Superday

The last step in the investment banking interview process

A “Superday” usually refers to final round interviews for summer analysts or first year employees at an investment bank, consulting firm, or other financial firm. The day usually consists of anywhere from 3 - 20 interviews for multiple hours. Many bulge bracket firms will do 3 - 5 half hour interviews back-to-back with different professionals from the group that you are applying to. Another thing to keep in mind is that candidates in this final interview are often some of a firm’s top candidates, with the amount of offers being handed out often being in the single digits. Read more about the final interview process at the Big 4 at this article.

Sample Superday Interview Questions

Below are a list of common IB questions you can expect during this final interview process. These are common investment banking interview questions in any round, so you should definitely be ready for them in this final round. Listed below are some sample questions and answers. Read more at this guide.

Here's a complete guide to answering the why investment banking question. The reality is you need to tailor the question to yourself. It varies with your background, how substantive you want to get, and what follow-up questions you want the interviewer to ask. No matter what, the answer here should be well rehearsed as well as the scenarios that could follow.

The three main financial statements are the Income Statement, the Balance Sheet, and the Statement of Cash Flows. The Income Statement shows a company's revenues, costs, and expenses, which together yield net income. The Balance Sheet shows a company's assets, liabilities, and equity. The Cash Flow Statement starts with net income from the Income Statement; then it shows adjustments for non-cash expenses, non-expense purchases such as capital expenditures, changes in working capital, or debt repayment and issuance to calculate the company's ending cash balance.

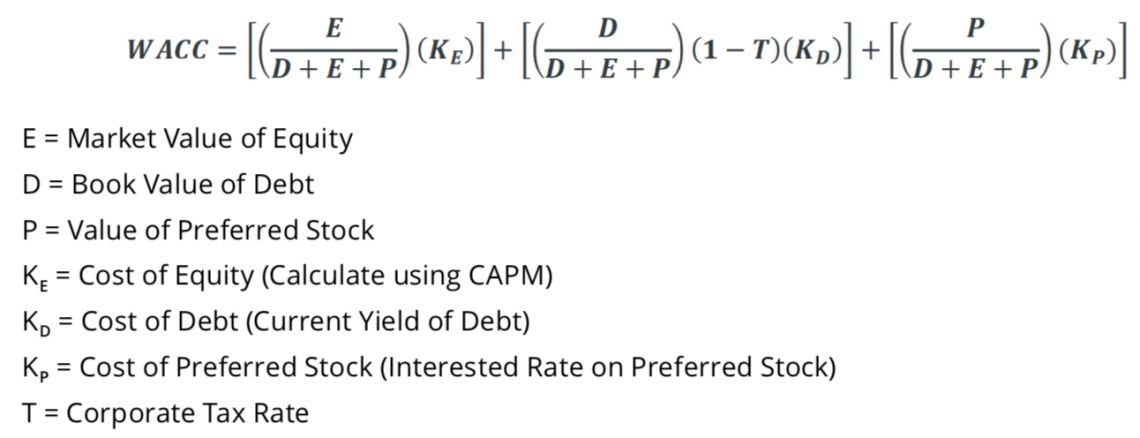

WACC is the acronym for Weighted Average Cost of Capital. It is used as the discount rate in a discounted cash flow analysis to calculate the present value of a company's cash flows and terminal value. It reflects the overall cost of a company raising new capital, which is also a representation of the riskiness of investment in the company.

- If the company feels its stock price is inflated they can raise a large amount of capital compared to the percentage of ownership sold

- If the projects the company plans to invest in with proceeds may not produce immediate or consistent cash flows to pay the debt

- If the company wants to adjust cap structure or pay down debt

- If the owners of the company want to sell off a portion of their ownership

Superday Format and Survival Tips

Generally, some interviews will focus on the technical, others on the behavioral, and then some that mixing it up and keep you guessing. The key to the interview process is to make the same positive impact in your first interview straight through the last interview.

It usually takes several hours, with a break somewhere in between, and by the end many candidates find themselves worn out, and sloppily stumble through the last interview or two - which often results in getting rejected. The marathon nature of these interviews is what makes it difficult, but if you know your answers and can keep your energy up you should be in good shape.

About 70-90% of the offers coming from these events are given in the same day or within 24 hours, but there are cases when an offer can also come weeks later if you are a borderline candidate and they are trying to get a feel for class size and yield from their first round of offers. The fastest way to get a response is to let HR of the bank know that you have another offer at another bank.

Superday Advice from an Investment Banking Associate

Here’s some insider advice from a fellow WSO member. To get the full breakdown, read the discussion in our forum. To see a more detailed breakdown of the final process at Goldman Sachs, reference this article.

Having been on the 'other' side of the table for many super day interviews over the last few years, I can tell you that 'perfect' answers sometimes are required and sometimes are a turn-off. It all depends, to be honest. The super days are somewhat of a crapshoot for candidates, so in order to get yourself an offer, you need to make the effort to attend as many of them as you can. Truth be told, getting a Bulge Bracket IBD offer is all about throwing a wide net.

To get you into the mind of an interviewer on a super day, specifically an associate or VP, you need to realize a few things:

- These bankers usually have a bunch of other things going on professionally over the course of the day

- It is usually on a Friday and they are all looking at getting out at a decent hour

- After a banker interview their slot of 4-6 candidates, there is usually an internal conference call between all the interviewers. Sometimes directors and MDs are too busy to attend, but the associates and VPs will always be there and usually participate the most

As an interviewee, what you have to do is get one or two of the folks who interview you to bring you up as a strong candidate during this call. If several other bankers respond with an "oh yeah, I liked that guy/gal quite a bit too," then you are well on your way to making the short list of who gets offers.

Usually, HR will be on this call as well and they will more-or-less run the call's overall structure but the associates and VPs have most of the say on who gets offers and who stays on the shortlist of those who may get offers should the first set of candidates pass.

One thing to note about HR is that they will almost always start the call out with how the female and minority candidates did in the interview process. If any of them did well, there will be a full-court press to get the offers and get them to accept the offers. The other candidates may get one or two initial offers between them but most likely may have to wait a few weeks before hearing anything definite back as they have effectively been pushed to the side for the time being. I have seen this happen countless times with some of the strongest candidates around who we really wanted to give offers right out of the gate.

My advice post-Superday is to reach out to an interviewer you believe you made a solid connection with and stay on him or her over the next few weeks and months. What I have seen happen many times is that a month or two after the interviews, HR comes back with "We have an additional spot we need to fill quickly or we lose it to another group." If you are on the shortlist and have stayed in touch with someone who can be your advocate, you can often pick one of these spots up very quickly.

The above also happens quite a bit with regional offices, so if you are not dead set on NYC this is also a good way to pick up a spot. A bit of a warning for recruiting in regional offices is that sometimes these spots are harder to get than the NYC spots. Sometimes a candidate with credentials that match the office more effectively (i.e. tech, healthcare, oil & gas) may win over a theoretically stronger candidate. Also, connections to the particular region (Midwest, West Coast, Texas/Louisiana/OK) will also work in a particular candidate's favor.

Superday: Success Tips

- Know the technicals, but also market yourself

- Make a personal connection with the person interviewing you. A likable personality and connections are ultimately what separate candidates from each other

- Review answers to all the common questions

- Research the firm and know what separates them in the market

- Prepare questions on the firm

- Know your personal story inside out

- Network whenever you can, but be careful not to overdo it

For a more comprehensive training package, reference the WSO Investment Banking Prep Course.

The Networking Advantage

Networking is one of the key differences that separate a good candidate from a great candidate. While technicals can help you get in the door and maybe even get you to the final interview process, the ability to network and socialize with your future team members is what ultimately lands the offer. People ultimately want to work with people they like, so be the kind of person they would want to spend most of their workday with.

Think about the answer to this common question: What do you know about our firm?

What is a more powerful answer in the interview?

- Regurgitating some corporate-speak from their website that anyone can access OR

- Leverage your networking calls by saying “well, I know this specific group has had a great deal flow lately (like the X and Y deal) and that you give the analysts a lot of responsibility running the model, so this is really attractive to me. I know because, in my conversations with X and Y, they both raved about their experience here…”

Here are a few more networking tips to help you deepen your connections:

- Always follow up with your new connections immediately after a meeting and ideally every 8 weeks (minimum once every 6 months)

- Ask questions about their lives, it’s not just about getting them to force your resume through

- Bring up mutual connections and any mutual interests

Desirable Qualities in a Candidate

Alongside knowing the technical information to interview questions, you may also be asked to explain some personal qualities that will help you in the job. Listed below are a few desirable qualities. Be sure to have a personal story or example to be able to bring up if the interviewer asks you about these qualities.

- Strong technical skills

- Likeable personality

- Analytical thinking

- Communication

- Leadership

- Resilience

- Team player

For some more tips check out this video:

What is a Superday Interview Known as in Other Countries?

In other countries such as the United Kingdom, Superdays may be known as Assessment Centres and contain other tasks such as group discussions, one-on-one presentations, and numerical testing.

Before reaching the final phase, most candidates will have gone through at least a first-round phone screen if not several levels of interviews of in-person interviews.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?