Naked Option

A type of options trade where the seller does not own the underlying security.

What Is a Naked Option?

A naked option is a type of options trade where the seller does not own the underlying security or does not have cash reserved to cover the option if it is exercised.

For sellers of a naked option, they are both in a position to make massive gains or losses. For this reason, it is considered to be a hazardous investment.

Examples include:

- The naked call

- The naked put

These two options strategies are cases when the investor is creating or writing a financial contract. They promise to buy or sell a security at a specified price and time. The key benefit of selling an option is that the premium is collected immediately.

The trade is more likely to be profitable in very general terms.

For investors buying call options or putting options without owning the security, the position is not considered to be naked, as they are simply paying a premium to speculate on price movement rather than collecting a premium with chances of future obligations.

What are Options?

Option contracts are a type of financial security that allows an investor to speculate on its underlying asset. An option is a derivative, and its price movement depends on the equity it tracks.

An option contract’s price is highly volatile compared to the underlying equity. This is because the option contract allows the investor to control 100 shares of the underlying stock.

For this reason, changes in the price of the stock itself profoundly affect the option contract cost.

Another aspect that leads to volatility is the time value of the option contract. As time passes, the option will lose time value. Less time means that there is less chance of significant price movement.

There are two options, which can be bought and sold in various combinations. These combinations allow investors to form different strategies depending on their expectations of price movements.

It is possible to create profitable strategies if a stock price increases, decreases, or trades sideways. Investors also can create designs that vary significantly in terms of riskiness.

Different strategies are simply deployed depending on the investor’s outlook on the underlying stock.

Option Contract Structure

An option contract contains several components. The key components include:

- Strike Price

- Expiration Date

- Premium

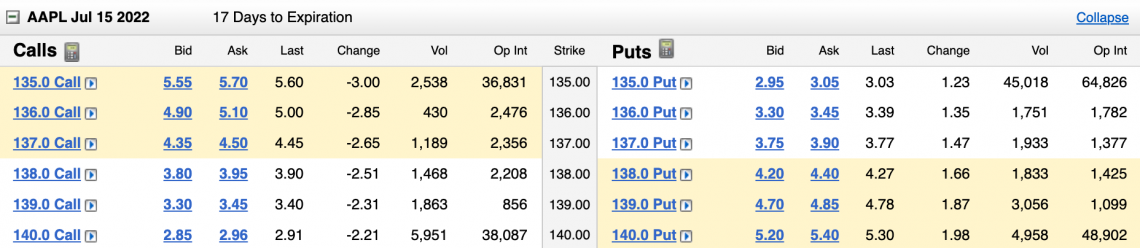

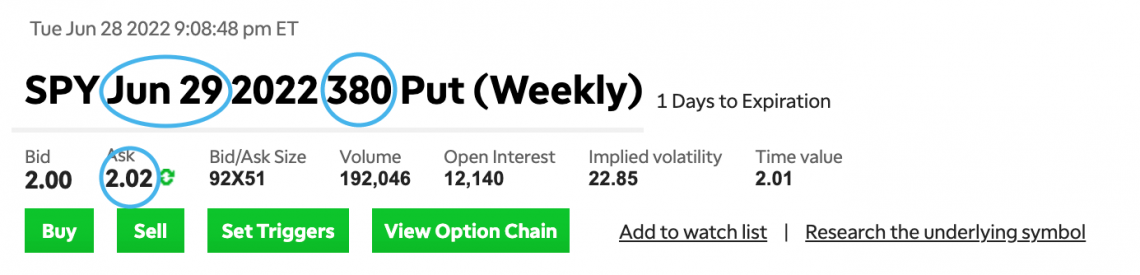

In this example, the expiration date is the 29th of June, 2022, the strike price is $380, and the premium to buy is $2.02.

The strike price is when an option becomes either in the money, at the money, or out of the money. The purchaser of an option has the right to buy or sell 100 shares of the underlying stock for that price on the expiration date.

The expiration date is the date at which the option expires. It can no longer be exercised after that date.

Options can be exercised beforehand, but typically investors choose to close their position by selling the option contract to another investor or by purchasing back the option they sold if they created a short post.

The premium is the price of purchasing the option. It is expressed as a price per share. This means a chance with a $2 tip would cost a purchaser $200. $2 for each of the 100 shares in the contract.

Contract Price = Premium x 100 shares

This premium is essentially the price an investor is willing to pay for increased leverage. Instead of needing capital to purchase 100 shares, an investor has to pay the premium for the option to control those shares. This leverage can lead to portfolio volatility.

Several factors determine the price of an option contract. These include the difference between the strike price and the current market price of the stock, the time until expiration, and the expected volatility of the stock price.

Types of Options

The two types of options contracts are calls and puts. Call options are the right to buy, and put options are the right to sell.

Furthermore, an investor can take either a long or short position on these options. This is analogous to buying or selling the option contract itself. What is the difference? One investor is taking on the risk while the other is purchasing the leverage of 100 shares.

Let’s take a look at a call option as an example. Buyers of a call option believe that the option's price will exceed the strike at expiration. For this reason, they are buying the right to purchase those shares at the strike price on that day.

Immediately after purchasing those options, they could sell the acquired shares on the market for the market price, netting the price difference.

In this example, the seller of the call option is required to fulfill the order. They must sell the 100 shares to the option owner at the strike price, regardless of the current market share price.

For a put option, the thinking is much the same. The purchaser of a put option has the right to sell a chance at the strike. They hope that the underlying stock's price goes below the strike price so they can make a difference.

Much like the call option example, the put option seller has promised to fulfill the order. In this case, they purchase the shares at the strike, regardless of their market price.

Understanding Naked Options

With an understanding of the seller’s obligation to purchase shares (in the case of a put) or sell shares (in the case of a call), we can look at a more specific selling strategy: the naked option.

A naked option allows the contract seller to collect the premium of selling the contract without holding any collateral in their account. The type of collateral held in a secured position varies depending on whether the seller sold a call option or a put.

Typically, or for a more risk-averse investor, they would also hold 100 shares of the underlying security in their account when selling a call option.

This is because if the option contract were exercised, they would need to sell those 100 shares at the specified strike price to the option contract owner.

This is a strategy known as a covered call because the contract seller has the shares needed to cover their obligation.

When the contract seller does not own the shares of the underlying, they are considered to be in a naked position.

Similarly, with a put option, an investor would hold collateral to cover their obligations for the trade. Seeing as a put option requires the seller to purchase shares as exercised, the collateral held by investors would be cash rather than shares.

This situation, known as a cash-secured put, ensures that the seller of the contract has enough money set aside to cover their obligation to the contract owner once again.

An important thing to note is that covered calls, and naked calls (short calls) are betting on different price movement directions. This is because fluctuations in the underlying asset in a covered call also affect the profit and loss regardless of whether the option expires in the money.

Naked Options Risks

The risk associated with this type of trading strategy is immediately apparent. Losses can be extreme if no collateral is held to fulfill the contract obligations. Investors are effectively on thin ice.

In the case of a naked call, the seller of the contract would have to purchase 100 shares of the underlying security to sell to the person who exercised the agreement.

The buyer would likely exercise the contract in a situation where the market price is above the strike price. The price difference would be the loss for the original seller, which is potentially unlimited.

Sellers of naked puts have limited but potentially significant losses in the case of adverse price movement. However, this loss is capped at 100 shares of the strike price in the case where the stock price plummets to zero.

This is because the contract owner can exercise the warrant, purchase shares, and immediately sell the contract seller for the strike price. The seller would now be left with claims worth less than what they bought them for.

Regardless of whether it was a call or put sold, a lack of collateral can lead to liquidation of the account. If there is insufficient cash in the budget to pay the price difference in either situation, the account owner would be forced to exit other positions to fulfill obligations.

This can be as extreme as an entire portfolio being reduced to nothingness if the value of other positions is not enough to make up for the price differences. In cases where the margin is used in a portfolio, there is even potential for bankruptcy!

Naked Options Benefits

The most significant potential upside of selling a naked option is the ability to collect premiums without holding any collateral. While tips always benefit an investor, not having collateral gives an investor much more flexibility.

For an investor expecting downward price movement, selling a naked call allows the investor to collect a premium immediately. Again, we can compare this to buying a put (a strategy for downward price movement).

In general, purchasing the put is only profitable if the underlying dips below the strike price by the premium they paid.

On the other hand, selling a naked call is profitable if the stock does not rise by the premium amount above the strike price.

Historically contracts expire out of the money 70% of the time; therefore, selling a naked call has a higher probability of profitability than buying a put, even though they are both bearish strategies.

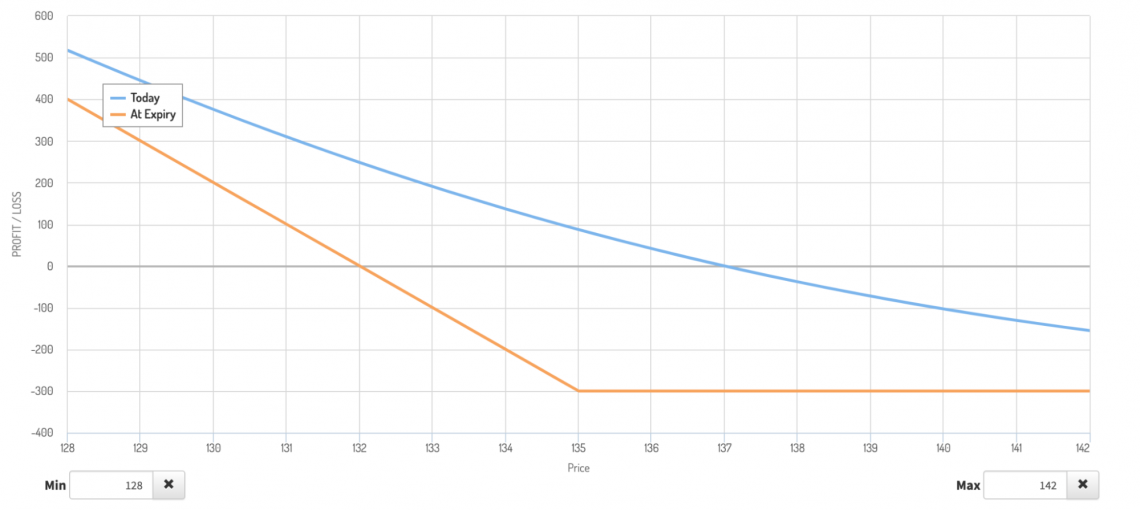

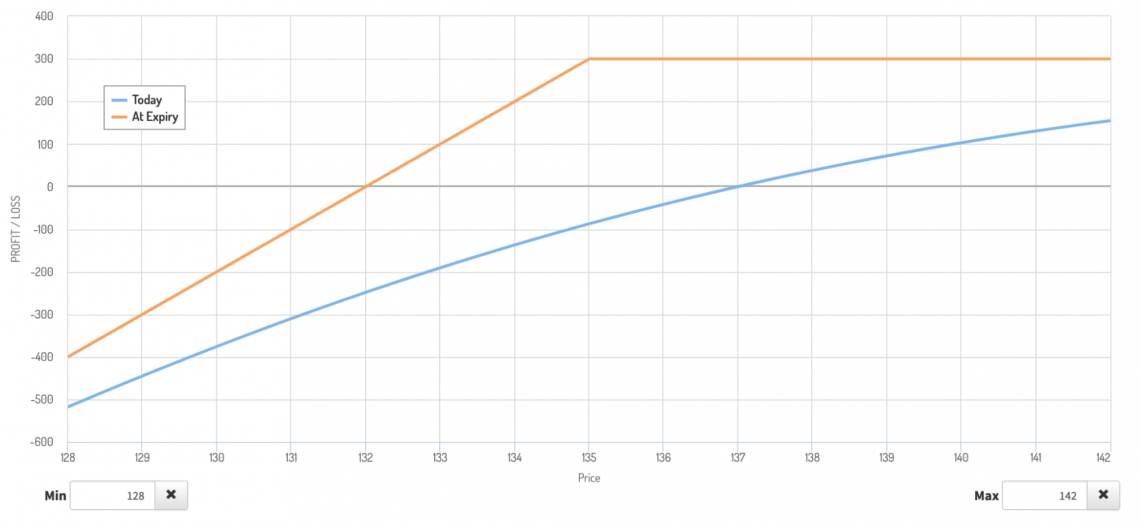

Let's look at an example of the profit and loss charts for a company currently trading at $137 per share.

This graph details the profit and loss graph today and at expiration for purchasing a put with a strike price of $135 for a $3 premium. As we can see, the trade has potentially unlimited gain, becoming profitable as the price drops below $132.

As we can further see from the graph. Simply reaching the strike price would leave the investor at a loss since they already spent money purchasing the contract. Therefore, the underlying price must drop by $3, the premium, for the trade to break even.

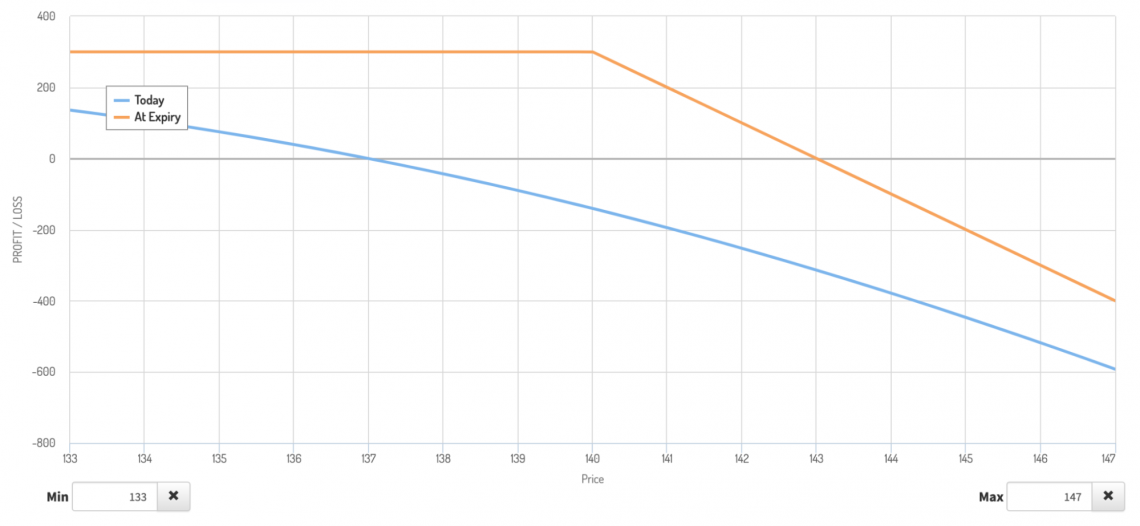

If we compare this to selling a naked call with a strike price of $140 and a $3 premium, we can see that we do not need any price change to become profitable. Instead, we need the price to not rise up and above $143. Beyond $143, there is potential for unlimited loss.

When comparing a naked put to a cash-secured put, the profit and loss expectations are the same (This is worth mentioning because the covered call strategy bets on price movement in the opposite direction of a naked call).

Both naked and cash-secured puts are used when there is an expectation of upward price movement. The only difference between these two strategies is the opportunity cost of having cash set aside to cover the price difference in cases where the buyer exercises the contract.

Comparing selling puts to just buying call options (which also bet on upward price movement), The seller of a naked put can collect a premium immediately, and the investor incurs a loss only if the price moves significantly in the opposite direction.

As we can see, selling a put at the $135 strike price with a $3 premium for the same security is profitable unless the underlying drops below $132.

The advantages of selling a naked put instead of buying a call option are identical to the differences between selling a naked call and buying a put. Investors collect premiums now with the chance of losses rather than paying a premium for potential gains.

Researched and authored by Jacob Rounds | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?