Why is European / UK PE firm recruiting the way it is? Aptitude tests...

American here. I recently had an interview with a European PE firm, and it was frankly a bizarre process. The modeling test was expected, but an aptitude test? What is this non-sense? Every process I have had in the past has been 30 minute call with a VP (e.g., deal walk through), modeling test (90 minutes to 4 hours), and then at most 1 more conversation / case, before being flown in for the superday.

I fail to see how a test like this has any bearing on my ability to do well as a finance professional. Apparently this is quite typical in Europe?

Also, do headhunters over there conduct your 1st round interview, rather than just pass along resumes? Your system seems in every way worse.

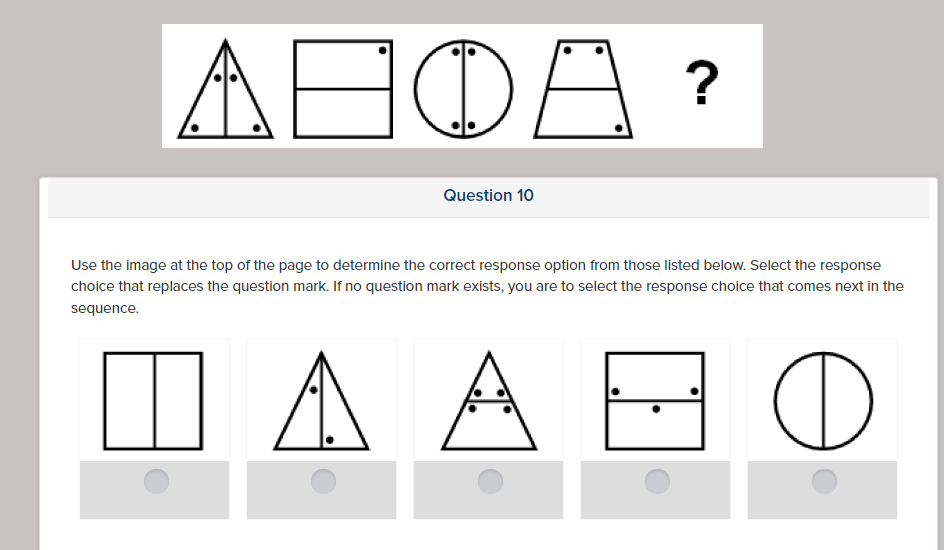

My last LOI fell through because I went with circle with 2 sub segments and 4 dots instead of trapezoid with 3 dots.

Couple of observations btw:

1) is it the triangle with 4 dots? Just because it’s going 4 dots, not 4 dots, 4 dots,etc.?

2) this question is moronic

3) I find european organizations in general to be weak on critical thinking. They think Americans are cowboys and love process. Holding on to their lords and ladies because they can’t handle real competition.

4) if it was up to them they’d just structure their whole civilization around birthright and inheritance and then probably go to war with whoever is nearby

5) the question itself hedges on whether there is a question mark in the picture. Gotta love that approach to solving a bug where sometimes there isn’t a question mark in the picture.

1) I tend to agree. This was more of an illustrative example, but imagine 30 minutes of this sh*t.

2) 100% agree. I found it borderline insulting to have to take an assessment like this, until I found out it is actually quite common for European funds. I get that maybe they need to whittle down the number of candidates, but how come every U.S. PE firm manages without this? What a waste of time...

3) You're telling me this isn't a good judge of critical thinking? Personally, I think pattern recognition is far better indicator of being a good associate then being able to talk through the merits of a deal I've worked on, assess risk, and take a position. Again, how moronic.

I never saw anything like this in a single process when I was still a banker in London, but more generally the U.S. takes positions 1,2 and 3 on HR and compliance bullshit.

US funds having to watch videos about how men can be women is the sort of craziness we don’t want on this side of the Atlantic…

Funnily enough this is common for hedge funds here in the US, I literally just took the P72 Wonderlic and it was full of questions like this

So what's the answer for the brain teaser here?

I’d guess it’s the triangle with 2 dots. Although the dots are actually meaningless here / more of a distraction.

I’d assume it’s about identifying patterns.

First thing I noticed is how the shapes are segmented. It’s vertical, horizontal, vertical, horizontal. Which means the next shape should be sliced vertically.

Also, in order, the shapes are 3 sided, 4 sided, 1 sided, 4 sided. Which to me implies the last shape is going to be 3 sided.

There are three shapes that are sliced vertically out of the options we are given: the square, the triangle and the circle. Out of those, the triangle is the only 3 sided shape.

The dots are useful, they imply the number of sides the next side has so 3 dots = next shape being a triangle etc So it’s either B or C given your other thoughts are correct and it has to be a vertical slice so it’s B (I think) which is also what you said

Was this sent to you by the recruitment or PE firm?

It is an IQ test. The try to figure out the g-factor, which is the biggest predictor of career success.

.

These are the types of questions they asked on my mensa test

Never had anything like these in Europe nor do my friends have seen this crap.

As a student, these sorts of tests are sadly quite common for springs and summers. That and numerical tests

I think it's because networking doesn't play as big a role to get a grad job here compared to the US, things are more standardised.

OP here. Interesting. It's bizarre. I've never networked for PE positions either. Headhunter emails out an opportunity, I say I'm interested, and they pass my resume through, simple as that. Do y'all just have a lot more applicants? I'm in experience at networking events, I'm competing against maybe ~80 people for 2 spots. Let's say after reviewing resumes the PE firm decides to interview 30 people. 30 X 0.5 hours / divided across 3 VPs = 5 hours per VP (e.g., blocking off a few hours Monday morning, a few hours Tuesday morning. That's workable...

Is it also the case that recruiting firms do first-round interviews? I've heard horror stories about "Dartmouth Partners."

Its very common, at least in junior London processes

Some recruiters use these as a way to filter out before the interviews

Est qui ex mollitia consequuntur ut. Quis quam sapiente eum consequatur porro. Aspernatur in accusamus harum. Non commodi expedita voluptatem pariatur possimus iusto.

Qui ut earum tempore ut debitis. Ut nihil aliquid ipsa quo ut ipsam. Accusamus libero architecto omnis quia. A totam molestiae nam autem quia qui tenetur. Deleniti omnis ducimus iure veniam qui nobis vero.

Facere qui mollitia consectetur voluptatem ut reiciendis veniam. Sit quidem distinctio molestias quasi est voluptatem et. Vel ullam vel magnam hic facilis. Minima culpa dolorem nihil at perferendis optio consequatur. Illo animi sed quos sapiente commodi odit cum.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...