Valuation Principles

These are the present value of a business, an investment, or an asset.

What Are Valuation Principles?

Valuation principles are the present value of a business, an investment, or an asset. There are several widely used Valuation Principles. Analysts who seek to assign a value to an asset typically consider the asset's or company's potential for future earnings.

The main goal of analysts when undertaking the valuation is to see whether the company is undervalued or overvalued and to determine the fair value of an enterprise. This is mainly realized when buying or selling a business for:

- Strategic Planning

- Capital Financing

- Securities Investing

The most widely used techniques for valuation are DCF analysis, Comparable company analysis, and Precedent transactions. One might employ the three methods when valuing a company or asset.

- Asset Approach: The Asset Approach determines each asset's fair market value, frequently considering the construction or replacement costs. Real estate, such as commercial property, newly built homes, or special-use sites, can be valued effectively using the Asset Approach approach.

- Income Approach: The Income Approach is the next, with the discounted cash flow (DCF) method being the most popular. The DCF method represents the most comprehensive and detailed approach to valuation modeling.

- Market Approach: The Market Approach, a relative valuation principle often employed in the finance sector, is the last method. It includes Precedent Transactions Analysis and Comparable Company Analysis.

Key Takeaways

- Enterprise valuation relies on five primary principles: projected profitability, Discounted Cash Flow (DCF) analysis, consideration of associated risks, subjectivity, and the negotiation of the final acquisition price.

- The estimated value of a company will always differ from the real price of the acquisition.

- We have three main approaches in Valuation: Discounted Cash Flow (DCF) method, Precedent Transactions Analysis, and Comparable Company Analysis.

Understanding valuation principles

A lot of companies have distinct growth phases as well as separate sectors. Consequently, numerous valuation principles are to be considered. Here is a list of the five most common valuation principles encountered in the investment banking world.

Projected profitability

In most M&A transactions, the buyer will look at what the company offers regarding earnings and opportunities. Past performance may indicate operational momentum, but it is not enough when computing the value of a company.

Example: Traditional car manufacturers may have a strong historical operational profitability, but investors are cautious due to the rising market share of electric vehicles, leading to differing future projections.

Discounted Cash Flow (DCF)

The DCF is a key criterion for companies that do not possess numerous assets like insurance, software, and consulting corporations. Investors accentuate their analysis on the discounted cash flow generated from the activity to get a better valuation approach.

Risk involved

Evaluating the potential risks associated with a company or its industry is paramount. Generally, higher uncertainty translates to lower valuations.

Example: Companies involved in legal disputes or operating in politically unstable regions often face increased risk.

Subjectivity

Analysts may interpret balance sheets and income statements differently. Indeed, two distinct investment banks will not obtain the same valuation of company A.

This is partly due to eliminating non-recurrent and non-necessary expenses from the EBITDA, which is considered a subjective exercise. As a result, each party will have its view on the matter.

Negotiation of the final price

Estimating an institution's worth is vital in assessing the final acquisition price. Here, the buyer could purchase his target by placing a higher bid than expected.

This situation can lead to the target company being overpriced. Such a decision might be driven by the buyer's recognition of strategic value and potential future synergies resulting from the acquisition.

Everything You Need To Master Valuation Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Comparable Company Analysis (market approach)

This analysis will focus on valuing "Orange SA," a prominent French multinational telecommunications corporation.

Financial forecasts

First, the analyst will pick comparable companies that have the following characteristics:

- Industry classification (telecommunications)

- Size

- Geography (Europe)

- Growth rate

Deutsche Telekom, British Telecom, Telefonica, and Telecom Italia meet all these requirements.

For this illustration, we will exclusively consider Deutsche Telekom as of 21/10/2019.

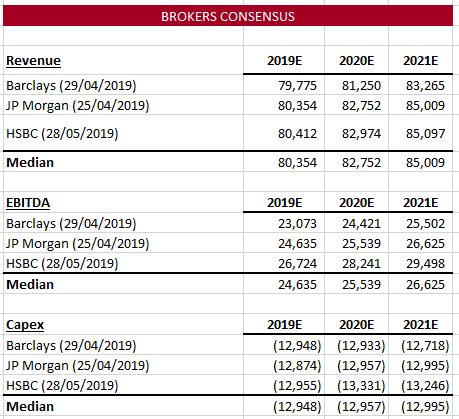

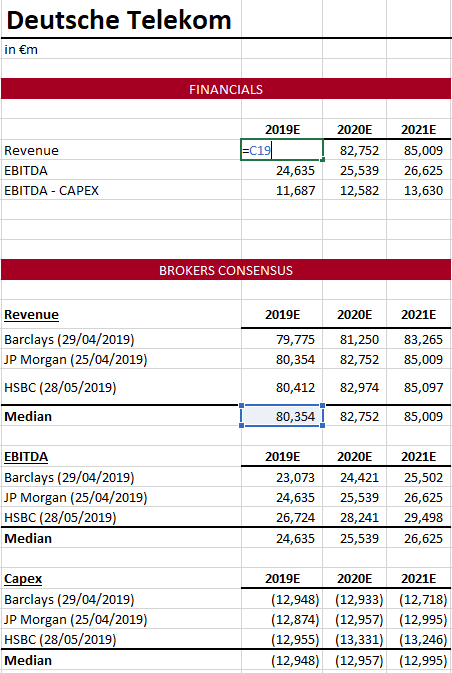

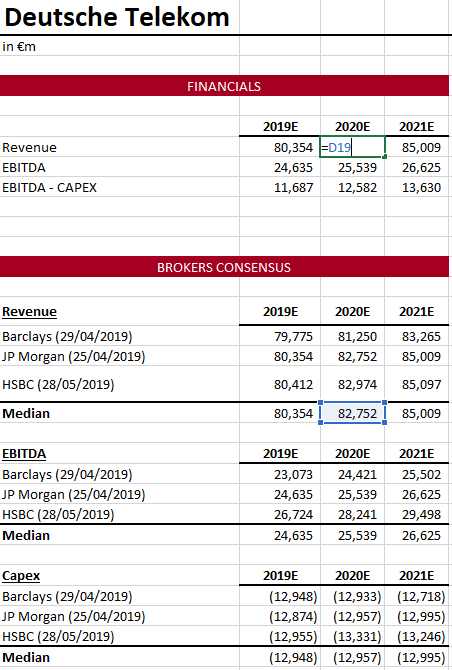

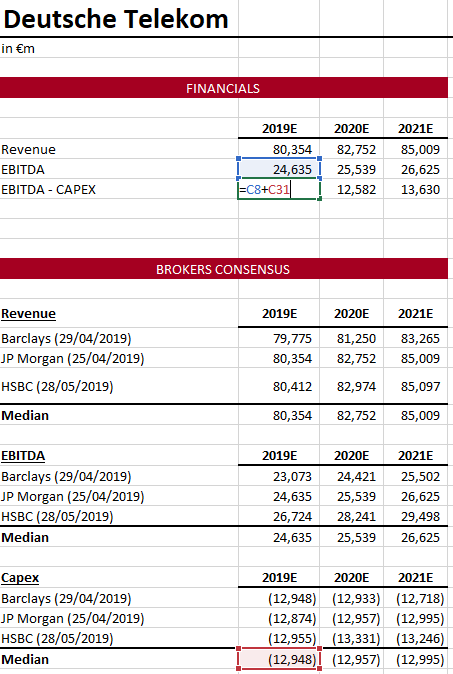

Below is an Excel sheet detailing revenue, EBITDA, and CAPEX forecast for 2019, 2020, and 2021. The goal is to find estimates from well-known brokers like Barclays, JP Morgan, or HSBC.

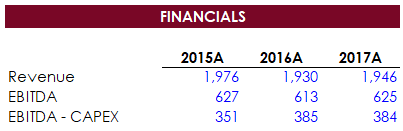

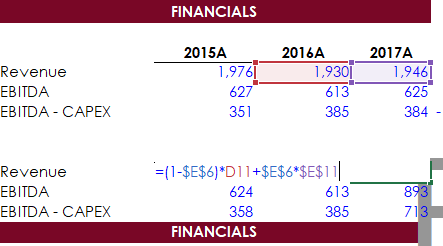

In a section called Financials, you can highlight all your past inputs from Brokers Consensus, as shown in the pictures below.

Consensus Estimates

Consensus estimates are the average of analyst expectations for a stock's sales and earnings.

The accuracy of these projections depends on several variables, including the availability of corporate data, historical financial statements, and projections of the firm's product market.

A company's stock price may fall or rise depending on whether it beats or exceeds consensus expectations.

Share Price

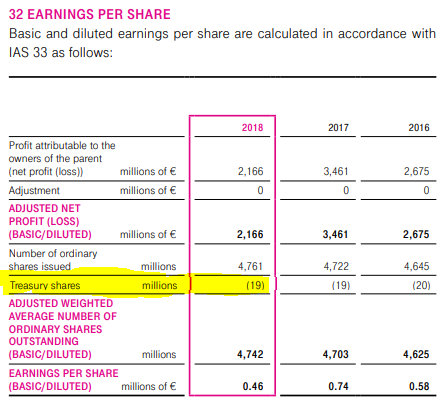

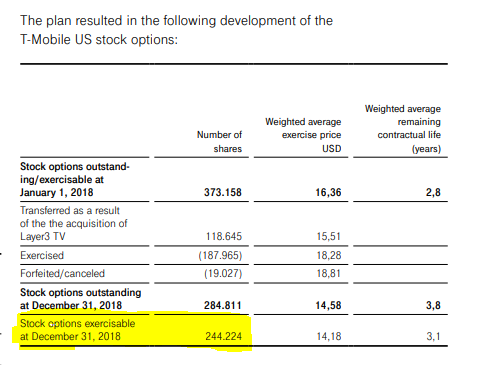

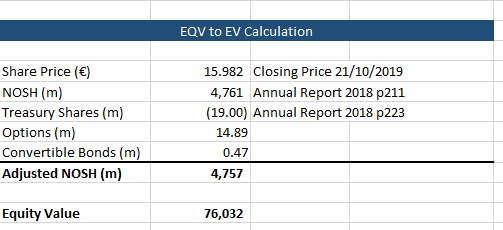

Navigate to Deutsche Telekom investor relations → Publications → Quarterly Results → Choose the previous year (in this case, 2018) → Scroll down to Annual report & Summary of Share Property → Download the Annual report.

In the annual report, you will find:

- The NOSH (number of shares of Common Stock outstanding) p 211

Under the Section: "18 SHAREHOLDERS' EQUITY ISSUED CAPITAL"

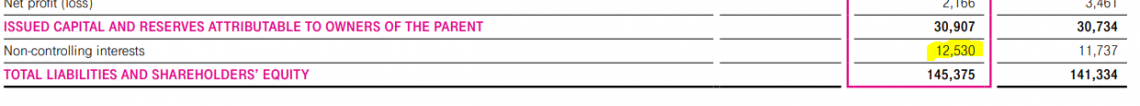

On December 31, 2018, Deutsche Telekom possessed a capital equivalent to 12 million euros with 4.8 billion shares. - Treasury shares (Stock that the issuing corporation purchases back) p 223

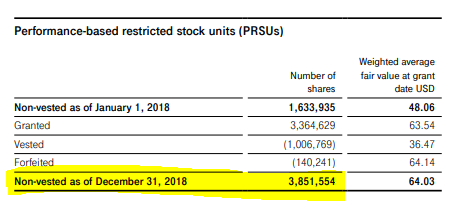

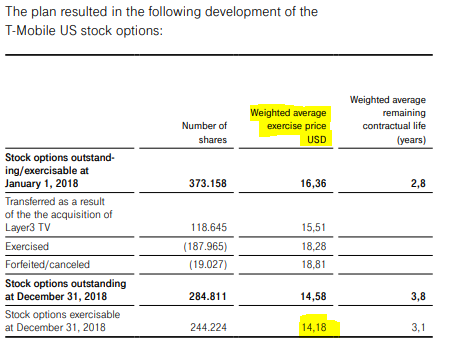

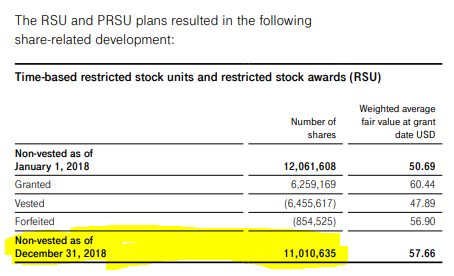

- Options ( Businesses may provide them to workers, independent contractors, consultants, and investors as a form of remuneration.) p 235

An option is a derivative that gives the right to acquire an underlying asset (stocks, commodities, bonds) before a particular deadline. Note that the owner is not obliged to activate the option.

This financial instrument can hedge a position and thus reduce the risks involved in an investment. Options are often obtained through purchase, as payment, or as a component of a complicated financial transaction.

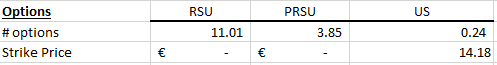

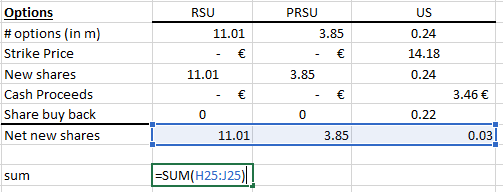

In this case, we have the RSU, PRSU, and US options.

P.S.: Convert the number of shares in millions.

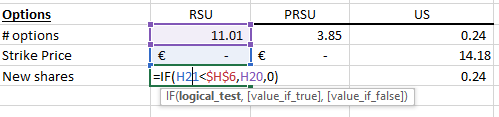

We will look for the exercise price or strike price. The exercise price is an agreed price between the buyer and seller. In this scenario, the investor should convert his options if the strike price is lower than the market price.

This information is only available for the US stock options, as shown in the picture below.

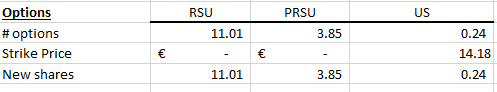

Here, you will find the Excel sheet showing the input that we found.

After that, if the strike price is lower than the market share price, the bonds will be converted to common stock (shares).

Finally, the number of shares converted is as follows:

Treasury Stock Method

This method calculates the net number of shares available by considering new shares times the strike price. The company uses the cash proceeds to repurchase shares.

Share buyback = Share Proceeds / Share Price

The net number of shares available = New shares - share buyback

The total number of options equals 11.01 + 3.85 + 0.03 = 14.89 million shares.

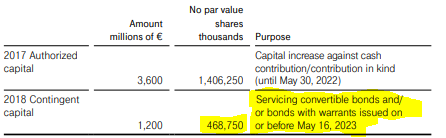

We should also seek other convertible options p 213.

Other convertible bonds = 0.468750 million shares

Adjusted Nosh = NOSH - Treasury Shares + Options + Convertible Options

Equity Value = Adjusted Nosh * Share Price

At last, we get the following Excel table,

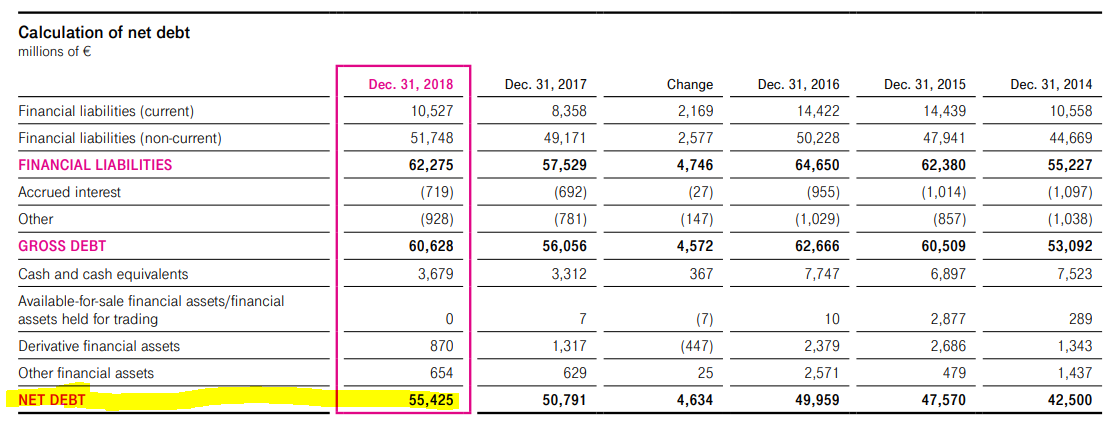

Bridge (Net debt, minorities, associates, pensions, provisions)

We will look for the Net debt p 57.

For the Minorities p 147

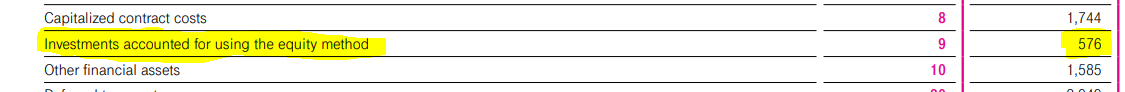

For the Associates p 146

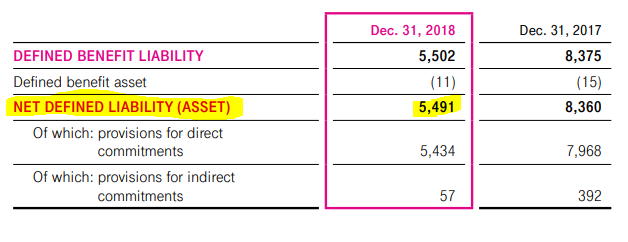

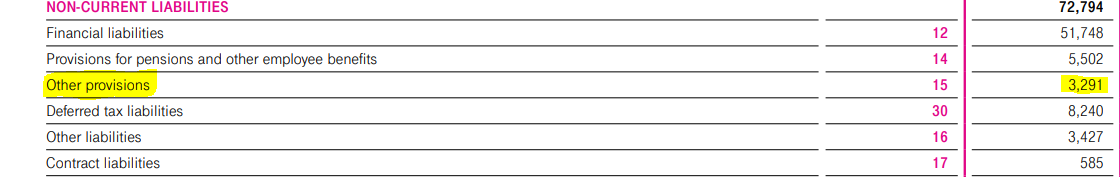

For the Pensions p 201 and Provisions p 147

Enterprise Value

Enterprise Value= Equity Value + Net debt + Minorities + Associates + Pensions + Provisions

Enterprise Value = 152 193 in €m

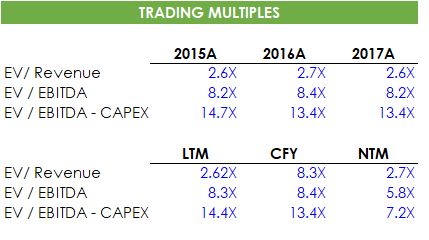

Trading Multiples

| 2019E | 2020E | 2021E | |

|---|---|---|---|

| EV / Revenue | 1.9X | 1.8X | 1.8X |

| EV / EBITDA | 6.2X | 6.0X | 5.7X |

| EV / EBITDA - CAPEX | 13.0X | 12.1X | 11.2X |

- Trading multiples are metrics determined by research analysts and vary depending on each industry.

- Choosing a multiple can be subjective and should be adjusted for each company.

- To choose a multiple, analysts consider the following criteria: business plan, revenue growth, industry (tech, pharmaceutical, real estate, banking), location, and clients.

- Always remember that sell-side analysts compute the value of an enterprise, but the acquisition cost will always be negotiated. Based on these negotiations, the buy side will perform due diligence, and the final price will evolve.

Final Output

| Market Cap | EV | EV / Revenues | EV / EBITDA | EV / EBITDA-CAPEX | |||||

|---|---|---|---|---|---|---|---|---|---|

| 2019E | 2020E | 2019E | 2020E | 2019E | 2020E | ||||

| British Telecom | 25,827 | 43,721 | 1.67X | 1.68X | 5.30X | 5.30X | 10.50X | 11.60X | |

| Deutsche Telekom | 76032.10 | 152193 | 1.89X | 1.84X | 6.18X | 5.96X | 13.02X | 12.10X | |

| Telefonica | 34,153 | 90,091 | 1.83X | 1.82X | 5.70X | 5.60X | 12.30X | 13.50X | |

| Telecom Italia | 12,369 | 44,199 | 2.30X | 2.35X | 5.50X | 5.70X | 13.90X | 12.00X | |

| Mean | 1.92X | 1.92X | 5.67X | 5.64X | 12.43X | 12.30X | |||

| Median | 1.86X | 1.83X | 5.60X | 5.65X | 12.66X | 12.05X | |||

N.B: To find Orange's enterprise value, multiply its forecasted revenue in 2019 with the median of EV / Revenues in 2019.

The same applies to the other multiples.

Precedent Transactions Method

The Precedent Transaction Method (PTM) is a valuation approach used in finance and investment banking to estimate the value of a company by comparing it to similar companies that have been acquired in the past.

The PTM involves analyzing similar companies' financial metrics and transaction multiples of similar companies and then applying them to the valued company.

This allows for comparing the company's financial performance and potential with those of similar companies that have already been sold or acquired.

Introduction

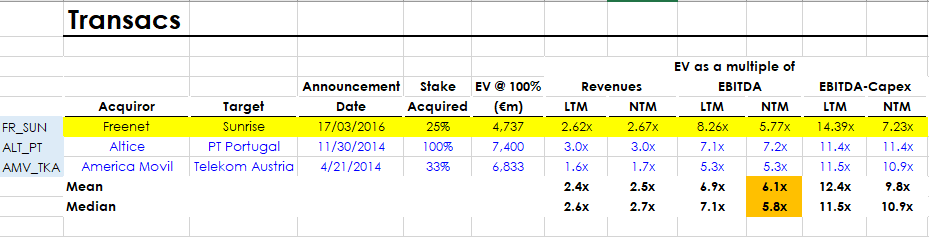

Freenet, Altice, and America Movil are similar companies to Orange and have recently made some acquisitions.

In this article, we will focus on the acquisition of Sunrise by Freenet. These acquisitions will help us compute the Enterprise value of Orange.

| Acquiror | Freenet |

| Target | Sunrise |

| Date | 17/03/2016 |

We will seek forecasted data for 2016 and 2017 in this study since the transaction occurred in March 2016. 2015 information is for the historical context.

Financials

| Revenue | 2015A | 2016A | 2017A |

|---|---|---|---|

| Company | 1,976 | ||

| DB (13-01-16) | 1,923 | 1,939 | |

| UBS (27-01-16) | 1,936 | 1,953 | |

| Median | 1,976 | 1,930 | 1,946 |

| EBITDA | 2015A | 2016A | 2017A |

|---|---|---|---|

| Company | 627 | ||

| DB (13-01-16) | 604 | 623 | |

| UBS (27-01-16) | 621 | 626 | |

| Median | 627 | 613 | 625 |

| Capex | 2015A | 2016A | 2017A |

|---|---|---|---|

| Company | (276) | ||

| DB (13-01-16) | (230) | (257) | |

| UBS (27-01-16) | (225) | (225) | |

| Median | (276) | (228) | (241) |

We can summarize the data with the following table:

Then calculate the LTM (last twelve months), CFY (current full year), and NTM (next twelve months).

Date: 17/03/2016

- January 1 to February 1: 31 days

- February 1 to February 28: 28 days

- 1 Mars to 17 Mars: 17 days

Total = 31 + 28 + 17 = 76

Divide that number by 365, and we get 21%.

So, 17/03/2016 represents 21% of 2016. To find the NTM of the revenue, for example, you follow the below computations.

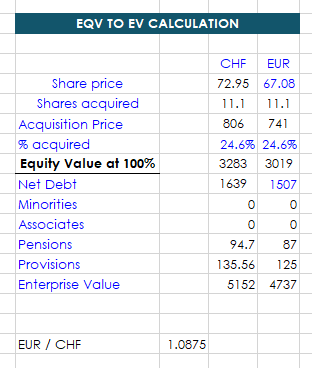

Acquisition Price

The acquisition price of a company is the total amount paid by the acquirer to purchase the target.

- Acquisition Price = 714 million euros

- Share price = 72.95 CHF

- Shares acquired = 11.1 million shares (10,721,395 + 330,183)

- Acquisition Price = 806 million CHF

Source: EQS News

Equity Value

% acquired = 24.6% (23.83% + 0.73% check the source)

Equity Value at 100% = 3283 = 806 / 24.6%

Bridge and Enterprise Value

Check the comparable company analysis to know how to compute the bridge in detail. All info is based on the 2015 Sunrise annual report.

- Net Debt = 1639

- Minorities = 0

- Associates = 0

- Pensions = 94.7

- Provisions = 135.56

- Enterprise Value = 3283 + 135.56 + 94.7 + 1639 = 5152

P.S.: We will convert our results into euros.

On 31/12/2015, 1 EUR = 1.0875 CHF

Trading Multiples

Final Output

N.B: One way of calculating the EV of Orange is to multiply the NTM EBITDA of Orange by the Median of EV / EBITDA.

Discounted Cash Flow Method

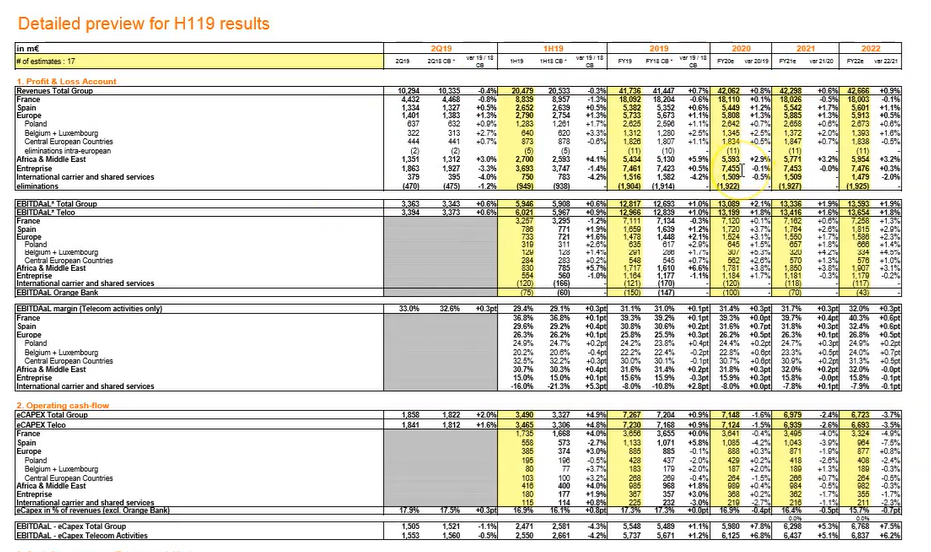

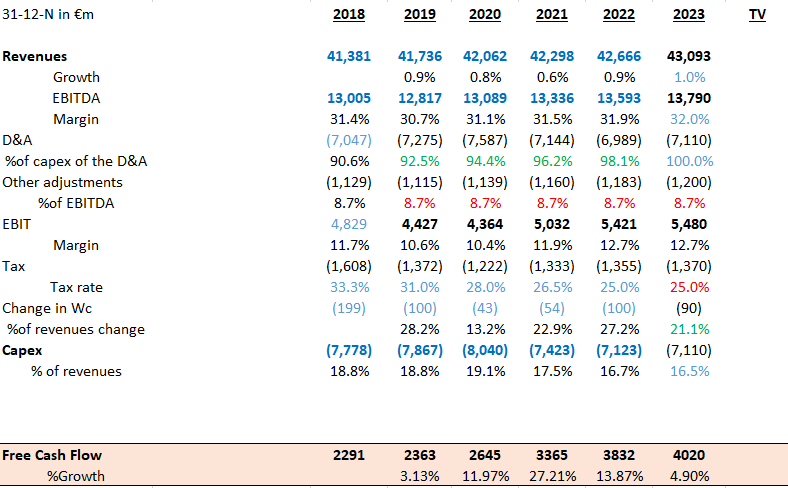

For the Discounted Cash Flow (DCF) method, we consider the current date to be October 2019.

First, we will look for a Detailed preview of the last quarter of 2019 to seek future estimates made by Orange SA.

Type Orange investor relations → Click on latest consolidated results → Finance→ Investor’s library → Collection → Shares and consensus → Consensus → Download the detailed preview Q4 2022 PDF version.

The document should look like this:

One crucial parameter to compute is the Free Cash Flow (FCF).

Enterprise Value = sum of discounted cash flows + terminal value

The owners of financial planning and asset management businesses can profit in several ways using the discounted cash flow (DCF) valuation principle.

The DCF valuation principle can produce results near an underlying stock market value. Valuation professionals can determine the company's fair market value based on the discounted value of future cash flow.

Future sales may be made simpler each year by having the fair market determined by an unbiased study, but there is another significant benefit.

An independent DCF analysis will make it simpler to ascertain the true asset allocation of business owners because many of them have a sizable amount of their wealth invested in the company.

Warren Buffet said:

“Intrinsic value is an all-important concept that offers the only logical approach to evaluating the relative attractiveness of investments and businesses. Intrinsic value can be defined simply: It is the discounted value of the cash that can be taken out of a business during its remaining life.”

Bottom Line For Valuation Principles

The five main principles employed for the valuation of an enterprise are the following: Projected profitability, Discounted cash flow (DCF), Risk involved, Subjectivity, and Negotiation of the final price.

It is imperative to perform a range of tasks to conduct a comprehensive, comparable company analysis, including:

- Financial forecasting

- Determination of equity value via share price

- Application of the treasury stock method

- Construction of a bridge

- Determination of enterprise value

- Analysis of trading multiples.

To arrive at a reliable Precedent Transactions Analysis, it is essential to employ various techniques such as:

- The Treasury Stock Method for determining diluted shares outstanding

- The Constructing of a bridge to adjust for any valuation differences

- The Calculation of the Enterprise Value to assess a company's total value

- The Analysis of Trading Multiples to evaluate its market performance.

The steps involved in a Discounted Cash Flow (DCF) analysis include:

- Projection of future cash flows

- Calculation of discount rate

- Discounted cash flows to present value

- Calculation of terminal value

- Summing of the present values

- Adjusted for debt and other items

- Sensitivity analysis

Everything You Need To Master DCF Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

or Want to Sign up with your social account?