Perfect Competition

It involves a market with numerous buyers and sellers, none of whom have significant market power.

Perfect Competition is a market structure characterized by a large number of buyers and sellers, homogeneous products, perfect information, ease of entry and exit, and no individual participant having the power to influence market prices.

In this relatively competitive marketplace, no single firm controls the market, and the price is determined totally by the forces of supply and demand. In a perfectly competitive marketplace, there are numerous buyers and sellers, none of whom have a dominant marketplace share.

Each firm operates independently and has no impact on the market price. This implies that all firms are price takers and must accept the prevailing market price without the ability to influence it through their individual actions.

The absence of market power ensures that no single participant can manipulate prices or restrict competition. Another characteristic of it is the presence of homogeneous products.

Consumers perceive no differentiation among the products offered by various firms. As a result, buyers make their purchasing decisions solely based on price, as there are no distinguishing features or brand loyalty to influence their choices.

Perfect information is a key assumption in this market structure. Both buyers and sellers have entire expertise about prices, high quality, and availability of products inside the market.

This allows buyers to compare prices and make informed decisions, and it allows sellers to adjust their production and pricing strategies accordingly.

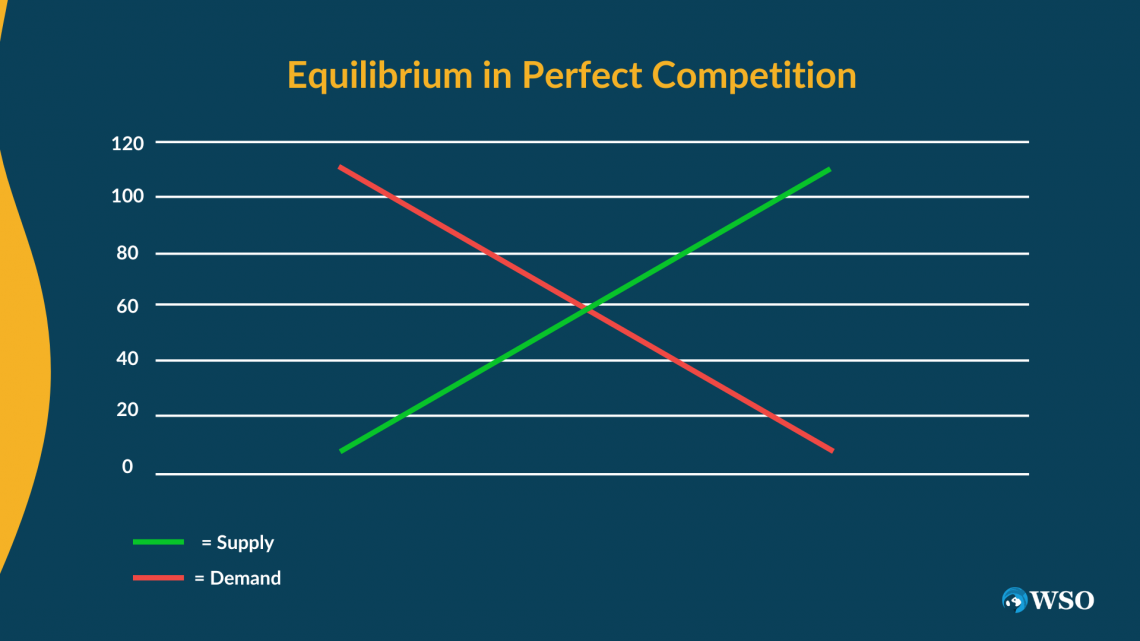

We can understand the concept better by taking a look at the graph below denoting the perfect competition.

Easy entry and exit into the market is another essential characteristic of it. New firms can freely enter the market if they see potential profits, and existing firms can exit if they incur losses.

This ease of entry and exit ensures no barriers prevent new competitors from entering the market, promoting competition and preventing long-term abnormal profits.

These conditions foster intense competition, efficiency, and consumer welfare by allowing prices to be determined solely by market forces.

Key Takeaways

- It involves a market with numerous buyers and sellers, none of whom have significant market power.

- In this market, firms produce identical products that are perfect substitutes for each other. There is no differentiation based on quality, features, or branding.

- Participants in perfect competition have complete knowledge about prices, product characteristics, and market conditions, enabling informed decision-making.

- Firms in it accept and do not influence the prevailing market price. They adjust their output based on market conditions.

- It fosters a dynamic environment that encourages innovation and progress. New firms can enter the market with innovative ideas, challenging existing firms and driving technological advancements.

- It assumes several idealized conditions that may not fully reflect real-world markets.

- It serves as a benchmark for analyzing market outcomes, efficiency, and the role of competition in promoting consumer welfare and economic growth. While not always achievable in reality, it provides insights into market dynamics and the impacts of market structures.

Assumptions Of Perfect Competition

It is based on a set of assumptions that define the market structure. These assumptions include the following:

1. Many buyers and sellers

There is a large number of buyers and sellers in the market, with none of them having a dominant market share. Each participant is small relative to the entire market and has no individual influence on prices.

2. Homogeneous products

All goods or services traded in the market are identified and considered perfect substitutes.

NOTE

There are no differences in quality, features, or branding among the products different firms offer.

3. Perfect information

Buyers and sellers have complete and accurate knowledge about prices, product characteristics, and market conditions. This information symmetry allows participants to make informed decisions based on available data.

4. Ease of entry and exit

Firms can freely enter or exit the market without facing significant barriers or restrictions. No legal, regulatory, or financial boundaries prevent new firms from entering the market or existing companies from exiting.

5. Perfect factor mobility

The resources (such as labor and capital) used in production can easily move between different firms and industries without incurring costs.

NOTE

There are no restrictions on the mobility of resources, allowing them to be allocated efficiently across the market.

6. Rational behavior

All participants in the market are rational and aim to maximize their utility or profit. They make choices primarily based on a careful evaluation of prices, benefits, and available information.

7. No externalities

Perfect competition assumes the absence of external costs or benefits associated with production or consumption. There are no spillover effects on third parties not involved in a transaction.

8. Constant returns to scale

Firms in it operate at an optimal scale with constant returns to scale. This means increasing or decreasing the scale of manufacturing no longer results in huge changes in costs.

NOTE

These assumptions serve as the foundation for analyzing the behavior of firms and market outcomes in perfect competition.

While these assumptions may not perfectly reflect real-world markets, they provide a useful benchmark for understanding market competitive dynamics and efficiency.

How Does Perfect Competition Work?

It works via the interaction of consumers and sellers in a market characterized by the following key features:

1. Price determination

In this, the price of the product is decided by using the forces of supply and demand. No individual buyer or seller has the power to influence the market price.

Rather, the market price is established as the equilibrium point where the quantity demanded by customers equals the quantity supplied by sellers.

2. Price-taking behavior

Individual firms are price takers in a perfectly competitive market. They accept the prevailing market price and adjust their output accordingly. Since homogeneous products characterize the market, buyers do not prefer one seller over another based on product differentiation.

NOTE

As a result, firms can not charge prices higher than the prevailing market price, as buyers would shift to different sellers providing the same product at a decreased price.

3. Profit maximization

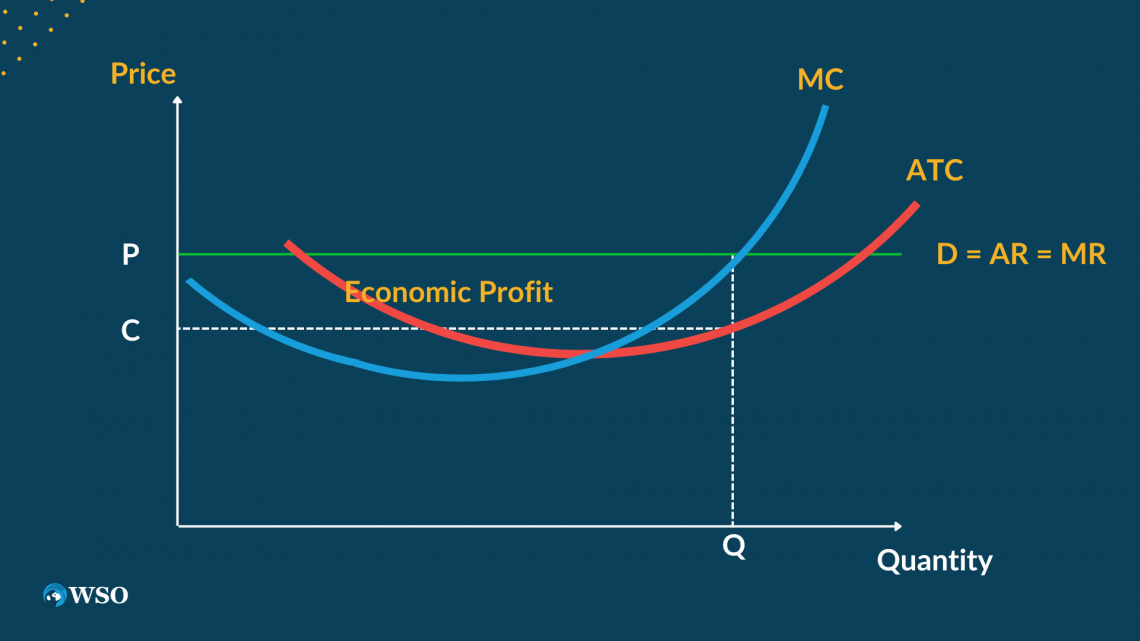

Firms aim to maximize their profits by making production and pricing decisions based on cost considerations and the prevailing market price.

NOTE

A firm will produce at a level where its marginal cost (the additional cost of producing one more unit) equals the market price. If the market price is higher than the average cost, the company earns profits, and if the market price falls under the average cost, the company incurs losses.

4. Free entry and exit

It allows for easy entry and exit of firms in the market. New firms can enter the market if they anticipate potential profits, while existing firms can exit if they are incurring losses.

This process ensures no long-term abnormal profits or losses in the market. If firms are earning profits, new competitors will enter, increasing supply and putting downward pressure on prices. Conversely, if firms incur losses, some will exit, reducing supply and increasing prices.

5. Efficiency

It is often associated with allocative and productive efficiency. Allocative efficiency occurs when resources are allocated to their most valued uses, as the market price reflects consumers' preferences and willingness to pay.

NOTE

Productive efficiency is achieved when firms produce at the lowest possible average cost, given the production technology. In perfect competition, firms operate at the minimum efficient scale, leading to efficient resource allocation and production.

It serves as a benchmark for analyzing market outcomes and efficiency. While real-world markets may not perfectly match the assumptions, understanding how it works provides insights into the role of competition, pricing, and efficiency in market economies.

Advantages and Disadvantages of Perfect Competition

It has both advantages and disadvantages. Let's explore the good and bad aspects:

The advantages are:

1. Allocative Efficiency

It tends to result in allocative efficiency, as resources are allocated to their most valued uses.

The market price, determined by the equilibrium of supply and demand, reflects consumers' preferences and willingness to pay. This efficient allocation of resources maximizes overall social welfare.

2. Productive Efficiency

Perfectly competitive markets encourage productive efficiency.

NOTE

Firms in perfect competition operate at the minimum efficient scale, producing output at the lowest possible average cost given the production technology. This leads to efficient resource utilization and cost-effective production.

3. Consumer Benefits

It often leads to lower consumer prices due to intense competition among firms. With many sellers offering identical products, price-taking behavior, and ease of entry for new firms, consumers can enjoy competitive prices and increased consumer surplus.

4. Innovation and Dynamism

It fosters a dynamic environment that encourages innovation and progress. Since there are no barriers to entry or exit, new firms with innovative ideas can enter the market easily, challenging existing firms and promoting technological advancements and improvements in product quality.

The disadvantages are:

1. Lack of Product Differentiation

In this, products are homogeneous, meaning no differentiation or variety exists. This can limit consumer choice and reduce the ability of firms to command higher prices based on unique features or branding.

2. Lack of Market Power

Individual firms in it have no market power and cannot influence prices.

NOTE

While this benefits consumers through lower prices, it can limit the ability of firms to invest in research and development, as they may struggle to earn above-normal profits.

3. Potential for Short-Term Profit Volatility

In this, firms can experience short-term profit volatility due to fluctuations in market conditions. If the market price falls below the average cost, firms can incur losses, leading to reduced investment and potential exits from the market.

4. Externalities and Public Goods

It assumes the absence of externalities, such as pollution resulting from production or consumption activities. It also does not address the provision of public goods, which may require government intervention due to the free-rider problem.

5. Inequitable Distribution of Income

It does not guarantee equitable income distribution. In highly competitive markets, firms may focus on cost-cutting measures, potentially leading to lower worker wages and income inequalities.

NOTE

Perfect competition serves as a theoretical benchmark and may not fully represent real-world markets. While it has several advantages, limitations and potential drawbacks are also associated with this market structure.

What Does the Demand Curve Look Like in Perfect Competition?

The demand curve for a single seller in a market with it is perfectly elastic. It is shown as a horizontal line at the market-clearing price. The demand curve represents the quantity of goods or services that consumers are willing and able to purchase at various price points.

Since sellers in a market with perfect competition are price takers, they accept the going rate and have no control over it. Their demand curve is, therefore, flat at the market price.

A seller's MR equals the selling price in a market with it. This is because, in a market with perfect competition, every additional unit a company sells increases income by the same amount as long as the market price stays the same.

The MC curve shows how much more business costs to create each extra production unit. By producing the amount where MC equals MR, which is identical to the market price, the company seeks to maximize its profits.

The ideal number of commodities for each seller to produce to maximize their earnings is determined by the intersection of the supply curve (MC) and the horizontal demand curve. This equilibrium point is reached when the market price and the MC of production are equal.

NOTE

Remember that in a market with perfect competition, the demand curve is downward sloping, indicating the asymmetry between price and quantity requested.

However, the demand curve for a single seller is a horizontal line at the market-clearing price, demonstrating demand elasticity.

Perfect Competition FAQ

It is a market structure characterized by many buyers and sellers, homogeneous products, perfect information, ease of entry and exit, and no individual participant having the power to influence market prices. In this market structure, firms are price takers and compete solely based on price.

The key characteristics include a large number of buyers and sellers, homogeneous products, perfect information, ease of entry and exit, price-taking behavior, and rational decision-making by participants. It also assumes the absence of market power, externalities, and barriers to entry.

It assumes perfect information, meaning buyers and sellers have complete and accurate knowledge about prices, product characteristics, and market conditions.

This information symmetry allows participants to make informed decisions, compare prices, and adjust their production and consumption strategies accordingly.

It often leads to lower consumer prices due to intense competition among firms. Consumers can choose from a wide range of sellers offering identical products, and price-taking behavior prevents firms from charging higher prices.

This increased competition results in consumer benefits in terms of lower prices and increased consumer surplus.

It is a theoretical construct used as a benchmark for analysis. While real-world markets may not perfectly match its assumptions, elements of perfect competition can be observed in some industries, particularly those with low entry barriers and standardized products.

However, it is rare for all the conditions to be met in practice.

It is a theoretical benchmark for understanding market dynamics, efficiency, and pricing mechanisms.

While actual markets may deviate from it, studying its principles helps economists and policymakers analyze the impacts of competition, market power, and market regulations on market outcomes and welfare.

or Want to Sign up with your social account?