Destroy My Non-Target Resume to Break Into IB

Hey guys,

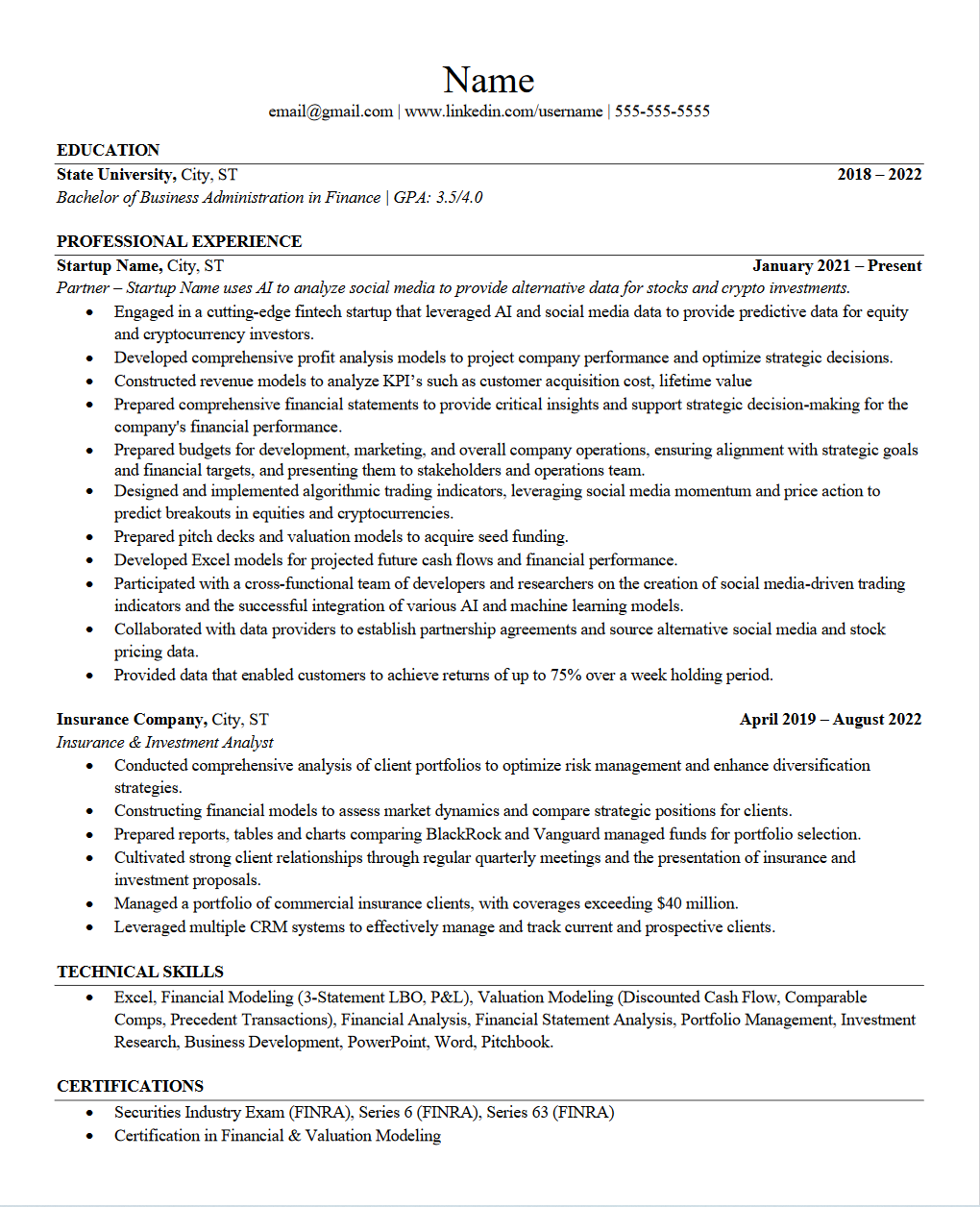

I've made it to the final rounds with a couple companies, recently 1 boutique investment bank. When it came down to the last candidates, my resume seemed to always be the reason they went with someone else. As a result, I redid it completely. (My previous one detailed the technology I had been working with, I made this one specific to finance).

I had a very different background than most people 2 years out of college. During school, I worked fulltime and I started a company. It was mildly successful, but with the slump in venture capital, we had to set it aside. Since I have no IB internships, my search has been super difficult.

I'm trying to break into IB through cold emails and networking. I'm also applying to valuation/M&A positions to break into IB as a backup. I want to make sure my new resume is perfect before I start the process of networking again. Please rip it apart and tell me anything else I should add.

Thanks!

From top down:

It feels like you’re missing stuff in the education section - you just have GPA listed essentially but no classes, activities, etc.

Your experiences are too sparse, bullets are too generalized, and also crypto-related is a red flag. You only have 2 things listed. If the reality is that you have no other relevant experience then you can’t do anything about it, it just feels like not very much experience. For reference, I had ~4 finance internships when I was applying for FT IB spots (3 of which were summer IB roles). Additionally, your bullets under your experiences are too general and don’t quantify what you did/achieved - this is why people like to list projects/deals they worked on, with specific/measurable points. Lastly, to be brutally honest I think crypto is generally looked down upon by these higher finance positions (I work in fintech PE and my VP said he would roast me if I ever sent him anything blockchain/crypto related), so that itself doesn’t help from a perception standpoint. You might try to focus on the other aspects of the startup besides the crypto side.

Technical skills section is also too general/not relevant. I’d honestly probably remove this - it’s kinda assumed you should already have these skills.

Last section - I would add in an interests section (e.g., golf, cooking, a TV show, etc.). Things that you’re really passionate about and can speak to. This is a great convo starter and a good way to connect with interviewers. This was standard advice to add in when I was updating my resume for OCR and I noticed most kids cold emailing me in banking did it as well.

Thanks a bunch for the response.

I'll take out all mentions of cryptos.

I worked full-time while in college, so I had no time for internships. I will detail projects rather than general points.

I'm worried taking out the skill section, the screeners won't pick up the filters they're looking for. It seems a good way to sum up what I have experience in.

I'll add an interest section. I was worried it was too informal.

Do you think my chances of breaking into IB are worth persuing? Or is my time better spent getting a relevant job and going the MBA route?

Thanks a bunch!

I don't think most would care to read that many comments of your "partner" role at a startup/internship or really any job. It's unfortunately a bad time for anyone to try to get a role in IB. Just place emphasis on your technical ms and excel skills and pray as you continue to network. At minimum try to get into a role adjacent to banking or an S&T role and ride that out at an mm or bb. Based on the environment your best shot would be a small spot with no clout looking to underpay you or an mba into ib but who knows what that entails. The commenter above is on point with your bullets, switch it from general into accomplishments or direct revenue generated from a project you lead or worked on (create a spin that can be applied to the role you want) and that's really all you can do.

Sed eum earum a. Id ut non saepe rerum molestiae voluptatem qui. Non voluptatem ipsa et voluptatem quia nulla illum doloremque. Architecto laboriosam voluptas alias enim.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...