Return on Total Capital

A measure of profitability that helps us weigh a company's success and ability to maintain an advantage over competitors

What Is Return on Total Capital (ROTC)?

Return on total capital (ROTC) is an essential measure of profitability that helps us weigh a company's success and ability to maintain an advantage over competitors. It can be a credible indicator of a company's moat.

Formulas that emphasize a company’s returns on the income statement and how the net income factors into the types of returns applicable to financial statements.

This ratio is most important for determining the return gained through a company's business operation, not random one-time transactions.

It is useful, especially for firms that invest large amounts of capital, such as oil and gas, technology, and packaging companies.

An important strategy to keep in mind for investing is to find a plan for your company to maintain a moat and have an advantage for success over other competitor companies.

For example, Google is one of the best businesses globally because of its strong advantage over other search engine firms.

Google generates a return on capital of 27.6% and has capital costs of 7.65%. It means that for every $27.60 that Google earns in profit, it costs them $7.65 to generate those profits.

Key Takeaways

- Return On Total Capital (ROTC) is an essential probability metric used to measure a company's competitive advantage and efficiency in its capital utilization

- ROTC is calculated as Earnings Before Interest and Taxes (EBIT) divided by Total Capital

- EBIT represents a company's operating income while excluding interest and tax expenses, making it a valuable indicator of profitability

- Total Capital consists of interest-bearing debt and stockholder's equity, reflecting a company's financial structure

- A good ROTC is considered to be above 5%, and ratios exceeding 20% are considered excellent and indicate a strong capital efficiency

Understanding Return on Total Capital (ROTC)

It measures the efficiency with which a company uses its invested funds.

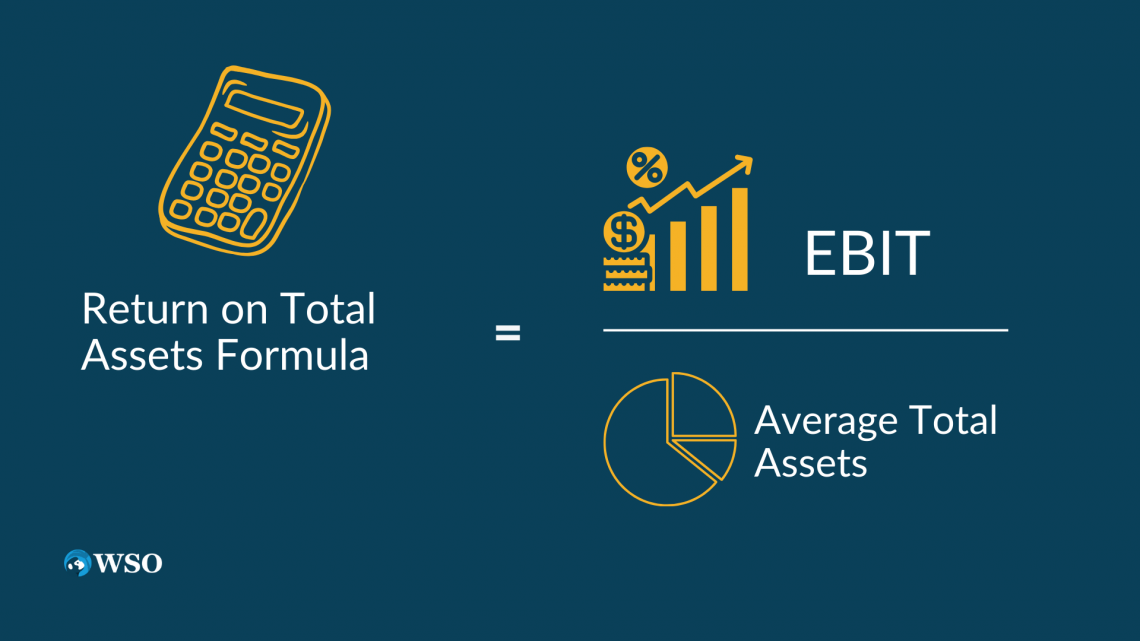

Another term that can describe the capital returns ratio is a return on total assets, which is the earnings before interest and tax payments (EBIT) divided by the average total assets.

This ratio helps us navigate strong businesses with a potential moat. Additionally, it provides insight into how well a company can protect its long-term profits and market share from competitors.

When a company's earnings are measured with ratios such as this one, investors can determine the capital needs that must be reinvested for the company to increase its value.

As long as the rate at which the company can reinvest is greater than the cost of generating the capital, it will continue to succeed.

The concept of return on total capital is most applicable to businesses that use large quantities of debt in their capital structure. For these companies to generate a significant return on equity, they employ leverage.

Employing leverage is an investment strategy of debt financing that increases an investment's potential return. In other words, it is the amount of debt a company uses to finance its assets.

How to Calculate Return on Total Capital?

The formula to determine the return on total capital is as follows:

Return on Total Capital = Net Operating Profit After Tax (NOPAT) / Total Capital

Below is a step-by-step explanation of how to calculate NOPAT and ROTC:

-

Calculate Net Operating Profit After Tax: NOPAT represents the operating profit of the company after accounting for taxes. It is essentially the company's profit from its core operations. The formula for NOPAT is as follows:

NOPAT = EBIT (Earnings Before Interest and Taxes) * (1 - Tax Rate)

- EBIT is the operating profit of the company, which can usually be found in the income statement.

- The tax rate is the company's effective tax rate, which is typically expressed as a decimal (e.g., 0.25 for a 25% tax rate).

-

Calculate Total Invested Capital: Total Invested Capital represents the total capital invested in the company, including both equity and debt. It can be calculated using the following formula:

Total Invested Capital = Total Debt + Total Equity

- Total Debt includes all long-term and short-term debts and loans of the company.

- Total Equity includes common stock, preferred stock, and retained earnings.

-

Plug the values into the ROTC formula: Once you have calculated NOPAT and Total Invested Capital, you can plug these values into the ROTC formula:

ROTC = NOPAT / Total Invested Capital

-

Calculate the ROTC as a percentage: To express ROTC as a percentage, multiply the result from step 3 by 100:

ROTC (%) = ROTC * 100

Earnings Before Interest & Taxes (Operating Income)

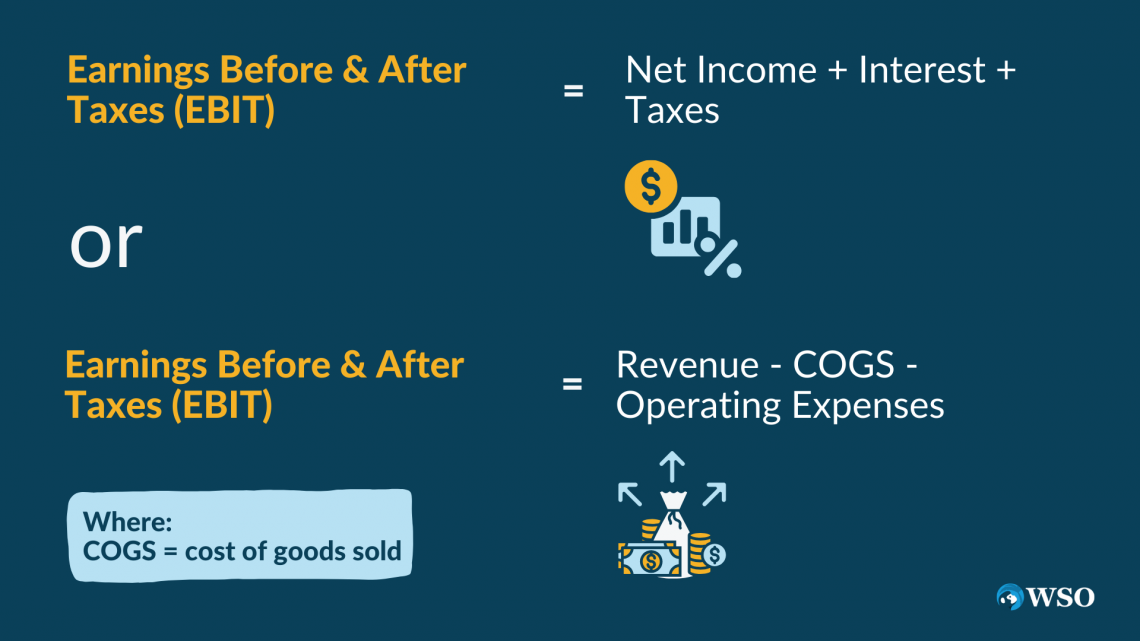

Earnings before interest and taxes are the numerator of the ratio for return on total capital and can also be defined as a company's operating income. It is the income generated by a firm after paying all operating expenses.

EBIT is a helpful tool when measuring a company's profitability or potential for success and can be calculated as revenue minus expenses, excluding interest and taxes.

EBIT can be calculated using multiple methods. It can be the sum of net income, interest, and tax expenses. EBIT can also be calculated as revenue minus cost of goods sold minus all operating expenses that do not include taxes or interest.

Interest and tax expenses are not included in a company's operating income since they do not relate directly to the core business activities of a firm.

In other words, a company's earnings before interest and taxes are considered interest and tax-deductible.

These payments are loans that a company uses to finance its growth and investments, but not expenses related to production and sales. EBIT can be helpful to investors looking to make decisions based on different tax situations.

This concept helps to drive the inner mechanics of financial and operating output.

For example, consider an investor who wants to buy a share of a company's stock. If that company were to have recently received a tax break or experienced a cut on corporate taxes, its net income or profit would increase.

On the contrary, the net income would decrease if that company experienced raised taxes.

EBIT does not include the benefits or detriments of tax expenses incurred. Instead, it helps investors compare the costs and returns of two or more companies in the same industry that might have different tax rates.

Earnings Before & After Taxes on an Income Statement

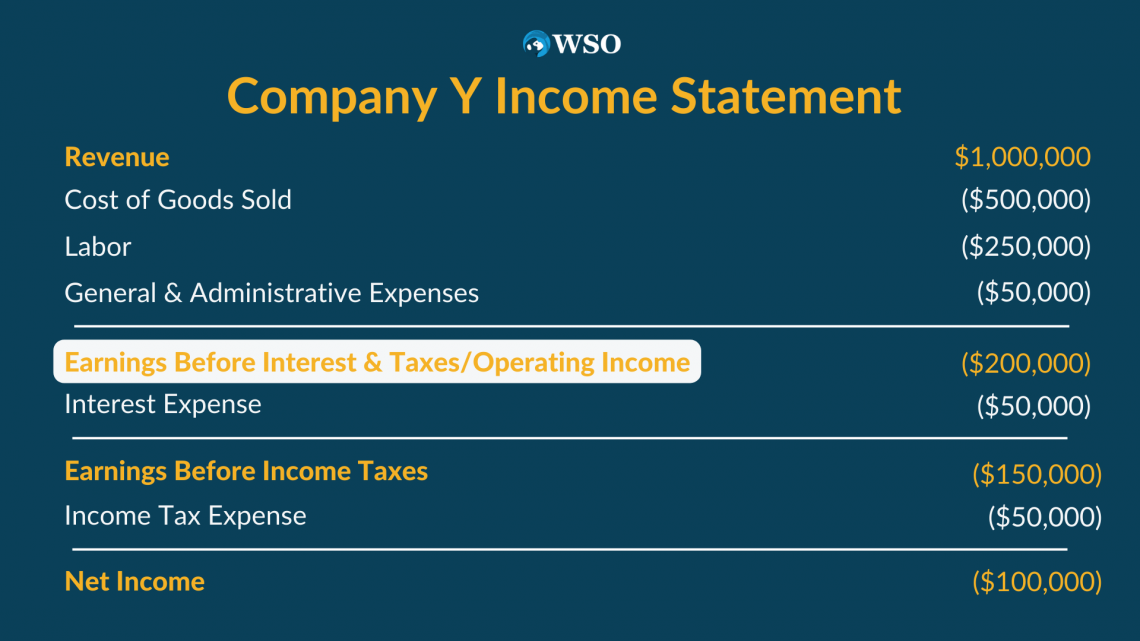

A company's operating income can be found by observing different factors on a company's income statement, such as the gross margin and operating expenses.

Sample income statement showing where the numerator for the capital returns ratio can be found. It shows the company’s tax and interest-deductible profit.

To derive the operating income, operating expenses must be subtracted from gross income:

Operating Income = Gross Income - Operating Expenses

- Gross income is calculated by subtracting the cost of goods sold from the company's sales.

- Operating Expenses are the total costs associated with running a company's business activities. It can include insurance, rent, wages, utilities, depreciation, etc.

For example, consider Company X, which manufactures and sells technology.

Say the income statement for Company X reports sales of $140,000, the cost of goods sold as $20,000, a gross margin of $120,000, and operating expenses as $18,000.

By subtracting the operating expenses from the gross margin, we arrive at the active income or the earnings before interest and taxes.

Operating Income = $120,000 - $18,000 = $102,000

Another way that a company's earnings before interest and tax payments can be derived is by considering its revenue generated from stocks or dividends.

A company's operating income, or earnings before interest and taxes, can be calculated by subtracting all dividends from the net income.

Total Capital

Total capital and earnings before interest and tax payments are essential for measuring a company's performance and profitability. However, those variables are determined by other factors involved in the company's financial data.

In addition to a company's operating income, this variable can also be found in financial statements like the balance sheet since it focuses more on assets, equity, and debt.

Two different ways of calculating a company’s total capital. The sum of debt and equity, or fixed and current assets.

The total capital accumulated by a company is the sum of all interest-bearing debt and shareholders' equity, which could include common stock, preferred stock, paid-in capital, retained earnings, etc.

It can also be found by calculating a company's current and fixed assets. Or in other words, fixed and existing assets are easier to put into terms of short-term and long-term.

Current assets are short-term assets that typically have a life span of one year or less. They are used in the day-to-day operations of a business to keep it running. An example of a current or short-term asset would be cash and cash equivalents.

Fixed assets are long-term and often require a more significant commitment. They can include physical property such as a processing plant or factory building.

Finding the fundamental aspects of a company's assets and equity are relatively easy to draw from a financial statement, such as an income statement or balance sheet.

However, gathering the most accurate data for investment purposes requires more information and measurements of past and present data and can require more than one document.

Composing those statements can be made more efficient with financial modeling, which can be learned through our Financial Statement Modeling Course.

Capital and the Balance Sheet

A helpful way to consider the relationship between costs and capital is to think of a balance sheet.

Example of a balance sheet showing which costs are considered assets, liabilities, and equity. The company owns assets, the company owes liabilities, and shareholders own owner's equity.

A company's capital on the balance sheet refers to any financial asset. It is not only limited to cash- it can include cash equivalents such as stocks and other investment forms.

There are four main types of capital:

- Working capital: represents the capital a company uses for its day-to-day operations and is the value of current assets minus current liabilities.

- Trading capital: refers to the amount of money funded to an individual or company for buying and selling various securities.

- Equity capital: generated through the issuance of stock in a company in exchange for a monetary investment.

- Debt capital: represents loans that a company must repay and is essentially the interest rate paid by the company for its debt.

Although the different categories of a firm's capital help consider various market or accounting factors, the main components for determining the return on total capital are debt and equity.

Keep in mind that the total capital, which is the denominator of the ratio for return on total capital, can be computed by adding debt and equity. In terms of a balance sheet, the sum of debt and equity is on the liabilities side.

The total capital cost is calculated as the sum of debt and equity. Let's say Company X has a debt expense of $200,000 and an equity expense of $480,000. The total capital would be

Total Capital = Debt + Equity

= $200,000 + $480,000 = $680,000

Total capital can also be calculated with a system of equations that derive percent ratios of debt and equity in terms of market risk.

The cost of debt can be determined by using the tax rate, interest expense, and the total amount of debt incurred.

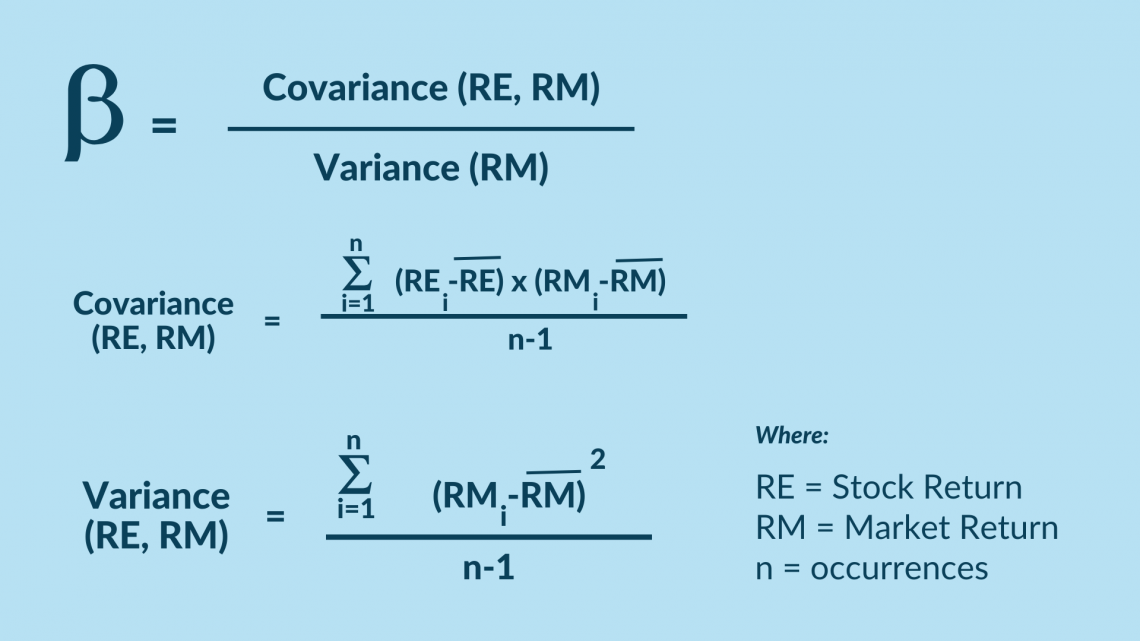

The cost of equity can be derived from the market rate of return, risk-free rate of return, and the volatility coefficient of the overall market, which is written as beta () and usually follows the S&P 500.

The volatility coefficient of the overall market is equal to the covariance of stock return and market return divided by the variance of the market return.

The beta, or volatility coefficient, is based on the Capital Asset Pricing Model (CAPM), a business model that emphasizes systematic risk and its relationship with the expected return on assets.

The equations for determining the cost of debt and equity can be defined as:

Cost of Debt = interest expense/ total debt * (1 - tax rate)

Cost of Equity = Rf + β(Rm - Rf)

- β = the volatility coefficient of the market as a whole

- Rm= the market rate of return

- Rf= the risk-free rate of return

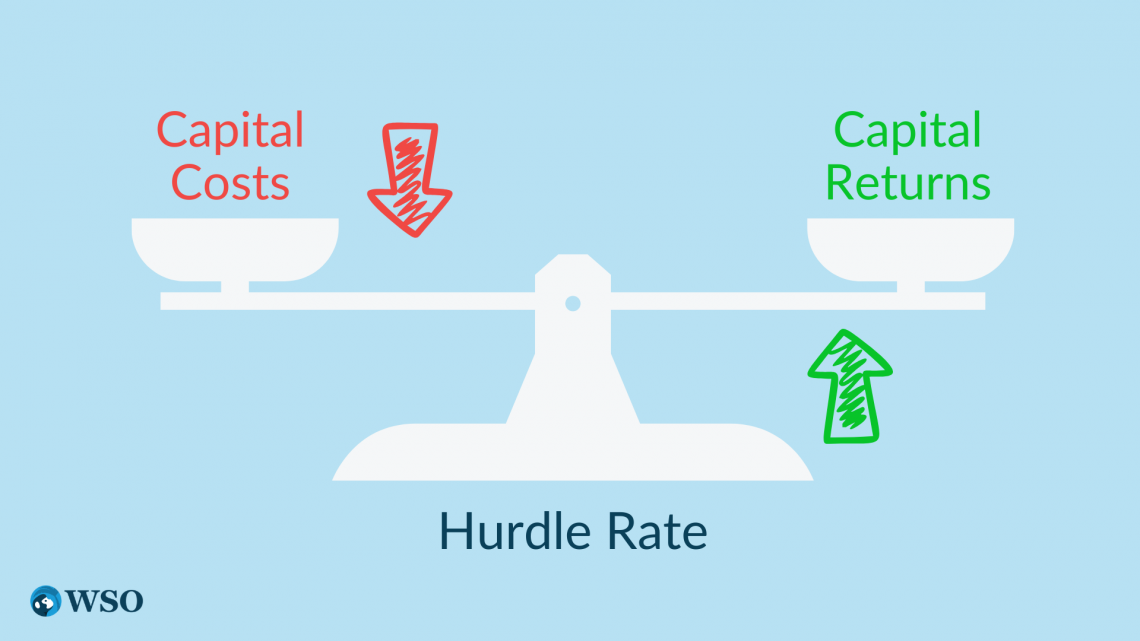

Comparing Capital Costs and Returns

From an investor's perspective, the cost of a company's capital is an evaluation of the potential return generated from the acquisition of stock shares or other types of investment.

The cost of capital must generate enough returns for an investment to be feasible.

This concept is critical information in determining the hurdle rate of a firm's project or task, which is the minimum required rate of return for ensuring success on that project or job.

Comparing and measuring returns and investment is essential because it helps investors understand how much to invest and what type of investment to generate a high return to make a profit or at least break even.

It is also necessary to accurately and precisely weigh the actual cost of capital investments because assuming a price that is only partially accurate may result in an externality or imbalance.

Say a firm's cost of capital is 11%. If the assumed cost of capital is below 11%, the firm understates the expense and will generate a negative return. If the firm assumes the cost of capital is greater than 11%, then the fee is overstated, and the firm will generate forgone profits.

To weigh the possible benefits and detriments of an investment carefully or check the feasibility of an investment, you must compute the averages and weight of the investment returns as well as capital expenses.

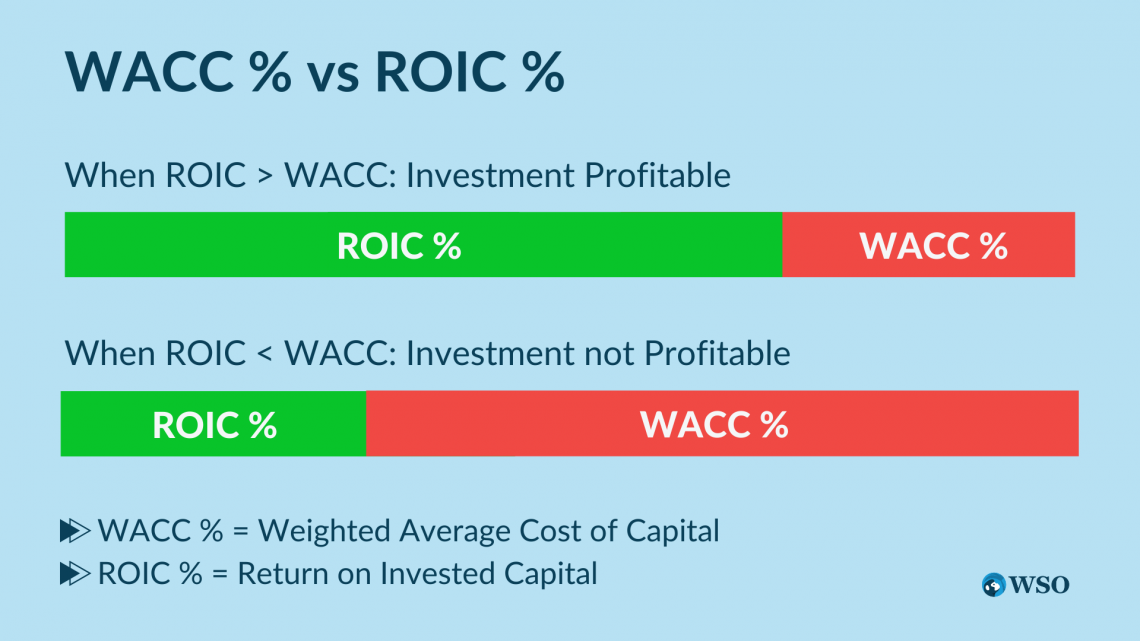

A firm can gain insight into how effectively the capital is being used by comparing its return on invested capital (ROIC) to the weighted average cost of capital (WACC).

Computing these data can be tedious and tricky in some instances, which is why using excel can help speed up the process and ensure greater accuracy.

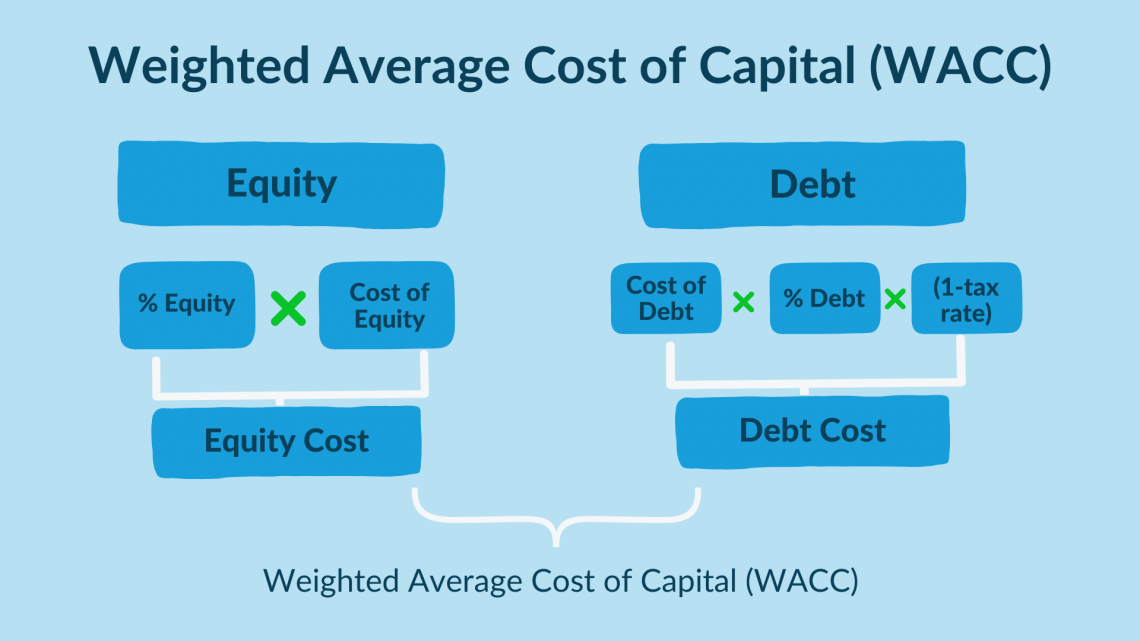

Weighted Average Cost of Capital (WACC)

A company's weighted average cost of capital constitutes the average cost of a firm's money from the debt and equity sections of the balance sheet and does not recognize tax expenses.

It weighs the market value of the investment expenses from the different capital sources and considers the average costs and quantities from each source of capital.

Simplistically, WACC measures debt and equity accounts. Overall equity cost is the product of the equity market price and percentage of equity invested. Overall, debt cost is the product of the debt market price, the share of debt, and one minus the tax rate.

The percentage of each cost and market price is essential and can be calculated using an equation to calculate the equity and debt costs.

The weighted average cost of capital can be written in the equation form as

- E = market value of equity

- D = market value of debt

- re = cost of equity

- rd = cost of debt

- t = corporate tax rate

The portion or percentage of equity invested is shown as the market value of equity divided by the sum of debt and equity. The percentage of debt is shown as the market value of debt divided by the sum of debt and equity.

When both ratios are multiplied by the cost of debt or equity, the obligation or equity cost is the result.

We derived the cost of debt and equity and the percentage of debt and equity to formulate the WACC.

Comparing this data average to a company's return on invested capital helps determine whether the invested capital is being used effectively or not.

For example, consider a company with a capital structure consisting of 80% equity and 20% debt. The cost of equity is 15%, and the after-tax cost of debt is 10%. The weighted average cost of capital would be

(0.815%) + (0.210%) = 12% + 2% = 14%

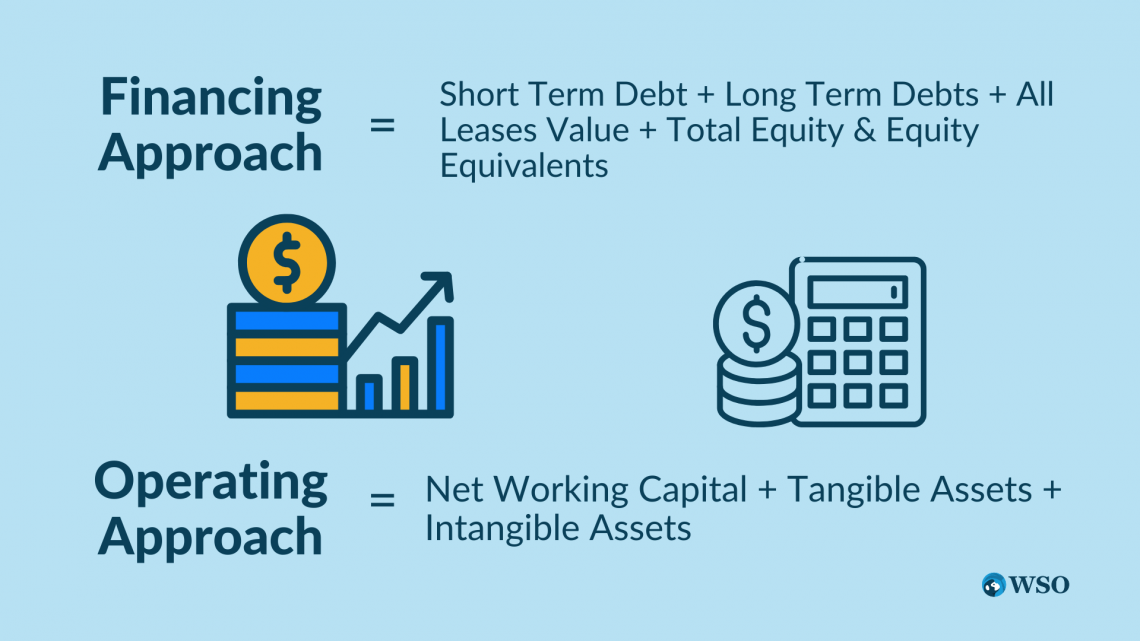

Return on Invested Capital (ROIC)

Return on invested capital (ROIC) is a statistical measure used to assess the efficiency of a company allocating its capital under its upper hand to profitable investments.

Formulas for capital invested via financing approach and functional approach. Both methods reflect a company's investments and for which function a company allocates those investments.

Therefore, it can be used as a criterion for calculating the value of other competitors and comparing those data.

The formula for return on invested capital can be defined as a company's net operating profit after taxes divided by the money invested.

Return on Invested Capital = Net Operating Profit After Tax/ Invested Capital

Consider a company with $500,000 invested in capital and a net operating profit of $100,000 after taxes. The ROIC would be calculated as follows:

Return on invested capital = $100,000/ $500,000 = 0.2 = 20%.

Generally speaking, if the return on invested capital is greater than the weighted average cost of money, the company accumulates more value by investing in projects.

On the contrary, the same concept applies if the return on invested capital is less than the weighted average cost of capital. It would mean that the company is losing value by investing in projects.

An investment is not profitable when WACC is more significant than ROIC, but it is advantageous if ROIC is more excellent than WACC.

When measuring a company's success, it is essential to consider the different returns on total capital for the various market sectors to compare your company to the overall industry and market.

For example, the returns on capital may be higher than anticipated for the company's IT sector. Still, the ratio may be lower than expected for the advertising sector of the company.

What is a Good Return on Total Capital?

When it comes to decision-making, you must keep track of cash inflows and outflows regarding operating expenses and income.

Looking for expense patterns for various operating expenditures and patterns for returns can help you understand which costs to keep or exclude, whether the operation is running efficiently or inefficiently, and overall help to assure that you aren't spending any more or less than necessary.

Comparing input costs and output revenue can provide better insight into the possible returns.

Ordinarily, the higher the ratio, the better, but according to the consensus, anything greater than 5% is considered a good ratio. Any ratio above 20% is considered to be outstanding.

Say a construction firm has a 5% return on total capital and decides to invest in $100,000 worth of machinery and equipment. This means that for the $100,000 spent, the firm generates a capital inflow of $5,000 from returns.

Looking back at the previous examples for Company X, we can compute its overall return on total capital. Since the entire capital was $680,000, and the operating income was $102,000, the return on total capital for Company X is calculated as:

Return on total capital for Company X = $102,000/ $680,000 = 0.15 = 15%.

Considering the ratio standards, Company X is generating back 15% of its capital in total, indicating that the firm has excellent performance.

Keeping a record of costs and returns is essential for the growth and success of a business.

or Want to Sign up with your social account?