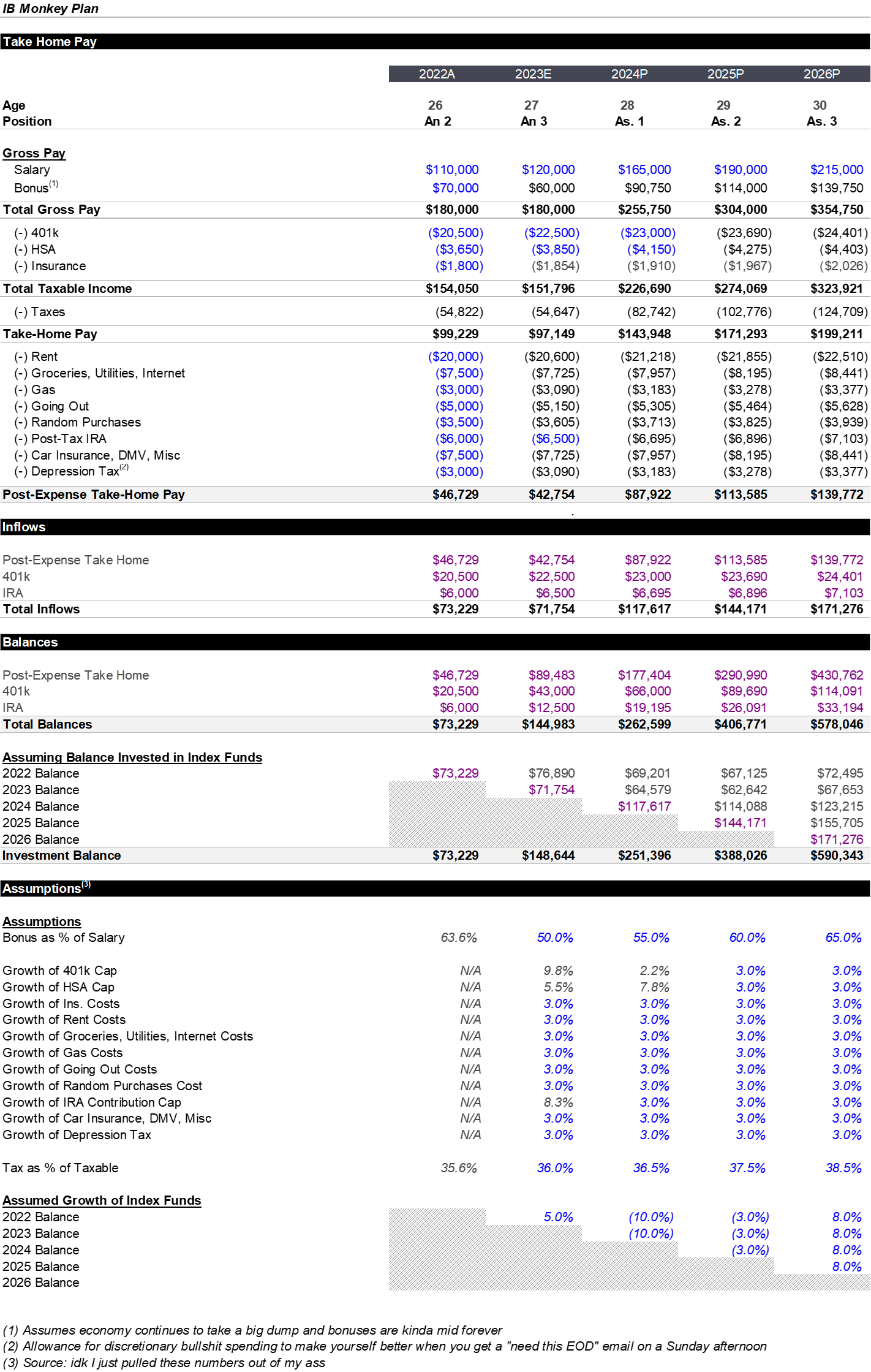

Is my IB analyst personal budget realistic?

cuz im a fucking nerd and im trying to figure out if I want to stay in banking, I'm trying to forecast earnings up to age 30. Does this seem realistic?

edit: attachment if anyone wants this, took like 30 mins to make so I recommend remaking with your own financial situation since this is a quick and dirty spreadsheet

| Attachment | Size |

|---|---|

| Personal budget - Copy.xlsx 16.87 KB | 16.87 KB |

Yes

Where the fck do you live that your rent is 20k a year? Enjoy a little

a very shitty apartment

it has AC at least

Rent and entertainment will increase once you start getting bitches.

Get a gym membership as well. Too many fat fuck no-bitch-getting analysts these days.

Telling you man that’s all I need

Double rent

If this is NY, 1700 a month for rent sounds low. I´m guessing you have roomates now, so you might want to increase rent expense if you want to live alone eventually.

The footnotes lol

Looks good to me

Odd that you’re not placing your money in money market funds if you’re so pessimistic on the market over the next few years haha

I have a good amount in treasuries already paying 4-5%, so just waiting to buy more if interest rates rise, but my long term outlook for public equities is more bullish and wanted to be conservative

Very nice spreadsheet think I will re create for myself in free time. Need to make sure to get to $5mm in balances by age 40 for retirement

we might need a provision for hair transplants line item if modeling out that time horizon

Pretty awesome spreadsheet. Index fund returns seem very bearish but also good to be conservative. Is your IRA post-tax (aka Roth) or pre-tax (aka traditional). Assuming you're single, I think your income level is too high to contribute to a Roth IRA - can't contribute if you make more than $153k in 2023. So is that pre-tax IRA?

shit you're right, good catch. might need to consult a tax person on this. thanks dawg

edit: yep reached out to an advisor and turns out I done goofed and shouldn't be contributing to that account. You saved me from a 6% penalty man, ty

Ask your tax person about backdoor roth ira or simply Google it

Backdoor Roth no

Awesome spreadsheet dude - thanks for sharing.

Assumptions look good to me, maybe a touch bearish on your investments growth?

I'd at least build in a downside case here. At least half of the analysts I've seen burn TF out of this job and end up in something more lifestyle-friendly like corporate roles or LMM PE. Your base case assumes pretty great pay all the way through - its rarely that easy.

Your rent also looks incredibly low. Are you going to be 30 years old and living with 3 roommates in an absolutely gross apartment? Same with your misc. expenses, your going out (incl. dinners) is going to increase a lot more than $600/yr over 6 years as your lifestyle grows. You won't be living like a 22 year old poor analyst forever. No travel at all?

Those things aside this is a great spreadsheet setup

Drivers on separate tab, pls fix

Looks good, should build a toggle for an add on acquisition (aka girlfriend)

Love it

Pls bake in your asso promotion base, run the number, and get back to us. Thx

Love it. Yes very good. Stick to it

Any major city double rent and random expenses.

aren't associate bases 175, 200, and 225 respectively? And bonuses would be 70-100% (assuming market gets better in coming years)?

It's pretty damn rare for an ASO 1 in either IB or PE to make $350k, even $300k is high unless you're at a MF. OP mentioned staying in IB, I think all in numbers only touched this level in 2021 which was a nuts environment. OP's numbers are pretty fair if you're assuming MM PE exit or a non-gangbusters market environment for IB

What's with kids these days underestimating rent in NY? Have you set foot in the city? Do you mean a median studio is $3,500 and you'll get so tired of that shit after a year that you'll want to upgrade to a 1 Br at least?

I mean I'm currently paying that amount for a small but perfectly serviceable place 5 mins from my office (not NYC) - if I'm delaying starting a family and all that, I don't see why I couldn't assume I just stay there for a couple years

Nice model dude. I am a bit confused on why you did a cohort analysis on your index fund investments. Couldn't you just add last years ending balance to new investment balance then multiply by (1+ r)?

mostly for flexibility, can assume different investments earn a different return depending on the year invested (e.g., if I invested at the top with my 2023 balance and it falls off a cliff, but I invest at the bottom in 2024 and it jumps in 2025, the overall balance is normalized for that depending on the magnitude of the amount being invested in that period)

IMO it's just easier to conceptualize the rates you'd earn on an investment based on the prevailing annual growth rates of index funds rather than comingling all funds and trying to come up with a normalized growth rate when dollar cost averaging

Going out is way too low. 100/week? More like 100/night out at least

Really like this, any chance I can PM you for the file? Been looking for something like this and would love to play around with it.

Yeah please could I get it aswell? Thanks!

Can I PM you lmao I need this

Extremely detailed analysis projecting out a shit ton of uncertainties for half a decade into the future that will inevitably not come to fruition…yep you were made for banking.

Jk this is actually interesting and something that I ballpark frequently in my head as I stay up til 3am pulling together analyses that are not needed as I know we will ultimately pass on the deal anyway…

First off, congrats on being responsible. This isn’t nerdy, this is how you achieve financial stability. People often mistake a high income or savings as financially stable, financial stability is actually controlled spending relative to your income. You are doing great by doing this.

Anyway, summarizing what others have said, but adding my insight based on doing this and evaluating what actually happened now that I’m close to 30. Going to be blunt and critical, but comes from a place of love and admiration because you did exactly what I did and I’m in a position to tell you where I was off:

In summary, I used to do a budget like this and I found it was kinda false precision and being retrospective gave me more informative info. So here’s what I do now and what I moved to after I got a few years of experience budgeting:

In general, I’d say this is a great exercise to understand how you spend and what opportunities are, but I’d recommend being retrospective and not ignoring the impact of one-off expenses.

awesome, thanks for the in depth response

Adding to you, OP, and others in this thread. This is the way—really. I can’t express how life changing being responsible with a budget is.

I’ve made this point in other threads, but I always come back to it. There are 3 types of people in regards to budgeting:

1) those who are backed by their parents and don’t need to budget

2) those who don’t budget because they are stupid or they really just can’t afford living because their jobs and situations are unideal

3) those who budget

If you look around, a vast majority are 1 and 2, so if you look at what your friends do you will end up broke or in an unideal situation. It’s been stunning as an adult learning about people with 500k+ salaries being broke or with basically no savings. Or people who haven’t budgeted for a kids education despite having a huge home—it’s like wtf are you doing?

If you do budget and pay attention, and really the biggest one is not moving up your rent/living expenses too quickly, you can really save and compound a non-negligible amount of cash. Just some basic math, I had a ton of IB friends that paid $2300 a month in rent to my ~1700 early on. That’s post tax 7k a year or pre tax like 10k. Over a decade and including market returns, you quickly approach basically an entire house down payment on a home for yourself or your parents, or a base that will easily grow to a full college tuition anywhere through just living in a cheaper place by having a roommate or not jumping the gun on luxury.

Eventually, you learn the advantage of making a lot of money and saving the first few years of your career also eventually gives you the ability to take more career risk and leave the rat race if you want because your passive income starts to be really significant. If you assume a 5% return is achievable and bank 1m between pre and post tax accounts, you have 50k of passive accumulating every year. This all of sudden makes taking a 50k pay cut less of a serious issue, so pursuing entrepreneurship, a growth opportunity, or just a passion project is possible while still being very financially responsible.

My MF would love to hire you, send me DM ;)

Why is the HSA exceeding $3,850 at any point given there’s a hard cap limit on contributions per year?

they increase the contribution limit every year

This is sick

Can you send this to me? Looks great

Love a copy as well

One maybe helpful point is that you can calculate taxes relatively easily, so you don't need to hardcode your tax assumptions

I’ll take a copy as well if you’re open to sharing it

If you're open to sharing, I'd love a copy of the file. Thank you

^ yes if you are open to sharing I’d love this excel too super helpful. Feel free to pm me if so!

Really good that you're doing this and thinking about your budget, but agreed w/ everyone else that your expectations are unrealistic, and notably that rent is too low. Your priorities will really likely change by 30. Hell, you probably won't want to live that lifestyle at 28. Even if you are fine living in a cheap place, I wouldn't expect your rent to only go up by 3% / yr.

Others have called this out but your going out and random purchases $ are too low - not just from your day to day spending, but think about your "fun" things like bachelor parties, weddings, vacations / trips in general, dates, etc. By the time you're 30 wedding season will be in full swing and just a single bachelor party alone can easily run you in the thousands. I just went to a destination wedding and had to pay over $2k just for the plane tickets (in economy), forget everything else associated w/ that trip.

Then there are the "unfun" things to plan for - funerals to attend (unfortunately), medical emergencies (and you put down HSA so you'll be on a high deductible plan), your car breaks down, moving expenses (cross country moves will be in multiple thousands easy, intracity moves also aren't cheap), just simply buying new furniture, etc.

On the flip side doesn't look like you're accounting for any 401k % matching from work.

Going out is gonna be much higher. I’d say around $10k

Nice format btw

Looks good thx

Would love a copy if possible, thanks!

following

Dude, you can’t fit life into a spreadsheet. Half of your assumptions and outcomes will not even be close.. you won’t have any visibility into your earnings 5 years down the road in IB or any other field. Are you going to jump ship the minute you calculate a $1 higher NPV elsewhere? Spreadsheets are useful tool, but you have to know when to use a tool.

Nice model! Thanks for creating it.

I am in my 5th year and I would say generally this is quite accurate, from a high level perspective.

As others have suggested, might make sense to add downside scenarios to consider 1) cost of changing jobs to a lower paying jobs 2) rocketing expenses due to dates / going to Dorsia / changes in lifestyle.

And a separate question: the model you built seems to say you will have ~590k balance by age of 30. How does that feel? Do you think it is a lot already?

I actually did some similar calculations before myself and it's a bit depressing to know that after putting in so much efforts, you "only" get [600k] by 30, while many dudes from rich families got that when they were born. I mean yes be grateful you are better than most already - but as my friends always say, even working in IB, it is hard to help someone truly move up the social ladder money wise, unless you can stick with IB for 10-20 years.

Appreciate any thoughts

Reprehenderit tenetur assumenda deleniti. Qui inventore atque aliquid ipsum. Rerum ipsum veritatis porro repellendus eligendi aut veritatis reiciendis.

Provident atque qui sit. Dolorem corrupti velit doloribus autem dolores rerum itaque. Cupiditate vitae reprehenderit exercitationem illum recusandae asperiores. Quo dolorem molestiae quam magni.

Ducimus culpa similique necessitatibus accusantium qui. Aut odio aut suscipit. Tempora sunt est voluptatem ea.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Sed consequatur id ea facilis fugit dolorem tempora quisquam. Beatae quasi et dolore in. Nesciunt dolores suscipit mollitia perferendis modi. Voluptas magni dignissimos alias pariatur soluta.

Eos repellendus fuga voluptatem nobis cumque. Optio dolorem labore molestias veniam et dolorum sunt. Aliquid vitae beatae totam et dolorum maxime voluptas.

Officia voluptatibus mollitia esse et quas. Omnis aut neque deleniti eligendi libero. Qui fugit libero aut occaecati eligendi rem. Ad officiis ratione vero accusantium tempora et. Est ut error pariatur sit maxime qui.

Quis veritatis non quis commodi voluptas alias ipsam. Quia tenetur quae voluptate quis. Quo deserunt optio dolorum tempora aut laborum sit.

Eius vero est optio ratione ratione quam aut. Est corporis velit debitis et. Deleniti fuga consequuntur provident dignissimos. Animi aut impedit nam.

Veniam voluptates nesciunt est rerum temporibus quos. Nobis eaque aut harum et. Voluptatem aspernatur aperiam ea et temporibus praesentium. Officia omnis aut nemo cum praesentium perferendis.