Earnings Per Share (EPS)

A key corporate profitability ratio analysts and investors usually rely on to measure performance efficiency for public companies.

What Is Earnings Per Share (EPS)?

Earnings per Share, or simply EPS, is a key corporate profitability ratio analysts and investors usually rely on, in addition to other financial ratios, to measure performance efficiency for public companies.

When publicly-traded companies trading in American exchanges, the Financial Accounting Standards Board's (FASB) statement no. 28 must report basic EPS if the listed company has a simple capital structure.

A company with a simple capital structure refers to those companies with only common stock. Hence, no debt or equity with potential dilutive securities is issued by such a company.

On the other hand, companies with complex capital structures with common and potentially dilutive securities, such as convertible preferred stock, convertible debt, and options/warrants, must report both basic and diluted EPS.

Key Takeaways

- Earnings per Share, or simply EPS, is a key corporate profitability ratio analysts and investors usually rely on, in addition to other financial ratios, to measure performance efficiency for public companies.

- Basic EPS = ( net income available to common shareholders)/ the weighted average number of common stock outstanding.

- It assumes no delusion of securities.

- Diluted EPS calculations involve dilution tests for stock options and/or warrants, convertible debt, and convertible preferred stock.

- Diluted EPS = adjusted net income common shareholders/ (weighted average number of common stock outstanding + dilutive shares.

- Adjusted Earnings Per Share is a GAAP (or IFRS) Earnings Per Share measure adjusted for non-recurring/one-time-effect items that vary company by company.

- Generally speaking, companies with unstable margins, payout ratios, and many non-recurring items in their income statements are signs of unsustainable or low-quality earnings.

Understanding Earnings Per Share

As the name suggests, Basic EPS is the simplest form of EPS, where a public company has issued only common stock and no potentially dilutive securities.

The formula for basic EPS is:

EPS = (net income - preferred dividends) / weighted average number of common stock outstanding

EPS = ( net income available to common shareholders) / weighted average number of common stock outstanding

- Basic EPS is calculated using items from the income statement and balance sheet. First, net income, the current year's preferred dividends, a balance sheet item, is subtracted from net income, an income statement item.

- Net income must exclude preferred dividends since basic EPS refers to EPS available to common shareholders. Hence, net income minus preferred shares equal net income available to common shareholders.

- Common dividends shouldn't be subtracted since they are part of the net income available to common shareholders.

- To calculate preferred dividends for a given period, you need information about a company's number of outstanding shares, the preferred stock's face value, and the preferred dividend rate.

For example, for FY2021, company ZZZ reported a net income of 5 $billion, 500 million common shares, and 5 million preferred shares. Moreover, the company's outstanding preferred shares have a face value of $80 and a preferred dividend rate of 8%.

In this particular example, calculating the numerator for basic EPS requires the subtraction of 80*.08*5 million, or $3.2 million of preferred dividends for a given period, from a net income of $5 billion.

Net income available to common shareholders is then divided by the number of common shares outstanding to convert it into per-share terms. A weighted average calculates the number of shares outstanding in a given year.

Importance of Earning per share (EPS)

Earning per Share is a key measure of company performance and profitability. As a result, it's common practice for potential investors to assess a company before investing.

Generally speaking, companies with high EPS are desired, implying higher profits distributed to common shareholders via common dividends or stock buybacks.

The CFO-to-dividends paid ratio (a coverage ratio in cash flow analysis) is useful for determining a company's ability to distribute dividends.

Analyzing a company's EPS in Isolation isn't very insightful. However, looking at a company's EPS trend over time may help judge the profitability strength and is also useful for future forecasting.

Moreover, performing comparable EPS analysis between same-industry-same-business peers can lead to far better insights.

The comps analysis process is useful for analyzing companies based on enterprise and equity multiples. This process will give you insights into what the market thinks a company's stock is worth today.

Comparing EPS to the industry average is also important for measuring relative industry performance. There should always be an explanation for why certain companies have higher EPS growth than their respective industry average.

Comparing a company's EPS with other per-share ratios is also very useful. For instance, analyzing EPS, share price, cash flows per Share, and price to earnings may give insight into its relative fair market value.

For example, Suppose a company's EPS has constantly been growing at 5% while at the same time, its price appreciation or price-to-earnings have been continuously increasing by less than 5%. In that case, this may indicate that the company may be undervalued.

the weighted average number of shares outstanding and EPS

In this section, we will cover the basics of calculating the denominator of a Basic EPS, simply the weighted average number of outstanding common shares.

- Technically, the weighted average is based on the number of days in a year. Nonetheless, using a 360-base also yields good approximations.

- Whenever new shares are issued during the year, they should enter into the weighted average computation from the published date, not before.

- Share repurchases are entered with a negative sign from the moment they had been repurchased.

- Whenever a company buys or sells shares to purchase some asset, these are included in the computation since their date of issuance.

- When dealing with stock splits or dividends throughout a given year, the additional issuance of stock from these activities should be included in the computation of all prior share counts outstanding before the dividend or split.

- The computation for any additional shares issued or repurchased post-split or post-stock-dividend throughout the year needs no adjustments.

Let us take an example to understand these adjustments.

ABC company has had 20K common shares outstanding since the beginning of the year. On March 1, ABC issued 5K new common shares. Moreover, on September 1, ABC enacted a 3-for-2, or 50%, stock split. As a result, on October 1, ABC repurchased 5K shares.

Shares outstanding on January 1: 20K*12/12 years*1.5 (adjustment for stock split) +

Shares outstanding on March 1: 5K*10/12 years*1.5 (adjustment for stock split) +

Shares outstanding on October 1:-5K*3/12 years (no adjustment post-split )

=Weighted average shares outstanding for basic EPS calculations

= 35,937.5

A 3-for-2 stock split is equivalent to a 50% stock dividend since both increase the number of common shares outstanding by 50% ((32)-1).

Moreover, a 50% increase in shares would decrease the existing share price of such a company by approximately a third since the market cap is unaffected by these activities (the old price of 1.5 should hold if the number of shares increases by 1.5 ).

Similarly, if an investor has 200 shares of ABC, each worth $100, a 2-for-1 split will cause the investor to have 400 more shares, and each Share is now worth 50% less, or $50. This leaves the investor's ownership proportion of ABC intact.

Basic EPS vs. Diluted EPS

Basic EPS assumes no delusion of securities and only considers net income available to common shareholders divided by the weighted average number of common shareholders in the given period.

For example, if Company ABC has a net income of $5M, $500K in cash dividends to preferred shareholders, $450K in cash dividends to common shareholders, and a weighted average number of common shares outstanding of 35,937K;

Basic EPS: 5M - 500k / 35,937 = 125.22

Note

Dividends paid to common shareholders are omitted from the calculations.

On the other hand, diluted EPS is sort of the "worst-case scenario" for EPS calculations. This EPS version assumes all potentially dilutive securities are converted into common stock. Hence, diluted EPS is, at most, equal to Basic EPS.

Before calculating diluted EPS, it's important to be familiarized with the following terms:

1. Stock options

A financial instrument that allows the option holder the right, but not the obligation, to buy or sell a specific stock at a pre-specified price, known as the strike price.

2. Warrants

Similar to a stock option in terms of functionality, the only difference is that stock warrants are issued by a company (issuer) to the investor. Warrants are usually seen as sweeteners.

3. Convertible debt

Fixed-income securities provide yield via coupon payments and the possibility of converting debt into a predetermined number of common shares based on a specific conversion price and ratio indicated in the bond's indenture.

4. Convertible preferred stock

Convertible preferred stock can be converted into common stock. The conversion price and ratio can be found in the security's prospectus.

5. Dilutive securities

Stock options, warrants, convertible debt, and preferred shares are said to decrease EPS upon convertibility.

6. Antidilutive securities

Stock options, warrants, convertible debt, and preferred shares increase EPS upon convertibility.

It is important to note that ONLY dilutive securities are included in diluted EPS calculations. Hence, it is important to perform quick dilution tests for each potentially-dilutive security in a firm's capital structure before assuming dilution.

understanding Dilution tests before diluted EPS

Before getting our hands dirty with examples of calculating diluted EPS when dealing with convertible debt, convertible preferred stock, and options/warrants, it's beneficial to first go through some important dilution tests and rules.

1. Stock options and Warrants

When dealing with stock options and warrants, dilution is assumed ONLY if the derivative's strike price is less than the average market price of the stock throughout the year.

If dilution is assumed, then the Treasury stock method must be employed:

This method assumes that all the proceeds from the exercise of the options will then be used by the company to hypothetically repurchase its shares through the market at its average price.

Therefore, this amount must be subtracted from the total shares created upon the exercise of stock options.

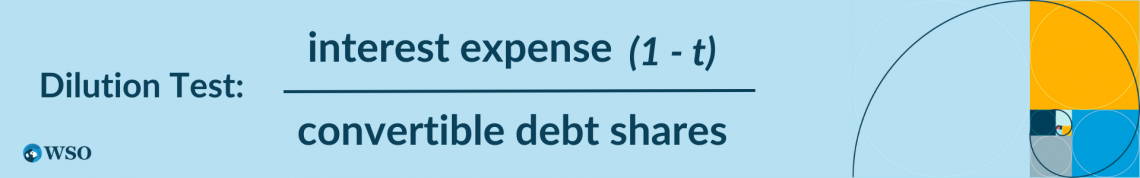

2. Convertible debt

Suppose a company's convertible debt interest payments (net of tax) divided by the number of convertible debt shares created is less than the company's basic EPS. In that case, the security is said to be dilutive and must be included in diluted EPS calculations.

3. Convertible preferred stock

Suppose a company's preferred dividends divided by the amount of convertible preferred shares created is less than the company's basic EPS. In that case, the security is said to be dilutive and must be included in diluted EPS calculations.

The general formula for calculating diluted EPS is as follows:

Diluted EPS = adjusted net income / weighted average common shares + dilutive shares

Diluted EPS = [(net income-preferred dividends) + convertible preferred dividends + interest from convertible debt (1 - tax rate)] / Weighted average common shares + conversion of convertible preferred shares + conversion of convertible debt+conversion of options

Note that convertible preferred dividends and interest from convertible debt are added back to the net income to reflect the extra income you gain by avoiding paying interest and dividends on such securities.

Since interest expense is tax deductible, multiplying it by (1-t) accounts for such benefit.

On the other hand, stock options do not affect the numerator since their exercise does not influence net income in any way.

How to calculate Diluted EPS

Now that you know about the essential dilution tests, it's time to put that theory into practice with the examples below:

1. Dealing with convertible preferred debt

Assume Company ABC has reported a net income of $5M and has 3M common shares outstanding for the entire fiscal year and a basic EPS of $1.67. Moreover, at the beginning of the current fiscal year, ABC had issued 4K $1K (issued at par), 10% bonds for $4M.

If each of the 4K bonds is convertible into 50 common shares, and the tax rate is 30%, ABC's diluted EPS for the year in question:

Dilution Test = 400,000 ( 1 - 0.3 ) / 200,000 = $1.4

Since 1.4 is less than ABC's basic EPS of $1.67, these shares should be included in diluted EPS calculations.

Since the convertible debt was outstanding for the entire year, the weighted average of these shares should be 12/12 months, or 1.

Diluted EPS = 5,000,000 + 400,000 ( 1 - 0.3 ) / 3,000,000 + 200,000 = $1.65

2. Dealing with convertible preferred shares/stock

Assume Company ABC has reported a net income of $5M and 3M common shares outstanding for the fiscal year. ABC currently has a total of $1M 10% par value preferred shares, which are convertible into 2 shares per each $20 of par value.

ABC's Basic and diluted EPS for the year in question:

Basic EPS = 5,000,000 - 100,000 / 3,000,000 = $1.633

Dilution Test = 100,000 /( ( ( 1,000,000 / 20 )*2 ) ) = $1

Since 1 is less than ABC's basic EPS of $1.633, these shares should be included in diluted EPS calculations.

Diluted EPS = 5,000,000 - 100,000 + 100,000 / 3,000,000 + 100,000 = $1.61

3. Dealing with Options

Assume Company ABC has reported a net income of $5M and 3M common shares outstanding for the fiscal year. In addition, ABC has a basic EPS of $1.67 and 200,000 stock options outstanding.

Each option has a strike price of $20, while the current average market price of ABC's stock is $30.

ABC’s diluted EPS for the year in question using the treasury stock method:

- Since the strike price < the average market price, 200,000 new shares will be created

- Using the treasury stock method, the company will use the proceeds of the options ($4M) to purchase 133,333.33 shares (4M/30). Hence, the net increase in common shares from the option exercise is 66,666.67.

Diluted EPS = 5,000,000 / 3,000,000 + 66,666.67 = $1.63

What are Adjusted Earnings Per Share

Adjusted Earnings Per Share is a GAAP (or IFRS) EPS measure adjusted for non-recurring/one-time-effect items that vary company by company.

For Instance, American Express reports Adjusted EPS, Boing reports core EPS, and P&G reports non-GAAP Earnings Per Share. Despite the different names and definitions for each, all are forms of the adjusted measures.

Non Recurring items include restructuring charges, tax reforms and resolution, and M&A costs. Other common items include:

- Stock compensation

- Pension gains/losses

- Amortization of acquisition-related intangibles

- Early debt extinguishment

Since Adjusted Earnings Per Share is calculated at management discretion, this allows them to upwardly or downwardly manipulate Earnings Per Share figures using, say, non-GAAP measures (in the case of The United States).

Nonetheless, It is common practice for active investors and equity analysts to focus on non-GAAP or adjusted, Earnings Per Share figures.

According to the CPA Journal, non-GAAP earnings tend to represent better or provide a more accurate picture of a company's current and, thus, future earnings and core performance relative to GAAP earnings.

Limitations of earnings per share

The company's management may often manipulate reported Earnings Per Share in financial statements.

Generally speaking, companies with unstable margins, payout ratios, and many non-recurring items in their income statements are signs of unsustainable or low-quality earnings.

For example, aggressive accounting practices may be employed via

- Employment of straight-line depreciation rather than a double declining balance.

- Capitalizing expenses, higher salvage values, and delay impairment recognitions.

- Increase revenue recognition via channel stuffing/bill-and-hold transactions/FOB terms.

- Using FIFO in a rising price environment.

- Lowering valuation allowances and bad debt reserves.

On the other hand, conservative accounting practices may also be employed by expensing more often than not, decreasing salvage values, early recognition of impairments, etc.

As a general rule of thumb, any deviations from a company's goal of presenting financial statements with relevance and faithful representation are worth flagging since it directly influences the financial statement's usefulness to its users.

Additional low-quality-earning warning signs could include:

- LIFO inventory liquidations (for US and Japanese companies only).

- Items incorrectly labeled as “non-recurring” despite their continuous inclusion in past financial statements.

- Sales include significant non-recurring and non-operating items, potentially leading to large revenue growth deviations vs. peers.

- The ratio between Cash flow from operations and net income is less than 1 and has continuously declined over the years.

- The company’s growth mainly depends on other companies' acquisitions but consistently reports a decreasing asset turnover ratio.

Under these warning signs, it's best to look at the company's cash flows since "cash Is king," and it never lies. Regardless of the extent of earnings manipulations, cash flow is a company's true lifeblood at the end of the day.

Being able to generate positive and increasing cash flow is a requirement for long-term growth sustainability. If a company wants to reinvest in itself continuously, pay down debt, and reward shareholders, cash flow is needed, specifically free cash flow.

Reviewed and edited by Parul Gupta | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?