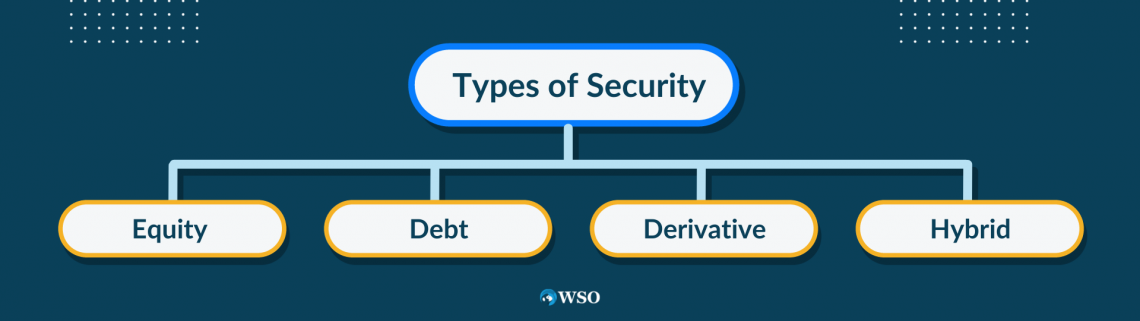

Types of Security

Financial securities can be categorized into four types: Equity, Debt, Hybrid, and Derivatives.

What Are The Types Of Security?

Securities are tradable financial products with monetary value and can be traded for cash. In general, the term "security" refers to all sorts of financial securities; nevertheless, the legal definition varies by jurisdiction.

In some jurisdictions, securities may only refer to stocks or fixed-income instruments, whereas others may include equity-like products such as equity options or warrants.

Financial securities can be categorized into four types: Equity, Debt, Hybrid, and Derivatives. Equity securities represent an ownership of a company, which gives the holder the right to the residual profits of the company.

On the other hand, debt securities represent ownership of a loan given to an entity which can be a secured as well as unsecured loan. Hybrid are securities that have properties of both equity and debt securities, for example Preference shares and Convertible bonds.

Derivatives are securities that derive their value from an underlying asset and do not represent any type of equity ownership of a company or ownership over any loan given to an entity.

Key Takeaways

- Securities are tradeable financial instruments with monetary value that can be liquidated for cash.

- Different regulatory authorities regulate securities depending on which country the security is trading.

- Securities can be traded on financial markets like the New York Stock Exchange and the Bombay Stock Exchange.

- There are four types of securities: Equity, Depth, Hybrid, and Derivatives.

- Some examples of securities or financial instruments are Stocks, Bonds, Mutual Funds, and Options.

Equity Securities

Equity securities are securities that represent an ownership stake in a business. The most common equity security is equity shares or stock in a company.

The holder of equity securities has certain rights and perks as this class of securities comes with high risk, and to offset that risk, it has the potential to generate the most returns compared to any other securities.

Examples of these perks are voting rights in the company, a share in profits generated by the company, and more favorable tax rules under capital gains tax.

These perks are given to equity holders to offset the high level of risk that comes with this class of securities. Equity is more risky than debt investments as, in almost all cases, equity holders are the last to get paid.

Whether it is the distribution of profits or a share in the liquidation process during bankruptcy, the equity holder is last in line regarding recouping their investments.

Debt Securities

Debt securities, also known as fixed-income securities, represent a loan that is lent to a borrower at a fixed interest rate and has a specified maturity period at which the borrower has to pay back the loan or securities value.

The security represents ownership of the loan, and whoever holds the security gets the benefits of the said security, like coupon payments, interest payments, or principal payments at maturity.

Most debt securities have a relatively low-risk profile because collateral often backs them. Even when collateral does not back the debt security, it has a seniority claim over other securities, making the holder first in line to get paid in almost all cases.

Both government and private institutions use debt securities to raise money. Some of the well-known debt securities are bonds, certificates of deposit, and commercial paper.

Government Bonds

Government bonds are a capital market instrument issued by the central bank and allow both local and central governments to borrow money from the public.

These bonds are considered extremely safe based on the country that issued the said bonds. Due to low risk, government bonds have lower coupons or interest than corporate bonds.

Corporate Bonds

Corporate bonds are debt securities that private and public corporations issue, and are capital market instruments.

These bonds have higher interest rates than government bonds but mostly these interest rates depend on the issuing company. A well-established and profitable company like Apple will have a low-interest rate bond, while any other less profitable company will have a relatively high-interest rate.

Certificate of Deposit

A Certificate of Deposit is a security that represents a locked-in security deposit with a financial institution with a fixed interest rate on the total amount for a fixed period.

An investor can create these certificates by depositing a set minimum deposit with a financial institution, like a bank or a NBFC, for a certain length of time in exchange for a greater interest rate than normal deposits.

These certificates can be exchanged on the open market (more often trading at a discount), and they can also be redeemed early if necessary, although the bank will levy a penalty for doing so. Certificate of Deposit is a money market instrument.

Commercial Paper

Commercial paper is another type of money market instrument firms typically issue to address their short-term financial needs.

Commercial papers are mostly unsecured promissory notes having a fixed interest rate and the right to get the full payment of principal plus interest at the end of the maturity period. The government also issues a similar financial instrument known as a Treasury bill to fund its short-term financial requirements.

Derivatives Securities

The securities that derive their value from an underlying asset are classified as Derivatives.

Derivative securities differ from stocks or bond securities as a derivative contract does not represent any type of equity ownership of a company or ownership over any loan given to an entity.

It is just a contract between two parties on how the underlying asset's price will move in the future. And are used mainly by two types of investors;

- A hedger; an Investor that already has financial exposure to the underlying asset and takes an offsetting position using derivatives to limit the potential risk, and

- A speculator; Investor who is looking to make a profit by betting on the movement of the underlying asset's price.

Derivatives can be categorized as shown below: futures, options, swaps, and forwards.

Forwards Contract

A forward contract is a contract between two parties agreeing to buy or sell a particular commodity at a specified time and rate. This commodity acts as an underlying from which a forward contract gets its value.

Forwards being a non-standardized contract means it can be customized by the parties involved in the deal as per their requirements. But this also means forwards do not trade in exchanges as the parties involved tailor every forward contract.

Futures Contract

A futures contract is just like a forward contract where two parties agree to buy or sell a particular commodity at a specified rate at a specified time. Futures contracts vary from forwards because they are standardized contracts that can be traded in derivatives markets.

Options Contract

An option derivative is a contract that allows the holder the right but not an obligation to purchase or sell the underlying asset at a fixed price on the contract's expected date.

The primary distinction between an options contract and a futures contract is that there is no commitment to complete the purchasing and selling transaction in an options contract. But options, like futures, are standardized contracts that can be traded in the derivative markets.

Swaps

Swaps are a type of derivative contract that allows two parties to exchange the cash flow of two different instruments. Meaning, that the underlying itself is not changing hands in the case of a swap contract; only the cash flow structure is changing hands.

For example, consider two homeowners, A and B, who have differing mortgage terms: A has a fixed-interest rate mortgage, whereas B has a floating-interest rate mortgage.

So, if B expects the interest rate will climb in the future and A believes it will fall, both will join into a swap contract after defining the notional principal amount and a maturity date.

This allows both parties to take each other's interest payment obligation without going to their lender to renegotiate the mortgage.

This concept similarly works on other financial assets like fixed interest rate bonds or assets that generate a return in a different currency, the parties create a contract to swap their income based on their future outlook.

Hybrid Securities

Hybrid securities are a hybrid of a debt security and an equity security, with some debt security characteristics and some equity security characteristics. Some well-known forms of hybrid instruments are:

- Preference shares: Preference shares have limited voting power but give preference over the common equity share in terms of dividend rate and payout during liquidation.

- Convertible bonds: As the name suggests, this is a type of bond that can be converted into the common stock of the issuing entity. It gives the investor the benefits of the price appreciation of equity with a fixed income structure of a bond.

- Equity warrants: Equity warrants are just like an options contract where the holder of an equity warrant has the right but not the obligation to buy the equity stock of the issuing entity for a specified price under a fixed time frame.

- The main difference is that, unlike options, equity warrants are issued by the company itself and not the exchange. For the most part, Equity warrants are issued as a part of a larger financial deal.

- For Example, Warren Buffet's deal with Goldman Sachs in 2008 gave Berkshire Hathaway Equity Warrants to buy an additional US$5 billion of common stock at US$115 per share of Goldman Sachs within the next five years.

Types of Security FAQs

Securities are tradable financial products with monetary value and can be exchanged for cash. In general financial language, "security" is used for almost all financial products with a monetary value.

Security can represent various rights given to the holder depending on the type of security. Equity security represents ownership in the issuer's organization, and debt securities represent a creditor relationship between the holder and the borrower.

Securities can be classified into four types:

- Equity is a security that represents ownership in the security issuer’s organization. Examples of equity security are stocks or shares in a public company.

- Debt is a security that represents a creditor relationship between the holder and the borrowing entity. An example of debt security is bonds.

- A derivative is a security that derives its value from an underlying asset. It does not represent ownership of a company or establish a credit relationship; instead, it is a contract or a speculative bet on the underlying asset's price movement.

- Hybrid security has the property of both equity and debt securities. Preference shares, convertible bonds, and equity warrants are some well-known forms of hybrid instruments.

Howey test is a type of litmus test with four criteria used by the SEC to determine if an asset is an investment contract and if it is required to be registered with the SEC.

The following are the four criteria for a Howey test:

- An investment of money

- In a common enterprise

- A reasonable expectation of profit

- Derived from the efforts of others

If a transaction satisfies all four criteria, then it is classified as a security and will have to follow the rules of the SEC. The name of the test comes from the case SEC v. W. J. Howey Co.

Everything You Need To Break into Private Equity

Sign Up to The Insider's Guide on How to Land the Most Prestigious Buyside Roles on Wall Street.

or Want to Sign up with your social account?