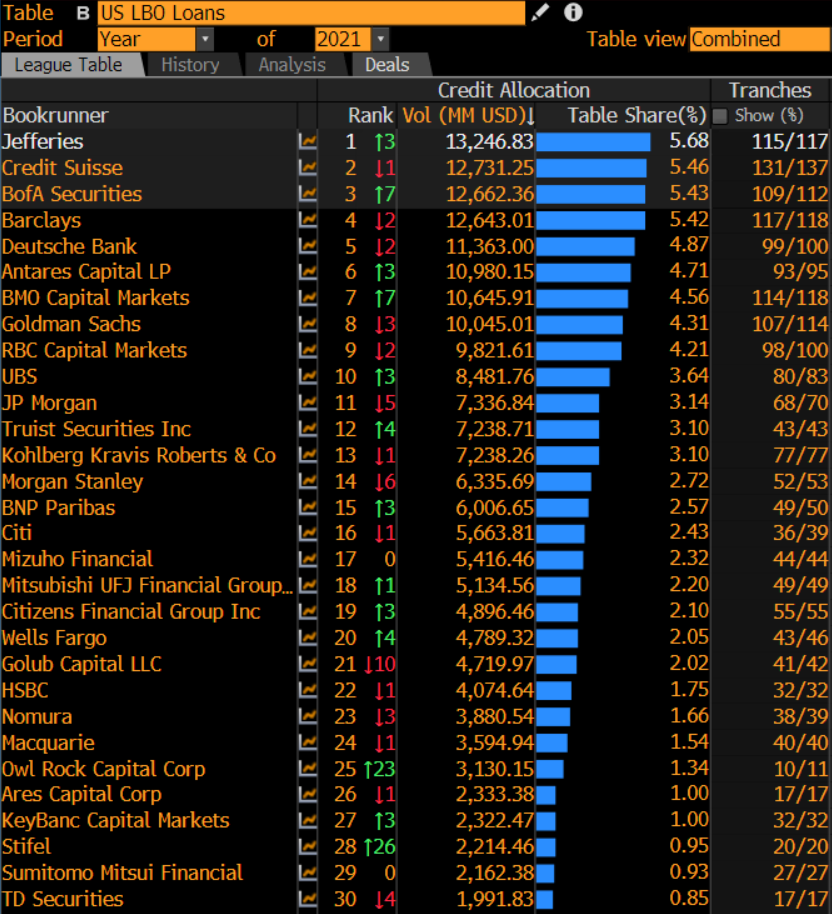

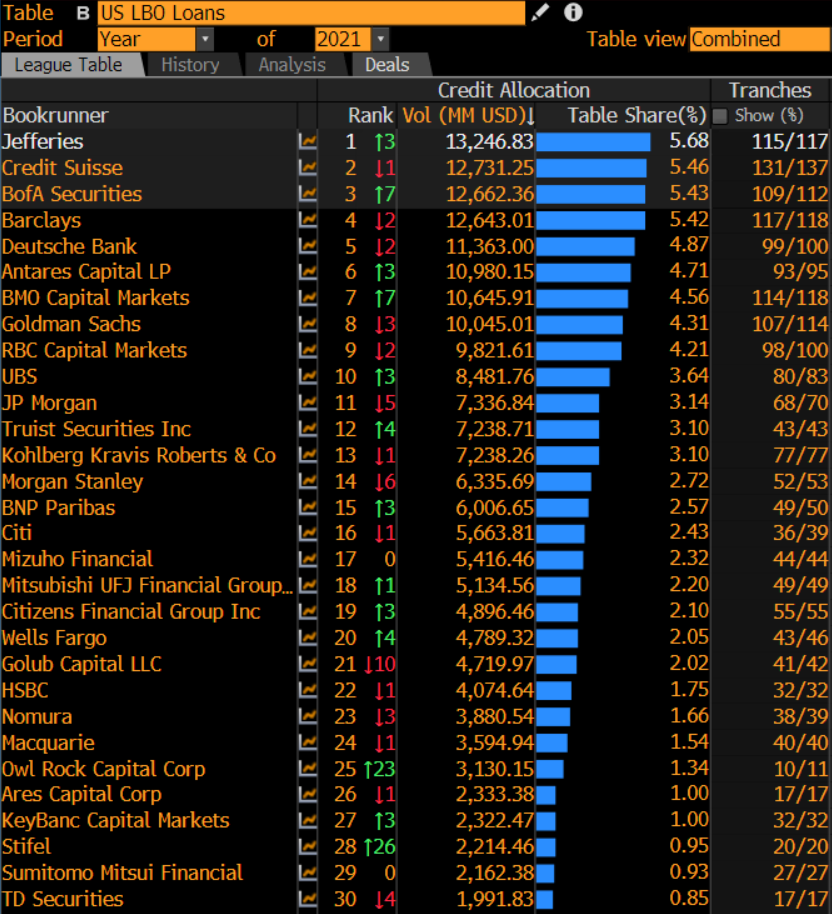

2021 LevFin League Tables

As per requested in the 2021 League Tables forum, here's a league table of US LBO loans pulled from Bloomberg.

As per requested in the 2021 League Tables forum, here's a league table of US LBO loans pulled from Bloomberg.

Career Resources

What are the m&a league tables by value and deal count? Thanks!

"LevFin league table" when its just US LBO Loans? Which is 5% of the actual LevFin volume?

On average, how many hrs are worked as a lev fin junior associate? Potential opportunity to switch from sales s&t macro role to a lev fin associate role, but not sure if it's worth the change. Currently working 55 hrs a week, 50-60 avg. Current all-in comp is 200k

Depends on the bank but usually it’s the same as any IB coverage associate more or less

I have seen this move done twice but You will have to start as an analyst 1

Quickly summarizing in excel, just left-leads (no JBRs - filters are tough by company w/ this one - they jumble all the JBRs into 1 cell) - if someone has the league tables excel file with underlying data - happy to sort a better output...

2021: New Money, left lead only

Note 1 (New Money): No Refinancings, repricings, DIP, GCP),

Note 2 Left lead only (no JBR - altho a huge part of fees/business)

Insights on EMEA Levfin?

JPM, GS, BNP, DB, BofA, CS is broadly the top 6 and most respectable ones. Think that this is broadly the correct order more or less.

JPM is clear #1 every year more or less but culture is rough. BNP does a bunch of volume through balance sheet but not necessarily great analyst experience. GS is more of capital markets shop. DB/CS/BofA are probably the better LevFin teams that model quite a bit.

If anyone can speak for TD Securities Lev Fin...generally I heard that it was a pretty decent group, but seems relatively low on the table?

Veritatis architecto perferendis quas eveniet vel. Distinctio incidunt sit praesentium ea qui sint id. Possimus et omnis ut cum non itaque. Laboriosam qui nihil assumenda quae dolorum.

Expedita fuga veritatis ab rem error voluptatem. Veniam nobis atque non voluptatem. Ducimus odio et amet sit. Exercitationem voluptatem aperiam est molestias veniam corrupti voluptas soluta. Praesentium sequi consequatur aut iste accusantium accusamus est. Doloribus non rem itaque cum rerum repudiandae quos. Sed aperiam qui est neque.

Aut doloribus atque quos et et eum. Repellat vel est dolore qui ipsam vel. Dolorem praesentium nesciunt ut eum at quos. Aut eos a quia reiciendis assumenda et corrupti. Illo neque excepturi sunt voluptas. Ipsa nulla vitae iusto qui harum eveniet numquam.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...