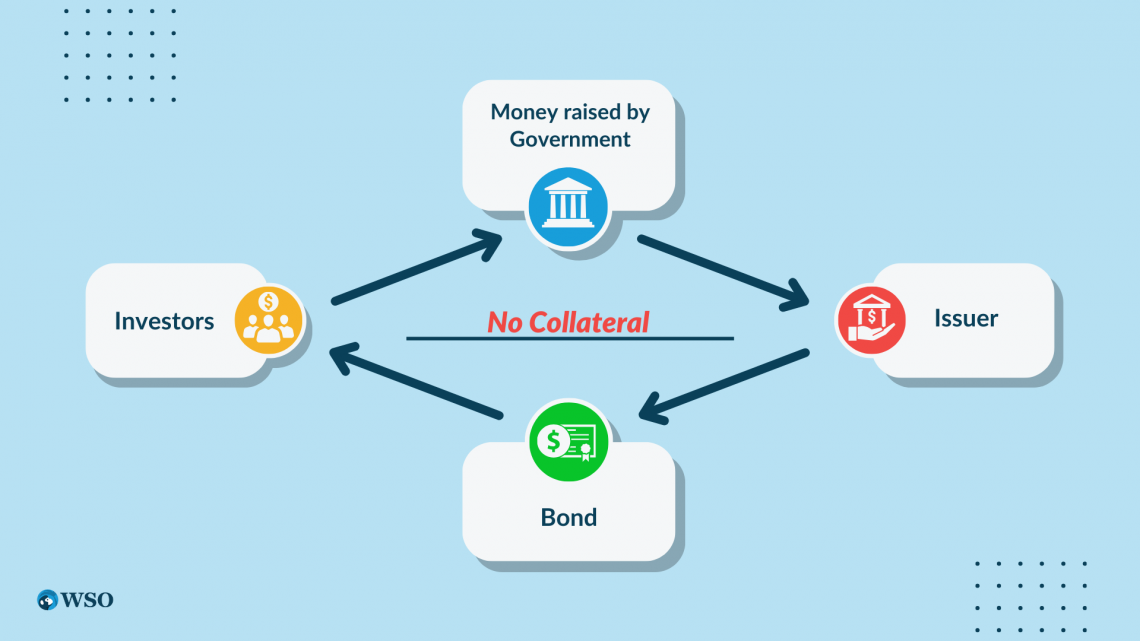

Raising of Loans and Debentures

The issuing of debentures, or the raising of long-term unsecured loans through public or capital investments very similar to bonds, results in being a source of the inflowing of funds for a business.

Secured loans are backed by collateral, such as your home or car, and get taken away if you avoid paying on time.

On the contrary, unsecured loans are not backed by anything except you, your credit reputation, and your creditworthiness.

To understand what a debenture is a little bit more, here is a simple investment cycle of them.

It truly does not matter if these loans are secured or unsecured, as they still result in being a source of funds.

This source of funds from the actual proceeds of issuing debentures and raising capital includes the amount of the premium or not having the discount rate if there was one at all.

However, loans raised for purposes other than a current asset, such as the intent to purchase a building, will not count as a source of funds because, in that case, the accounts involved are only fixed or non-current.

This is where selling them can also be considered a source of funds.

Sale of fixed assets or long-term investments

There are many fixed or non-current assets. Many of these are great investments, especially for the long term.

Some of these non-current or fixed assets are:

- Land

- Buildings and architecture

- Plants and machinery

- Household equipment and furniture.

When any of these long-term investments are sold, it subsequently generates revenue and, as a result, becomes a source of funds.

We mustn't forget that even if one fixed asset is exchanged for another, it does not mean there is now a source or inflow of funds because no other acquisitions are currently involved.

For an accountant lodging a journal entry, it would go into the balance sheet as:

- Debit cash for the amount which you received

- Debit all of the accumulated depreciation

- Debit the whole loss on the sale of the asset account

- Credit the asset for the fixed amount.

These ideas are essential. Every business has to have a team of accountants who can lodge these journal entries appropriately.

As every business wants to increase its profits, they need to hang onto the appropriate assets to make that possible so that it won't lose money over time.

Hammering home the idea that these assets do not depreciate is essential. This source of funds is meant to be one for long-term growth, not short-term.

Non-Trading Receipts

Any receipts which are non-transferable such as a dividend received, a refund on your taxes, or a landlord receiving rent, all increase funds and are treated as a source of funds because this source of income is not included in the funds you received from operations.

Unlike most other ways of trading when your main goal is to sell what you have to make a profit, the concerns of non-trading entities always are accepting receipts and donations.

These receipts are usually from the general public, corporate entities, and the government carrying out their operations. Some common examples of non-trading concerns are:

- Hospitals

- Athletic and sports clubs

- Orphanages

- Libraries

- Colleges and Universities

The common theme between these places is that these institutions were established and originated not from making a profit but rather for some religious or charitable purpose.

There are many concerns associated with non-trading institutions, which are essential to note, such as:

- Non-Profit Motivation: Many non-trading organizations do not seek to earn profit. Instead, their main objectives are to serve their members or society, which can lead to concern over the common.

- Entity: The concept of entity is a common concern for non-trading entities, as they do not associate with or have any ownership or lack thereof.

- Organizational Forms: As mentioned above, clubs, universities, hospitals, and others are all forms of organizations for non-trading entities.

- Sources of Income: Non-trading concerns have limited sources of income. Such organizations depend on the donations given by the members and outsiders, such as tuition for a university. All these donations might be inadequate, which can be a concern if they underperform.

- Budgeting & Use of Funds: For organizations on a larger scale, even if they have or don't have non-trading concerns, always prepare an annual budget. Likewise, the use of funds from non-trading entities should be strictly for the benefit of the consumers. As mentioned before, if the sources of funds are inadequate, it might become challenging to suffice the individual needs.

Decrease in Working Capital

Suppose the working capital decreases from period to period, and the current period is less than the previous period. In that case, it means that funds have been released from working capital, which constitutes a source of funds.

When less money is spent to pay your workers, more money is spent on the company.

In other words, if a company's WCR or Working Capital Ratio falls below one, it has a negative cash flow. Therefore, a WCR below one is not good and means its current assets are less in value than its liabilities.

The company cannot pay its debts with its current working capital. When something like this happens, a company will have difficulty paying its creditors on time.

As previously mentioned, decreasing the working capital increases cash flow and is a viable source of funds.

It is wise for businesses to do this, as ideally, they would always want a source of income to tap into in the event you need quick cash for operational expenses.

In summary, there are many uses and sources of funds. When it comes to the statement of cash flows, every company is doing its best to ensure that its cash flows are most liquid and with many revenue streams from them.

The companies doing the best with the most profit usually use multiple, if not all, six or more sources of funds to increase their own.

or Want to Sign up with your social account?