Triangular Arbitrage Opportunity

It is a low-risk strategy where a trader exploits price discrepancy between three currencies to make an almost risk-free profit.

What Is A Triangular Arbitrage Opportunity?

Triangular Arbitrage Opportunity is a trading strategy mostly used in foreign exchange markets. This strategy capitalizes on the price discrepancy between three different currencies to make a low-risk profit.

Arbitrage involves leveraging pricing disparities between different markets for identical items or commodities. Triangular arbitrage is mostly used in the foreign exchange (forex) market due to temporary inconsistencies or inefficiencies in exchange rates among three currency pairs.

These discrepancies can arise for several reasons, some of the biggest being:

- Market inefficiencies

- Latency in information dissemination

- Market order imbalances

- Geopolitical events

As the opportunity for triangular arbitrage is created due to market inefficiency, the window of opportunity is typically very short-lived, often lasting for only seconds or minutes.

Institutional traders and algorithmic trading systems actively monitor the markets to exploit these opportunities, which makes it so a successful triangular arbitrage requires fast execution, sophisticated trading tools, and careful consideration of transaction costs and the risks involved.

Key Takeaways

- Triangular Arbitrage is a low-risk strategy where a trader exploits price discrepancy between three currencies to make an almost risk-free profit.

- Triangular Arbitrage Opportunity has a small window, so the trades must be executed quickly.

- Because of its simple concept, the strategy can be easily automated and is regularly explained by the High-Frequency Traders (HFTs).

- Arbitrage traders exploit market inefficiency, ultimately making the markets more efficient.

Example of a Triangular Arbitrage Opportunity

We know that arbitrage opportunities occur due to market inefficiency, so similarly, a triangular arbitrage opportunity arises in forex trading when a currency is overvalued in one market and undervalued in another market.

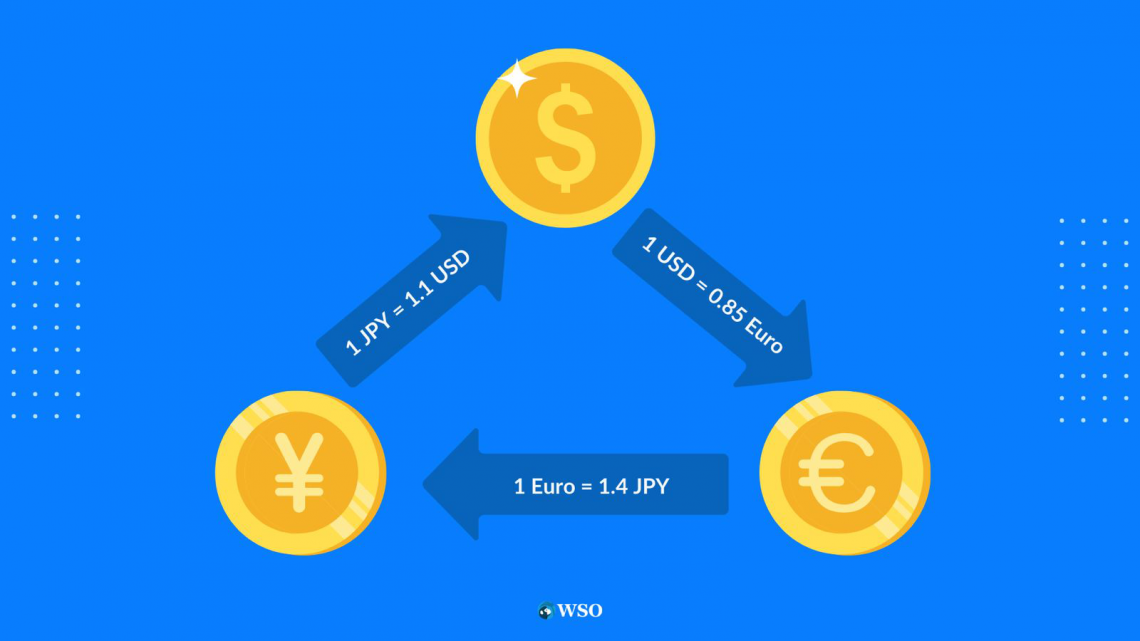

Let’s understand it with an example. A forex trader, Bob, has 1000 USD and is looking for an arbitrage opportunity to make a low-risk profit. He finds a discrepancy between JPY (Japanese Yen), Euro, and USD.

Bob observed the exchange rates between the three currencies as follows:

- 1 USD = 0.85 Euro

- 1 Euro = 1.4 JPY

- 1 JPY = 1.1 USD

Bob started to exploit this difference by using a triangular arbitrage strategy, the process of which is as follows:

- He first buys Euro with his 1000 USD, which comes out to be 850 Euro (1000 x 0.85)

- Then he buys 1190 JPY with 850 Euro (850 x 1.4)

- At last, he buys 1309 USD with 1190 JPY (1190 x 1.1)

So, at the end of his trading, Bob made a low-risk profit of 309 USD just by exchanging currency in the open forex market.

The above example is for understanding how the concept of triangular arbitrage works.

Note

In real-world trading, one has to keep in mind that the price discrepancies are very small in most cases, and there are trading fees involved, which impact the end profit.

Impact of Automation in Triangular Arbitrage Strategy

The evolution of the internet and the integration of technology into financial markets have ushered in a new era of efficiency, with information flowing almost instantly to every trader.

However, this efficiency surge has profoundly impacted arbitrage opportunities, especially in triangular arbitration.

As there is less gap in information in the market, the arbitrage opportunities have become smaller and smaller, requiring more significant investments to make a reasonable profit. In most cases, the price difference in an arbitrage opportunity is in cents or a fraction of cents.

Automated trading has reduced arbitrage opportunities for manual traders, as algorithms can quickly identify and exploit opportunities.

As there is no deep analysis required to exploit arbitrage, as the strategy is to just look for price discrepancy between similar or correlated assets in different markets, it is very easy to program a trading algo to screen different markets to find the opportunity.

So, by the time a manual trader finds an opportunity to implement the strategy, an automated trading bot would have already traded multiple times, making the price difference smaller and smaller.

By the time the trader has put his trade, the potential profit would have become so small that after all the expenses, it may not even be worth it to make that trade, or the trader will have to put in a higher investment amount to make the trade worth his time.

But as the barrier of entry for access to an automated trading bot has gone down, an average trader with an internet connection, basic knowledge of trading, software, and a system (PC or laptop) can take advantage of automation.

Risks and Considerations in Triangular Arbitrage

In principle, arbitrage is a low-risk method to earn since you just purchase a commodity in one market and sell it in another, pocketing the difference.

However, there are inherent risks when using a triangle arbitrage method that might result in losses. The following are some key considerations to remember when executing the arbitrage strategy.

Transaction cost

Transaction cost is one of the main costs that reduce the profit margin earned on the triangular arbitrage strategy. As the strategy requires multiple trades in rapid succession, the cost of brokerage can add up fast, eating the profit margin.

Regulatory compliance

After transactional costs, regulatory costs like taxes are the next big profit eaters. Most governments want investors to invest long-term in the economy, and strategies like arbitrage are discouraged by putting them under higher tax brackets.

Another regulatory risk is that the government may stop the free trading of its currency in the forex market. Countries like China and India have higher levels of currency controls in comparison to the USA and Japan.

Execution risk

The time frame for executing an arbitrage strategy is usually very small. Hence, the trader has to move quickly and be willing to keep track so that the window of opportunity does not close in the middle of the trade.

Capital requirement

As the difference that can be exploited has decreased considerably, the amount of capital required to make a reasonable profit after accounting for all expenses has risen. To make a proper return, one must trade hundreds of thousands of dollars.

Liquidity risk

Liquidity risk is a situation where the trader cannot exit the arbitrage trade due to low market demand for the currency.

Even if a trader finds a good arbitrage forex trade, if the currencies have low liquidity, the execution of the trade will be difficult and might result in an overall loss.

Currencies like the Brazilian Real, the Argentine Peso, and the Chilean Peso are known to have low liquidity, as the government heavily controls their market price and international trades.

Market Competition

The automation potential of arbitrage strategies, coupled with minimal market analysis requirements, has led to widespread adoption by High-Frequency Traders (HFTs).

The expansion of the internet and digital trading has intensified competition, driving lower profit margins. As trading bots scour forex markets for discrepancies, human intervention diminishes, making rapid execution essential for success.

Triangular Arbitrage Opportunity FAQs

A triangular arbitrage algorithm is an automated trading bot programmed to scan the markets for arbitrage opportunities and perform automated trades based on pre-set criteria.

Automated trading algorithms and bots have transformed the trading landscape. Strategies that used to take hours to screen and execute can now be completed in seconds with preset conditions.

In theory, arbitrage is not a risk-free but a low-risk strategy, as you are just buying an asset from one market and selling it in another market and pocketing the difference.

Points to keep in mind while performing the arbitrage strategy to reduce the risk are

- Transaction cost: Transaction cost is the largest cost contributor for an arbitrage trade, as in this strategy, the trades have to be done back to back and in quick succession, the trading cost can add up fast, eating into the profits.

- Government regulation: Governments regularly regulate their nation's assets and markets, so the trader has to keep in mind the regulations that involve the asset and market in which he is trading.

- Execution Risk: Sometimes, a good profit-making opportunity can turn into a loss trade due to simple execution errors. Some examples of these execution errors are late trade input, misjudgment of available margin, and misjudgment in determining market liquidity.

Everything You Need To Master Valuation Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

or Want to Sign up with your social account?