Private Equity Salary Guide

Overview of private equity compensation

A Private Equity (PE) firm is a pooled investment vehicle that collects capital from other funds, institutional investors, wealthy individuals, etc., to invest in private businesses. They convince capital owners to invest their assets with them and charge a fee to manage and grow these assets.

A job in the private equity sector can be challenging, rewarding, and lucrative. Employees manage portfolios of PE investments and monitor their performance to ensure that they meet their intended goals. A typical day-to-day workload includes working with existing companies and prospective acquisitions to analyze financial data and project future revenues, net income, and expenses.

PE firms provide an intellectually stimulating environment that stresses having a calculative and disciplined approach to analyzing investments. In addition, they generally offer higher compensation and better hours and, thus, are more forgiving with the work-life balance than investment banking (IB) which is infamous for its long workdays. Of course, success in either field comes with bags of money, but the caps are higher in PE than in IB.

Although they are usually much smaller and more careful in choosing their employees, the employees are not required to maintain sky-high performance standards once hired, resulting in less stressful days. In addition, some PE firms are more progressive than others, offering food, televisions, and even beers in offices instead of the traditional cube environment.

Many jobs in the PE sector offer competitive salaries and perks such as bonus potential, company stock options, health insurance benefits, 401(k) matching plans, paid vacation time, and paid sick leave. In this industry, an employee’s compensation varies based on their experience, role in the firm, and geographic location.

“Okay, so how much $ can I make?”

Here is a summary of what you can expect to make at a PE firm at various levels.

| Role | Compensation Excluding Carry ($) | Share In Carry |

|---|---|---|

| Analyst | $100,000 - $150,000 | Unlikely |

| Associate | $160,000 - $300,000 | Unlikely |

| Senior Associate | $200,000 - $400,000 | Unlikely/Small |

| Vice President (VP) | $260,000 - $550,000 | Increasing |

| Director/Principal | $550,000 - $800,000 | Significant |

| Managing Director (MD)/Partner | $1,300,000+ | Enormous |

We go into what each of them means and break down the compensation based on additional factors such as region and fund size. Finally, we answer some FAQs concerning the PE salaries.

Compensation structure at a PE firm

Before diving into how much PE firms pay, let’s look at a brief overview of how they make money.

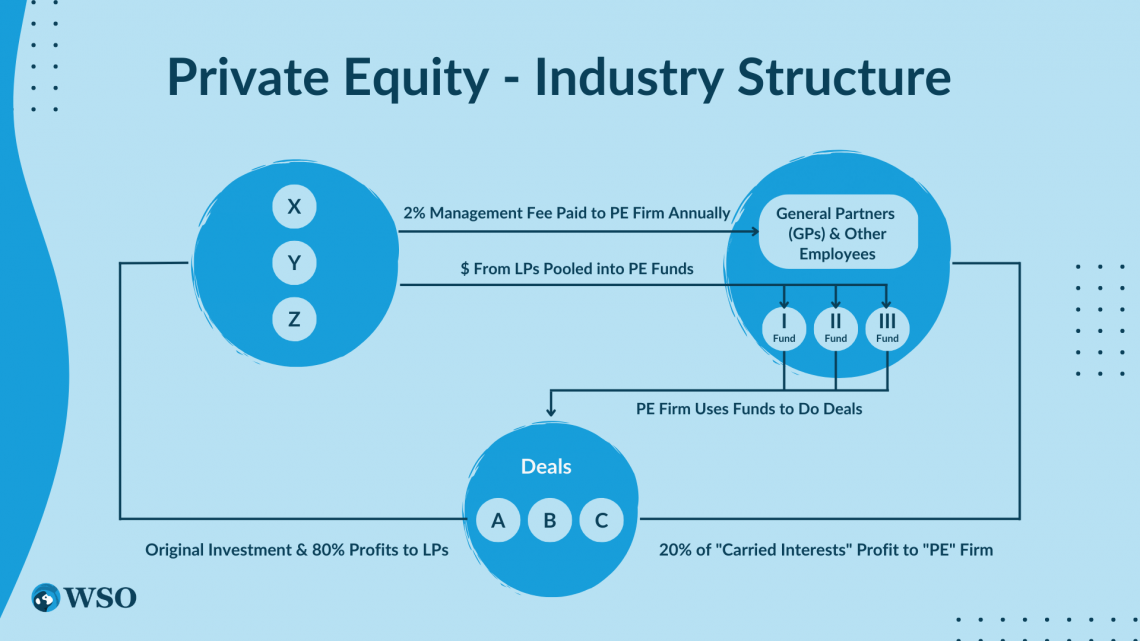

PE firms primarily earn through three sources.

- Management fees: This is charged by PE firms from their investors (LPs or Limited Partners) for managing the Assets Under Management (AUM) and is typically around 2%.

- Investment returns: It is the primary source of income for PE firms, which also decides the bonuses that high-ranking employees will bag. At higher ranks, bonuses form the majority of the compensation.

The figure below illustrates how the general partners and employees of a PE make money.

The income from these sources is distributed to employees in the following ways.

- Base salary: It is a fixed sum and is covered by management fees.

- Bonus: These are discretionary sums that firms pay to their employees based on their and the fund’s performance. This component is paid out of investment returns and includes two sub-components.

- Co-investment: Some firms allow their employees to put their own money up for specific deals, usually starting at the associate level. The returns from these deals form part of compensation.

- Carried interest: Also known as “carry,” it is accessible to the higher ranks, usually starting from Vice President (VP). It is a share in the returns generated by the portfolio companies. Carry is defined as a percentage of the total pool for each fund and vests over several years (5 to 10 years).

Combining the base salary and the bonus gives us the “all-in” or all-inclusive compensation. At megafunds, the all-in compensation is about $315,000 on average at the Associate level. Furthermore, you can also expect an annual raise during the 2-3 years’ Associate program. The raises are discretionary and can range from $25,000 to $50,000.

The video below provides an in-depth explanation of PE salaries and jargon like “co-investing” and “carried interest.” Further, it also walks us step-by-step through navigating the WSO company and compensation database.

Roles and salaries (Salary Overview) at a Private Equity firm

Although the hierarchy can vary from firm to firm, roles in PE are generally observed to have a structure where senior professionals are engaged in deal sourcing, managing relations, and making investment decisions. In contrast, junior employees deal with analytical work.

However, unlike investment banks, PE firms have fewer layers, partly due to PE firms being smaller in size than IB divisions at bulge bracket banks. A smaller structure provides aspiring junior professionals with opportunities to work directly with seasoned investing veterans in the firm.

Below is a representation of the general hierarchy at PE firms.

- Analyst

- Associate

- Senior Associate

- Vice President (VP)

- Director/Principal

- Managing Director (MD)/Partner

From Analysts to MDs, the real potential to earn is by way of bonuses and carried interest (“carry”). Carry is the part of returns that PE professionals get to keep when the returns exceed a certain level.

At senior levels, carry influences the majority of the compensation. As a result, VPs, Directors, and MDs take varying yet substantial sums home each year since the carry is primarily tied to the fund performance.

Let’s dive deeper into the functions performed and how much professionals are compensated at each level in PE firms.

Analyst

They are cherry-picked out of target undergrad schools with prior full-time work experience. They are primarily tasked with the same functions as Associates, such as deal sourcing, monitoring investee companies, evaluating potential investments, and fundraising. However, they enjoy less freedom to finish projects from start to end independently and may spend more time assisting Associates.

Analysts can expect to earn a total cash compensation (base salary and bonus) in the range of $100,000 to $150,000, with most of it coming from the base salary and the bonus averaging around 70% of the base. Admittedly, this is slightly less than what they can probably earn as an IB Analyst. Unfortunately, they are also unlikely to have a share in the carry.

Associate

They handle the bulk of financial modeling and due diligence for prospective investments and are expected to lead deal processes from beginning to end on their own. Additionally, they also help with continuously managing and monitoring current investments. Like IB or PE Analysts, PE Associates spend plenty of time romancing with Excel spreadsheets and PowerPoint presentations, but they bear more responsibility and enjoy more independence.

They can most likely expect to earn between $160,000 and $300,000 with bonuses close to 100% of the base. However, the bonuses depend on the firm’s size and performance each year. In addition, they can expect to be promoted to the role of Senior Associate in a reasonable span of 2 to 3 years, especially if working at a smaller firm. Again, however, the chances of participating in the carry are trivial.

Senior Associate

The line between the responsibilities of Senior Associates and Associates is blurry since they share most of them. Nonetheless, Associates are promoted to Senior Associate after working at the firm for a few years or working there for a few years and returning after attending a B-school. The work is essentially the same, but owing to their experience, they are closer to the VP level with more managerial responsibilities than the Associate level.

They generally bag between $200,000 and $250,000 initially and up to $400,000 after gaining a few more years of experience. The compensation at this level can vary from firm to firm depending on the size, performance, and even region. They can earn a promotion in about three years to make VP, but it is not so easy as the nature of their job changes at that level. Many do not see a clear progression, so they join smaller firms to advance.

Vice President (VP)

They must know what they are doing as they are responsible for leading and mentoring others, working directly with clients, and conducting negotiations. At this level, sweet-talking during negotiations to prevent the deal from falling through counts for more than being an Excel wizard.

Most people who make VP have excellent communication skills, but few make it with only superior technical skills. Hence, soft skills like communication and presentation matter far more as a VP than technical skills.

Principal or Director

Although they have ample leeway for decision-making, they don’t yet have the same ownership as the Partners. One of their primary duties is sourcing opportunities by fostering and maintaining relations with various parties, including consultants and investment bankers. In addition, they spend a considerable part of their time fundraising and deal sourcing and are the first to persuade business owners to consider selling.

They also manage Associates and Senior Associates and delegate most of the deal process management to VPs and Senior Associates. They engage towards the closing of the deal when critical negotiations ensue.

While salaries get increasingly variable at this level, they can typically fall between $550,000 and $800,000. In addition, carry becomes an increasingly more significant part of their total rewards.

Managing Director (MD) or Partner

They stand atop in the hierarchy and are the ultimate decision-makers. They focus on fundraising and boosting the firm’s brand by attending events, cultivating relationships, and speaking with the LPs. The single most needed skill at this level is nurturing relationships.

Besides, it is noteworthy to mention that they co-invest a considerable chunk of their net worth into the fund to have their skin in the game. Generally, after being at the firm for years, most Partners continue their role indefinitely, given that there is usually no reason to leave. However, politics, disputes, or the firm’s collapse may force them out.

Compensation can vary incredibly at this stage, but it is safe to say that they can reasonably earn any sum north of $1.3M, with more than half of it coming from bonuses. Moreover, the carry is the weightiest determinant of their total compensation as it can even range up to multiples of the cash compensation.

Below, we have summarized the compensation data presented in this article for you.

| Role | Compensation Excluding Carry | Share In Carry |

|---|---|---|

| Analyst | $100,000 - $150,000 | Unlikely |

| Associate | $160,000 - $300,000 | Unlikely |

| Senior Associate | $200,000 - $400,000 | Unlikely/Small |

| Vice President (VP) | $260,000 - $550,000 | Increasing |

| Director/Principal | $550,000 - $800,000 | Significant |

| Managing Director (MD)/Partner | $1,300,000+ | Enormous |

Learn more about Private Equity CFO.

Salary by region

The compensation sums are different across the world.

For example, PE firms in the US have been observed to pay their employees more – usually 20% higher than their European counterparts. Further, firms in Asia pay about 40% less than those in the US due to smaller deal flow.

This makes the US the ideal region for someone working in PE. Compared with Europe, remunerations are generally higher at every rank in the US. However, managing directors (MD) and partners in Europe report earning more than those in the US or APAC. In addition, because the sample size at the MD level is smaller, the figures are more prone to annual swings.

Below, please see the summary of pay scales in PE across the US, Europe, and APAC categorized by levels in the hierarchy. All figures represent averages in USD. Specific numbers vary based on the size of funds.

| Roles | US | Europe and Africa | Asia Pacific |

|---|---|---|---|

| Analyst | $100,000 - $150,000 | $100,000 - $130,000 | $65,000 - $85,000 |

| Associate | $160,000 - $300,000 | $150,000 - $250,000 | $110,000 - $140,000 |

| Senior Associate | $200,000 - $400,000 | $200,000 - $350,000 | $200,000 - $300,000 |

| Vice President | $260,000-$550,000 | $230,000 - $500,000 | $200,000 - $400,000 |

| Director/Principal | $550,000 - $800,000 | $500,000 - $600,000 | $300,000 - $550,000 |

| Managing Director/Partner | $1,300,000+ | $850,000+ | $600,000+ |

Source: Heidrick & Struggles’ North America private equity compensation survey (2021), Europe and Africa private capital compensation survey (2021), Asia Pacific private capital compensation survey (2021)

North America

Despite the popular and necessary work-from-home (WFH) culture and many people living in low-tax regions, the compensations did not decrease. On the contrary, most professionals received more dollars in their accounts in 2020-2021 than the previous year and expect the same in the next year. Bonuses remained hefty, and over 60% of professionals reported bigger numbers.

Europe and Africa

Over the past few years, there has been an uptrend in the cash compensation figures across all PE roles in Europe and Africa. Associates and Senior Associates’ wages rose by over 22% (compounded annually) over the past three years, of which most of the increase occurred in 2019-2020.

Associates in the UK saw a substantial hike among all ranks in 2020-2021, with their mean cash compensation climbing by close to 12%, from about $170,000 to about $190,000. The cash compensation appreciations for higher ranks (MDs and Principals) were overshadowed by those of their subordinates. Nonetheless, carry forms the biggest part of the compensation at their level.

Asia Pacific

Overall, the PE industry in this region saw decent hikes in the mean cash compensation during the period 2020-2021, mainly at the Associate and Vice President levels (8%-9%) equally due to increases in the base salaries and bonuses. At the Partner level, the increase was due to a much more significant increase in their bonuses (12.9%) than salaries (2.9%). Conversely, Principals took home slightly lighter bonus cheques on average (-3%).

PE compensation by AUM

Other than region, salaries in PE can also vary from fund to fund, depending on their AUM.

For example, working at megafunds (funds with over $5B AUM) almost always comes with a higher salary than working at middle-market funds.

The salary ranges based on AUM have been summarized for you below. All figures represent the average “all-in” compensation (base + bonus) in USD.

| Regions and roles | < $500M | $500M - $1B | $1B - $2B | $2B - $4B | $4B - $6B | $6B - $10B | > $10B |

|---|---|---|---|---|---|---|---|

| Associate/Senior Associate | $177,000 | $203,000 | $211,000 | $249,000 | $260,000 | $284,000 | $300,000 |

| Vice President | $266,000 | $304,000 | $349,000 | $410,000 | $409,000 | $457,000 | $520,000 |

| Principal | $471,000 | $461,000 | $500,000 | $608,000 | $609,000 | $752,000 | $840,000 |

| Partner/MD | $592,000 | $845,000 | $885,000 | $998,000 | $1,392,000 | $1,642,000 | $1,490,000 |

| Managing Partner | $1,900,000 | $915,000 | $2,455,000 | $1,669,000 | $3,086,000 | N/A | $3,300,000 |

Source: Heidrick & Struggles’ North America private equity compensation survey, 2021

Private Equity vs. Investment Banking compensation

Due to differences in work and the compensation mechanics, PE firms pay analysts around 30% less in salaries than investment banks. An IB analyst typically earns a total of $150,000 to $200,000, while a PE analyst usually earns $100,000 to $150,000 on average. It is reasonable to expect more if we talk about megafunds in New York, where analysts sometimes make close to $200,000.

In IB, total compensation depends on the individual’s performance, their team performance, as well as the market conditions. Moreover, the figures are lower at smaller banks and in other regions. Further, bankers are paid in stock rather than cash at some bulge bracket banks once they climb to higher ranks.

In PE, bonuses are higher if you perform well. Moreover, you earn not only high salaries and bonuses but also the carried interest. Although you won’t receive any carry until you get to a senior position, it will grow larger as you get promoted to higher ranks.

To know how much you can earn in IB, check out our Investment Banking pay guide.

Private Equity vs. Hedge Funds compensation

Overall, hedge funds’ compensations are higher but vary more than in PE. The differences between HF and PE compensations at the initial levels are not significant. However, the gaps grow as we move up the ladder. At the top levels, a hedge fund portfolio manager who has a great year could easily earn more than a managing director in private equity – depending on the fund size and structure.

Please check out our Hedge Funds salary guide to know more about compensations in that industry.

What is “carry” in PE?

Carried interest, also known as “carry,” is a portion of the returns that PE firms get to keep out of the profits that they generate on the limited partners’ capital. It serves as the primary source of income and motivation for the rainmakers as it can form a significant part of compensation at the senior levels past Senior Associate. Associates are often not allotted a share in carry (or at least not a meaningful share), but the fact that they are entitled to carry may mean more than the sum itself.

All funds charge a management fee to cover the expenses of managing the fund, except the fund manager’s compensation. However, there is often a prespecified hurdle rate, which is the rate of return that must be achieved before the firm earns carry. In the absence of a hurdle rate, they must at least ensure that all the initial capital contributed by the limited partners is returned to them.

Here is a simple example. Let’s assume that the carry is 20% for a fund with an AUM of $1B. If the investments bear fruit and the fund’s value grows to $1.5B over a few years, the firm will be entitled to 20% on the $0.5B or $500M increase in the fund’s value. The carry will amount to $100M (20% of $500M), divisible among the senior-level professionals at the fund. In reality, few teams can end up claiming most of the carry.

Furthermore, retired professionals are often offered a share of carry for a particular period after their retirement as a buyout of their stake or equity in the firm. Spun-out firms, those with minority shareholders, or those with parent companies, often pay a significant portion (10% to 50%) of carry to their old/existing shareholders.

In practice, the amount of carry will be contingent upon the time taken to generate profits. Further, there may also be a prespecified hurdle rate. On average, carry usually vests over four years if done on a deal-by-deal basis or over six years on a fund basis. Further, higher titles do not bestow shorter vesting periods. Investors prefer extended vesting periods to keep managers focused on long-term profitability.

Typically, LPs are more generous in the US, where returns are more outsized. Carry on a deal-by-deal basis with escrow and claw-back provisions is common.

On the other hand, Europe takes a whole-of-fund approach where partners get their slice of the pie only after investors have been paid capital and returns. Like the European model, PE in Australia is dominated by a few LPs who tend to negotiate conservative carry terms, where only funds with consistent track records can demand favorable terms.

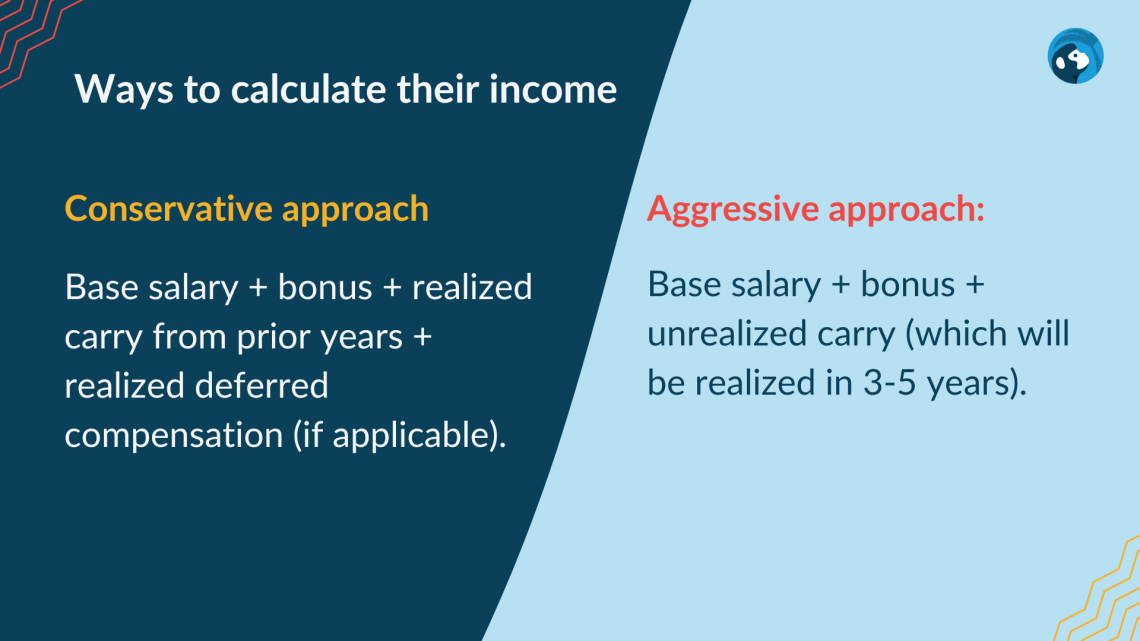

PE professionals are almost always earning carry as they raise new funds and receive new carry grants before the old ones fully vest, which gives them two ways to calculate their income.

- Conservative approach: Base salary + bonus + realized carry from prior years + realized deferred compensation (if applicable).

- Aggressive approach: Base salary + bonus + unrealized carry (which will be realized in 3-5 years).

Regardless of their perspective, the key to handsome payouts is sticking with a PE firm for a decade. Otherwise, other than not making as much, there may also be a risk of being unable to negotiate favorable terms and figures at another PE firm.

Frequently Asked Questions (FAQs)

The first step to negotiating compensation is to review the starting salary for the position that interests you. This will provide you with a benchmark for the appropriate compensation package for that position.

If you are not satisfied with the starting salary, you can speak with your PE firm and ask them to increase it. In addition, if there are performance-based bonuses, you should also consider asking for them as part of your negotiation.

You should also inquire about benefits, such as tuition reimbursement or other perks offered by the company. If there is a 401(k) or a different retirement plan available, make sure that it aligns with your personal views and expectations.

Co-investing is when your firm allows you to invest together with itself into a specific deal or fund, which means that when the firm buys a company, you can invest some of your money and have an equity stake in the business. If the fund returns 15-20% or more annually, it can be a way to grow your personal wealth significantly, quickly, and safely.

The ability to co-invest is exciting because most people in their mid-20s cannot access attractive alternative investments. However, it is noteworthy that some firms do not permit co-investing. Deal-based co-investment eligibility is more common among associates and senior associates, while high-rankers mostly co-invest on a fund basis.

An essential consideration is the illiquidity constraints, which PE has as an asset class. For example, suppose you are expecting large financial obligations soon. In that case, it might not be the best idea to have a significant portion of your money tied up in an illiquid private investment.

Additional Resources

Thanks for reading our salary guide! Please check out the following additional resources to help you advance your career:

or Want to Sign up with your social account?