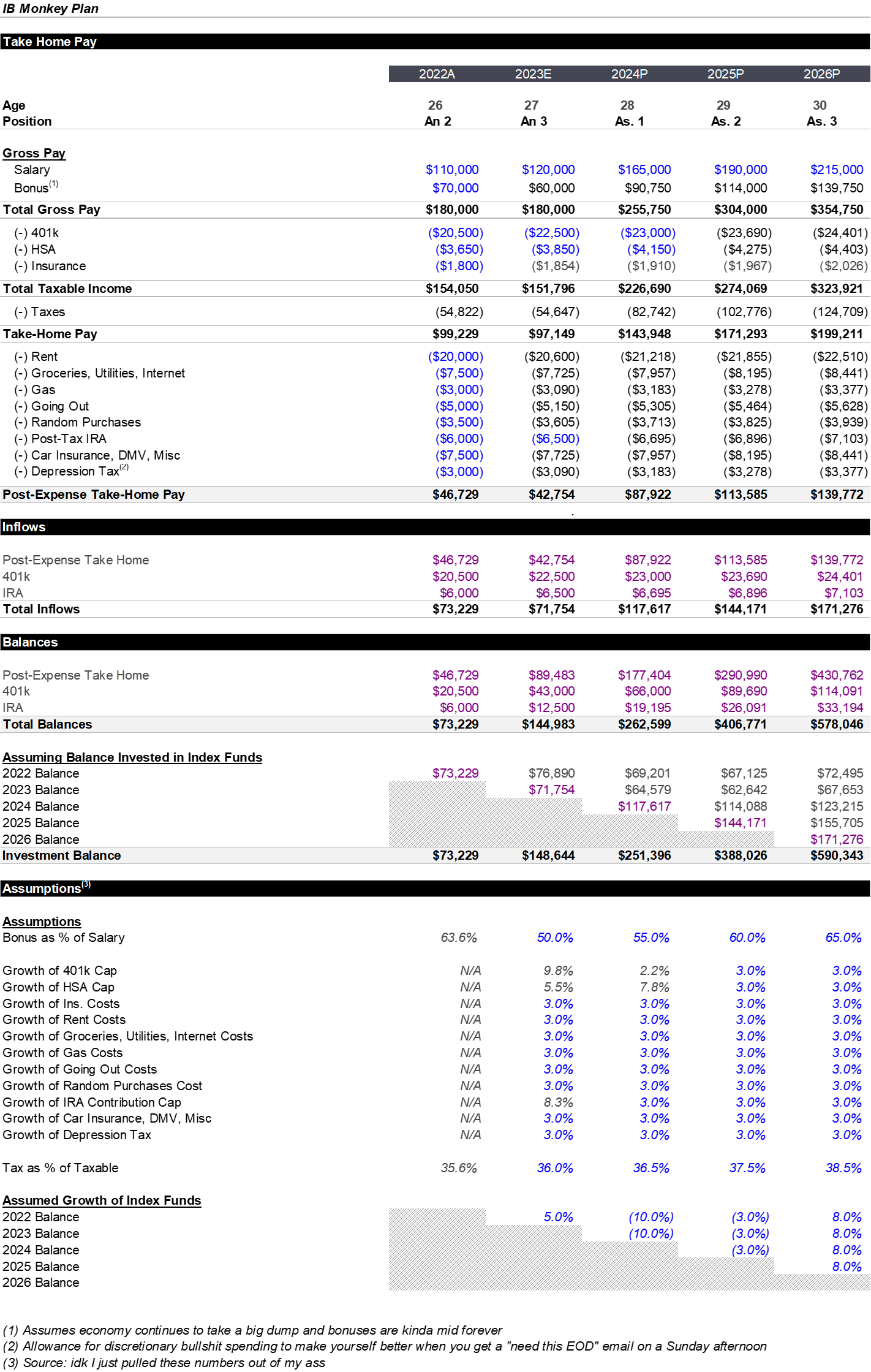

Is my IB analyst personal budget realistic?

cuz im a fucking nerd and im trying to figure out if I want to stay in banking, I'm trying to forecast earnings up to age 30. Does this seem realistic?

edit: attachment if anyone wants this, took like 30 mins to make so I recommend remaking with your own financial situation since this is a quick and dirty spreadsheet

| Attachment | Size |

|---|---|

| Personal budget - Copy.xlsx 16.87 KB | 16.87 KB |

Where the fck do you live that your rent is 20k a year? Enjoy a little

Rent and entertainment will increase once you start getting bitches.

Get a gym membership as well. Too many fat fuck no-bitch-getting analysts these days.

we might need a provision for hair transplants line item if modeling out that time horizon

I'd at least build in a downside case here. At least half of the analysts I've seen burn TF out of this job and end up in something more lifestyle-friendly like corporate roles or LMM PE. Your base case assumes pretty great pay all the way through - its rarely that easy.

Your rent also looks incredibly low. Are you going to be 30 years old and living with 3 roommates in an absolutely gross apartment? Same with your misc. expenses, your going out (incl. dinners) is going to increase a lot more than $600/yr over 6 years as your lifestyle grows. You won't be living like a 22 year old poor analyst forever. No travel at all?

Those things aside this is a great spreadsheet setup

Drivers on separate tab, pls fix

Looks good, should build a toggle for an add on acquisition (aka girlfriend)

First off, congrats on being responsible. This isn’t nerdy, this is how you achieve financial stability. People often mistake a high income or savings as financially stable, financial stability is actually controlled spending relative to your income. You are doing great by doing this.

Anyway, summarizing what others have said, but adding my insight based on doing this and evaluating what actually happened now that I’m close to 30. Going to be blunt and critical, but comes from a place of love and admiration because you did exactly what I did and I’m in a position to tell you where I was off:

In summary, I used to do a budget like this and I found it was kinda false precision and being retrospective gave me more informative info. So here’s what I do now and what I moved to after I got a few years of experience budgeting:

In general, I’d say this is a great exercise to understand how you spend and what opportunities are, but I’d recommend being retrospective and not ignoring the impact of one-off expenses.

Adding to you, OP, and others in this thread. This is the way—really. I can’t express how life changing being responsible with a budget is.

I’ve made this point in other threads, but I always come back to it. There are 3 types of people in regards to budgeting:

1) those who are backed by their parents and don’t need to budget

2) those who don’t budget because they are stupid or they really just can’t afford living because their jobs and situations are unideal

3) those who budget

If you look around, a vast majority are 1 and 2, so if you look at what your friends do you will end up broke or in an unideal situation. It’s been stunning as an adult learning about people with 500k+ salaries being broke or with basically no savings. Or people who haven’t budgeted for a kids education despite having a huge home—it’s like wtf are you doing?

If you do budget and pay attention, and really the biggest one is not moving up your rent/living expenses too quickly, you can really save and compound a non-negligible amount of cash. Just some basic math, I had a ton of IB friends that paid $2300 a month in rent to my ~1700 early on. That’s post tax 7k a year or pre tax like 10k. Over a decade and including market returns, you quickly approach basically an entire house down payment on a home for yourself or your parents, or a base that will easily grow to a full college tuition anywhere through just living in a cheaper place by having a roommate or not jumping the gun on luxury.

Eventually, you learn the advantage of making a lot of money and saving the first few years of your career also eventually gives you the ability to take more career risk and leave the rat race if you want because your passive income starts to be really significant. If you assume a 5% return is achievable and bank 1m between pre and post tax accounts, you have 50k of passive accumulating every year. This all of sudden makes taking a 50k pay cut less of a serious issue, so pursuing entrepreneurship, a growth opportunity, or just a passion project is possible while still being very financially responsible.

Adding another thing here on purchases I made that I regretted and ones I didn’t:

Huge Regret Purchases:

Things I enjoy immensely and believe I have gotten more than the value I bought them for:

These are some of the outlier purchases and some recommendations I’d make. Don’t be so afraid of saving you miss memories and moments and also don’t be so stingy you need to double buy shit because you get crap things that wear out fast.