Discouraged CFA Charterholder looking for first big break - advice

Hi Everyone,

I am writing the post as I find myself quite frustrated with my career progress. To give you some background, I worked at BAML in back/MO roles for close to 5 years and then abandoned ship and moved to Spain to "take a break from reality". I've been working as a English teaching assistant for the past three years. Concurrently, I completed the CFA program (Charter Received in August 2021). I viewed the CFA Program as my ticket back into Finance. In August/September, I applied for over 100+ jobs within AM/IB/S&T/Consulting mainly in Europe (Madrid/London) but also in the US (NYC/Charlotte). Of these applications, I received interviews for about 3 and none resulted in an offer. Discouraged, frustrated and a bit deceived by my belief that the CFA would open up some doors for me, I decided to enroll in a Master in Finance program at a European Target. Fast forward to having been accepted, I have proactively been applying for summer internships (2022) at BB and brand name AM firms. I'm at about 60+ applications and have yet to receive and interview... I guess my question is What gives? What am I doing wrong? I get the 3 year hiatus does not pass the optics test but i've got decent experience plus the CFA Charter. At 30 years old, am I over the hill? Is it a lost cause? Not sure if the future will be any more optimistic.

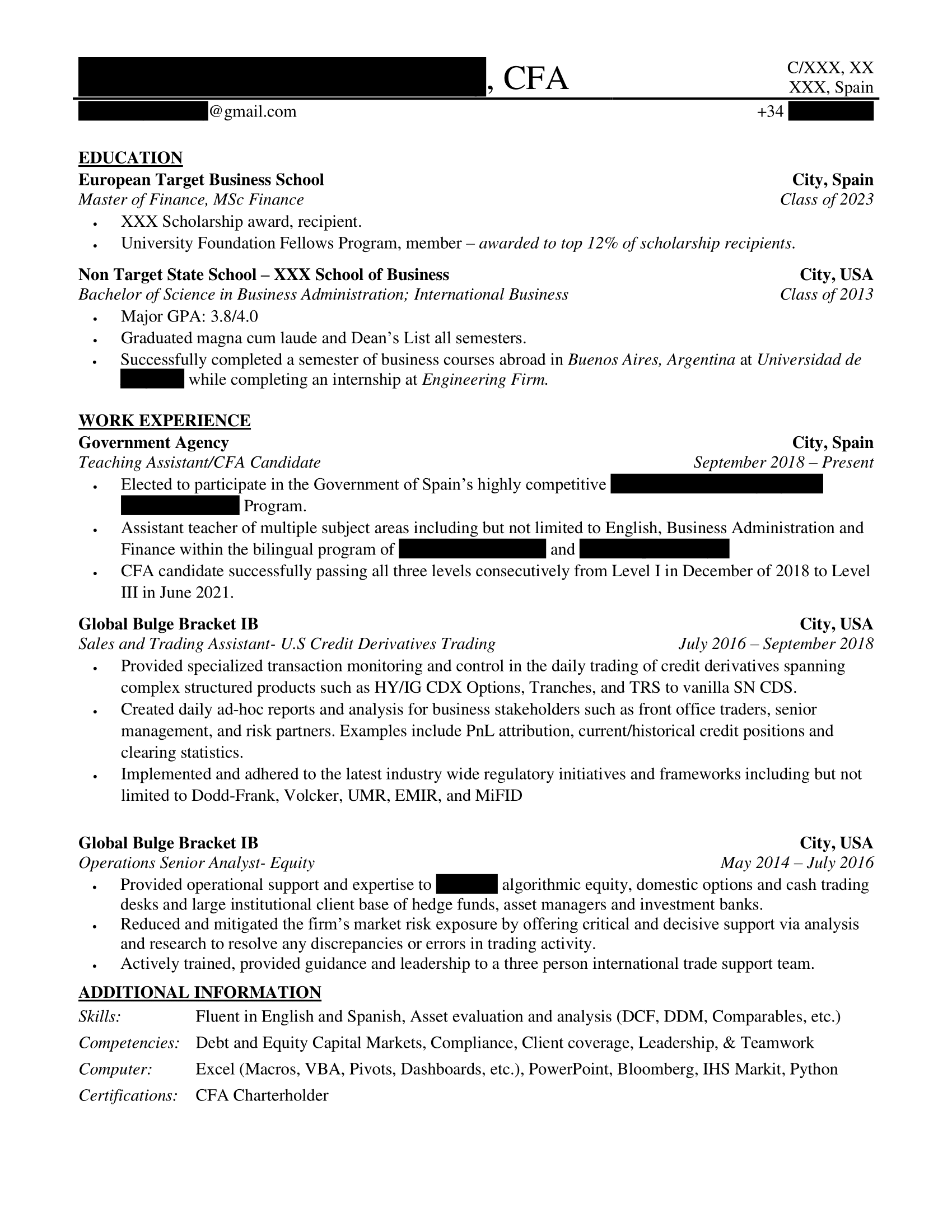

I've attached my CV, I'd appreciate any candid feedback

I don’t know what to say mate. You’re applying for internships right? Maybe they see your age on the application and thinks something’s up? Your CV is great… guarantee it will be better than 90% of kids without prior FO experience.

(I know this doesn’t add value, just my 2C)

I am applying to graduate level internships. So I assume,the competition is of the same experience and or around the same age.

Graduates are typically 21 - 23 year olds, whereas, you’re a 30/yo, so HR might see that as a red flag. I think that’s the point OP is making.

Honestly the CFA is a bit of a scam. I think it’s helpful for people who come from engineering or arts backgrounds. That aside, I think it works better if you use the network of your school to break in.

I hate to say it, but you're right, the CFA's return on investment is horrific outside of people who are:

a) complete outsiders and majored in liberal arts or something unrelated to finance

b) Canadian

Thoughts on doing CFA in Canada if I'm already FO in markets? Worth it maybe for buyside or nah?

Asset managers view the CFA as a step up but not much outside of that. So unless thats where youre looking, not a ton of value in it

What kind of jobs are you applying to/interested in? What roles are you applying to at the BB banks specifically?

You have a solid resume, but doesn't scream investment team at brand name asset manager to me (which is where you said you applied) or S&T. Remember that the people getting these internships at the graduate level go to M7 business schools and probably came from research roles at top asset managers previously.

Edit: just noticed this but I would try and minimize the "assistant" part of teaching assistant in your bullets there and move the CFA part out of there (it doesn't belong there). You use the word assistant at least twice. Try and describe it in a way that shows more leadership without being dishonest. First bullet point there is great - leave it.

Firstly, I could be wrong on this but I'm sure CFA needs its own section under the Education part. It doesn't belong where you have put it at all, as mentioned above.

Also, I think the problem may lie with the fact your previous 4 yrs BB experience is BO/MO, so not actually relevant to what you may be applying to. Yes, you have the CFA and are studying a masters, but 3 years out of work is quite a long time to come back and expect you will be among the top picks for the highly competitive areas you are applying to. May also raise a few eyebrows.

I am not sure if you qualify, but have a look at some 'return to work' programs, quite a few BBs have started them. Also, maybe look at getting back into your BO/MO role or similar that you were into previously. You will have a much stronger case now with the CFA & masters to network/lateral internally into the FO role you want.

I think you have a decent resume and the CFA completion is quite prestigious. It shows you can grasp complex concepts and have a strict and disciplined work ethic. I would continue applying as it is just a volume game.

Just out of curiosity, regarding the Target B-School in Spain, did you enter in a 5 figures debt?

Yes, I did. But luckily, I received a decent scholarship to offset some of the costs and the loan I took out will also help with living expenses.

Put your CFA in education as other commenters mentioned. Something like "Completed all three levels while working full time over X years" might be a good idea for a bullet point too.

Don't lose hope, age is only an obstacle, not a road blocker. I'm much younger but was in a similar job search recently. I had a solid resume with decent grades, top notch experience, and great extracurriculars. Kept applying to the best places, but the only way I got interviews was by networking. I eventually landed at a MF Analyst stint. Europe, USA, wherever, networking is huge.

Given that, try reaching out to people that you can relate to at these firms. Maybe they went to your undergrad, or your grad school (doesn't have to be the same program btw), or they're a CFA holder. You have a huge BB with MO experience. I bet many people left that bank to places you want to be at (maybe even coworkers from a long time ago). It's 100% possible with your CV. Reach out to them, have a story ready on yourself, and ask for their help/ guidance.

Also, since you're a CFA holder. Do you have any good investment pitches written? While talking to people in AM, maybe ask them to review it. This lets you improve anything you might have missed in your pitch AND lets them see your talent. Go get it.

No networking = no interview. Cfa is worthless without the relevant experience.

Are you networking? That's more than half the battle.

As someone who has passed level 1 and 2 I can honestly say it has not helped me at all with applications outside of making it easier to network with people who have or are going through the program (same with the MSF, which I also have). At the end of the day, I have only gotten jobs through networking i.e. applying for a job and then reaching out to someone on the team via LinkedIn or ideally having the email template for the company and emailing them directly. Most bank emails are [email protected]. There are also website databases like careershift (paid subscription, but worth it if you’re really trying to grind on the networking) that you can use and they do a pretty good job of getting you email templates.

Need to network man, networking is 10,000% of the battle, nowhere near half the battle as some say. Memes aside, the problem here aside from age (and age isn't even THAT big a problem) is that you just seem directionless (from the resume, you completed the CFA which I know is literally brutal and requires immense sacrifice to complete). There is little to none incentive to hire you over the 20 something year old that is starving for work and has loads of energy. 30 is still super young and you have great experience. The other thing is that you picked what is probably the worst European country to do a masters in, as yeah Spain is a great country to party in and have fun in, but it has literally no value add beyond having fun. I am Spanish myself and my sister lives there and I can tell you that beyond being beautiful, having super rich culture and having a fun group of people, it is a trainwreck beyond imagination (as I'm sure you realized when inevitably trying to get a job, which is almost impossible in Spain for white collar professionals). I know this message is brutal, but look at the 'back to work' programs and put the CFA in a prominent position in the resume.

Also, you can't be a nun and a whore at the same time, any time I see one of those "English teaching programs" being done, it makes people seem like partiers, not hardo's (many individuals don't care, but it's the impression it gives off to banks). You have to pick whether you're going to be a hardcore finance guy who can do the 60hr/week+ or someone who just wants to have fun and take it easy in life, but you cannot have both.

this is good shit. 100% agree

I really appreciate this candid take. Lots of good points here.. and if you are willing to connect, I would love to get in contact with you. Thanks

CFA is in the wrong place on your resume, but I’d also say that I don’t think European shops care too much about it.

Also, the best way to get a job is to network with people not to fire off job applications!

I'm very sorry you're having such a hard time recruiting. My two cents are your problem revolves around:

1) School - you're not a typical MSc student, you're more of an MBA student in terms of years post-undergrad. You entered your MSc after 10 years of undergrad. This would put you as much older than most MSc students who are normally right out of university, and not the type of students on-campus recruiters focus on. This will impact all on-campus recruiting.

2) Story - you did a non-target, then BO at a bank, then taught Spanish, and now a MSc program. It's hard to paint one single unifying thread throughout this story. There seems to be a lot of jumping around in your interests. Obviously you're a smart guy, but it may be challenging to convince a firm that you know 'finally' know what you want to do.

Offset

For every weakness, there is an offset strategy.

Given you speak Spanish fluently and have lived/worked in the US, I'd focus on crafting a story that you want to be an EM guy. You have a CFA charter, lived in Spain and studied at a Spanish university. I would push hard for any EM role on the buy side or sell side regardless of location. Be open to living anywhere. All MDs who work on the sell side in any EM publishing role should be your target. I would not just focus on on-campus hiring, but try to 'sneak' into the MBA hiring as you may be more of a fit for those roles. I'd also think about how you can go the extra mile in proving you can do the job compared to others. You may want to skew your CV to focus on this area, or at least have 1 CV for general jobs and 1 (or more) for targeted roles.

Best of luck!

Thank you for taking the time to reply and offer feedback. You have some great points

In regarding the MSc vs MBA... it was a tough decision but honestly I found myself priced out of many MBA programs. The difference in price between a MBA and MSc was often a $50,000. I couldn't justify that gulf especially as a lot of the coursework in a typical MBA program just does not interest me at all (Strategy, Operations, Marketing, etc).

The story I have tried to craft is that, although I did leave a good MO job that in hindsight may have propelled my into FO, I stayed the course and stuck to continuing my education and dedication to finance by concurrently studying for the CFA exams. I think this gets missed in my CV and is hard to convey without an in-person interview. This is my biggest crux and I'm really not sure it can be overcome on paper.

Ullam dolores magnam sint. Non modi esse veritatis velit. Sit dolorem aperiam magnam quia architecto omnis odit. Aspernatur consequuntur aut ab ipsum quis.

Rerum sit fugiat sed deserunt voluptatum magnam esse labore. Asperiores sunt dolor enim voluptatibus nostrum accusamus vitae.

Tempore ullam et maiores eaque quisquam. Ut tenetur minus dolore. Delectus fugit a eos quis autem est dignissimos. Et pariatur magnam commodi repudiandae voluptas temporibus odit. Facilis hic fugit eum voluptate harum hic.

Dolores dolorem autem dolores quia illum. Est nulla non et voluptatem. Quibusdam dolore consequatur velit sit quis minus eos optio.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Atque numquam dicta et doloremque consequatur facilis ratione tempore. Quia tempore aut sit ab aut. Perferendis et aut non omnis sequi placeat vitae. Molestiae labore perspiciatis sunt odio occaecati voluptatem quod.