Deadweight Loss

Societal costs of market inefficiency when supply and demand are out of equilibrium due to inefficient allocation of production resources

What Is Deadweight Loss?

Inefficient markets, such as those that result from an imbalance between supply and demand, lead to a deadweight loss, which may be considered a cost to society.

Although the term deadweight loss is often used in economics, it may be used to describe any shortfall resulting from resource waste.

Governments rely heavily on taxes collected from market activities, particularly taxes on labor, to fund their operations.

As a result of taxes, the value of a transaction decreases for all parties involved (the customer pays more for the goods, and the provider earns less). It is precisely because of this depreciation that taxes are levied.

Though the government would benefit from this, everyone in the market would lose more than they would gain. Thus, taxing results in a total loss, known as the deadweight loss of taxation, which hurts the economy as a whole.

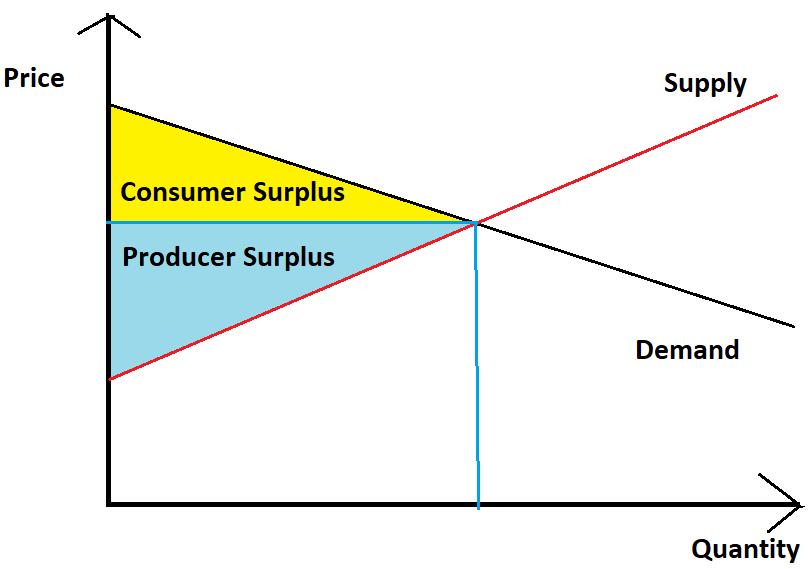

When people choose not to purchase or sell in a market for reasons aside from the price of a good or service, the economy suffers a loss of surplus that may be broken down into two categories:

- consumer surplus

- producer surplus

Artificial impediments to competition, including such occupational licensing requirements or the artificial limitation of supply by monopolists or oligopolies, may also lead to deadweight losses.

When supply and demand are out of sync, the market loses efficiency, and deadweight loss results. When products in a market are overpriced or underpriced, the market is inefficient.

Certain individuals in society may reap the benefits of the unbalance, but the move away from equilibrium will have repercussions for many others.

Key Takeaways

- When there is a mismatch between supply and demand, leading to market inefficiency, a deadweight loss results.

- Interventions such as price ceilings, price floors, monopolies, and levies all contribute to poor resource allocation, which is the primary cause of deadweight losses.

- Because of these causes, the market price of a product is often incorrect, resulting in either an artificially high or low selling price.

- The economy suffers when consumer and producer behavior shifts because of inaccurate product pricing.

- Deadweight loss may result from minimum wage and living wage regulations if they force companies to pay too much for workers and put unskilled people out of employment.

- Price limits and rent restrictions also cause deadweight loss since they discourage production and reduce the supply of products.

- Even though price limits seem beneficial for the customers, they bring several long-term repercussions.

- Deadweight loss is proportional to the product of the elasticities of supply and demand.

- Elasticity In economics is the percentage change in a variable in response to a percentage change in another variable.

- There is a direct correlation between the degree to which supply or demand may be elastic and the amount of deadweight loss.

Causes of Deadweight Loss

Deadweight loss may result from minimum wage and living wage regulations if they force companies to pay too much for workers and put unskilled people out of employment.

Price limits and rent restrictions also cause deadweight loss since they discourage production and reduce the supply of products, services, and housing below what customers genuinely desire. As a result, both consumers and producers suffer.

Due to the ultimate price of the commodity being higher than the equilibrium market price because of taxes, consumers are dissuaded from purchasing items they would otherwise make, resulting in a deadweight loss.

If taxes are increased, the cost is often passed along to both the manufacturer and the consumer, who must pay a higher price for the product.

Consequently, fewer goods are purchased, which is bad for the company's bottom line and the market as a whole.

The elements of a perfect market, where fair competition precisely establishes a price, are eliminated by monopolies and oligopolies, leading to a deadweight loss.

Supply for a product or service may be artificially limited by a monopoly or oligopoly, driving the price. Since this is the case, sales of all types will inevitably decline.

Deadweight Loss and Inefficient market

An inefficient market is one in which the prices of assets do not correctly represent the assets' real values, which may occur to several causes.

This phenomenon is based on economic theory. Inefficiencies almost always result in losses of deadweight.

The vast majority of markets exhibit some degree of inefficiency, and in the most severe cases, an inefficient market might illustrate a failed market.

The Efficient Market Hypothesis (EMH) asserts that asset prices will always and correctly represent the asset's real worth in a well-functioning market. This view is supported by the term efficient market.

For instance, the current price of a stock should accurately represent all of the information readily accessible to the public on that stock.

On the other hand, an inefficient market does not represent all of the information readily accessible to the public in its pricing, which indicates that there may be opportunities to find deals or that prices may be overvalued.

Economists and academics have long theorized about the characteristics of a well-functioning market. Thus, this introduction is necessary before we can examine dysfunctional marketplaces.

There are three versions of EMH or Efficient Market Hypothesis. First, if all information about a company, including its previous returns, is accessible to investors, then the market perfectly reflects that information, according to its weak form.

The semi-strong variant of this hypothesis states that an efficient market considers both past and present data. Furthermore, the strong form states that an efficient market considers publicly and privately held information.

supply and Deadweight Loss

As a cornerstone of economics, supply denotes the whole accessible quantity of an item or service. It is the amount of a good, service, or any valuable object a firm, producers, or laborers are willing to supply to an individual or a market in a given fiscal year.

When looking at a graph, supply may refer to the quantity available at a given price or the total amount available throughout a certain price range.

This is related to the level of interest in the product or service at a certain price since all companies want to maximize profits regardless of the cost of providing the item or service.

The dynamics of supply and demand are today's bedrock of the global economy. The supply and demand for the product or service will fluctuate in response to factors such as price, practicality, and consumer preference.

Manufacturers will increase the production of a product if there is sufficient consumer demand at a premium price.

If demand stays the same, but supply grows, the price will drop. In a perfect market, consumer utility and producer profits would be maximized since supply and demand would balance at the same price.

demand and Deadweight Loss

Overpaying for employees due to minimum wage and living wage legislation and the inability of unskilled people to find employment are two ways these policies generate a deadweight loss.

Deadweight loss may also result from price limits and rent restrictions, discouraging production and reducing the supply of products, services, and housing below what customers genuinely desire.

There aren't enough goods for buyers, and manufacturers aren't making as much money as they might be.

Because the ultimate price of the commodity is higher than the equilibrium market price due to taxes, consumers are dissuaded from making purchases they would have made otherwise, resulting in a deadweight loss.

If taxes are increased, the cost is often passed along to both the manufacturer and the consumer, who must pay a higher price for the product.

It causes fewer people to buy the product, which is bad for the company's bottom line and diminishes the market's potential gain.

Due to the absence of perfect competition, which determines prices fairly via robust and plentiful supply and demand, monopolies and oligopolies also cause DWL.

Supply for a product or service may be artificially limited by a monopoly or oligopoly, driving the price. Because of this, sales of all types of products and services will inevitably decline.

Deadweight Loss and Price Ceiling

Despite the fact that they could seem to be a clearly beneficial thing for customers, price limits bring with them several long-term repercussions. First, there is little doubt that, in the short term, costs will decrease, which might, in turn, drive demand.

However, manufacturers need to figure out how to make up for the limits placed on prices (and profits) in some manner.

They might limit the supply, reduce output or production quality, and perhaps charge additional fees for choices and services previously provided.

As a consequence of this, economists question whether or not price limitations are even effective at protecting weak customers from high prices or whether or not they protect vulnerable customers at all.

The argument against price caps that is more general and theoretical is that they result in a loss of deadweight for society.

This is a description of an economic deficit generated by an inefficient allocation of resources that disrupts the equilibrium of a marketplace and leads to the marketplace being more inefficient.

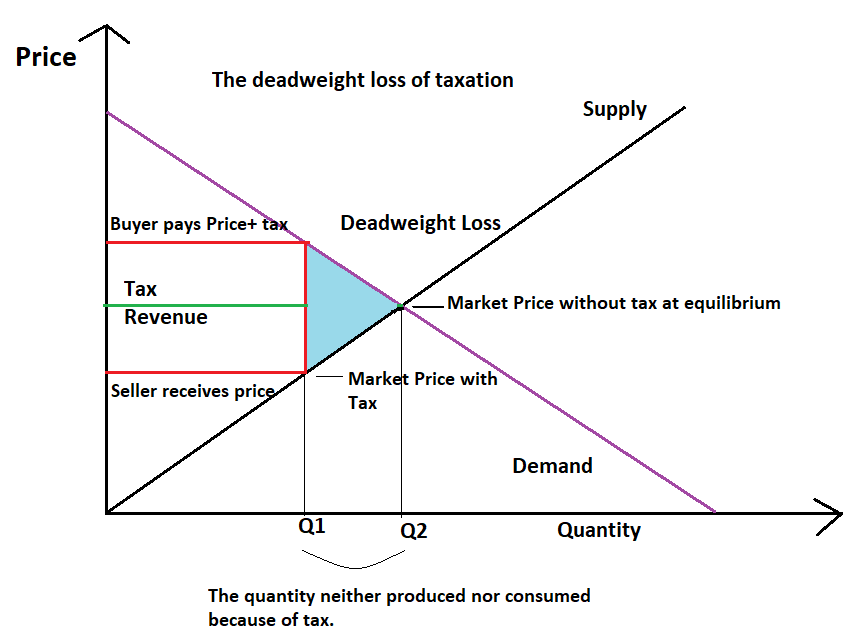

Figure 2: Deadweight loss of taxation

Examining the supply and demand curves in the following graph will illuminate the causes of this deadweight loss.

Price increases for buyers and decreases for sellers result from taxes on market transactions.

As a result, the equilibrium of buyers goes up the demand curve from the market price (Pm) to a higher price (Pb) at lower quantities; sellers move down the supply curve from the market price (Pm) to a lower price (Ps) and the amount provided.

The sum collected by the government is equal to the tax, which is calculated as the difference between the selling price and the purchasing price multiplied by the number of items bought or sold.

Deadweight Loss and Elasticity

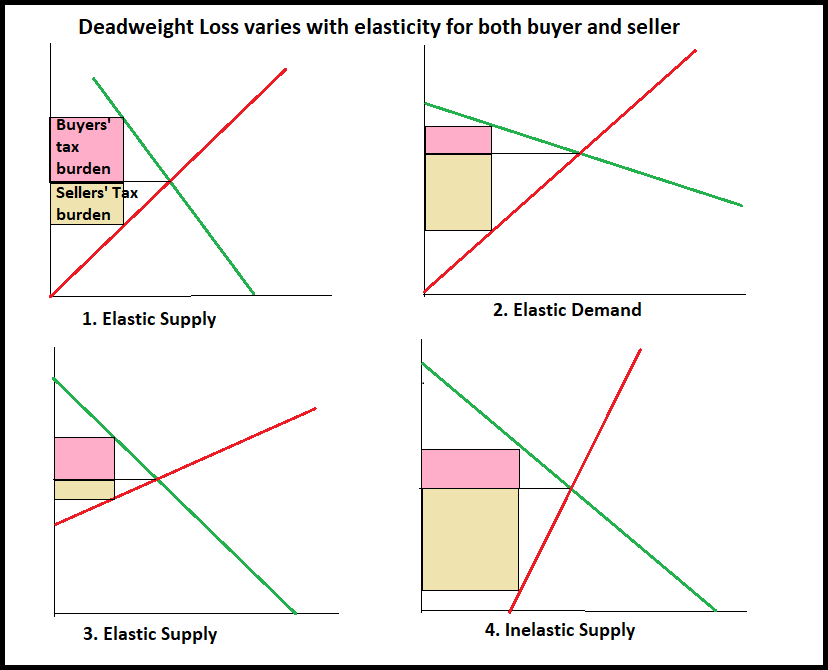

Deadweight loss is proportional to the product of the elasticities of supply and demand. Elasticity in economics is the percentage change in a variable in response to a percentage change in another variable.

Figure 3: Deadweight Loss Varies with Elasticity

It tells us the measure by which one factor is responsible for causing another change if it changes itself by a certain amount.

The deadweight loss from taxing decreases when either demand or supply is inelastic since this reduces the responsiveness of supply and demand to price changes. In the absence of any deadweight loss, complete inelasticity prevails.

There is a direct correlation between the degree to which supply or demand may be elastic and the amount of deadweight loss.

The elasticity of the economy also determines who must pay the tax, the consumers or the producers.

Graphs 2 and 4 show that the seller bears the brunt of the tax when supply is inelastic, and demand is elastic, whereas the buyer bears the brunt of the tax when demand is elastic and demand is inelastic (Graphs 1 and 3).

Elasticity has the same impact on the tax as on anyone else's price change.

Deadweight Loss and Tax Revenue

The amount of money collected in taxes is proportional to the tax applied to the total cost of a product or service.

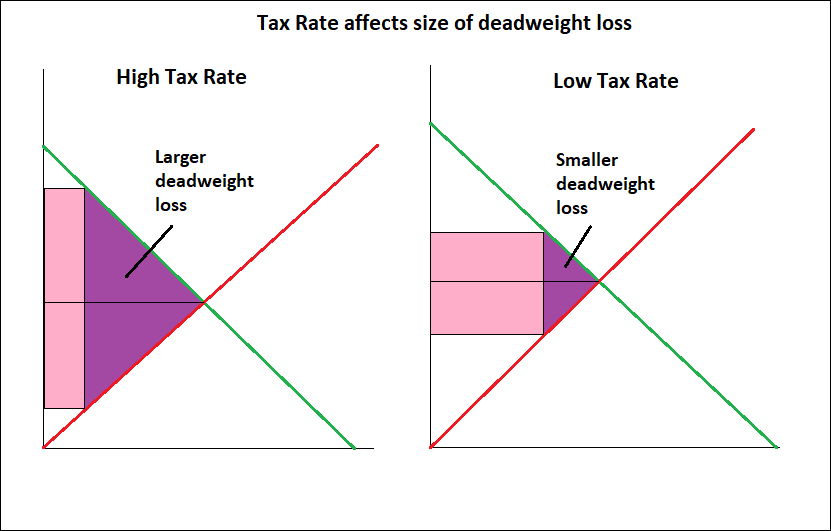

Figure 4: Tax rate affects the size of Deadweight loss

The first graphic above shows that the highest tax income is collected with a modest tax rate. The government brings in less money, whether the tax rate is low or high.

The government collects a smaller share of revenue when tax rates are low. Conversely, as seen in the pictures below, a high tax rate results in a lower total income since fewer units are sold.

It is also shown that the deadweight loss associated with a high tax rate is much more than that associated with a low tax rate.

While both high and low tax rates generate similar amounts of government money, the former is more costly to the economy since it decreases overall surplus to a lesser extent, meaning fewer individuals will indeed be able to take advantage of the latter.

This is ideal for excise taxes on harmful products and services like smoke and alcohol. Here, a high rate of taxation not only helps the government bring in money but also encourages positive social change.

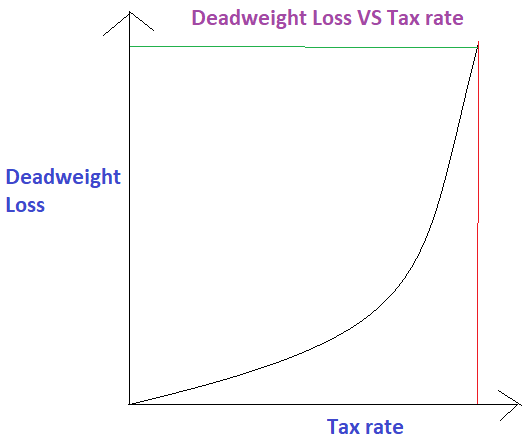

Figure 5: Deadweight loss vs. Tax Rate

This simplified graph shows that a tax's deadweight loss arises in tandem with its growth rate, first gradually and then sharply when the rate of increase approaches the price at which the product would sell in the absence of the tax.

Revenue from taxes also rises initially but eventually falls due to a loss in quantity that more than cancels out the benefits of a higher tax rate.

The following YouTube video briefly explains what this loss is:

or Want to Sign up with your social account?