Negative Growth

The term refers to a decline or fall in corporate sales or profitability over a sustained period of time.

What Is Negative Growth?

Negative Growth refers to a decline or fall in corporate sales or profitability over a sustained period. This also applies to a recession in a country's economy, measured by the fall in its gross domestic product (GDP). In most cases, it is presented as a negative rate.

The growth of a corporation is an effective indicator of its efficiency and competitiveness compared with its competitors. When a company has a high rate of return and increases the size of its market, it is in the stage of positive growth.

However, if a company has a decrease in sales and significant losses in its operating activities, it is in downward growth. Downward growth can cause a company to go out of business or go bankrupt in the long run.

In economics, an economist constantly measures GDP growth to describe the size and performance of a country's economy. The gross domestic product consists of the dollar value of all final goods and services produced for sale in the market.

When measuring gross domestic product, an economist considers all consumption expenditures, gross investment, net exports, and government spending. Growing GDP is indicative of a strong economy, while declining GDP is indicative of a poor economy.

An increase in gross domestic product means the economy is growing toward prosperity and expansion. Conversely, if GDP falls, the economy shrinks, harming businesses, employees, and the money supply.

An economist sees a country's economic growth slowdown as a signal of a recession or depression. For example, if the economy of a country's gross domestic product shrinks for more than two consecutive quarters, that's an indicator of a recession in the business cycle.

Key Takeaways

- Negative growth is a reduction in a corporation's sales or earnings over a sustained period.

- Negative economic growth in real GDP for more than two quarters in a row can signal a recession or depression.

- The NBER measures real income, employment, manufacturing, retail sales, and real GDP to see if the economy is in recession.

- A company is improving and will likely record better profits when it experiences positive business growth.

- The exact opposite of positive business growth, negative business growth represents the performance of a company that is seeing a decline in sales and profitability.

- The introduction stage is during which the industry's businesses grow slowly. Finding market leaders in a particular business can be difficult because everyone involved in the field is subject to high risk.

- Sectoral enterprises start to form during this period of steady positive growth. It is decided by a small group of companies with a substantial market share. Industry growth typically outpaces economic expansion in these sectors.

- In the third stage, the industry's development, every rival offers the same value. Hence the price is the main differentiator. For industry enterprises, the negative rate of return growth has diminished.

- The final stage of the industry life cycle is the relative decline stage. An industry's growth is currently slower than the economy's.

- The Great Depression of the 1930s, the Great Recession of 2008, and the COVID-19 recession are great examples of times when the US suffered a severe economic crisis.

- Negative growth can be observed at the stage of maturity and the relative decline in the industry life cycle.

Negative Growth of an Economy

Frequent periods of negative growth measurements are one of the most important indicators to determine whether a country's economy is in recession or depression. Economists use real GDP as the most critical indicator of a recession.

Natural gross domestic product measures everything corporations and individuals produce in the United States. It is called "real" because it excludes the influence of inflation. In addition, the National Bureau of Economic Research (NBER) tracks the average length of US recessions.

When real GDP growth initially turns negative, it can signal a recession; however, change will sometimes be harmful and then turn positive in the next quarter. That's why the NBER measures the following monthly statistics to see if the economy is in recession:

- Income: A measure of personal income adjusted for inflation. When real income falls, both consumer purchases and demand fall.

- Employment: The growth rate of employment and real income together indicate the economy's overall health.

- Manufacturing: A measure of the health of the manufacturing sector. If, over time, it decreases, so will employment at factories.

- Retail sales: A measure of retail sales adjusted for inflation. It determines how companies respond to consumer demand.

- Real Gross Domestic Product: The NBER also looks at monthly GDP estimates provided by economists to measure the economy's health.

In a recession, significant reductions in economic activity last for two or more quarters. A depression, on the other hand, will last for several years. Most recessions are short, averaging 11 months since 1945, but their impact on the economy can be long-lasting.

The Great Recession of 2008 is a perfect example of a sharp decline in economic activity during a long period of negative growth from 2007 to 2009. It began when house prices began to fall.

Poor lending practices, securitized bad loan derivatives, deregulation, and an interconnected global financial system all played a role in causing the financial crisis and recession in the years leading up to the economy's collapse.

After a recession causes a contraction in economic activity, the economy enters an expansionary phase where it must return to pre-recession levels and continue to grow.

Because expansion is the normal state of an economy, this phase tends to last longer than the negative economic growth phase. For example, US history's most extended expansionary phase lasted 128 months from 2009, after the Great Recession, until 2020.

Example of Negative Economic Growth

The economic downturn could become a depression if it lasts long enough. However, there is no set period for a recession or conditions that must be met for a depression to be recognized.

The Great Depression of the 1930s was the worst economic downturn in the history of the United States and the industrialized world.

During the Great Depression, which lasted ten years, real GDP shrank by 30% from 1929 to 1933, and industrial production in the US fell by nearly 47%.

One of the causes of the Great Depression was the stock market crash, which significantly reduced consumer spending and business investment. By its peak in 1933, unemployment rose from about 3% to nearly 25% of the nation's workforce.

The Great Recession was the second major economic crisis in the United States after the Great Depression of the 1930s. Many factors contributed to the Great Recession. These factors include:

- Immoderate investments

- Deregulation

- Weak lending standards in the housing market

- Subprime mortgage crisis

- The stock market crash

During the Great Recession of 2008, the gross domestic product growth rate fell from 2.01% in 2007 to 0.12% in 2008; in 2009, it was -2.60%.

The recession lasted 18 months, and the country's GDP fell by 4.3%, the most significant decline in 60 years.

The unemployment rate rose to 10.0% in October 2009. It was even higher among black and Hispanic households, at about 15% and 12% in the United States. Because of unemployment, US household net worth declined, losing $19.2 trillion in wealth.

Another excellent example of negative economic growth is the short recession during the COVID-19 pandemic in April 2020. The slowdown in economic activity during the pandemic caused real incomes to fall, unemployment to rise, and production to decline.

During a short COVID-19 recession, the US economy contracted 5% in the first quarter of 2020 before hiring a record 31.4% in the second quarter. As a result, the gross domestic product growth rate fell from 2.3% in 2019 to -3.5% in 2020, while unemployment rose to 14.7%.

The main factors of the COVID-19 recession were:

- Lockdowns: Governments worldwide have initiated a population lockdown, schools have been shut down, and non-essential businesses have closed.

- Unemployment surge: Many states required the closure of non-essential businesses, causing the US economy to lose 20.6 million jobs.

- The decline in retail sales: Retail sales in the US in April 2020 fell by 16.4%.

- Stock market crash: Uncertainty about the impact of the pandemic caused the stock market to crash in 2020.

Negative Growth in Business

A corporate sales or profitability reduction is referred to as negative business growth. In business, growth is used as one of the main methods of describing a company's performance.

Positive business growth indicates that a company is improving and is expected to report higher profits. Conversely, negative business growth is the exact opposite of positive growth and reflects the performance of a company experiencing declining sales and profitability.

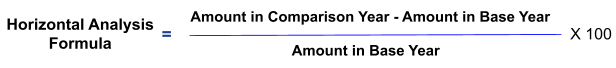

In business, horizontal analysis is used in financial reporting to identify trends and patterns of business growth from year to year. In addition, horizontal analysis can detect negative business growth over years of decline.

Horizontal analysis of financial statements involves comparing financial reports across multiple periods to show trends. Negative trends can be precisely pinpointed by performing calculations on a nominal or proportional basis.

When comparing the company's account balance on an annualized basis, negative nominal growth can be detected. This is a helpful indicator to measure if the size of a company is decreasing.

For instance, when the property, plants, and equipment (PP&E), also known as the fixed assets of a corporation, decrease every year, a company will likely sell or dispose of its capital assets.

Eventually, this may result in a reduction in the projected future cash flows provided by the company's production assets.

When preparing financial statements that are uniform in size, negative proportional growth can be observed. Financial statements can be made uniform by dividing balance sheet accounts by total assets or income statement accounts by total revenues.

Horizontal analysis of financial accounts of standard size reveals growth trends over time. For example, if the typical size cost of goods sold is growing at a negative rate year-over-year, it means that a company's revenue has grown faster than its cost of goods sold, increasing its gross margin.

Negative Growth in the Industry Life Cycle

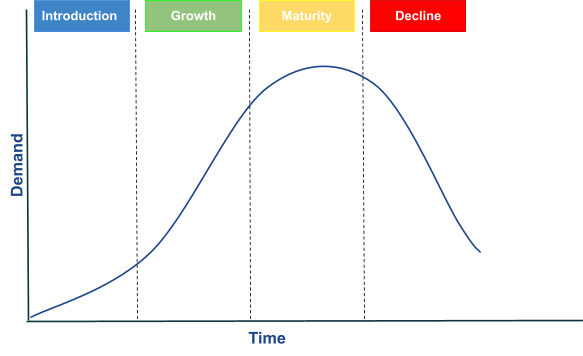

The life cycle of an industry is used as a theoretical basis for assessing the industry's maturity. There are four most important stages in the life cycle of an industry, which can be divided into the following:

- Introduction Stage

- Growth Stage

- Maturity Stage

- Decline Stage

Introduction Stage Of The Business

The introduction stage is when the industry enterprises experience slow growth. Since all players in the sector are exposed to significant risk, identifying market leaders in a given industry can be challenging.

In general, breakthrough technology characterizes the introduction stage that has the potential for large-scale growth.

Due to a large amount of capital initially invested in technology and other fixed costs, companies at this stage are likely to earn very low profits and experience negative cash flows.

Growth Stage Of The Business

This is a phase of consistent positive growth during which sectoral enterprises begin to emerge. It is determined by small enterprises that own a significant market share. In general, industries in the growth stage develop faster than the economy.

Companies in this phase of sustained positive growth begin to generate positive cash flows and earnings as revenue and production costs exceed breakeven.

Maturity Stage Of The Business

At this stage of maturity, all competitors in the industry offer the same value proposition, and competition is primarily based on price. As a result, industry enterprises' negative rate of return growth has decreased.

Most companies at the maturity stage are well-established in the industry. They try to moderate the intensity of industry competition to remain profitable by adopting strategies to become dominant players.

Relative Decline Stage Of The Business

The relative decline stage is the last phase in the industry life cycle. At this stage, an industry grows more slowly than the economy. During this time, there is usually a limited or negative market share and profitability increase.

To get past this stage, some large companies will try to acquire smaller competitors to become the dominant players. However, for companies suffering huge losses and not believing they have a chance of survival, exiting the market will be their best choice.

Researched and authored by Mumina Abdurakhmonova | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?