Sterling Overnight Interbank Average Rate (SONIA)

A rate charged by banks as the overnight interest rate for unsecured transactions in pounds sterling.

What is the Sterling Overnight Interbank Average Rate (SONIA)?

SONIA is charged by banks as the overnight interest rate for unsecured transactions in pounds sterling, which is a currency used by British markets.

It indicates the market's nighttime activity and provides overnight financing for transactions after regular business hours.

The Sterling Overnight Interbank Average Rate is provided to traders and financial institutions as an alternative to the London Interbank Offered Rate, or LIBOR, as the benchmark interest rate for short-term financial transactions.

In contrast to LIBOR, the benchmark is established using actual transactions rather than survey results.

This reduces the possibility of the rate being altered and ensures that it accurately reflects the average rate of transactions. Hence, this benchmark will allow the market to be more transparent than LIBOR.

Before this benchmark, LIBOR served as the standard for daily interest rates on loans and other financial agreements in the UK.

Thirty-five banks worldwide were surveyed to get an idea of what interest rates they would charge one another for short-term loans. The middle 50% of these responses were averaged to produce the LIBOR daily value.

Understanding the Sterling Overnight Interbank Average (SONIA) Rate

Banks' effective overnight interest rate for unsecured transactions in the British sterling market is known as the Sterling Overnight Index Average.

It shows the breadth of nighttime business in the market and is utilized for overnight finance for deals after business hours.

As a substitute for the London Interbank Offered Rate, or LIBOR, as the benchmark interest rate for short-term financial transactions, the Sterling Overnight Interbank Average Rate is offered to traders and financial institutions.

In 1997 the Wholesale Markets Brokers' Association (WMBA) created the Sterling Overnight Interbank Average Rate in Great Britain.

The new rate stabilized the overnight interest rates in the UK, as before its formation, they were considered to be volatile.

It is calculated in London each working day using the weighted average rate of unsecured overnight sterling transactions mediated by WMBA members. A deal must be valued at least 25 million British pounds to be considered for inclusion.

As a result of the rate, the Overnight Index Swap (OIS) market and the Sterling Money Markets were established in the United Kingdom.

The sterling Overnight Indexed Swap Market reference rate is only one of the many transactions for which it is regularly used as a benchmark.

The BoE and International Organization of Securities Commissions (IOSCO) best practices oversee the benchmark's stringent workflow methodology.

They start by collecting information on the transactions carried out on the previous trading day from banks in the UK. So, as a result, if you had checked the rate on a Friday, what you would have seen is Thursday's transaction data.

The BoE then runs the data through its algorithm to ensure there aren't any unexpected trends affecting the data's quality.

The rate is then determined by averaging all unsecured overnight sterling transactions with a minimum value of £25 million. The middle 50%'s mean is displayed and rounded to four decimal places after the top 25% and bottom 25% are eliminated.

The rate is transmitted to the BoE's licensees at 9 am, and users can access the information through Bloomberg or Reuters afterward.

SONIA Advantages and disadvantages

Unlike LIBOR, the benchmark is determined using actual transactions rather than survey results. Because of this, there is less chance that the rate will be manipulated and reflect the average rate of transactions. The market will become more transparent thanks to it.

It took a lot of work to switch from LIBOR to SONIA because the former system covered sterling transactions with a notional value of $30 trillion.

Concerns concerning the shift included the fact that, for a while, the old and new benchmarks would have to coexist and that it would be challenging to build workable, reliable alternatives as well as liquid markets.

The idea that the group of five currencies won't be entirely aligned has been brought up concerning SONIA. However, the benchmarks will need to abide by international laws, which will help unify the rates across the board to some extent.

Changes to SONIA

Most financial benchmarks require periodic alterations to keep up with current markets, and this benchmark is no exception. It is administered by the Bank of England (BoE).

The Wholesale Markets Brokers' Association is governed by the Financial Conduct Authority (FCA) as a calculating and publication agency. The recent changes made regarding it include:

-

A group of powerful, active dealers in the sterling interest rate swap market known as the Working Group on Sterling Risk-Free Reference Rates announced in April 2017 that this benchmark would be preferred, close to the risk-free interest rate benchmark.

-

In addition to providing an alternative interest rate to the prevalent London Interbank Offered Rate, this shift will influence sterling derivatives and related financial contracts (LIBOR).

-

For that purpose, the Financial Conduct Authority of the United Kingdom declared that as of 2021, banks would no longer be required to submit LIBOR quotes. After that, LIBOR will still exist, but its usefulness as a reference rate will probably decline.

Overnight Markets

In general, interbank markets let banks pool, manage, and redistribute money to offer loan and deposit services. One of the most significant interbank marketplaces is the overnight market.

The market is crucial to a nation's monetary and payment system since it acts as a safety valve. Banks are compelled to borrow if their cash flow is insufficient to allow them to balance their position at the end of a trading period. On the other side, banks that end a trading period with a lot of cash reserves can lend it to other banks that have weak cash flows.

Since borrowing from the central banks carries a hefty penalty in comparison to borrowing from the market, it is typically only done as a last resort.

The overnight interest rate is a crucial short-term indicator for traders as well as serves essential purposes, including influencing monetary policy.

From LIBOR to SONIA

As aforementioned, LIBOR was used in place of SONIA as a benchmark for daily interest rates on loans and financial contracts in the UK.

It was estimated by soliciting responses from 35 banks worldwide regarding the interest rates at which they would provide one another with short-term loans. The LIBOR daily value was the average of the central 50% of these responses.

While LIBOR serves as a benchmark globally, SONIA is a UK-focused index. It was estimated using the US dollar, the euro, the British pound, the Japanese yen, and the Swiss franc.

However, it was discovered in 2012 that bank personnel was rigging the rates to profit. As a result, significantly tougher guidelines and criteria were established to guarantee that facts supported all interest rate benchmarks.

The former LIBOR participants also had to develop substitute indexes, such as SOFR for the US and ESTR for the EU.

In most areas, SONIA now serves as the benchmark rate in place of LIBOR. The scarcity of activity challenging LIBOR's stability as a benchmark rate supports the argument. Secured interbank borrowing, the foundation for financial firms' LIBOR, has also sharply decreased.

The post-crisis liquidity status, which categorizes interbank borrowing as unstable, has furthered the tendency.

The baseline for discounting sterling rates and sterling overnight index swaps is already the sterling overnight interbank average rate (OIS).

The sequence of modifications made by the Bank of England has made SONIA an even more important benchmark for financial contracts in sterling markets.

SONIA is anchored on actual transactions, in contrast to LIBOR, where the actual values are based on a market for brokered transactions with a finite volume of transactions.

A broad spectrum of unsecured deposits is now reflected in SONIA. The Bank of England estimates that the new benchmark accounts for roughly GBP50 billion in financial transactions per day following the revised methodology.

The sum is thrice what LIBOR records for financial transactions.

SONIA Historic Data

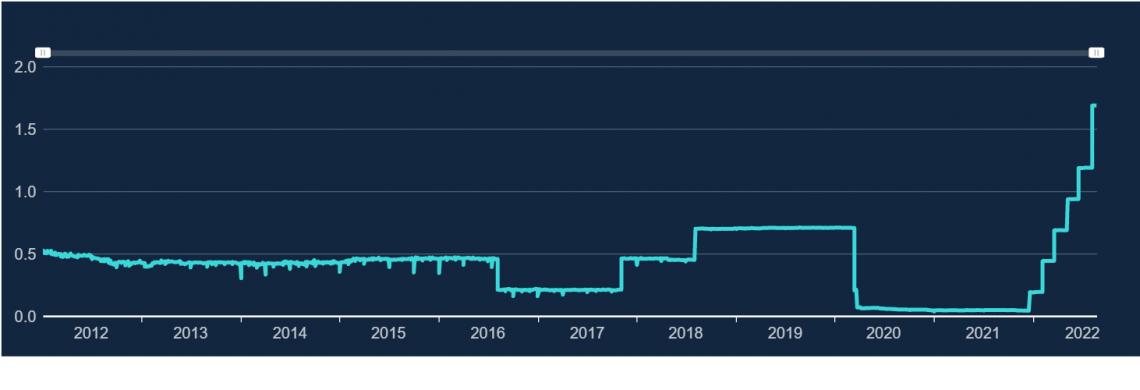

The SONIA rate has been quite steady from 2012 to 2016. However, it became more volatile from 2017 to 2022. It plateaued in 2020, likely due to the COVID-19 pandemic.

Nevertheless, its peak of 1.69 occurred on August 5th, 2022, after a steady incline from mid-2021. The data can be visually examined in the chart below provided by the Bank of England:

Additionally, its lowest point in the last 10 years appears to have occurred on September 30th, 2016, when the rate was 0.16.

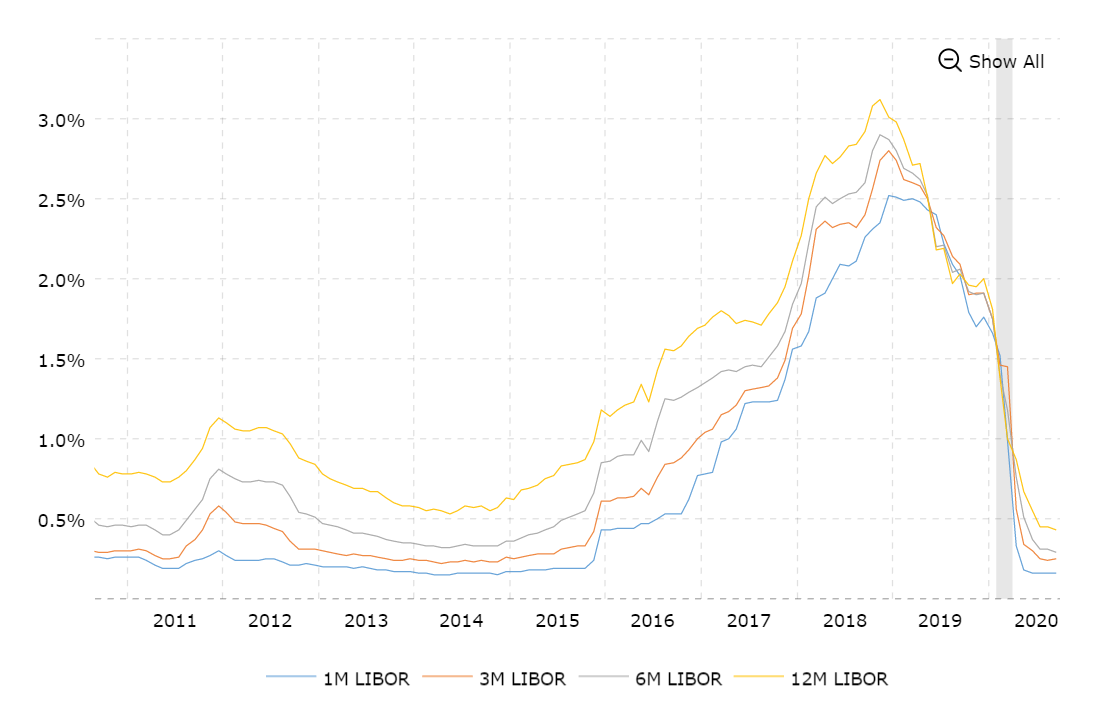

Additionally, below is the chart displaying the LIBOR rates in the last 10 years:

Compared to SONIA, LIBOR rates were much more volatile. SONIA's reliability further proves why it replaced LIBOR. Its peak occurred in December 2018, and it experienced a sharp decline in 2020.

The fundamental difference between the two is that SONIA is based on real market transaction data, making it " risk-free " and more solid.

SONIA will replace LIBOR as the industry standard benchmark for sterling debt instruments and other financial products, necessitating considerable modifications in paperwork and the calculation of interest.

Borrowers, in particular, must ensure that these changes are detected and appropriately implemented to minimize any negative impact on their position.

How is SONIA significant in the U.S.?

While SONIA compounded in arrears is projected to be primarily used in the U.K. market, that is not the case in the U.S.

Many U.S. lenders are developing internal systems based on SOFR norms since the Dollar LIBOR is being replaced by SOFR.

As a result, they are attempting to use the same methodology to track the replacement benchmarks for the other LIBOR-quoted currencies.

Most fund finance professionals in the United States have adopted SOFR as the initial fallback to Dollar LIBOR.

The Daily Simple SOFR is the next alternative in the replacement rate waterfall, per the recommendations of the Alternative Reference Rates Committee (the "ARRC").

Many Americans are likely to adjust SONIA and the other risk-free reference rates that will replace LIBOR to reflect SOFR.

As a result, it is anticipated that the leading U.S. approach to that benchmark will use the term as the primary replacement benchmark if it is available, and simple daily SONIA as the backup fallback.

Sterling Overnight Interbank Average Rate (SONIA) FAQs

SOFR is a risk-free overnight rate, just like the other benchmark. The Federal Reserve Bank suggests using SOFR, or Secured Overnight Financing Rate, in place of LIBOR for loans denominated in US dollars.

Every day's calculation is refreshed since it takes into account the trades from the previous day. Unlike the other benchmark , which is a secured rate supported by repo transactions, SOFR is an unsecured rate established by underlying interbank money market trades.

Basic SONIA and SOFR are distinct from interbank offered rates like LIBOR, which come in several tenors (one-month, three-month, six-month, etc.)

Given the number of transactions that support it, SONIA is stable and long-lasting. It is a more accurate indicator of the general level of interest rates than LIBOR since it excludes a term bank credit risk component.

SONIA can be compounded to be used in term contracts. In general, compounded it is predictable.

The best method for minimizing the risks associated with LIBOR discontinuation is to make use of other financial benchmark alternatives such as SONIA.

or Want to Sign up with your social account?